This week’s newsletter zooms in on the builders reshaping European venture, the scientists turning breakthroughs into companies, the AI-native founders rewriting what it means to start from zero, the longevity investors pushing medicine into its next frontier, and the operators rebuilding GTM from first principles.

Across biotech, AI, and B2B, a shared pattern is emerging: the edge now comes from clarity of narrative, of strategy, and of how you allocate your next unit of effort or capital. Whether it’s SV Health engineering biotech inflection points, Ole Lehmann showing how content-market fit accelerates solopreneurs, Sergey Jakimov mapping the trillion-dollar longevity shift, or Harrison Rose rethinking how companies decide who to sell to, every conversation this week is ultimately about one thing: decision quality.

And that’s just as true for fund managers. In this week’s Insight, we dig into why so many LP–GP conversations stall: not because of performance, but because the story, the model, or the framing isn’t doing the work it should. Narrative has become a distribution channel. Modelling has become a strategic tool.

And in an environment defined by AI acceleration, macroeconomic volatility, and constrained capital, the winners will be those who treat clarity as a lever, not a decoration.

Hope you enjoy.

with 💖 David & Andreas

Final call.

This cohort moves you from intuition-driven investing to outcome-driven fund management. You’ll learn how to shape returns with structured modelling, rigorous portfolio design, and scenario planning that keeps you grounded in real constraints, not guesswork.

Across the 12-week Fund Modelling Cohort, you’ll build an LP-ready model from the ground up. One that deepens your insight into strategy, reserves, pacing, ownership, and long-term return potential.

By the end, you’ll have far more than a spreadsheet. You’ll have a model that empowers you to steer your portfolio with clarity and conviction.

Just 3 spots are still open. Join us and build the portfolio your future LPs will be excited to back.

Still unsure? Watch the teaser from our Essential Building Blocks masterclass.

Table of Contents

What Moved in European Tech This Week

Podcasts of The Week

Ole Lehmann: AI Solopreneurs, Crypto’s Unkept Promise & the Case for Building in Europe

Sergey Jakimov, LongeVC: Impacting Lives Through Longevity & Health Investing

Harrison Rose, GoodFit: How AI Is Rewriting B2B Go-To-Market

Insights of The Week

What Moved in European Tech this Week

Spotted with help from our friend Sebastian Johnson, founder of Scaling Europe.

GoCardless: Dutch Fintech Mollie acquired GoCardless for €1.05bn as two European Fintech powerhouses combine. The deal, which values the combined entity at €3.5bn, is composed primarily of stock with a small cash component.

Why it matters: The companies complement each other well and have a robust combined offering to take global, however both accepted significantly reduced valuations as part of the deal, highlighting the harsh reality for Fintechs who raised large rounds at the height of the 2020/2021 market

Nu Quantum: The UK startup, which is aiming to create the internet of quantum computers, raised a $60 million Series A - the biggest funding round ever for a pure‑play quantum networking company.

Why it matters: Europe is undoubtedly losing the AI race to China and the US. Quantum technology is seen as the next frontier of technological innovation. It’s crucial that Europe invests in it early to avoid the mistakes that have been made with AI

Revolut: Europe’s most valuable private company is conducting a share buy back scheme, purchasing shares from ex-employees at a 30% discount (i.e. a $52bn valuation).

Why it matters: This follows Checkout.com conducting a share buy back last month as companies feel bullish on the market. This is going to put millions in the hands of operators, founders and investors that will re-invest it back into the European ecosystem.

Distribution is becoming a core part of the venture playbook, and a strong communications strategy is key to helping you compound in the right rooms.

EUVC Communications combines Europe’s leading venture platform with a decade of specialist tech communications expertise. We help founders and funds shape their narrative, own their category and get in front of the people who matter: investors, customers, partners and talent.

To encourage more European founders and investors to communicate with impact, we are gifting one European team a complimentary communications strategy session led by one of our sharpest comms operators.

Apply now and we will select one team.

If you know a team this opportunity would benefit please feel free to forward this offer.

🎧 Podcasts of The Week

Charles Dunn & Ruth McKernan, SV Health Investors: Exit of the Year Winners and Biotech Company Builders

Andreas sits down with Charles Dunn and Ruth McKernan of SV Health Investors to explore how one of Europe and the US’s leading biotech builders blends company creation with later-stage investing. Their model gives LPs a diversified risk profile, letting SV incubate companies from scientific inception while also backing later-stage winners like EyeBio, which sold to Merck for up to $3B.

Draig Therapeutics, SV’s newest neuropsychiatry company with a $140M Series A illustrates their approach: start with strong science, assemble elite founders, install interim leadership, and build fast around clear inflection milestones.

