Firm Spotlight | Startup Wise Guys

Startup Wise Guys' Challenger Fund II is backing 200+ startups coming out of what is rapidly becoming the go-to accelerator in New Europe.

Welcome to The European VC 👋 we’re getting you access to the best European VCs.

🎧 To get European VCs straight in your ears: Listen on Spotify or Apple Podcasts.

The EUVC Syndicate is investing into Startup Wise Guys’ Challenger II. Join us to explore the opportunity further with us.

This article outlines why the EUVC Syndicate decided to participate in this investment opportunity. It is not, and should not be perceived as, investment advice.

The TL:DR

Startup Wise Guys (SWG) is one of the most active early-stage investors in Europe with a strong footprint in the “New Europe” region (CEE / CIS countries). The accelerator program and the first fund was established back in 2012, in Estonia.

From a small team and accelerator in 1 city in 1 vertical, SWG has grown into a leading player in the European accelerator scene with 32 completed batches across 8 cities and 5 verticals, thus investing in more than 300 startups.

Challenger Fund II is the flagship fund that gives LPs exposure to 100+ of the pre-seed startups SWG accelerate during the 3 year investment period across SaaS, Fintech, Cyber and Sustainability in the Baltics, CEE, CIS & Turkey.

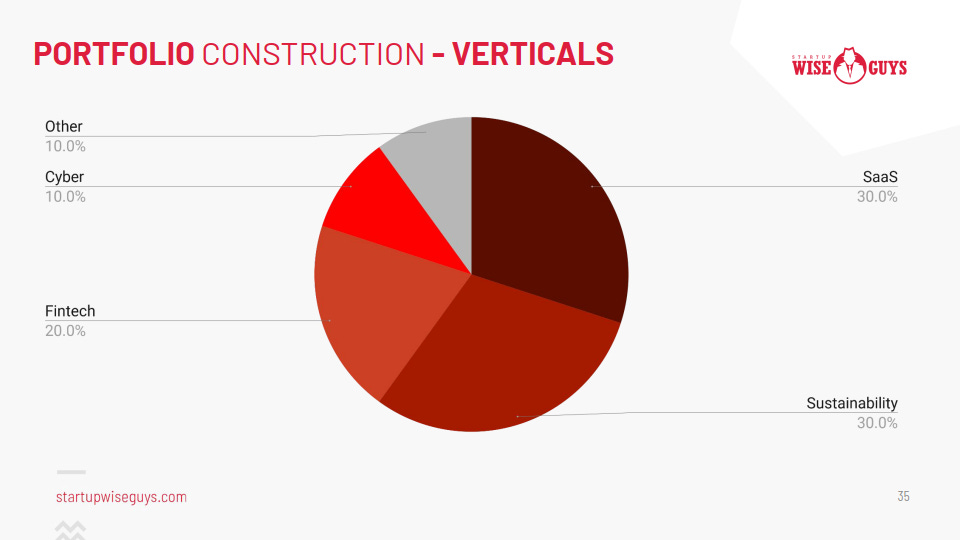

The fund will do 120 accelerator investments and 20 direct investments in companies outside of the accelerator. 30% will be invested in SaaS, 30% in Sustainability, 20% in Fintech, 10% in Cyber and 10% in other verticals.

In total, the Startup Wise Guys team has accelerated more than 300 startups with a follow-on rate of 50% - while the market average is 18% (Techstars clocking in at 34% and Y Combinator at 33%).

The POC fund of 800k€ launched in 2012 has a Net MOIC of 13x as of 31.03.22. The fund invested in 59 startups out of which 37 are still active.

Challenger Fund I of 8.15M€ launched in 2019 and has since invested in 115 startups. The fund is still actively deploying and MOIC is already at 1,75x - a solid performance for an accelerator fund of this vintage.

Notable investments include SkySelect, coModule, Ready Player Me, EstateGuru, MRPEasy, CallPage, Wolf3D, Teamscope, Rebelroam, Wisboo, Soter Analytics, Bolt, Katana, Ondato, Botscrew, SensusQ, Montonio, Cenos, PayQin, Fractory, Planet42, Rendin, Vumonic, Adact, Cenos, PayQin, and Multiorders.

Listen to the memo episode with Cristobal Alonso, Startup Wise Guys’ managing partner 🎧

The EUVC Syndicate is investing into Startup Wise Guys’ Challenger II. Join us to explore the opportunity further with us.

