Venture in Eastern Europe — Why Romania is the new cool kid in CEE

Key findings from Eastern European Venture Report by How to Web.

This week, our friends from How to Web launched the Venture in Eastern Europe Report, striving to surface the deals behind the entire region

The report also draws insights into how the industry in this part of Europe is shaped and is finding its edge, making it one of the world’s startup powerhouses.

Key findings:

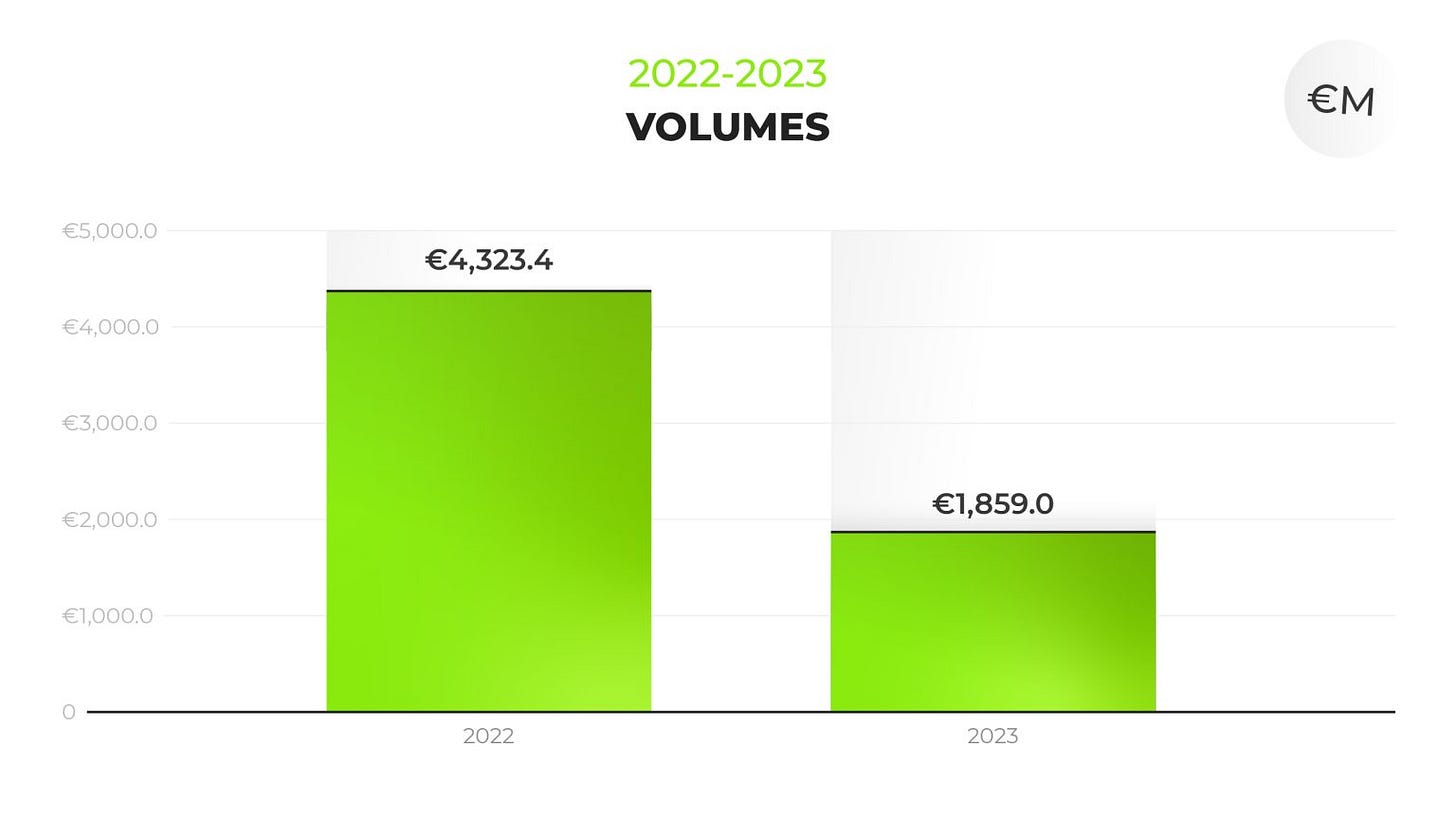

→ 57% drop in investment volume compared to 2022

→ top 6 countries with an investment volume of +€100M: Poland, Greece, Lithuania, Czech Republic, Estonia, and Romania

→ €1.23B raised in late-stage investments in 2023

→ 78.5% of total investment volume are follow-on rounds in Greece, Lithuania, Poland, Estonia, and Romania

→ Poland, Romania, and Estonia add +80% of the total investment volume in the first rounds

57% drop in investment volume compared to 2022

The European tech scene in 2023, as per Atomico's report, was set to invest around $45B. This is a big dip from the previous years - down 45% from 2022's $82B and even lower than the whopping $100B in 2021.

Despite the drop in 2023, it's not all gloomy. This decrease actually signals a market correction from previously inflated levels. In fact, 2023's investment is still 18.4% higher than in 2020, which saw $38 billion pumped into tech.