But growth-stage capital remains the continent’s Achilles heel, often pushing companies to rely on US investors to scale. Against that backdrop, Charles and Ruth discuss market shifts from the post-COVID correction to cooling oncology hype and the rise of neuropsychiatry, where new biomarkers and digital tools finally make precision patient targeting possible.

With Europe’s registries, patient populations, and scientific depth, they believe neuropsychiatry is poised for a breakout decade if the region can close its growth-capital gap and fully harness the science already here.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Ole Lehmann: AI Solopreneurs, Crypto’s Unkept Promise & the Case for Building in Europe

Andreas talks with Ole Lehmann about the rise of solopreneurship, the post-crypto shift toward AI-native company building, and why blockchain may finally matter not as a speculative asset class, but as the quiet infrastructure underpinning AI systems. Ole traces his journey from music production to crypto to building one of Europe’s fastest-growing AI education platforms, explaining how the FTX collapse and the release of ChatGPT happened within days of each other, making it obvious that a new era of founder leverage had begun.

Ole breaks down the solopreneur mindset: freedom, curiosity, and the ability to test ideas at the speed of content. His thesis is clear: content market fit beats product market fit, because every post is a real-time experiment revealing audience needs before a single line of code is written. With AI collapsing the cost of design, distribution, and operations, a single founder can now function as a 10-person studio to launch ideas, iterate instantly, and scale without permission.

Ultimately, Ole sees Europe at a pivot point: embrace founder-led momentum and regulatory reform, or risk losing its most ambitious builders to more dynamic ecosystems.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Sergey Jakimov, LongeVC: Impacting Lives Through Longevity & Health Investing

Andreas had a great conversation with Sergey Jakimov, Co-founder & Managing Partner at LongeVC, the longevity-focused venture firm backing biotech breakthroughs, AI-driven drug discovery, and the science of healthy aging.

With Fund II targeting $120M, LongeVC is positioning itself as the category-defining European player in what Sergey calls a trillion-dollar frontier.

Aging-related diseases represent $1.6T in market opportunity, while Big Pharma’s pipeline erosion pushes M&A toward small, fast-moving biotech teams — exactly where LongeVC invests. Case studies like Insilico Medicine (valued at $1.5B), Turn Biotechnologies (a $300M+ deal with HanAll), and Rubedo Life Sciences highlight LongeVC’s model: back world-class science early, use AI to derisk clinical pathways, and partner with pharma when validation hits.

For LPs, LongeVC offers proprietary access to early science, co-investment rights in AI-designed drug platforms, and exposure to emerging clinical protocols through medical networks. Their strategy blends early bets capable of 10x returns with mid-stage investments offering shorter holding periods and clearer M&A visibility. Sergey’s message is clear: Longevity is not just about living longer. It is about reducing the years we spend sick, and it is poised to become one of the most influential venture themes of the coming decade.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Harrison Rose, GoodFit: How AI Is Rewriting B2B Go-To-Market

This episode spotlights Paddle co-founder Harrison Rose, who is now building GoodFit, an AI-driven GTM data platform redefining how B2B companies decide who to sell to, why, and through which channels. With a $13M Series A led by Notion Capital, Harrison argues that the traditional SaaS playbook is fundamentally broken. GoodFit tackles the strategic layer of go-to-market by mapping a company’s entire market, enriching every account with structured intelligence, and helping teams prioritise where human effort and budget actually produce ROI.

Harrison explains who GoodFit serves best (companies with large TAMs and meaningful ACVs), why AI should inform GTM strategy rather than automate bad outreach, and how the real step-change is in designing optimal sequences, channel mixes, and resource allocation across thousands of accounts, not in generating more emails. His critique is clear: most GTM teams today automate noise instead of improving decision quality.

The episode also digs into the realities of a second-time founder’s journey: four years of bootstrapping, intentionally choosing a diverse investor syndicate, understanding the GTM differences between the US and Europe, and stepping away from Paddle to rediscover his personal identity beyond the company he built as a teenager. With GoodFit, Harrison is building with maturity, governance, and long-term clarity—aiming not just to fix outbound, but to redefine how every B2B company designs its commercial engine.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

This Week in European Tech with Dan, Mads, Lomax & Andrew

This episode of Upside tears into the biggest forces reshaping European tech and macroeconomics, starting with Bending Spoons’ wild roll-up strategy that has turned Milan into the unlikely home of Europe’s most aggressive software consolidation play. The team unpacks how the company is acquiring distressed US tech assets, replacing bloated organizational structures with elite Italian engineering talent, and running each product as a cash-efficient microbusiness, raising the question: is this Europe’s Berkshire Hathaway moment or a looming tech debt iceberg?