Prologue

This memo is the first part of a series of content pieces on Startup Wise Guys.

Wait what!? 😲 Yup. With 300+ investments, 700+ founders and 65 people in the team, we don’t believe SWG can be made justice in a single instalment 😁

In this memo we’ll cover the first two quadrants in the VC Fund Canvas: Thesis & strategy and GP & Team. Join the syndicate to review the full SWG presentation.

1. Thesis & Strategy

Distinctive investment thesis, including origin story, core principles & focus

We invest in the strongest technical B2B founders primarily from “New Europe” early on and speed up their growth through our flagship accelerator program

Excerpt: SWG Investment Deck

Let’s decompose that thesis.

“The strongest” means SWG has a sourcing engine in place to that allows them to select and nurture hundreds of startups on an annual basis through an our online pre-accelerator (400 startups in 2 years) as well as complement that with outbound scouting activities that lead to the identification and evaluation of more than 1000+ startups per year. To ensure that SWG can invest in the teams that do not fit the accelerator model, a small allocation is reserved for seed investments outside the accelerator portfolio.

“Technical B2B founders” means that SWG are investing in SaaS (historical portfolio 30%), Sustainability (30%), Fintech (20%), Cyber (10%) and Other (10%). Sustainability investments have been specifically within foodtech, agritech, usage of land, forest tech, and materials.

“primarily from New Europe” means that SWG is great at attracting talented founders from the overlooked regions, with a historical focus on Eastern Europe. Since the pandemic however, SWG has also expanded into Italy and Spain, to nurture the next generation of digital entrepreneurs thriving for global scale. In addition, founders from Africa, Australia, Asia and Latin America have also increasingly sought to join SWG hybrid programs, thus further diversifying the geo structure of the portfolio. The historical portfolio construction is split as follows: 25% Baltics, 10% Ukraine, 30% other CEE/CIS countries, 10% Turkey and 25% Global.

“Early on” means that SWG is typically the first institutional investor.

“Accelerator program” means that SWG are selecting (on avg.) 10 startups per batch to invest in. These teams are plugged into the SWG five-month-long acceleration program, a program that has been developed and tested over 10 years. It comprises intense training & mentoring in business development, sales, fundraising international expansion, etc. In addition to this, SWG also has an ”after-care” program for accelerator alumni companies and a strong community of entrepreneurs who further support international scaling. Follow-on investments are made in the winning teams coming from the accelerator.

Origin story and core principles

In a small European country called Estonia, a generation of successful tech entrepreneurs were born in the wake of Skype’s success. Many of them became investors and some decided to give back and empower the next generation of tech entrepreneurs. They chipped in from their own pockets and created a private fund and accelerator for IT startups. This is how Startup Wise Guys was born in 2012.

From founders to founders, from ecosystem to ecosystem.

Lots have changed since the launch of SWG - they’ve expanded to 8 cities, run 32 batches, established a portfolio of 300+ startups from 50+ countries and the team has grown from 5 to 60+ people. Some important milestones in SWG’s journey have been:

2016 - SWG expands their physical presence to Latvia

2019 - SWG expands to Lithuania and recognized as top VC of the year in CEE

2020 - SWG expands to Italy and runs programs in Turkey, Georgia, Balkans, and Africa. 2020 is also the year where SWG is recognised as “Best Accelerator in CEE”

2021 - Listed as strategic partner of Google, AWS, Microsoft, EIT Digital, EBRD, European Fund of Southeast Europe (EFSE) and many more. SWG is broadly recognized as one of the top 5 most international accelerators in Europe.

The story of diamonds in the rough 💎

SWG is built on the core belief that there are two kinds of early investors: the diamond miners and the jewelers. While the first finds the hidden treasure through hard work and sweat, the latter focuses on shaping the existing diamonds. The SWG footprint and network in CEE/CIS has built a strong position as the first; shaping them via their accelerator program and then bringing them to a closed group of jewelers - angel investors and VCs who share the same beliefs and values as the SWG team.

SWG was built to help founders become entrepreneurs and we are true to this mission! We care deeply for the success of the founders we work with. In good times and tough times – we are on their side. Even being an investor, we keep the “founders' hat” always on.

Excerpt: SWG investment deck.

In the early days of SWG, their accelerator programs were mostly focused on turning techy founders into sales guys. But the later programs have expanded to also encompass transforming founders' mindset developing central entrepreneurial capacities like leadership, planning, mental toughness and negotiation.

But most importantly, the SWG culture is one which you’ll be hard-pressed to find matched. We encourage you to watch the video below to get a feel for the SWG culture 👇 as well as explore the SWG universe on their website.

Distinctive investment strategy, including rationale, assumptions and role

Challenger fund II is SWG’s flagship fund that invests across the SWG portfolio. That means it gets exposure to all the startups that are invested in the SWG family. To understand this, we need to dive a bit deeper on SWG’s setup. Check out the below excerpt of their investment deck to get a broad overview and then hold on tight 🤠

The role of pre-accelerator program

When pre-MVP/ idea stage founders seek to join SWG acceleration program and it turns out that they are good, but too early on, they have the possibility to join SWG’s pre-acceleration program first. This is a fully online program, equity-free, no strings attached program where SWG helps founders get the key components of their business and idea in order so they’re ready for their first round and/or applying to join the SWG full-time accelerator programs. Check the graphic below for some stats on this (and pay attention to the graduation rate) 👇.

The accelerator/pre-seed deals

After the pre-accelerator programs come the five vertically focused accelerator programs that SWG runs. Some of them have their own (small) vehicles dedicated to investing in the best teams - and dedicated fund managers to lead this effort. These vehicles only do initial tickets and the Challenger fund co-invests with them in the deals (50/50) but take over the pro-rata right of the vertically focused vehicle, creating a preferential position for the Challenger fund. Pretty nice gig, tbh.

The Challenger fund dedicates forty percent of the fund to initial tickets at this accelerator/pre-seed stage - corresponding to 120 investments in total. Fifty of these are made only by the Challenger fund II whereas 70 are made as co-investments with the vertically focused vehicles.

Target ownership is 4-9% with 8 being the average and a typical entry valuation of 500k - 1 M€.

The seed & follow-on deals

The remainder of the fund is dedicated to do eighty seed & follow-on deals spread across sixty follow-on investments in the accelerator deals and twenty initial tickets into seed stage companies scouted via the SWG network or from the existing SWG portfolio.

Target ownership on accelerator deals is 5-10% with 8 being the average and a typical entry valuation of 1 - 3 M€. On deals outside the accelerator the target ownership is 2-5% and entry valuations ranging from 3 - 10M€.

Portfolio split across verticals

Naturally, the portfolio split of Challenger II is an expression of the SWG accelerators and is expected to look like this 👇

Exit strategy, including exit criteria & factors

SWG has an interesting exit strategy compared to most funds, in that they deliberately aim to build a series of partial and full exits at all stages. We’re not disclosing the average valuations and returns from these categories here, but the below shows that the exit assumptions imply a different model than normal.

So why do SWG employ this strategy? Alexa put it well in our recent LinkedIn Live event:

“When Ready Player Me raised 56 M$ from a16z, we already had more than 2000x on that investment.”

- Alexa Balkova on Building Accelerator VC funds.

That perfectly states the power of accelerator models. And what we love SWG for is that by taking as many shots on goal as they do (120, as you see from the above chart), they’re playing a game where the odds hitting those outliers is improved many times over.

Is there a market for these secondary shares? Cristobal puts it well. And the short answer is that he is right, especially in the market we’re coming out of. If the market continues, the secondary market will take an impact (just as the rest of the VC market) but the truth remains: good companies will continue to raise - and be attractive in the secondaries market.

When companies are doing well, everyone wants to invest.

Cristobal, EUVC episode 47.

Listen to our very first interview with Cristobal, GP & CEO of SWG and pay attention at minute 16:20 for the conversation on the exit strategy.

Exit experience & performance

Out of Fund I (800 k€ 2012 Vintage) SWG have exited 5 companies from: VitalFields, StepShot, Sorry As A Service, CallPage, Wisboo. Notable portfolio companies still in this portfolio are SkySelect, coModule, EstateGuru, MRPEasy, Wolf3D, Teamscope, Rebelroam, and Soter Analytics.

Out of Challenger Fund I (8.15 M€, 2019 Vintage), SWG have exited ; Vochi. Notable portfolio companies are Bolt, Katana, Ondato, Kevin, Botscrew, SensusQ, Montonio, Cenos, PayQin, Fractory, Planet42, Rendin, Vumonic, Adact, Postoplan, Finmap.