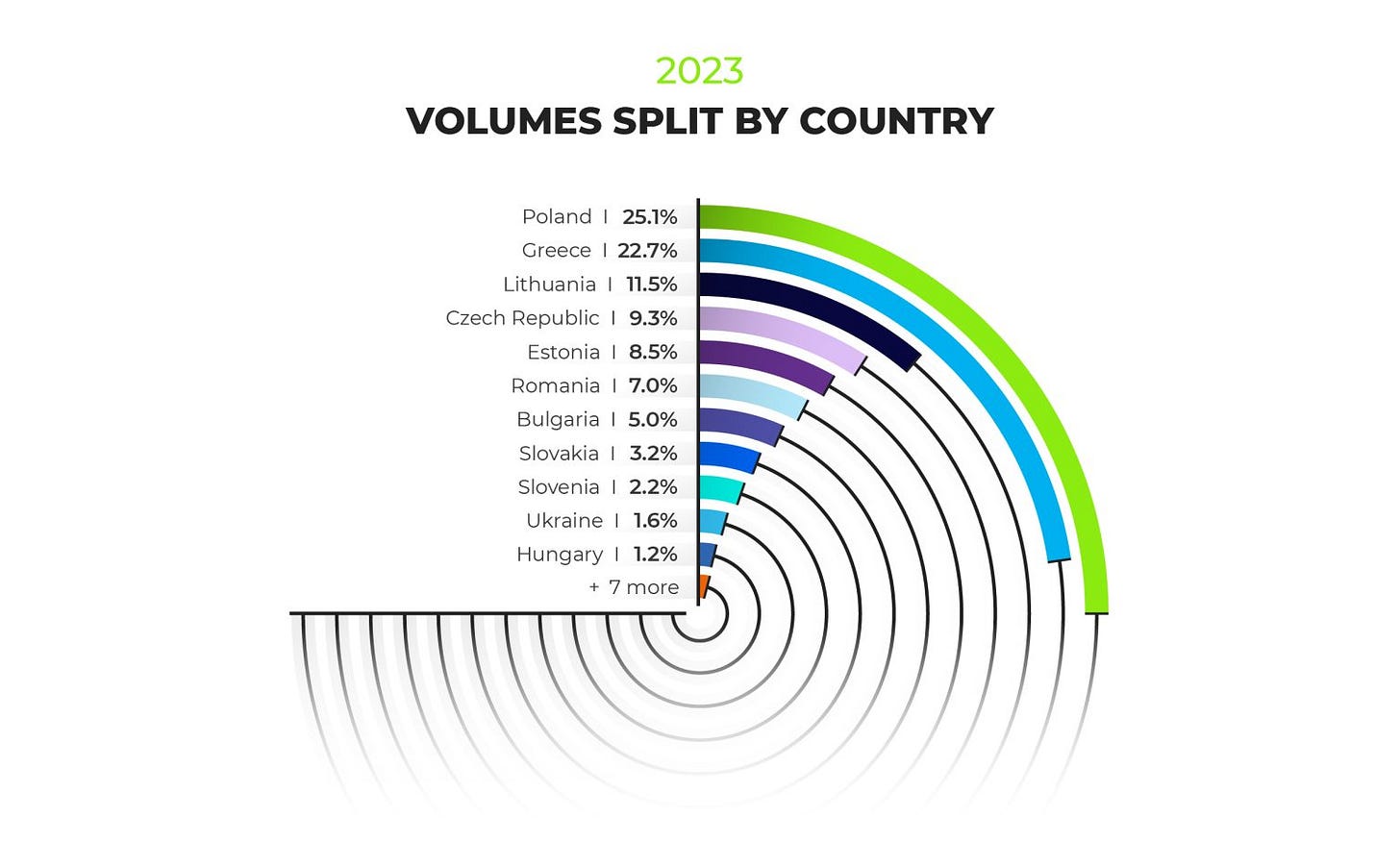

6 countries with an investment volume of +€100M

Six countries in Eastern Europe were the show's stars, grabbing over 84% of the total investments, which hit €1.65 billion.

Poland: €466M.

Greece: €422.7M.

Lithuania: €214.2M.

Czech Republic: €173.1M.

Estonia: €158M.

Romania: €129.6M.

Year-on-year growth and drop trends:

Greece: Investment in Greece rose by 17.6%, from €359.5M in 2022 to €422.7M in 2023. That's a solid increase showing more interest in Greek startups.

Lithuania: Lithuania saw a huge jump in investment volume, up 81.4% from €118.1M in 2022 to €214.2M in 2023. It's clear that Lithuania is becoming a hot spot for investors.

Estonia: Estonia experienced a significant downturn, with investment dropping by 90.1% from €1.6B in 2022 to just €158M in 2023. That's a tough break for Estonia's tech scene.

Poland: In Poland, venture deals fell by 39.9%, from €775M in 2022 to €466M in 2023, as reported by PFR Ventures and Inovo.vc.

Czech Republic: Venture deals in the Czech Republic took a 63.6% dive, from €475.1M in 2022 to €173.1M in 2023, according to Czech Founders and Czech Invest.

Romania: Surprised everyone with a 27.4% increase from €101.7M, marking the third year in a row of surpassing €100M.

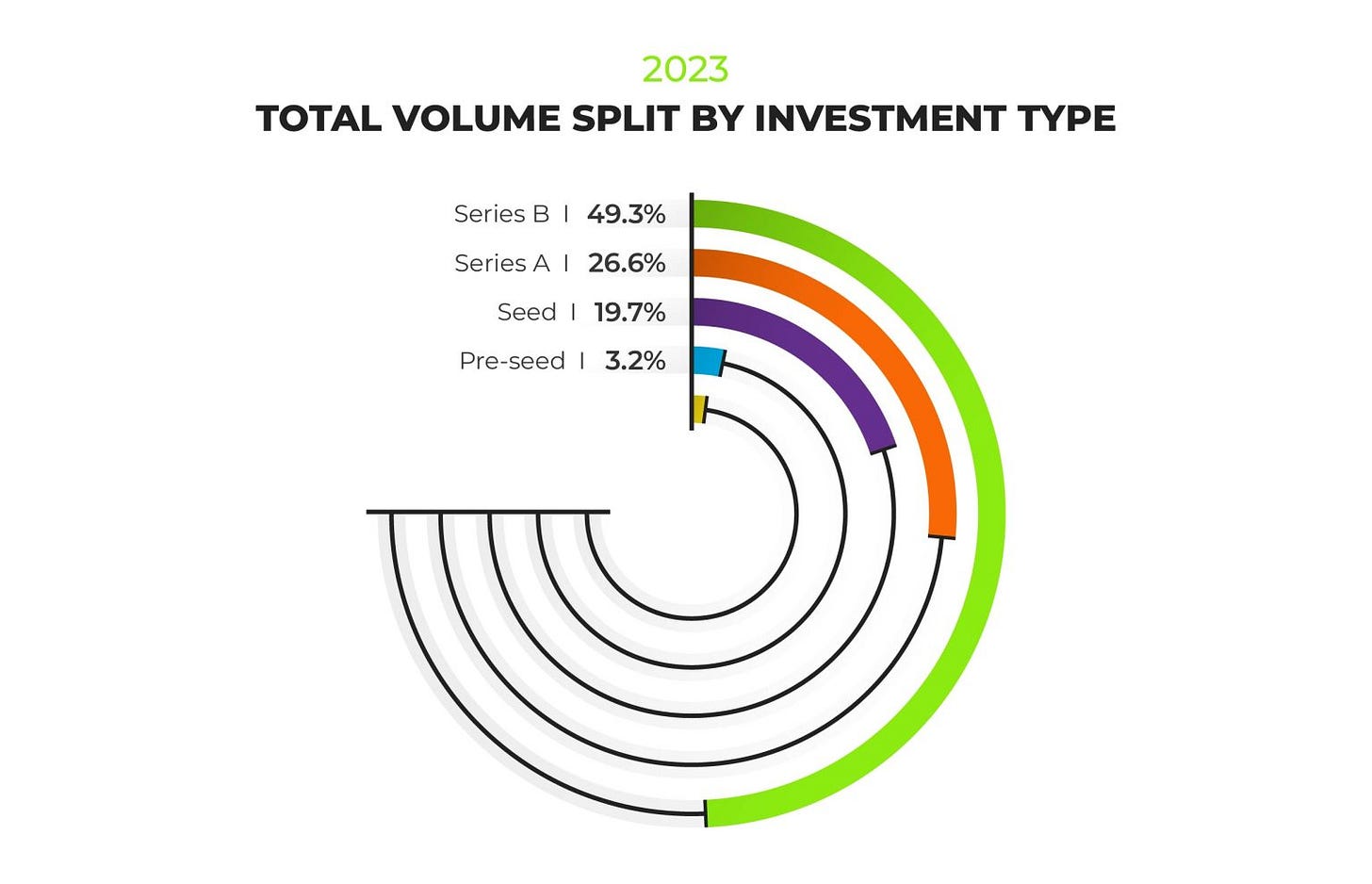

€1.37B raised in late-stage investments in 2023

Strong Late-Stage Investments: 2023 was great for late-stage investments in Eastern Europe, with €442.2M directed to Series A and €925.9M to Series B. This suggests Western investors may have found more appealing opportunities in the region amidst a lack of sufficient deal flow back home.

Pre-Seed and Seed Stages: Investment at the pre-seed and seed stages remained lower, totaling just €395.9M.

Market Adaptation: The overall decline in startup funding across Europe led companies to shift their strategies towards achieving profitability sooner and opting for bridge rounds over aggressive growth, focusing more on revenue and sustainable business models.

Eastern Europe's Maturing Ecosystem: Despite the funding challenges, Eastern Europe's startup ecosystem continued to grow and mature, emphasizing technological innovation.

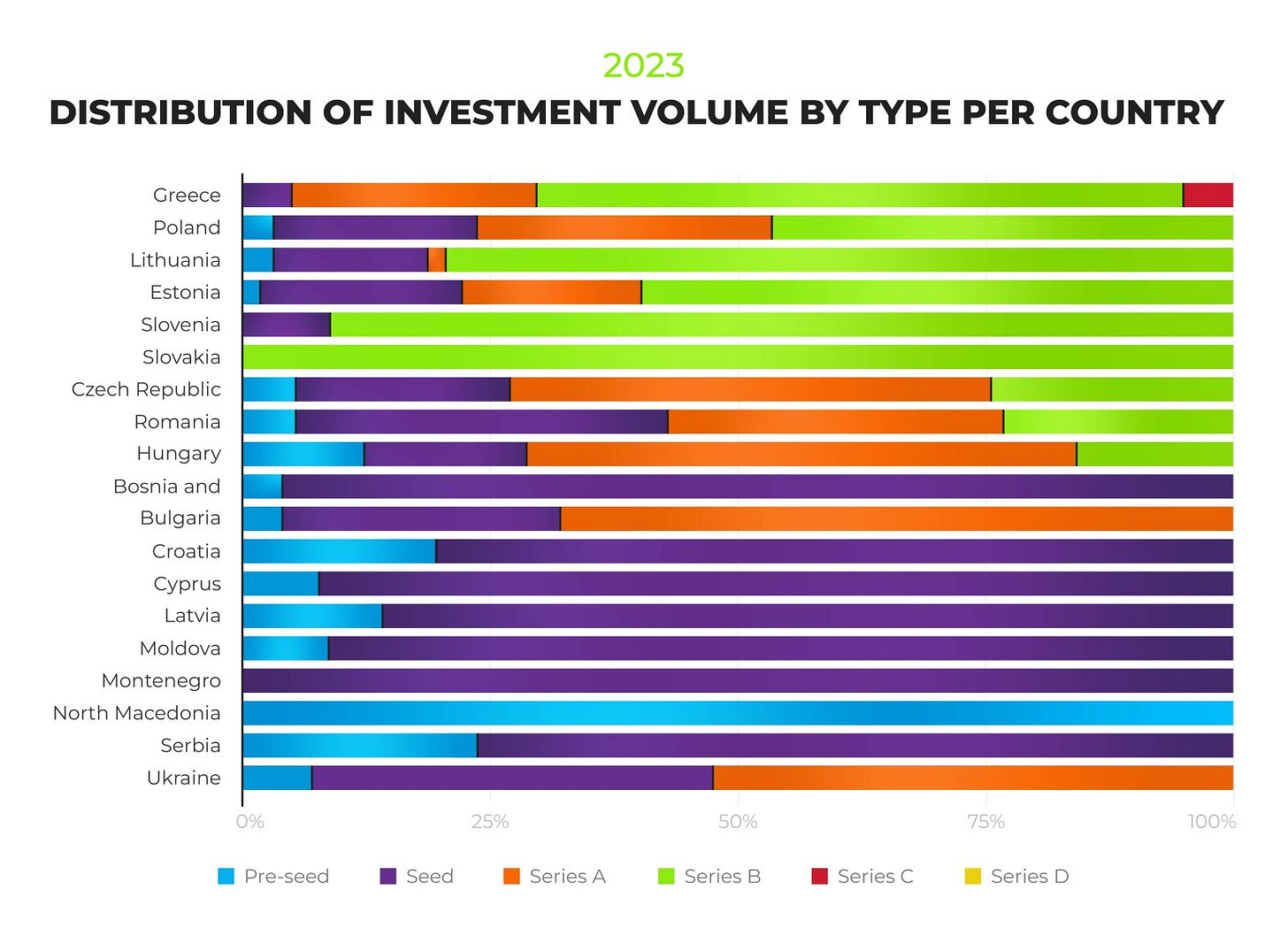

Varied Deal Flow Across Countries: Investment varied significantly by country and stage, with some countries seeing a mix of deals across all stages and others focusing mainly on pre-seed and seed investments.

Standout Series A Rounds: Notable Series A funding rounds in the region included ElevenLabs in Poland, Dronamics in Bulgaria, and FlowX.AI in Romania, showcasing the region's potential for high-value startups.

ElevenLabs' Rapid Rise: ElevenLabs' journey to unicorn status within two years highlights the potential for startups in Central and Eastern Europe to rapidly achieve significant success, encouraging entrepreneurs and investors.

Series B Round Highlights: Series B investments were significant in countries like Greece, Poland, Lithuania, and Estonia, with companies like Funderbeam, Causaly, and PVcase standing out, indicating a healthy ecosystem for growing startups.

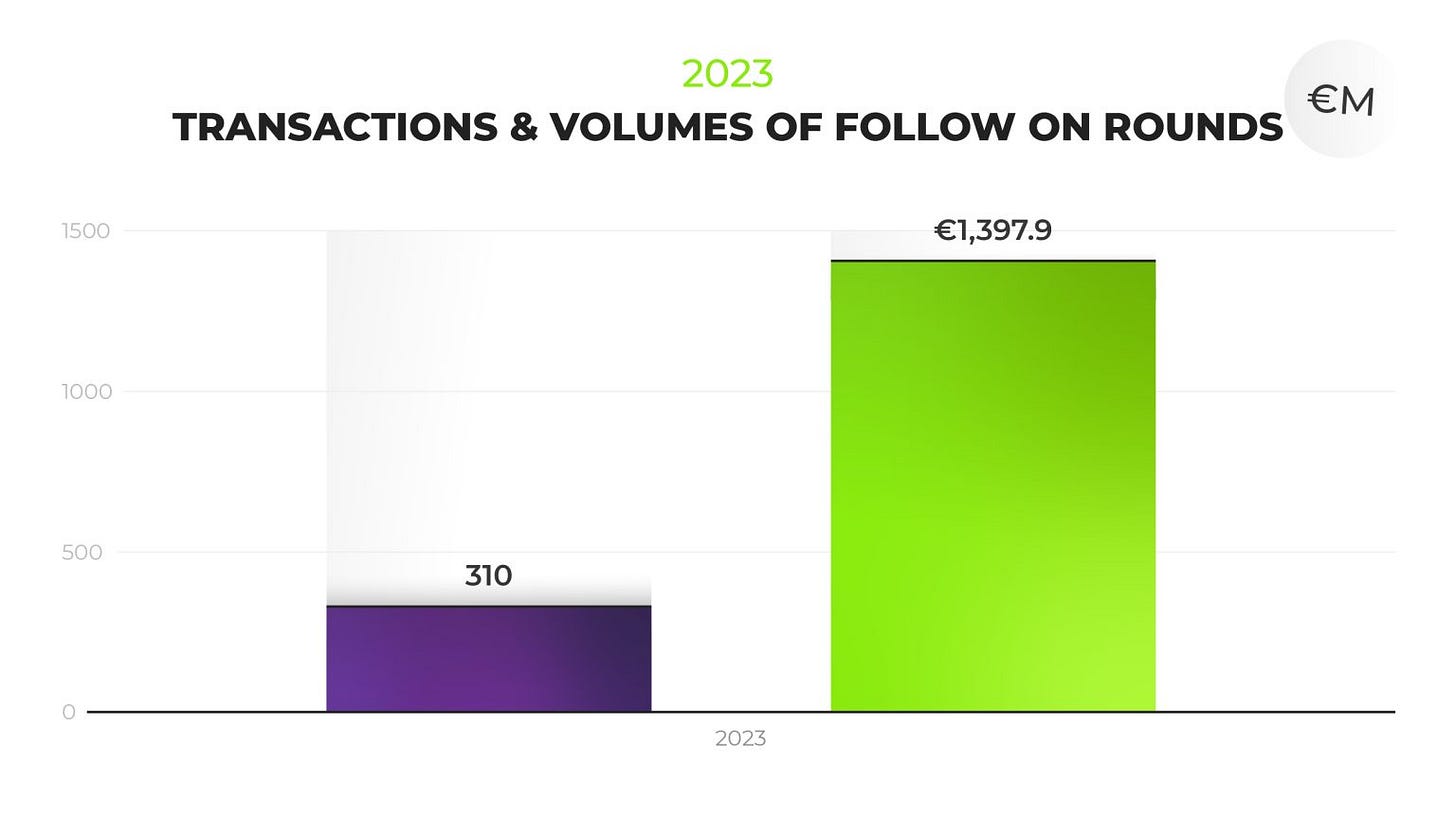

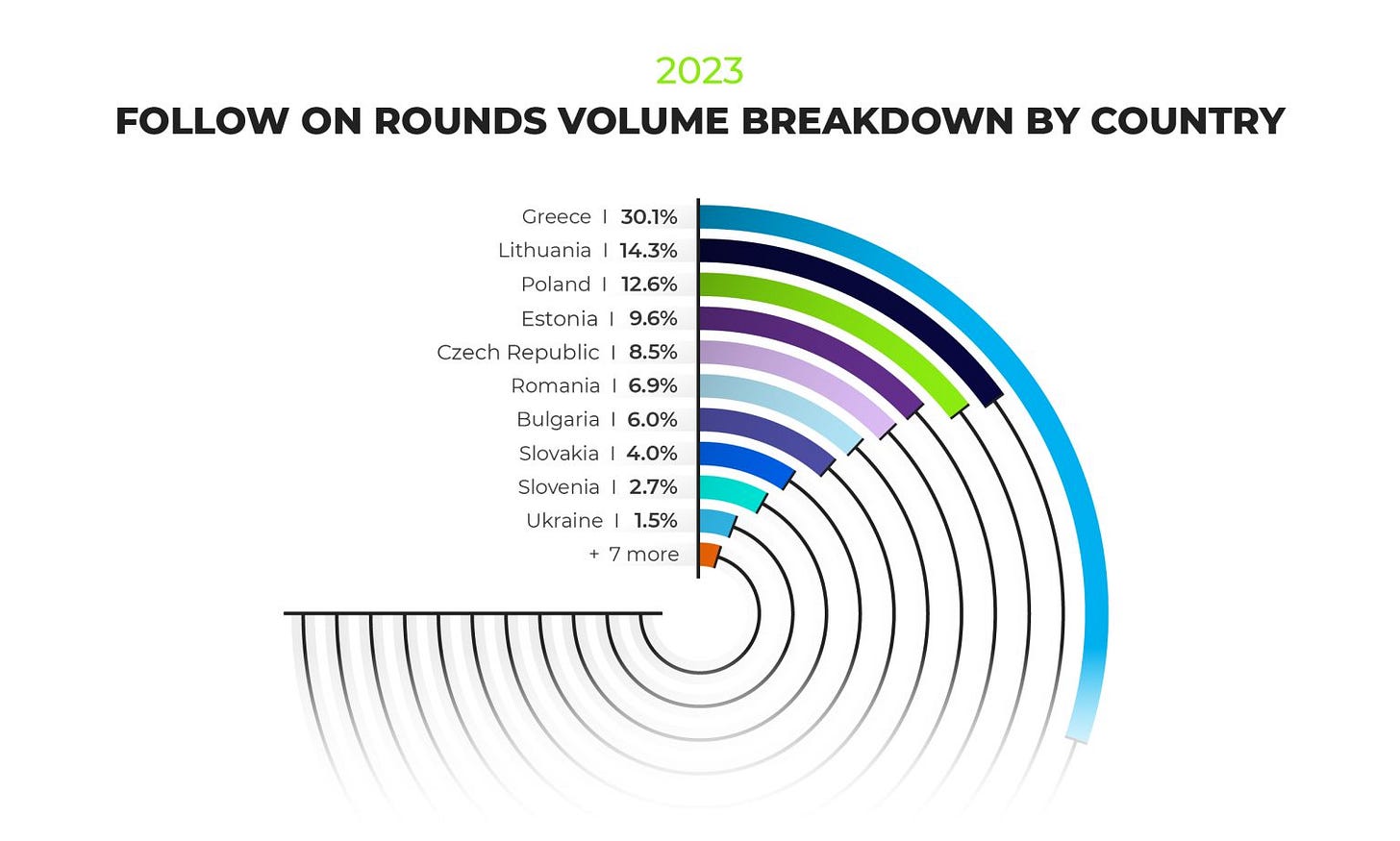

79% of total investment volume are follow-on rounds in Greece, Lithuania, Poland, Estonia, and Romania

Big chunk of the pie: Follow-on rounds were a major player, making up 78.5% of the total investment volume, totaling more than €1.4B.

Where the action Is: The countries with the most follow-on action were Greece, Lithuania, Poland, Estonia, and Romania. Together, they accounted for 79.2% of the follow-on investment volume.

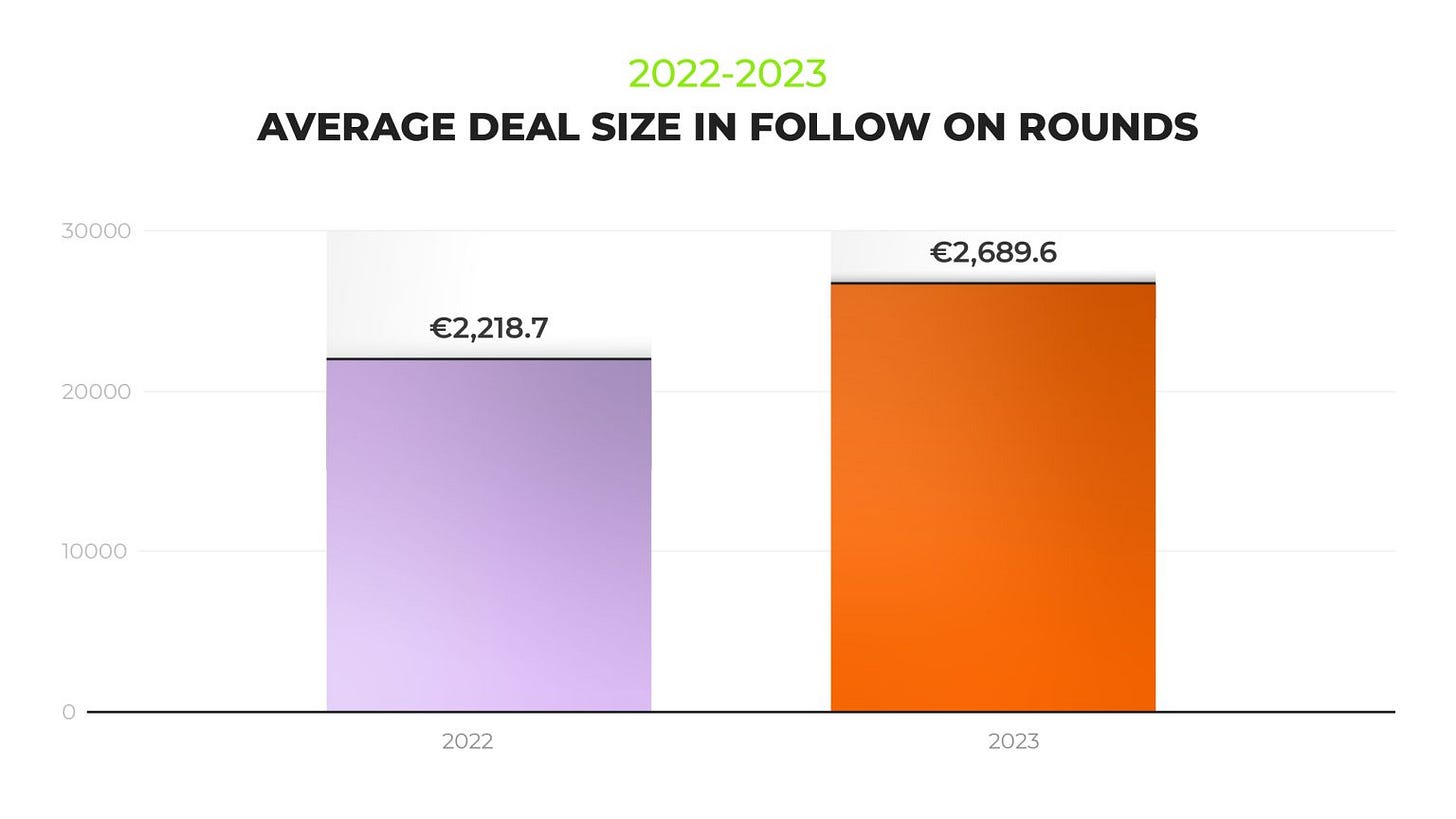

Average deal size: The average follow-on round size was €4.5M.

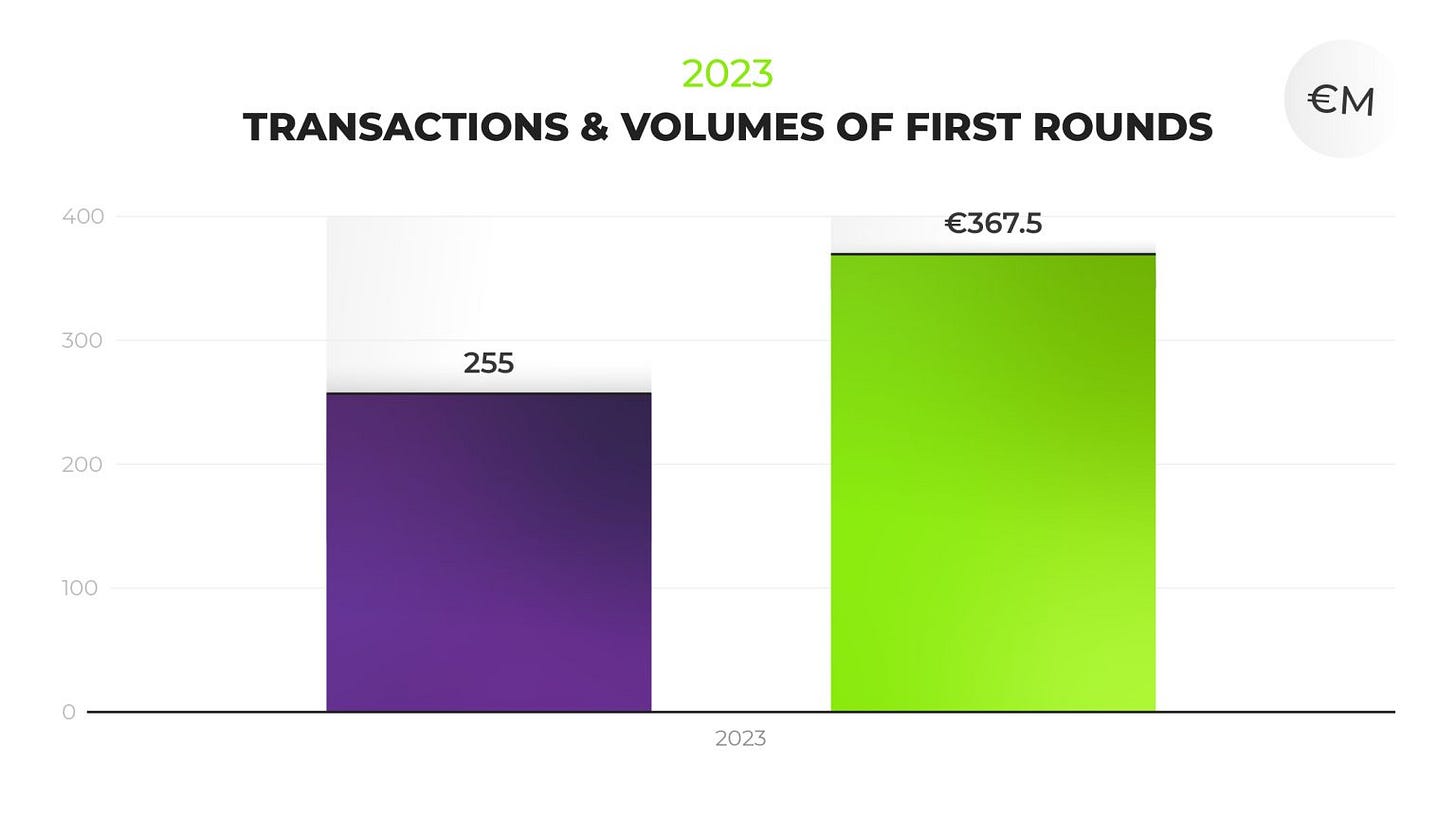

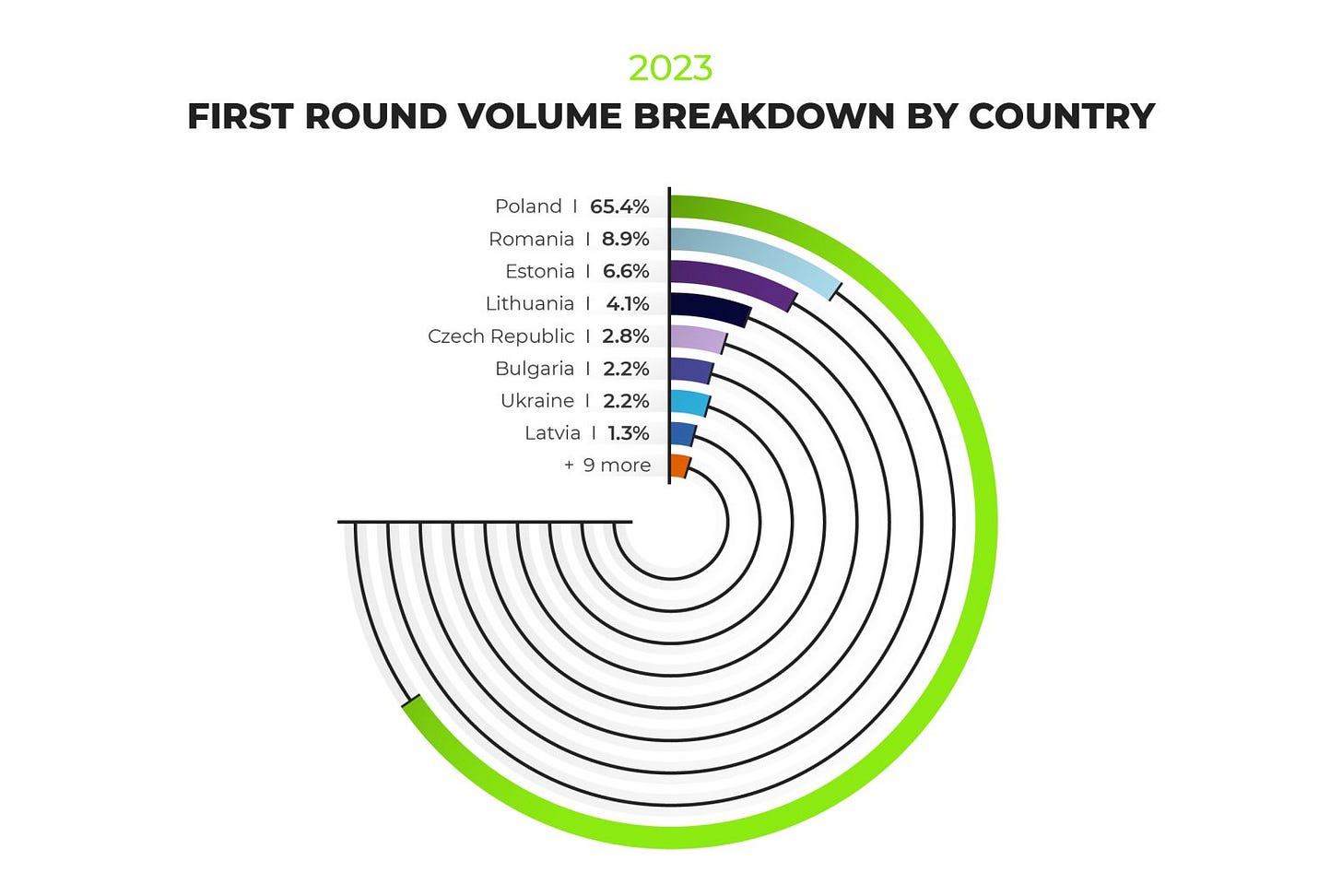

Poland, Romania, and Estonia add +80% of the total investment volume in the first rounds.

First rounds make their mark: Despite being overshadowed by follow-on rounds, first-round investments still made a significant impact, reaching €367.5M. This represents 20.8% of the total investment volume for the year.

Average size of first rounds: The average investment was €1.44M, indicating strong support for early-stage startups.

Leading countries: A whopping 80.9% of the first-round investment volume was concentrated in startups from Poland, Romania, and Estonia, highlighting these countries as key players in nurturing new ventures.

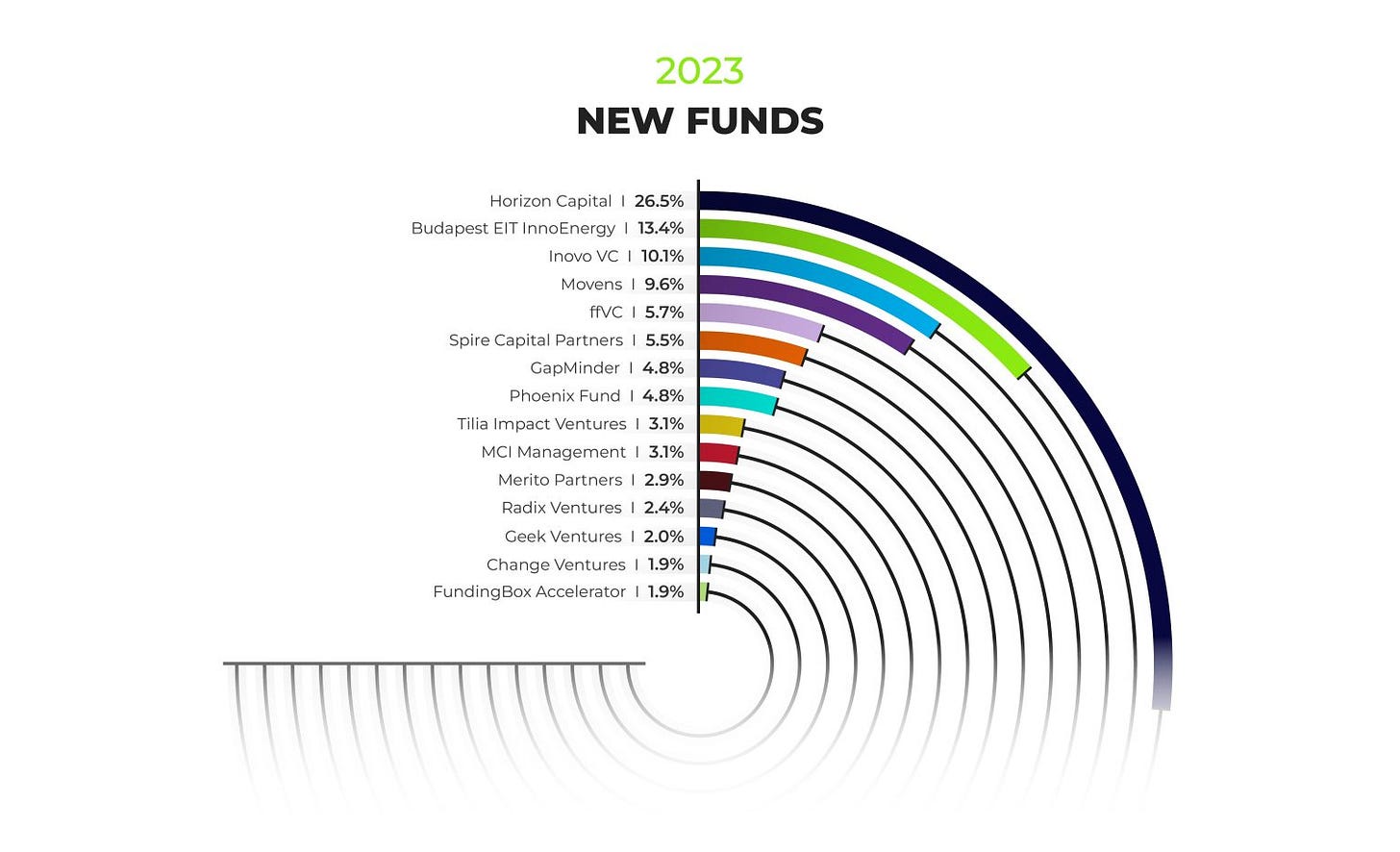

VC funds raised in 2023 with a focus on CEE.

Horizon Capital (€227.2M)

Budapest EIT InnoEnergy (€140M)

Inovo VC (€105M)

Movens (€100M)

ffVC (€60M)

Spire Capital Partners (€57M)

GapMinder (€50M)

Phoenix Fund (€50M)

Tilia Impact Ventures (€32M)

MCI Management (€32M)

Merito Partners (€30M)

Radix Ventures (€25M)

Geek Ventures (€23M)

Look AI Ventures (€20M)

Change Ventures (€20M)

FundingBox Accelerator (€20M)

SQ Capital (€5M)

Toloka VC (fund size unknown)

Romania is the new rising star in the CEE region.

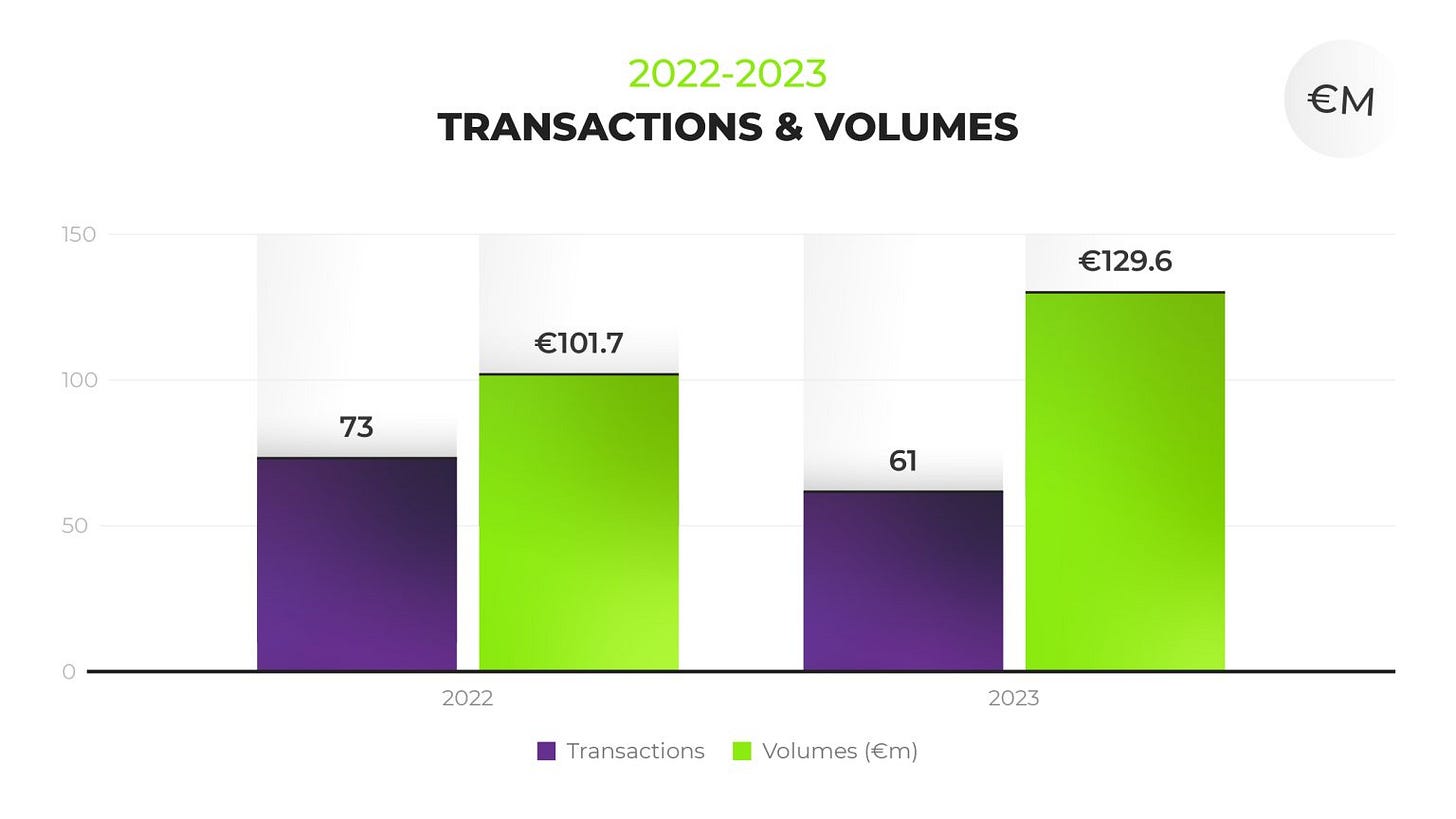

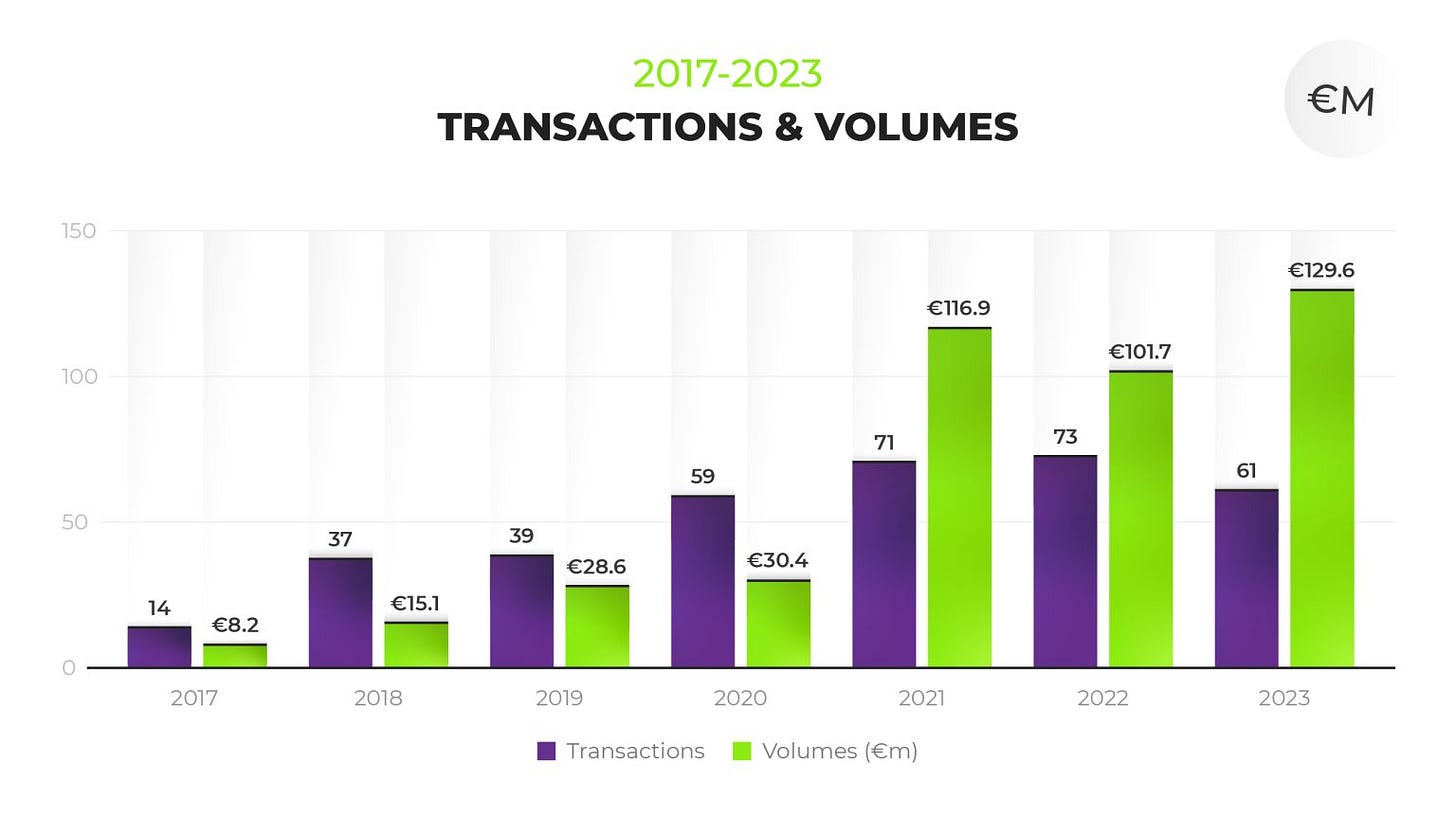

€129.6M total volume raised in 2023

3rd consecutive year breaking the €100M mark

27.4% increase compared to 2022

61 recorded transactions

16x growth in investment volume in 2023 compared to 2017

+260.8% increase in average deal size in 2023 compared to 2017

follow-on rounds volume reached €96.8M, close to 2021

16.1% increase in the number of follow-on transactions

40.8% increase in the volume of follow-on transactions compared to 2022.

21.2% increase in the average deal size of follow-on rounds

