Europe's Leading LPs on Raising in The Current Bear Market

Insights from our roundtable with David Dana, Joe Schorge, Christian Roehle & Michael Sidgmore.

Table of Contents

Part 1: State of the Current Market

State of the Market: Light at the end of the tunnel?

Public Institutions’ Role in The Current Market

Cyclical Trends or Unique Challenges?

Part 2: Considerations for Raising in the Current Market

A change in fundraise strategies by GPs

Emphasizing the need for differentiation

Don’t take recommits or govt backing for given

Understand and respect the complexity of institutional LPs

Navigating First close and Minimum Viable Fund Sizes

Early engagement and transparency takes the front seat

Getting off the ground: Advice for First Time Managers

Part 3: Getting the Terms Right For Funds

Commence Dialogues Pre-emptively

Forge Consensus on Key Terms Swiftly

Adopt a Flexible, Investor-Centric Approach

Upholding Transparency and Operational Autonomy

Independent Governance Mechanisms

Navigating cornerstone LP engagements

Watch the webinar 👀

00:02:17 - Meet the LPs

00:08:55 - Is there light at the end of the tunnel?

00:12:22 - Taking Time for Thoroughness

00:14:34 - The Challenge of Raising Funds in the Industry

00:17:08 - Challenges for Private Investors in Fundraisings

00:19:40 - The Need for More Private Investors

00:21:54 - Trends in the Private Wealth Channel

00:23:49 - The Strength of the European Ecosystem

00:27:42 - The Exit outlook in Europe

00:30:10 - Outlook for IPOs in Europe

00:34:38 - On Track Record Performance in European Venture

00:36:50 - The Potential Impact of IPOs on the Tech Market

00:39:13 - IPO Pricing Differences and the Future of Exits

00:41:26 - The Role of Secondaries in Providing Liquidity in Venture Capital

00:44:00 - Exit Strategies for Early Investors

00:46:27 - The importance of knowing your USP as a VC

00:48:58 - Building and Demonstrating Track Record

00:50:58 - Articulating Your Edge and Building a Team

00:53:24 - Evolution of Fund Terms and Conditions

00:56:01 - Creating a Smooth Road for Incoming LPs

00:58:25 - The Importance of Bringing More than Returns to Investors

01:00:39 - Building Relationships with Potential LPs, from HNWs to Institutionals

01:05:19 - Considerations on Spinning Out Firms

01:09:50 - LPs' Criteria for Investment Decisions

Part 1: State of the Market

Light at the end of the tunnel?

First of all, the fund-raising atmosphere today stands in sharp contrast to that of 2020-21, in that it - across the board - is noticeably more challenging. Nevertheless, the resilience of competent fund managers and budding companies is noteworthy. In the face of the current market dynamics, they persist in securing investments, but the chips have been rearranged so the fundraising journey has become longer, which while presenting a challenge for fundraising VCs is perceived by LPs as a net positive, as it provides allocators the leeway to cultivate sincere relationships and meticulously evaluate potential ventures before committing.

During the boom, direct investment and even some fund investments often demanded quick decisions. While we have seen some bets resulting in substantial returns from this period, it’s clear that it wasn't beneficial (for anyone).

Given that many partnerships last a decade or more, there's a collective acknowledgment of the need for comprehensive due diligence rather than hasty decisions. The consensus seems to be that the slower pace isn't merely healthier but also essential in ensuring all involved parties align in their expectations and dedication. No doubt, emphasis has shifted to a more thoughtful approach, which bodes well for forging new, strong enduring partnerships.

That said, it is clear that many institutions increasingly prefer to reinvest with managers they're already acquainted with, as it minimizes uncertainty and there’s often less capital to be deployed, resulting in a lightening of the pressure to deploy.

In conclusion, while the current market might seem daunting, there are potential benefits emerging from the challenges. A more deliberate approach to investments and partnerships might be the necessary evolution for the long-term health of the sector

Public Institutions’ Role in The Current Market

With both David Dana and Christian Roehle, the heads of venture investments at EIF and KfW respectively, a discussion of the role and approach of public investors in the current market was particularly prescient. Here’s what we learned.

