Championing European Women in VC

Today’s insights article is dedicated exclusively to championing European Women in Venture 🏆 and taking a closer look at where we’re at as an ecosystem 👀

Last week we shared Gesa Miczaika from Auxxo’s list of rockstar female founders, this week’s EUVC Lowdown with the amazing Cathy White will be dedicated to women in venture and so will this week’s insights article.

But before we get started, why is this topic so important? Kinga of European Women in VC put it well in an interview to Forbes 👇

Building on this, I wanted to draw out and add my five cents to some key conclusions from the European Women in VC report that Kinga spearheaded with support from many of the greats in the ecosystem.

Startups - where the money is invested

Let’s start where the money ends - the founding teams. Obviously, we have a problem. “But hey!” you might say, interjecting: “who says the teams should be all-women!?” They shouldn’t, of course. But the number for mixed gender-teams is 9.3% - not exactly that much better.

But the worst thing is: we’re not making progress.

At best, we’re flat and at worse, we’re reversing - having gone from 2.7% of all funding going to all-women teams in 2018. Dive into the source of the data in this article by downlading the Euroepan Women in VC report below 👇

And don’t forget to pre-register for what I’m sure will become one of the most influential conferences in European Tech 👇

And as Oliver Holle says in his quote below: work for action, not just talk ✊

VCs - where the money is managed

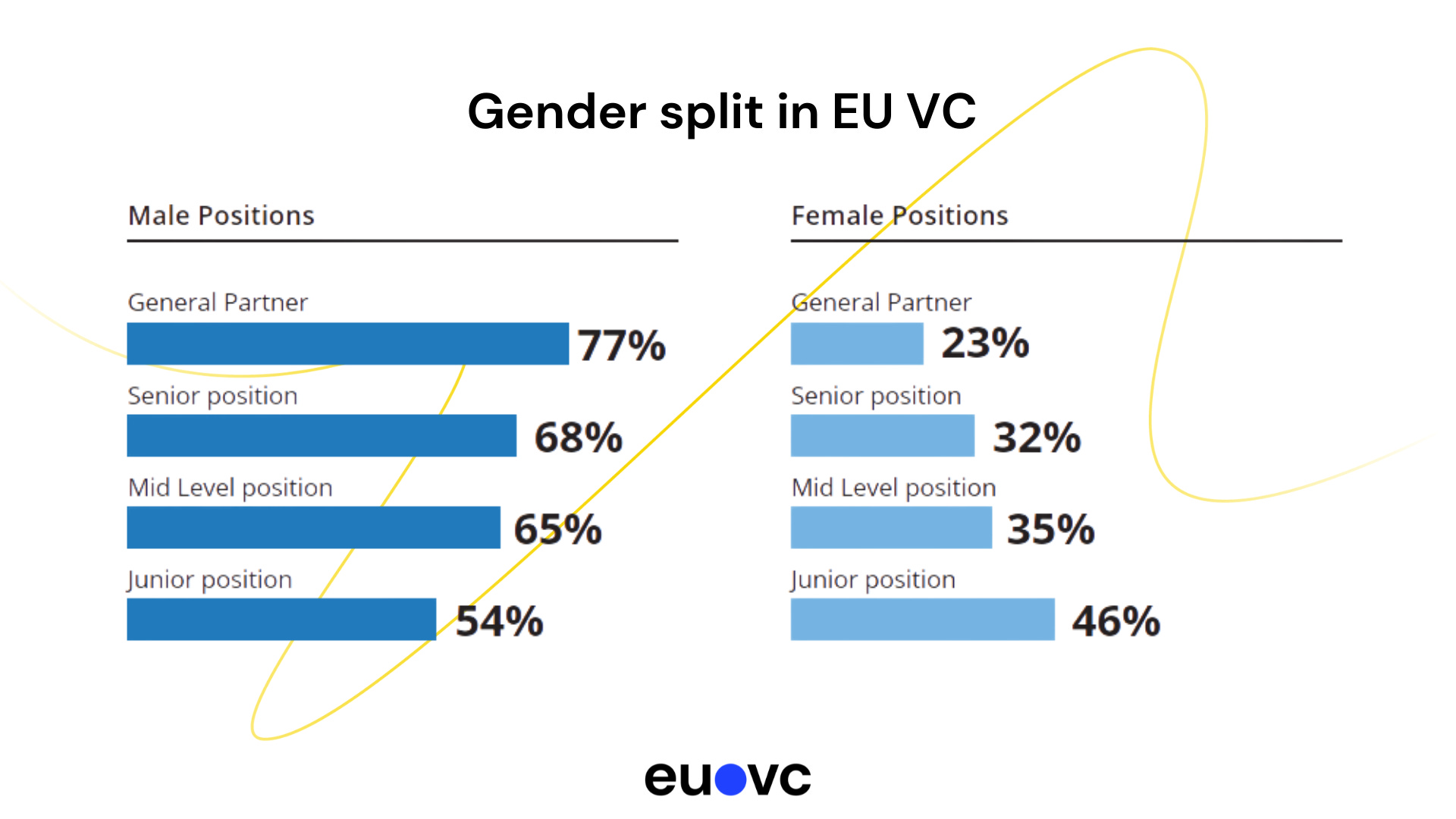

Now let’s turn our attention to where the money is managed; the VCs. Here, we find a startling statistic:

Where men tend to grow their careers at VCs, women tend to drop off. Gender balance at the junior and mid-level positions is more evenly distributed, yet there are still quite a few funds without a single female on the investment team.

