It was awesome hosting more than 600 European venture investors for our Roundtable on strategies for winning with non-dilutive funding in Europe 📺

In case you missed it, you can rewatch the session above, read the quick recap below or tune in on Spotify or Apple to get it right into your ears 🎧.

You’re in for a treat with the magnificent panel consisting of:

Gilles de Malbosc, Chief Investment Officer at Harmony Family Office

Bailey Morrow, Managing Director at HSBC Innovation Banking

Hemal Fraser-Rawal, General Partner at White Star Capital

Benjamin Rieder, Founder & CEO of Levenue

Chapters and scroll ⏬ for the core learnings

00:00:00 - Introduction to the Round Table Discussion

00:02:52 - The Difficulty of Company Financing

00:05:33 - Using Recurring Revenue as Collateral for Financing

00:08:12 - Investing in RBF as an MFO

00:11:16 - Risk and Reward in Venture and RBF

00:13:47 - Varying Capital Stack for Companies

00:16:17 - Financing for Entrepreneurs and Investors

00:18:43 - The Benefits of Non-Dilutive Capital

00:20:45 - Non-dilutive Capital and Cap Table Management

00:22:55 - Blending Debt and Equity Instruments

00:25:22 - Uses and Benefits of Short-term Working Capital Finance

00:27:57 - Complementing Equity in Financing

00:30:13 - Investing in Alternatives

00:32:57 - Risk and Data in Private Markets

00:35:36 - Loss Rates in Private Credit and Alternative Finance

00:37:59 - Investing in Venture-backed Companies

00:40:25 - Risk Management and KPIs in Lending

00:42:30 - Choosing the Right Business Partner

00:44:54 - Fraud Stories and Short-Term Analysis

00:47:25 - Financing Options for Venture-backed Companies

00:49:46 - Partnering with VCs and Being Creative in Venture Debt

00:52:05 - Short-Term Capital for Companies & Investors

00:55:00 - Non-Dilutive Financing

00:57:40 - Closing Remarks

The quick recap

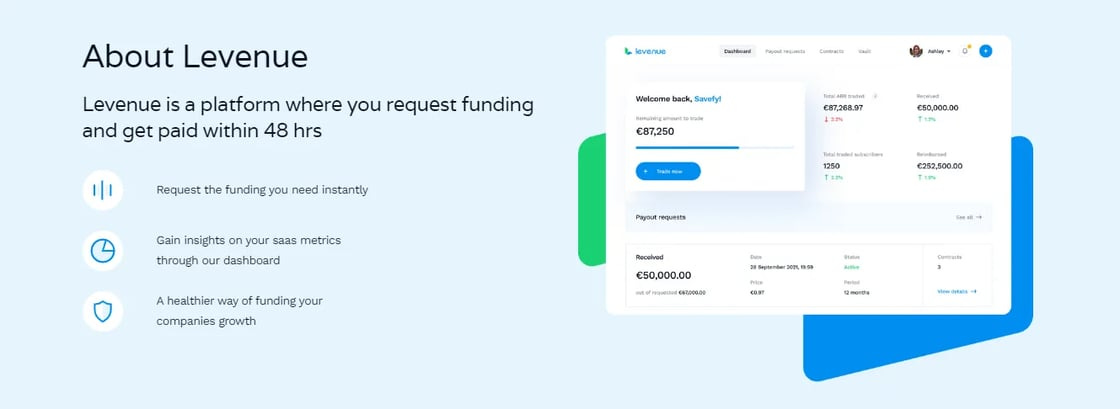

In the rapidly evolving realm of startup financing, Venture Debt and Revenue-Based Financing (RBF) have emerged as pivotal tools. Our roundtable, "Winning with Non-Dilutive Financing in Europe," highlighted these instruments, with a special focus on venture debt, hybrid strategies, RBF and how Levenue is breaking new ground in how they approach RBF which we believe is an important addition to the European market.

Venture Debt: A Strategic Complement to Equity

Venture debt has become increasingly crucial for startups, especially those with venture capital backing. As a strategic complement to equity, it allows startups to leverage their existing equity investments for additional funding. This method is particularly beneficial for startups at critical growth stages who are looking to avoid equity dilution. Its inherent flexibility, coupled with warrant components, provides a hybrid solution that offers the stability of debt with the potential upside of equity. In our panel, Hemal Fraser-Rawal from White Star Capital and Bailey Morrow from HSBC Innovation Banking did an excellent job describing the nuances of venture debt and the combination of equity and credit capabilities from both a founder and investor perspective. You can dive much more into that in the article below by Hemal in connection to the announcement of WSC’s first close of it's Structured Growth Capital Fund I 👇

Revenue-Based Financing and Levenue’s distinct approach

In our panel, we also got to dive deep into how Levenue distinguishes itself in the RBF landscape with their marketplace model that stands in contrast to traditional on-balance RBF models. This approach involves:

Fixed Repayment Structure: Unlike typical RBF where repayments vary with income, Levenue sets a fixed repayment, calculated as a trading limit, over a 12-month period, offering predictability and stability.

Clarity in Fees and Repayments: Levenue stands out with its single fee structure and fixed monthly repayments, differentiating it from other RBF providers.

Data-Driven Decision Making: Focusing primarily on current revenue, banking, and accounting data, Levenue departs from the reliance on founders' future projections. This method enables more accurate and real-time financial assessments.

The Marketplace Model for Investors: Exclusive to Levenue, this model involves selling the ownership of a company's revenue to investors. It’s a model that lowers investment risks and is particularly attractive for investors due to its focus on predictable, recurring revenues.

Targeting Predictable Revenue Streams: Levenue's services are tailored specifically for businesses with stable, recurring revenues, like those in the SaaS or subscription-based sectors, steering clear of non-recurring revenue models such as typical e-commerce.

Complementing Equity Financing: Levenue's RBF is not just an alternative to equity financing but a complement to it. By aligning with VC interests, Levenue offers a cost-effective solution without impacting company valuation.

RBF from an Investor's Perspective: The Levenue Edge

As Gilles shared in the roundtable, Levenue's model presents a compelling proposition for their investors. It provides predictable returns and a lower risk profile due to its focus on revenue ownership. The platform thus offers access to burgeoning sectors characterized by steady revenue streams, making it an attractive addition to investment portfolios.

Clearly, Levenue is at the forefront of a paradigm shift in startup financing. Their approach to RBF, characterized by its marketplace model, fixed repayment schedules, and focus on predictable revenue, is a game-changer. And this is not just a promise, it's backed up by hard numbers:

0% default rate

> 400M€ traded through the platform

> 500 companies active in 15 European countries (30 in Q1 2024)

A beautiful mix of providing startups with a flexible, founder-friendly financing solution while offering investors a lower-risk, data-driven investment opportunity. What's not to like? 🤷♂️

Check out Levenue to go deeper 👇

Upcoming events

📺 Virtual events we’re hosting

Acing LP Relationships | Feb 12, 2024, 12:00 PM - 1:00 PM

The O.G. Roundtable of the Year | Jan 29, 2023, 12:00 PM - 1:00 PM

Data-Driven Portfolio Modeling | Jan 17, 2024, 12:00 PM - 1:30 PM

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg, Sweden

Odense Investor Summit | 📆 13 - 15 March | 🌍 Odense, Denmark

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany