US vs EU: The Battle of the 🦄's

There's nothing better than a fight.. If you're winning,. but are we? Join us as we dive into that Q with us 👀

The new unicorn report by Affinity and Dealroom is out and we’re well-entertained 🤓 Read on for our take on some of it or download it directly here:

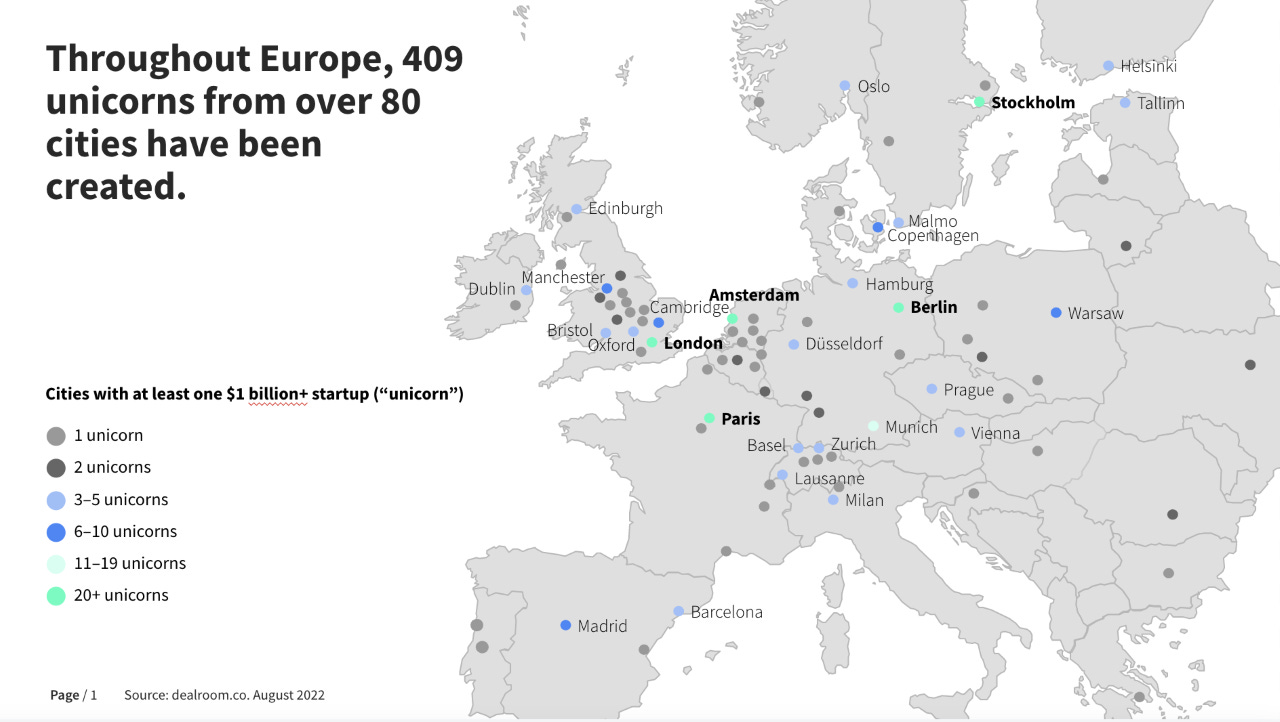

But we’re before jumping into this, we should avoid the pitch forks and torches by presenting a map with all the European Unicorn cities on it. Suffice it to say, the hyper-caffeinated, machinegun typing European LinkedIn-VCs had us sweating after posting an incomplete map on LinkedIn some time back 👇

So long awaited - and to Mathias’ great satisfaction - we’re pleased to announce, the one and only 🎉 true Unicorn map of Europe 🎉

Rate of unicorn creation

There’s another graph from Affinity & Dealroom’s report that I wanna draw out 👇

While in absolute numbers, the US is far ahead of us, we’re seeing that over the past 5 years, the U.S. has been creating net new unicorns at a rate of 52% YoY which is half the rate of Europe (roughly 2x YoY).

Data being from Q2 - so don’t be disconcerted by the steep drop in the tail there.

New funds raised

Zooming in on new funds raised by startups, the investment volume of U.S. firms into European unicorns grew from 4.6B to 24.6B - a 5.3x increase between 2020 to 2021. In the same period, European investments into the same European unicorns grew from 6.1B to 17.9B, a 2.9x increase. Mike Butcher’s phrasing “the US scramble for Europe” truly is real.

VC reactions to the market uncertainty

I really enjoy reading the relationship intelligence parts of these reports ‘cos they give us something that the datasets of the dealroom’s and crunchbase’s of the world can’t give us.

Notice the trend lines of the below graphs and how European email activity and number of deal opportunities changed in the period in comparison to US firms. Did we slow down more?

I’ll leave it to you to read the full report and make up your own opinion.

Join us in making sense of the current cycle.

Based on the data presented in the unicorn report, we’re putting together a webinar where we try and make sense of the current cycle. ‘Cos honestly, even the most experienced investors say “I have no clue” when you ask them about what will happen next. But hopefully, we’ll get closer by putting the question to the our expert panel on the 8th of November at 4 PM CET - we sincerely hope you’ll want to come join us! 😍

Our expert panel will be:

A peek at what we'll be covering 👀

The rate of unicorn creation in Europe vs US - what are we seeing and why?

Capital efficiency across geos and it's importance for shaping VC returns.

The role of networks in pan-European investing and how the best build competitive advantage via community.

How our panel thinks about the coming 6 months, what they see in their pipeline and how they plan to act.

Loving the map mate. Portugal in it now... YAY 🎉🎉🎉🎉🎉