Why Venture Funds Must Rethink Fundraising as a Core Business Strategy

Capped off by a members-only GP AMA

"The economy does matter. Tech and venture are not isolated - they are integral parts of the wider economy. Innovation must create real value, not just exist for its own sake."

- Daniel Keiper-Knorr, Speedinvest

Many insights like this one were shared by Daniel Keiper-Knorr during our past discussions, but given how fast the world is changing, does he still stand by them in 2025?

👉 This is your chance to ask him live.

On June 12th, we’re hosting a members-only GP AMA with Daniel Keiper Knorr - Founding Partner @ Speedinvest and EUVC podcast’s guest on our Raising 500 M€ episode. Free & for EUVC community members only. This is your chance to ask all the questions, challenge his views, and explore how venture fundraising strategies must evolve in today’s new reality.

Fundraising as a Core Function

Why Leading VCs Like Speedinvest Treat Capital Raising as a Year-Round Operation

Treating fundraising as a discrete project ignores the reality that investor relationships - especially at the institutional and family office level - require years to mature.

Raising successfully today demands continuous engagement, capital markets expertise, and full-time relationship management embedded inside the firm’s leadership structure.

Quarterly updates, strategic roadshows, and proactive capital pipeline management are no longer optional; they are foundational to operating a sustainable fund.

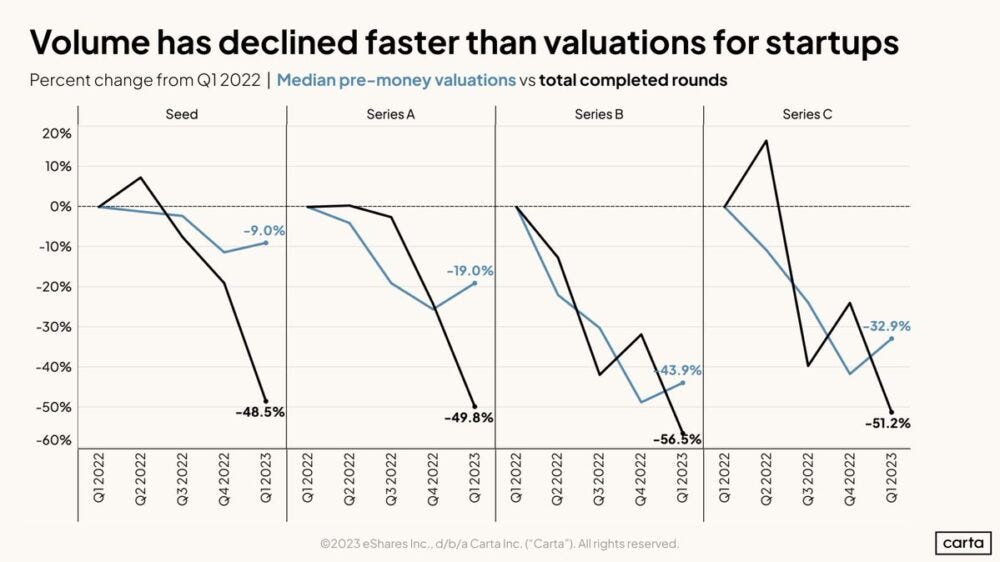

A recent chart from Carta, highlighted in the SaaStr article, reveals a significant contraction in startup funding activity from Q1 2022 to Q1 2023.

The data shows that the number of completed funding rounds declined more sharply than median pre-money valuations across all stages. For instance, Series B and Series C rounds experienced a dramatic drop in volume, down 56.5% and 51.2% respectively, while valuations in those stages declined by 43.9% and 32.9%.

At the Seed stage, valuations held up relatively well, with only a 9% decrease despite a 48.5% drop in deal volume. This suggests that while investors have become far more selective, high-quality early-stage startups continue to attract capital at resilient valuations.

The findings underscore the article’s main thesis and further validate Daniel’s thoughts: in a volatile market, consistent, year-round fundraising is no longer optional; It’s essential.

The Structural Deficiency of Episodic Fundraising

"A fund is a marketplace. There is capital demand on one side and capital supply on the other. Both sides must be constantly worked."

One of the most important shifts in recent years has been the reassertion of macroeconomics over venture dynamics.

For a brief time, it was fashionable to imagine that tech investing operated in its own insulated world.

That illusion collapsed when inflation surged, public markets corrected, and interest rates spiked.

Fundraising conversations today are no longer limited to portfolio performance and ARR metrics.

LPs now routinely probe funds about:

Exposure to interest rate risk,

Asset class competition,

Inflation resilience,

Broader capital market positioning.

A successful fundraising strategy must internalise these realities, adapt messaging accordingly, and demonstrate a credible understanding of how macro cycles impact venture outcomes.

Building Trust over Time, Not Engineering Urgency

Unlike startup fundraising, where urgency and FOMO often drive decision-making, LP commitments are governed by patience, methodical diligence, and risk management.

Efforts to "engineer" urgency among LPs tend to fail.

What succeeds instead is consistent, structured communication:

Sharing regular portfolio updates,

Managing expectations transparently,

Demonstrating predictable execution over multiple years.

In the LP world, trust is accumulated slowly and lost quickly.

Fund managers must approach capital raising as a long-term relational process, not a pressure-driven sales funnel.

Therefore, trust is essential in the relationship between Limited Partners and General Partners, often outweighing short-term fund performance. When trust is strong, built through transparency, integrity, and consistent communication, LPs are more likely to reinvest, even if a previous fund underperforms. In fact, most of EUVC’s successful guests have stated they will reinvest with a GP they trust, even if the fund fails to meet its original return targets.

This underscores the fact that reinvestment decisions are as much about partnership quality as they are about performance metrics.

Managing Multiple Funds with Strategic Clarity

Strategic Guidelines for Venture Fundraising Today

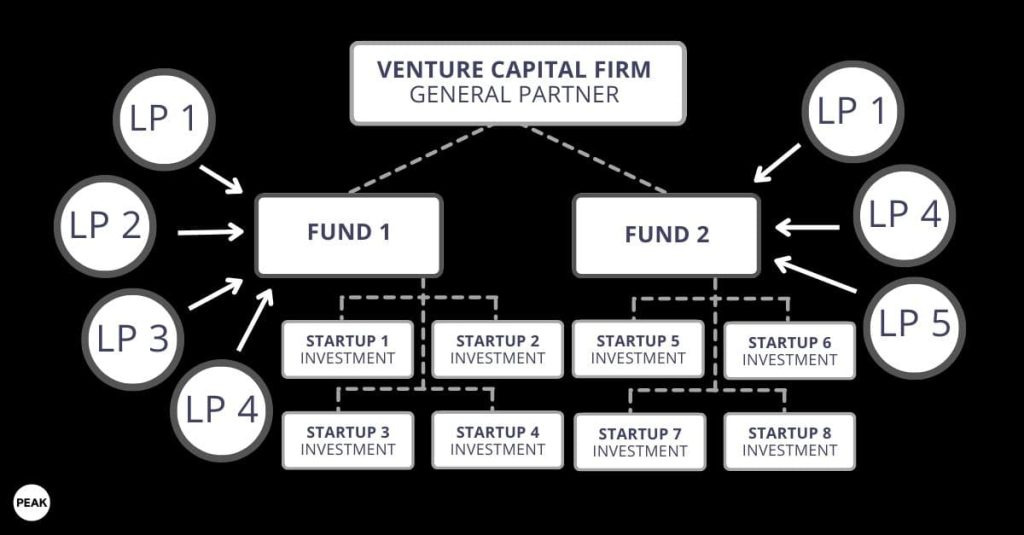

As more venture firms operate multiple strategies - seed, early growth, opportunity funds - managing complexity without creating confusion becomes critical.

Each fund must have:

A clearly defined investment strategy,

Distinct teams and investment committees,

Transparent rules for capital deployment.

Maintaining clear internal and external differentiation ensures that LPs understand what they are investing in and why, minimising perceived risk and reinforcing institutional trust.

For fund managers navigating this new reality, several imperatives emerge:

Professionalize fundraising: Dedicate senior resources, integrate capital markets strategy into the firm's leadership, and treat fundraising as a permanent operation.

Embrace macro-awareness: Fundraising messaging must align with broader economic realities, not just internal portfolio successes.

Prioritize relationship-driven growth: Focus first on building strong LP relationships in local and regional markets before chasing distant geographies.

Accept the timeline: LP decision cycles are measured in years, not months; patience and strategic persistence are essential.

Communicate consistently: Structured, transparent, proactive communication builds credibility over time — the most valuable currency in capital markets.

Fundraising in venture capital is no longer an episodic sprint.

It is a permanent, mission-critical function that requires the same strategic planning, operational excellence, and leadership focus as investing itself.

The firms that recognise this - and build for it - will be the ones that endure and thrive in a world where capital is no longer easy, sentiment is no longer irrational, and success depends on resilience and trust.

Many of these insights have shaped how leading funds operate today, but the question remains: do these strategies still hold up in 2025?

Our guest, Daniel Keiper-Knorr, founding partner at Speedinvest, leads limited partner relations and fundraising at both the fund and portfolio levels.

With a career spanning investment banking, entrepreneurship, and venture capital, Daniel began as a stockbroker and private banker at Erste Bank in Vienna and Credit Suisse in Zurich, before co-founding 3united - later acquired by VeriSign. Since 2007, he has been an active angel investor and, in 2011, co-founded Speedinvest. He brings deep expertise in capital markets, fund strategy, and early-stage growth - and now you get the rare chance to challenge his thinking, live.

Join our exclusive AMA session on June 12th and ask your questions live.

Free- for EUVC community members only.

The conversation around fundraising in venture capital often focuses on tactics: when to raise, how to pitch, what metrics to show. But what was made clear is that the real challenge lies much deeper: in how a firm structurally prioritizes capital formation as a strategic function, not a reactive task.

We saw a shift in narrative: from managing relationships and storytelling to navigating macroeconomic headwinds and institutional expectations. The ability to adapt without losing coherence - to evolve your messaging while staying true to your thesis - is what separates enduring funds from episodic ones.

The broader insight is this: fundraising is not a function of charisma or even performance alone - it is a function of operational excellence. A fund that treats investor relations as a core competency, that builds permanent infrastructure around communication and capital markets understanding, will consistently outperform those who treat fundraising as an occasional campaign.

And here's the takeaway: the firms that treat LP engagement with the same intentionality and iteration as product-market fit are the ones best positioned for long-term relevance. Just as startups can't scale without reliable customers, venture firms can't scale without capital partners who believe in the model, and that belief must be earned, updated, and reinforced across cycles.

We’re entering a phase of the venture cycle where capital will reward discipline, consistency, and macro-awareness, not just vision. Those who internalise that lesson now will be the ones still raising, and still relevant, a decade from today.