Unlike private investors, institutions such as the EIF have a fundamental duty to bolster the market, particularly during less favorable cycles. Even in challenging times, their market engagement remains unwavering, though with an adjusted focus. The current emphasis is on being more proactive in sectors emphasizing climate and sustainability. There's also an inclination towards pioneering technologies, including space tech, AI, blockchain, and quantum technology.

Notably, the role of public institutions like the EIF, alongside counterparts such as KFW in Germany and BPI in France, is evolving. In contrast to a bull market, their role in a downturn is about much more than achieving initial fund closings and deploying capital on behalf of their beneficiaries. In downturns, they become essential for the very survival of many funds.

This shift is evident when considering that many funds in the bull market could secure substantial backing from a wide range of LPs even after being declined by institutions like the EIF. Bu that narrative has changed. While premier funds maintain their fundraising endeavors, albeit more cautiously, the more “innovative funds” face escalating challenges in a market like that which we have today.

It’s important to remember, that despite the public markets showing a bullish trend, the overall mood in private markets isn't as buoyant. A significant number of LPs made substantial investments around 2021-22, resulting in over-allocations. This has been exacerbated by a lack of distributed profits from investments (DPI) which complicates matters for private investors, especially because many managers are coming back to market for their next funds. These shifts present significant challenges, especially for new, emerging funds trying to gain a foothold in the market.

Cyclical Trends or Unique Challenges?

Let’s make one thing abundantly clear. The European Venture Capital scene has consistently exhibited growth, drawing significant capital to its fold and yielding even more capital for their beneficiaries. However, while the growth narrative suggests a high-performance rate, the insider would also know that many of these gains remain unrealized. This observation, when melded with the complexities of the geopolitical climate and other associated risks, presents a conundrum for LPs looking at the asset class in the current market.

Delving deeper into the investor psyche, it’s important to realize that our VC ecosystem has undergone a revival after the financial crisis, marking a period of uninterrupted growth. This continuous growth in Europe has led to an influx of Limited Partners, many of whom were venturing into the VC space for the first time. Unfortunately, through this period, we have failed to build sufficient understanding that company-building and venture investing is a marathon, not a sprint. Their anticipation of unceasing growth is now colliding with the reality of market downturns. This has led to a surge in secondary sales of LP stakes, a trend that many view as the precursor to a much larger wave. A trend more evident in Europe than our transatlantic counterpart, speaking to the sophistication of our individual LP landscapes.

All that said, in the long term, it is clear that Private capital's role in the investment sphere is on an upward trajectory. We’re witnessing an uptick in interest from private wealth channels, especially as institutional channels are witnessing a slowdown. This burgeoning trend, although in its early stages, holds the potential to invigorate the ecosystem and may even make up for the loss of institutional investors holding out. It's also noteworthy that private banks in Europe are exploring this avenue with increased enthusiasm.

What is more, despite certain hesitations, there's a discernible increase in U.S. funds setting their sights on Europe at the same time as we’re seeing an influx of global talent, counting also high-profile talent from global companies like Lyft moving to European entities. Coupled with Europe's robust developer community and prestigious educational institutions, this bodes well for the continent's future.

Part 2: Considerations for raising in the current market

We’ve done the hard work of teasing out the core considerations from our LP Roundtable on Raising a VC fund in the Current Market with David DANA, Head of VC Investments at European Investment Fund (EIF), Joe Schorge, Founding Partner of Isomer Capital, Christian Roehle, Head of Investment Management at KfW, and Michael Sidgmore, Co-Founder & Partner at Broadhaven Ventures by Broadhaven Capital Partners.

Let’s dive right in.

A change in fundraise strategies by GPs

As we all know, venture has undergone a notable transformation from what it has been in the past 5 to 10 years, but the changes have been particularly evident in the fundraising dynamics. Going to market today with the expectations of yesteryear will for most lead to sore disappointment.

One example of this change became clear when the Governmental LPs of the roundtable (KfW & EIF) described that new managers increasingly seek commitment from them before securing funding from family offices or similar entities, which we assume is largely due to the escalating difficulties that first-time teams face in securing funds. While these institutions don’t hesitate to back first time managers in that situation per se, they don’t do it for novelty’s sake.

Emphasizing the need for differentiation

While it’s almost too obvious to mention, this point seems particularly hard to internalize. So bare with us for restating, if you feel you have this 100% covered. Here we go. Competition is fierce so now more than ever, you must be uniquely differentiated and stand out from the crowd.