The EUVC Syndicate is investing into Startup Wise Guys’ Challenger II. Join us to explore the opportunity further with us.

Market deep dive

Startup Wise Guys are focused on capturing the opportunity of Eastern Europe, or as they call it: New Europe.

Full disclaimer: The EUVC Syndicate is super bullish on the promise and potential of Eastern Europe and have already invested in Acrobator Ventures and committed to 500 Emerging Europe as well. Consequently, this will be biased 😂 but we do believe there’s good facts to back it up. Let’s dive in and then you judge for yourselves!

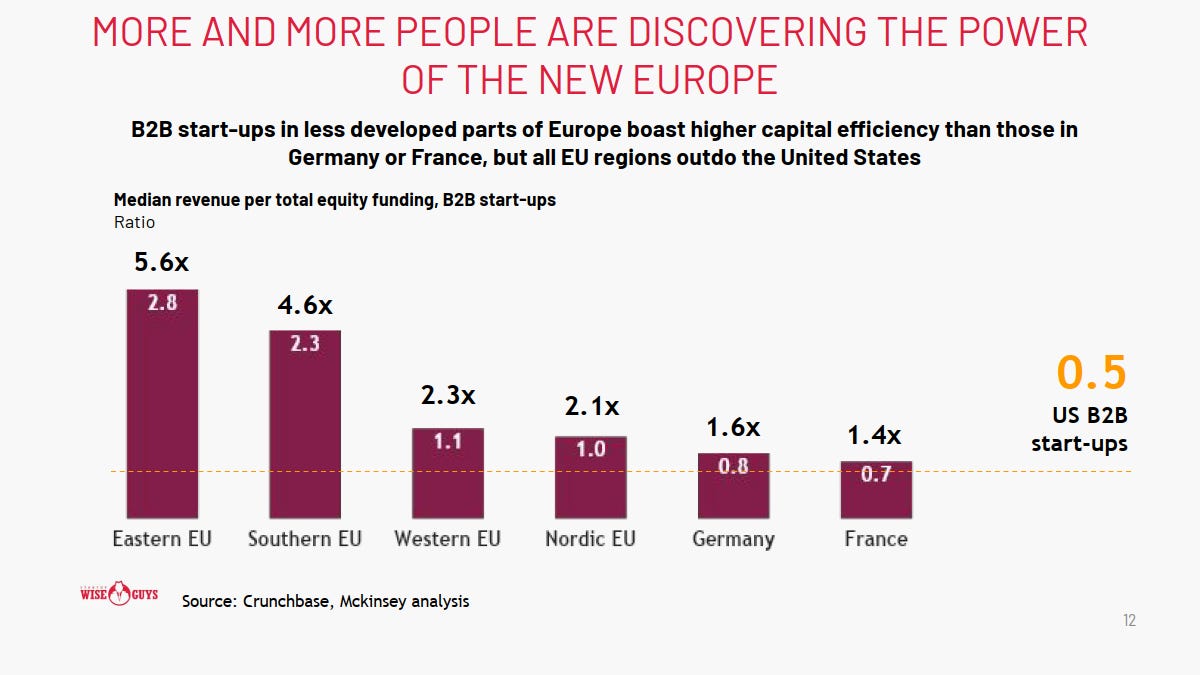

The CEE/CIS region has produced 70 of Europe's unicorns, only 4x times less than in US with 40x less funding.

There's high volume of technical talent (500k tech developers in Poland and Ukraine), high work ethics and significantly lower cost (annual developer cost in the US is circa $140k. In Ukraine it is $40-60k depending on expertise level) than in the West.

This region historically has largely been overlooked by international VCs and US accelerators, leaving room for SWG to emerge. This picture has started to change in the wake of the pandemic with more accelerators going online.

The accelerator opportunity in Europe

Looking to the evolution of accelerators in the US, three prominent players have risen to dominance, becoming one of the most important pipelines for early stage VCs in the region.

The holy grail of accelerators – or the one to beat, depending on how you look at it – is of course Y combinator with more than 3,000 investments. While Europe is still far behind in terms of volume, we’re starting to see some players emerge as winners, with SWG being one of them.