The conversation shifts to a brutally honest examination of Brexit’s real economic cost, dismantling the myth that “we can’t know the counterfactual.” GDP, investment, productivity, and trade data now paint a clear picture of structural underperformance, and the group debates whether rejoining the customs union is politically inevitable and whether Europe would even say yes.

AI, capital markets, and venture trends round out the discussion. Google’s Gemini 3 triggers an internal “Code Red” at OpenAI, Anthropic prepares for an IPO, and Amazon, Meta, and others double down on custom silicon, intensifying the compute arms race. Meanwhile, the team outlines what Europe must do to remain competitive: overhaul pension allocations, reboot R&D investment, recruit global talent, and fix procurement and late-stage capital markets.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Insights of The Week

7 strategies for building LP relationships

Raising a first or second fund is harder than many emerging managers expect, and in today’s cautious fundraising environment, momentum depends less on pitch decks and more on the strength of your LP relationships.

LPs aren’t just underwriting your strategy. They’re underwriting you: your judgment, consistency, ability to execute, and discipline across market cycles.

Based on recurring feedback from LPs across Europe, we’ve distilled seven strategies that matter most when building long-term trust:

Clarity over flash: a stable, well-defined fund strategy is non-negotiable.

Depth over hype: LPs back authentic expertise, not trend-chasing.

Timing matters: engage LPs early, but only once your thesis is truly locked.

First-close risk is real: understand which LPs can move early and why.

LPAs shape relationships: expense policies and key-man clauses signal professionalism.

Consistency compounds: LP relationships are built between fundraisers, not during them.

Different funds, different LPs: continuation and secondary vehicles require distinct audiences and pitches.

Strong LP relationships aren’t built during fundraising; they’re built in the years leading up to it. Managers who invest early in clarity, communication, and trust are the ones best positioned to rise across cycles.