To this end, Sam Endacott of firstminute gave us a great framework to think about this in our recent episode with him:

In our panel, Michael Sidgmore underscored a similar sentiment, emphasizing that LPs should be able to summarize the essence of a fund's strategy in just a few sentences. He illustrated this with clear-cut examples:

Goodwater: “Data-driven venture capital”

Tiny VC: “Indexed exposure to Europe at pre-seed and seed stages”

Lower Carbon: “Chris Sacca’s - 100% committed to climate”

Don’t take recommits or govt backing for given

In our panel, our LPs issue a stark reminder to fund managers regarding the precarious nature of presumed support, stretching from governmental to private funds and spanning new investments to subsequent fund iterations. The presence of entitlement, rather than a value-driven approach, is as a strong deterrent. Furthermore (and almost incredible that it needs to be said(!): coercive tactics or attempts to politically sway govt LPs do nothing but solidify any pre-existing reservations, potentially jeopardizing the collaboration.

A stark counter example to this behavior is that which Hampus from Pale Blue Dot describes in a soon to be released eu.vc episode when recounting how an LP enquired if there’d be any first close incentives. To this, Hampus replied that they don’t believe in that and if the LP had any reservations about joining first close, they should definitely wait for the final closing so they could work through that together. The LP responded to that by doubling his commit.

Understand and respect the complexity of institutional LPs

Navigating partnerships with substantial institutions presents its unique labyrinth. Fund managers must recognize that securing an investment partner's advocacy is merely the opening gambit. The institutional landscape is multifaceted, encompassing several dimensions such as risk management, compliance, legal protocols, executive leadership, and board governance. Achieving a harmonious consensus across these diverse segments is crucial. An initial nod of approval demands unanimous reinforcement from each internal department, a critical factor that accentuates the importance of maintaining momentum and consistency through these layers, especially in the current, unforgiving market conditions.

Navigating First close and Minimum Viable Fund Sizes

Fund managers must identify the leanest fund size that ensures operational viability. This consideration is particularly critical as the risk that the fundraising journey will extend beyond anticipated timelines is very high in today’s market. The notion of minimum viable fund sizes is not one only to apply to first time managers as a second time fund manager who raised Fund I in the hey-days might find the raise of this fund just as tough and unpredictable as the first one.

When planning out the first close it's crucial to meticulously calculate this close’s capacity, considering the potential number of transactions possible and our panel advised that managers apply a more conservative approach than earlier so the fund doesn't overextend its commitments. This market has seen bad stories written on the back of tiny first closes, often to the detriment of the first close LPs who backed them early. The last thing you want to do is risk their trust.

Early engagement and transparency takes the front seat

As always, to streamline the fundraising cycle, managers should initiate discussions with potential LPs at the earliest opportunity. Early engagement facilitates an understanding of LPs' perspectives and investment criteria, enabling managers to tailor their strategies accordingly. Similarly, building trust with LPs hinges on transparency. Whether it's responding to inquiries or disclosing performance metrics, clear and honest communication establishes credibility which is paramount. It’s often advisable that managers avoid overcomplication in their presentations, as directness often resonates more effectively with potential investors. For a great example of trust and transparency at play, give a listen this episode with Chris from Isomer and Alexis fro HCVC 🎧.

In these conversations, managers must prepare for In-depth Valuation Discussions as the ability to justify and defend portfolio valuations robustly is essential. Managers need to provide clear rationales for maintaining certain valuations, reflecting comprehensive knowledge of their portfolio entities and market trends. Proficiency in these discussions, including fluency in the relevant financial metrics, reinforces confidence in a fund's strategic acumen and is central to any sophisticated LP.

Getting off the ground: Advice for First Time Managers

Our LP panel emphasize the old adage to fund managers, particularly newcomers: actions indeed speak louder than words. To make a substantial impression and build credibility, managers must transcend beyond mere promises. Here's how they can tangibly demonstrate their prowess:

Facilitating Co-Investments: Offering co-investment opportunities serves as a practical showcase of a manager's strategic approach within a real-world fund environment. It allows potential investors to witness firsthand the decision-making process, investment style, and, importantly, the value-add that the manager brings to each deal.