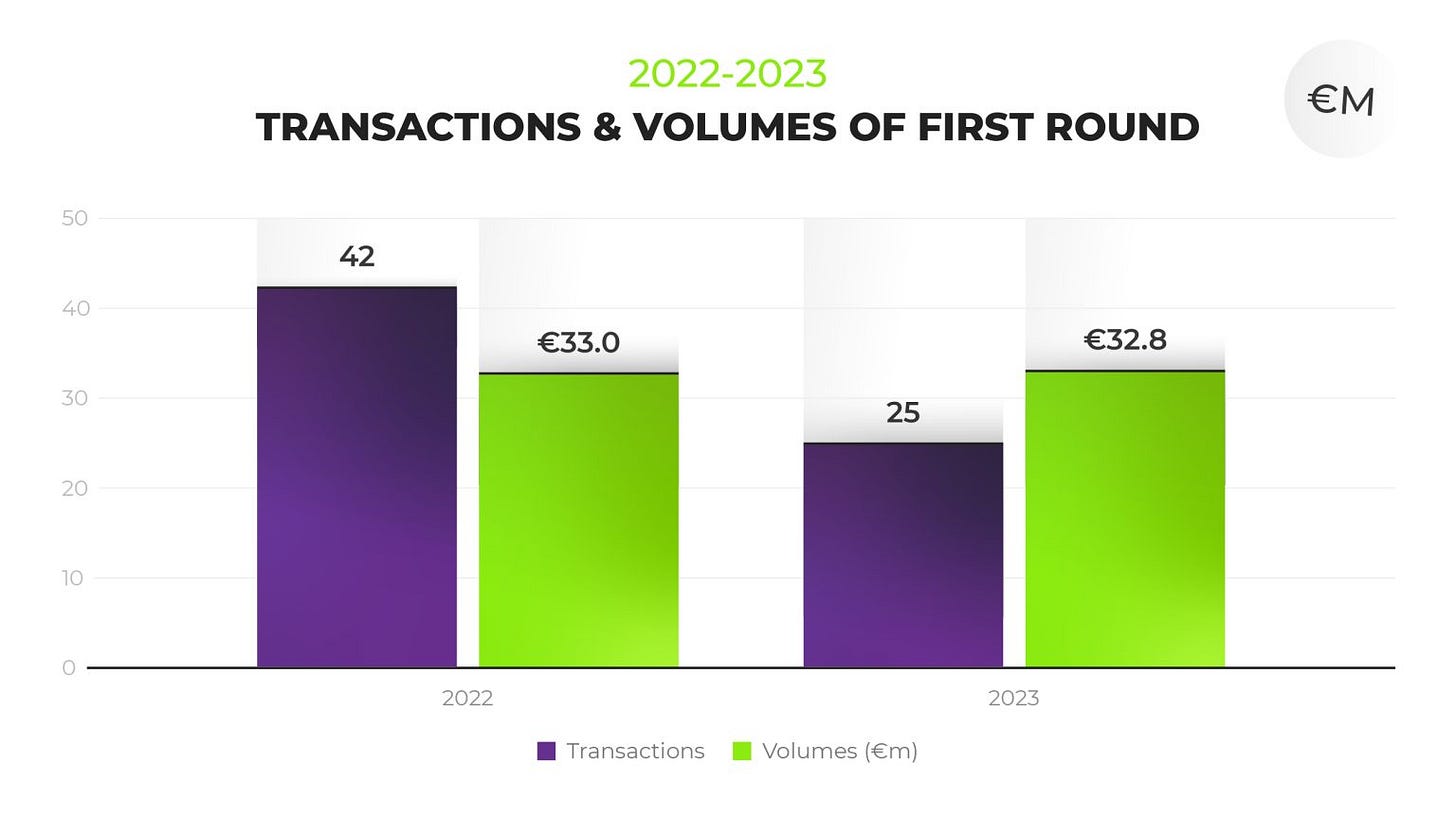

40.5% decrease in first rounds - the quantity of first-round funding events saw a significant drop by 40.5%, but the investment volume stayed relatively stable at €32.8M, almost on par with the €33M seen in 2022.

67.1 increase in average deal size - there was an increase of 67.1% in the average deal size for first rounds, rising from €784.7K in the previous year to €1,311.6K.

Investing and scaling in Romania and beyond

Join us for a virtual roundtable unlike any other, where leading VCs tackle the challenges and unveil the secrets of investing and scaling in Romania - a true pillar of the Eastern European ecosystem!

Get insider insights from some of Eastern Europe’s renowned investors as we discuss how to succeed in Romania and beyond.

When? March 18th, 12:00 - 13:00 CET.

tch The Roaring Tigers of Europe Documentary

The first documentary about the Romanian startup ecosystem came out in December 2023 and shows the journey of local companies and important players from the early days of capitalism to its current state.