With their focus on all of CEE, SWG is built on the thesis that European accelerators that focus single countries and smaller regions will have an insufficient pipeline to attract high quality deal flow, talent and investors. Consequently, the European ecosystem is wrought with regional accelerators that have failed to raise large private funds and therefore relying on EU funding or running equity free programs supported by governmental organisations and corporates. And often, the VC firms that are established around these accelerators find themselves crawling up market where they end up competing head-to-head with VCs and angels rather than complementing them by creating a quality pipeline.

Given all these conditions, we see a great opportunity for a European pan-regional player that position themselves as the first choice for startup founders looking to build VC scale businesses and as a quality pipeline for European VCs and super angels.

2. GP & Team

Being an accelerator fund, the Startup Wise Guys organization is a different beast than most funds. In other words; 65 people work their butt off every day to create the pipeline and value-add of a 20M€ fund. That’s what a typical solo GP manages. With SWG, you’ve got three general partners and three regional & venture partners. And a small army dedicated to acceleration.

So what’s the catch? Or at least; what should we pay attention to? First of all, we’re very focused on the health of that type of organization, meaning it’s ability to sustain performance during growth and adapt when needed.

In the case of Startup Wise Guys it seems to us that they’ve only grown stronger as they’ve grown bigger. Performance on fund as well as accelerator-focused metrics have improved, even as the team has scaled from 5 to 65 members since founding in 2012. An example of this is that TVPI on the fund level is increasing steadily (even in the current market) and portfolio survival rate equally so.

Similarly with the flexibility of the organization. When faced with COVID-19 one week before the launch of their batch which was planned to be run in-person, the team managed to turn around their processes, digitize and launch without delay. Only a well-oiled machine can do so.

Role division & incentive alignment

We’re about 60 people now, with more than 20 nationalities, 49 of the team are female, and half of the partner team are female.

Cristobal Alonso, #84 The Memo episode

The Startup Wise Guys fund team is also involved in the acceleration activities, which we find to be a strength as it improves incentive alignment between the fund and the accelerator which is crucial as the accelerator is the bread and butter of the fund: if the accelerator teams would optimize for other parameters than the fund, performance would suffer. Having the executive team running the fund also running the accelerator is consequently a strength in our eyes.

But let’s jump into an overview of the SWG organization (we highly recommend giving a listen to the memo episode with Cristobal where he dives deeper into this).

The SWG Challenger consists of 5 GPs (see bios of each further below) with Cristobal and Alexa responsible for the accelerator investments and Herty and Gunce responsible for the direct and follow-on investments. In addition to this, the GP team are supported by the entire business acceleration team, counting amongst other 7 people doing scouting, 3 in portfolio management and seven people in the back-office supporting the funds with things like LP relations and compliance.

Looking at the accelerator team, there’s around a 50/50 split between roles running the machine, so project managers, marketing, legal etc. and roles working more directly with the startups giving portfolio support and running the programs. In addition to this comes dedicated tech teams and specialists that can assist on the product side and in legal.

The number one person called by the portfolio is our lawyers. “What do you think about these clauses? How do we solve that this founder is leaving? We’re going to a new place, how should we think about IP?” We now have four lawyers with us and they’re providing so much value to our portfolio companies.

Cristobal Alonso, #84 The Memo episode

But the legal team is also important for the operations of the fund and in adding value to LPs.

It’s also something our LPs really benefit from when they invest with us. They don’t have to go direct alone in a new market. They can go with us, either via us entirely or by also co-investing with us. And when they do that with us, they don’t need to understand the legal consequences of investing in a different country alone. We have the framework to do it, so we take some of the legal risk out for LPs when they want to have diversification internationally.

Cristobal Alonso, #84 The Memo episode

Partner network, advisory board, board of directors, etc

If it’s not apparent by now, part of the strength of SWG is their scale and thus the network this scale offers. Normally, and of course integrally, the network of a fund is equal to the network of the partners – which counts multiple Business Angel Networks (e.g. DanBAN & EstBAN), elite alumni networks, Family business networks, etc. But the breadth of the organization has allowed the organization to become pillars in the startup ecosystems of their local geographies where their main investment activities are.

Similarly, the EUVC syndicate fits this strategy of making SWG hyper-connected as it will further expand their network with 50+ venture investors from the European ecosystem – all vested in their success. At the aggregate level, the EUVC community is made up of:

👷♀️ >50% are Founders & operators.

👼 >40% are VCs & angels.

🏆 >20% are Ecosystem champions.

💰 >10% are Limited Partners & Fund-of-Funds.

The EUVC Syndicate is investing into Startup Wise Guys’ Challenger II. Join us to explore the opportunity further with us.

Team overview

Cristobal Alonso, General Partner & SWG CEO

14 years of experience on corporate roles | 11 years on VC backed startups and entrepreneurial | 11 years of investment experience

Hands on entrepreneurial and corporate executive experience in various roles:

Led as CEO and commercial lead a Spanish startup mmCHANNEL into a 2 Mio Eur series A and contracts in 7 countries in Eastern Europe and SA between 2006 – 2009;

Led as Chairman and then interim CEO Lithuanian startup Mobofree to become during 2014 & 2015 African’s leading social marketplace, securing funding for its expansion;

Have recruited, invested and accelerated more than 150 companies from 20 different countries within last 5 years as CEO of Startup Wise Guys.

Telenor as Head of Transformation Europe and Planning Director & integration at Vodafone CZ;

PE backed companies / CTO & member of the management board at Bite Group (exited in 2015);

Angel and early stage venture capital investment experience:

Startup Wise Guys, since 2016

Angel invested in various Seed stage companies.

Dag Ainsoo, General Partner & SWG CFO

15 years in corporate roles | 13 years of entrepreneurial | 9 years of investment experience

Hands on business and entrepreneurial experience in various roles in new business creation:

Started career in PwC, including 2 years in Silicon Valley office.

CFO of Egeen International Corporation 2008 - 2011 leading financial management, fundraising, investor relations.

In 2007 co-founded Smart AD that was successfully acquired by Modern Times Group (STO: MTG) in 2015.

Angel and early stage venture capital investment experience:

Starting from 2011 active investor in multiple startups also acting as financial consultant and CFO.

Invested in 50+ companies.

2012 started advising and mentoring start-ups at Startup Wise Guys,

2016 management board member of Startup Wise Guys.

Have invested more than 150 companies from 20 different countries within last 5 years as CFO ad GP of Startup Wise Guys.

Herty Tammo, General Partner & co-founder of SWG

26 years of entrepreneurial | 14yrs of investment experience

Hands on entrepreneurial experience in various roles in new business creation:

Tammer: Building early team and brand.

Active board member;

HT Comp: Leading sales and negotiating exit;

Ridango: CFO role, acquiring debt from bank and private investor, two acquisitions, one exit, new CEO, exited to Baltcap.;

Startup Wise Guys: Raising money from VC and angels, developing partnership and strategy.

Angel and early stage venture capital investment experience:

Startup Wise Guys (since 2012);

Angel investor: 20 Seed/Early stage investments

Lead investor for 6 syndicates;

Leverage buy out experience.

Alexandra Balkova, General Partner & Head of Portfolio

6 years of experience in investments

3 years as deal flow and investor relations manager at WannaBiz VC (Ukraine), managing portfolio of 10 startups +

3.5 years as a managing director at Startup Wise Guys, leading 5 acceleration program

Have recruited and accelerated 50 startups from 19 countries in the past 2 years, where 5 accelerated companies have already reached 50k+ MRR, and one has closed 2.2m round

Worked with 7 markets: Estonia, Latvia, Lithuania, Ukraine, Russia, Georgia. Worked closely with the US startup ecosystem

5 years in marketing & communications

5 years as head of PR & Comms in IT & logistics fields, including leading CEE comms in IT enterprise (ABBYY)

Gunce Onur, General Partner

7 years of experience in investments & technology

Since November 2019, in Startup Wise Guys, screened 1000+ startups from CEE, Turkey, Italy and the Balkans, working with portfolio companies, organizing accelerator programs and marketing activities in Turkey

2 years as a Startup Portfolio Manager at Startershub, managed mentor network which includes over 100 C-Suite Executives and partner companies network that consists of 50 major international and domestic companies such as Microsoft, Amazon, Google, most major banks in Turkey, and large holding companies. Supported and managed portfolio of 60 startups. (StartersHub is Istanbul and Silicon Valley based early-stage VC fund)

2 years as an Investor Relations Executive at Keiretsu Forum Angel Investor Network, raised more than $ 3M angel investment for 12 startups, analyzed more than 3000 startup applications for investment processes, raised the total number of angel investors from 52 to 96. Access to investors network, ecosystem & educational background