Initiating Preliminary Transactions: Executing several well-chosen deals before the complete fund is raised presents a live portfolio that investors can assess. However, managers need to exercise caution with the use of Special Purpose Vehicles (SPVs) as a means of establishing a track record. Overdependence on these instruments might satisfy potential LPs' appetite for investment, leading them to skip participation in the main fund, an occurrence frequently observed among family offices.

Highlighting Relevant Expertise: Institutional investors often vet the fund management team's background for pertinent experience. Here, Samir Kaji's GP - Thesis Fit framework is a great tool, emphasizing the fit between General Partners (GPs) and the investment thesis. The team's history should resonate with the fund's proposed direction, ensuring coherence in strategy execution.

Showcasing a History of Successful Exits: In today’s market and the learnings from the past year present in every LPs mind, a record of deployment capital is just a starting point, but what truly distinguishes a fund management team is evidence of successful exits or fruitful portfolio oversight. Today, many consider it insufficient to merely participate in deals; managers must exhibit their acumen in steering these investments to profitable conclusions or stable growth pathways. This aspect attests to the team's proficiency in not just spotting promising ventures but also nurturing them to fruition.

Part 3: Getting the Terms Right For Funds

When Possible, Go Plain Vanilla

Helped by the fact that venture in Europe is largely influenced by major stakeholders like the EIF, standardized terms reign supreme. But this is not to be shun. It helps expedite the investment process with all LPs and curtails excessive back-and-forth and uphold clarity in proceedings. In our panel, it’s a clear recommendation that managers steer clear of minor, often unnecessary customizations and instead focus unerringly on the fund’s primary goals, getting to a solid fund that appeals to LPs.

New funds, in particular, should prioritize simplicity in their investment structures. Introducing convoluted terms or pioneering untested financial innovations could introduce hesitation among potential investors. Straight-forward terms facilitate smoother transactions, quicken decision-making, and provide a clear vision that investors can rally behind. Don’t create friction where there doesn’t have to be any.

A note on Super Carry

Before the reset, we saw more GPs asking for super carry but while possible for some swing in that market, the current times demand a balanced approach. Not surprisingly, our LP panel underlined that, in their view, a super carry structure implies an expectation of superior returns and thus logically should accommodate the converse scenario in return.

In other words, the panel underscored the importance of proportionate compensation, where a willingness to accept reduced gains during less successful periods should be as present as the quest for higher rewards in prosperous times. Such variable carry structures, contingent on performance, establishes a more equitable partnership between managers and LPs. This model not only incentivizes outstanding performance but also fosters a culture of accountability for underachievement. By embracing lower carry for underperformance parallel to super carry, fund managers demonstrate commitment to shared success, enhancing trust with LPs.

That said, fund managers considering this route must provide substantial evidence of past successes to justify such premiums. Opting for aggressive financial structures without a solid performance history risks alienating potential investors who may view this as overconfidence or an attempt to bake in what’s considered a clear misalignment of financial interests.

Navigating cornerstone LP engagements

Skillfully navigating cornerstone LP engagements is absolutely integral given their influential role in setting the tone for subsequent fundraising. Our panel gave some advice on how fund managers can optimize these pivotal interactions:

Commence Dialogues Pre-emptively It’s prudent for fund managers to initiate conversations with prospective cornerstone investors ahead of formal commitment requests. Early interactions facilitate a mutual understanding, paving the way for smoother negotiations. In doing so, focus on informing yourself as to the LP’s specific processes and investment criteria. This allows you to anticipate their needs and preferences so you can develop a more tailored and compelling proposal and process.

Forge Consensus on Key Terms Swiftly: Once you’re ready to talk terms, ensuring that you achieve early consensus on fundamental investment terms is crucial. Discerning their deal-breakers early prevents future stalemates but it also avoids that unaddressed discrepancies can snowball into substantial impediments, potentially derailing not just the involvement of cornerstone LPs but also deterring subsequent investors. This is particularly important if the potential LP requests unconventional conditions or requirements.

Adopt a Flexible, Investor-Centric Approach: Recognize that each investor interaction is distinct with its own dynamics. While overarching industry norms guide term acceptability, there’s often negotiation room, especially for cornerstoning investors. That said, be careful about terms that aren’t confined to the current fund generation as the long term effects can be substantial - it’s hard to know which position you’ll raise the next fund from.

All in all, while it’s wise to exercise adaptability in negotiations, it’s equally important to remain anchored to standard practices to preserve the fund’s broader appeal. Plain vanilla baby. This is particularly true if you’re creating your initial momentum with commitments from personal networks or smaller investors. Managers truly need to be circumspect about the conditions they consent to, ensuring they don’t alienate future institutional investors.

Upholding Transparency and Operational Autonomy: To little surprise, our panel argued vehemently that fund managers be forthright about any unique relationships or agreements between the GP and LPs. As an example seen more often one might think, situations like an LP possessing an option to acquire a stake in the GP or third-party entitlements to carried interest will necessitate upfront communication to avert trust issues. By being transparent, managers uphold integrity and mitigate potential conflicts of interest that can arise at a later time.

Independent Governance Mechanisms: Our panel emphasizes the importance of having governance structures that affirm the fund’s autonomy to solidify investor confidence in the fund’s self-governing operations and reassures investors of the fund’s focus on core objectives and investment strategies, without the distraction of operational ambiguities.

Feel you must be able to level up your LP game? Read on how Affinity can help you below 🤖

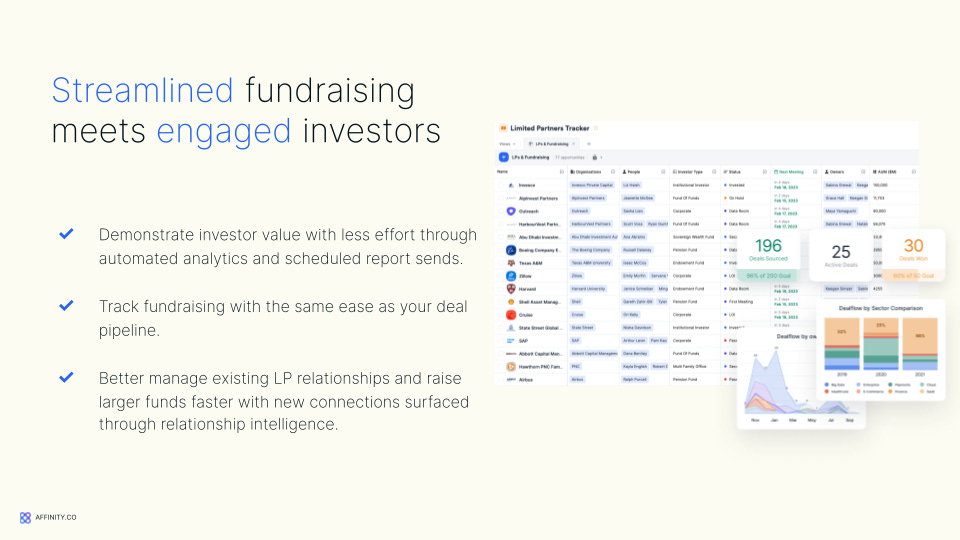

As a VC, you know that it is important to demonstrate value to your LPs. This means providing them with clear and consistent updates on the progress of your funds.

Affinity can help you do this by providing you with powerful reporting and analytics tools. With Affinity, you can quickly create reports on your activity, deal pipeline, and engagement with founders. You can also use Affinity's analytics tools to tell a clear story about your team's successes to current and prospective LPs.

Here are some specific ways Affinity can help you demonstrate value to LPs:

Create clear and concise reports: Affinity Analytics makes it easy to create reports that are tailored to your LPs' specific interests. You can easily filter and sort data, add custom charts and graphs, and customize the look of reports to keep everything engaging and on-brand.

Save time and resources: Affinity's automated reporting tools can save you a significant amount of time and resources. This means that you can focus on more important tasks, such as sourcing deals and managing your portfolio.

In addition to providing clear and consistent updates, it is also important to build strong relationships with your LPs. Affinity’s relationship intelligence platform is designed to help you build new connections and nurture your most important LP relationships. Affinity analyzes your firm’s collective network to identify paths to warm introductions and opportunities to connect with new LPs.

During fundraising, your engagement history and notes combine with Affinity’s enriched data to help you shortlist your most promising investors by criteria such as thesis relevancy, previous investments, or history of interest, and ensure that your outreach speaks directly to your audience. You can continue to track investment status and engagement by both organizations and individual investors throughout your raise, so you know where to best devote your time and resources.

With Affinity, you can demonstrate value to your LPs and build the strong relationships you need to quickly secure capital for future rounds.