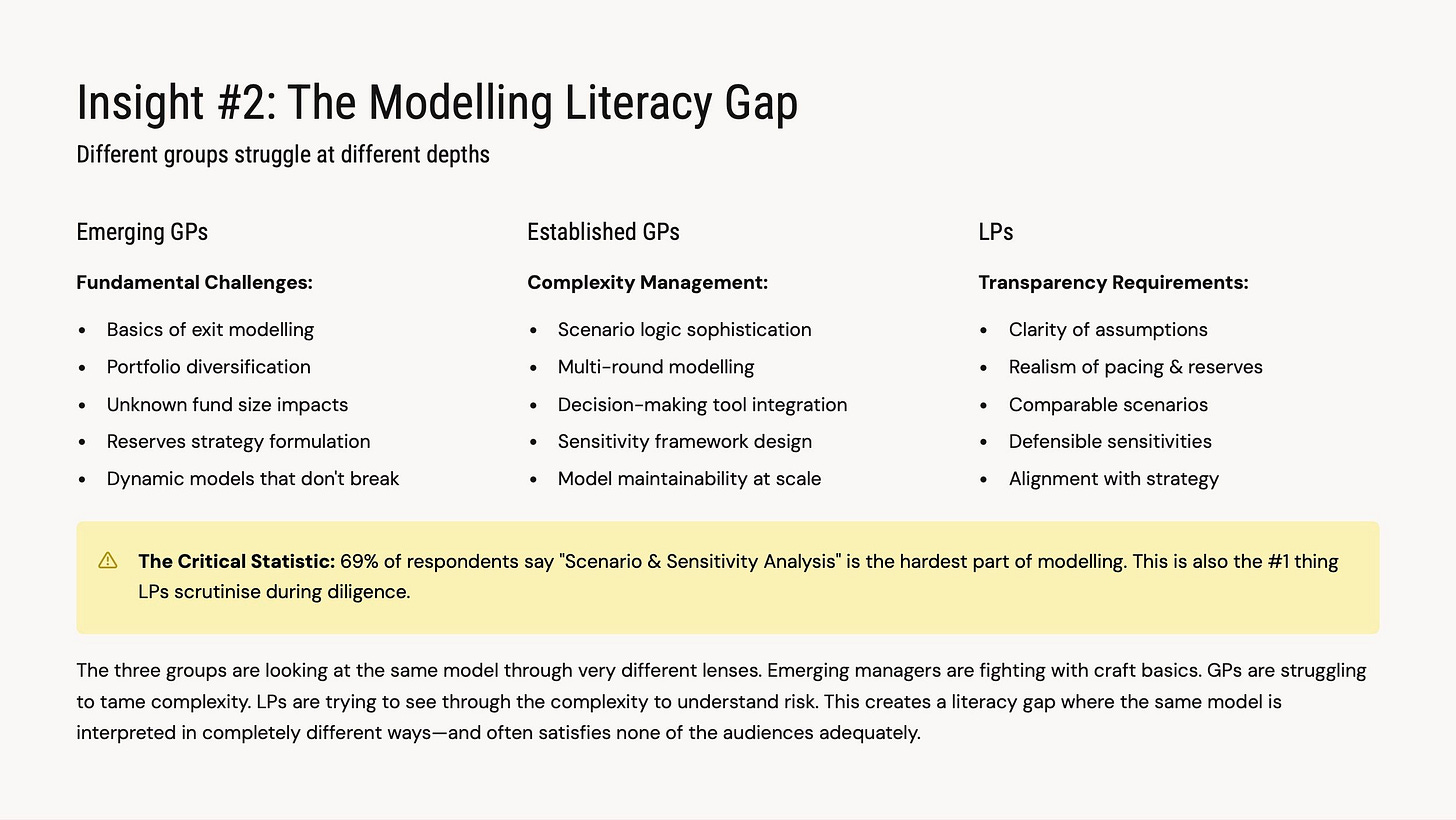

Pattern of the Week: We’re Not Speaking the Same Modelling Language

One of the strongest patterns in the data so far:

Emerging GPs, established GPs, and LPs struggle with completely different parts of the fund model.

Emerging GPs → fundamentals (assumptions, pacing, reserves)

GPs → scale & complexity

LPs → transparency, clarity, comparability

This “modelling literacy gap” shows up in every data room and every fundraise conversation.

It’s one of the biggest reasons LP–GP expectations miss each other.

We’ll go deep on this inside the Fund Modelling Cohort — with real examples pulled straight from the study.

The Next Era of Computing — A Field Guide for Capital Allocators

The Next Era of Computing — A Field Guide for Capital Allocators is a practical roadmap for investors and founders looking beyond the hype. It explores the shift from predictive algorithms to autonomous, embodied intelligence — where machines don’t just think, they act. The guide breaks down what this means for value creation and how to spot the early winners shaping the future.

The book is authored collectively by the FOV Ventures team, a European early-stage VC backing frontier technologies in AI, robotics, spatial computing, and mixed reality. It reflects their hands-on experience investing in founders building the next generation of computing systems.

Tailored for LPs, VCs, and founders, it dives into the real dynamics driving the next decade: new infrastructure layers, emerging business models, and defensibility moats as intelligence becomes embodied. It’s less about buzzwords, more about frameworks for making smart bets at the frontier.

If software “ate the world,” physical AI is set to rebuild it. This field guide is a friendly, actionable playbook for those seeking early insights into the technologies, teams, and systems that will define the next era of computing.

What does compensation look like in Venture Capital?💰

We’re bringing back the VC Compensation Benchmark, and if you work in the industry, we need your help to make it even better.

Last year, we gathered 400+ responses from 24 countries, including both VCs and CVCs. This year, we’re aiming even higher.

✅ 100% anonymous.

🚫 No emails or personal data collected.

👉 Take 1 minute to fill out the survey:

Thank you — we’ll share the full results with you soon!

Most of the stories in venture are about founders and VCs...

But behind every great fund, there’s women writing the checks behind the checks.

That’s why we’re proud to partner with FOV Ventures on the Female LP Pathways Survey 2025 - the first deep dive into what drives (and blocks) women from becoming LPs.

If you’re a female LP or an aspiring one, take 6-10 minutes to add your voice. Your answers will help us:

👉 Map the untold stories of women in venture capital.

👉 Build better data for new LP structures and syndicates.

👉 Open the door for more women to step into the LP role.

Every response helps write the Female LP Pathways Report, and yes, it’ll be fully open for everyone to learn from.

@fov-ventures @tesi @unlockvc @ada-ventures @kvanted

A small step toward better fund models (for all of us)

We’ve been digging deep into fund modelling - through masterclasses, podcasts and countless GP/LP conversations. One thing is clear: everyone’s wrestling with similar challenges, but almost nobody talks about them openly.

So we’re pulling together a shared snapshot for the whole community. Not an ask — just something we’re building together so we can all get a clearer picture of where the real friction points are in fund modelling today.

You can read about it here but, more importantly, please add your voice 👇.

We’ll gather the themes and share them back with everyone. No fluff - just striving continuously to raise the bar and giving Europe’s venture ecosystem the signal it’s been missing.

Grateful to be building this with you all.

Where operational expertise and innovation work for you.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.