The more senior the position, the fewer females are present.

We cannot get around it. Female career development and female career perspectives must be addressed ASAP to create more evenly balanced growth opportunities in the VC community.

We couldn’t support the below quote from Joe Schorge at Isomer Capital more whole-heartedly 👇

"We need to push for transparency and strong policies to create equal opportunities for development and promotion. VC firms with lasting success are those that carefully build the next generation of investors and consciously open the partnership to a diverse range of genders, ages, ethnicities, life experiences, and socio-economic backgrounds. We’ve all got more work to do. "

Joe Schorge, Isomer Capital

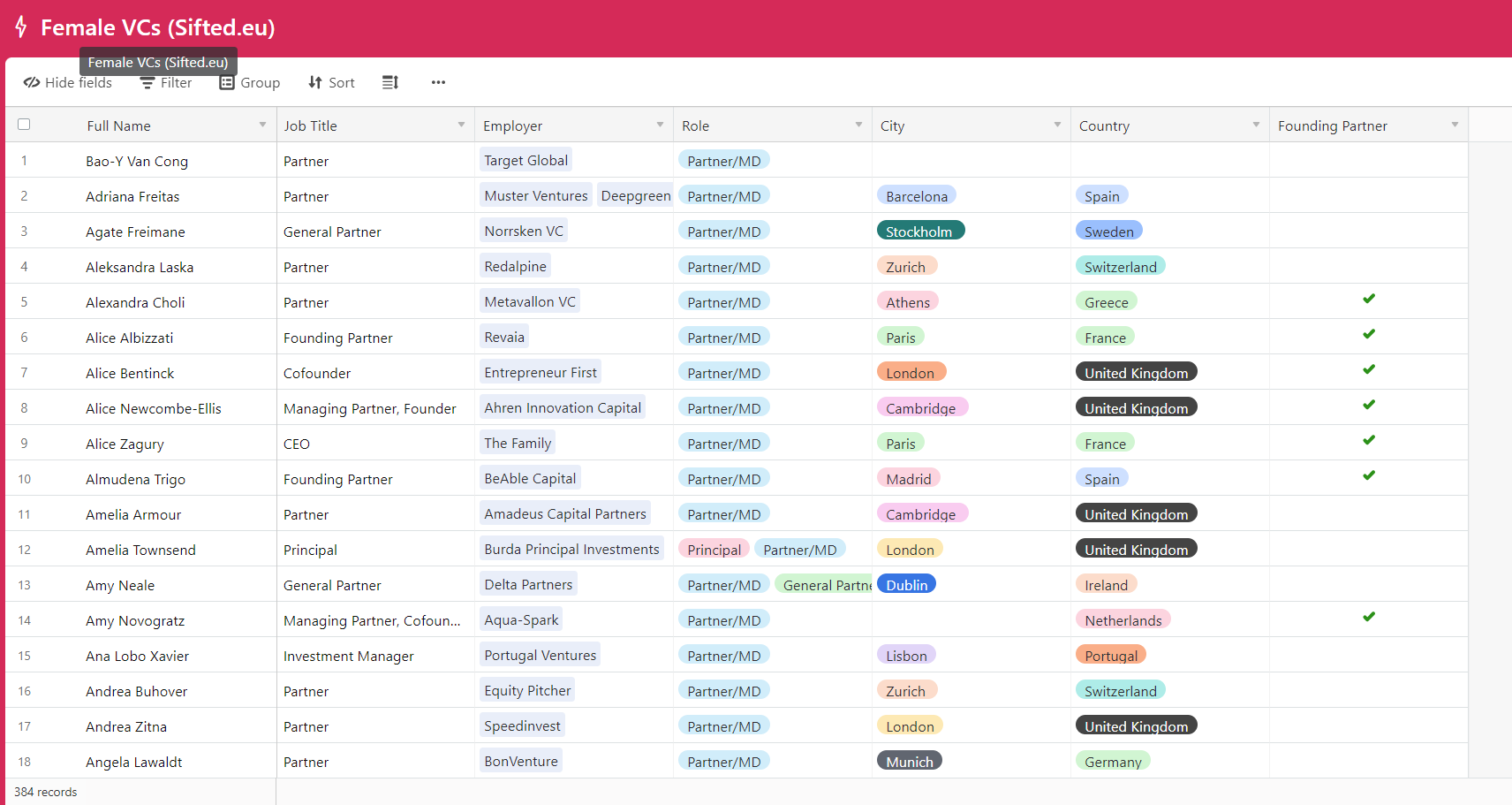

Sifted’s list of 300+ Female VC Partners

While on the topic of women in VCs, we want to share the Sifted team’s amazing overview of 300+ female VC Partners in Europe. Access it on the link below.

And finally, if you wanna hear the voices of some of the trailblazing women of our industry, here’s a playlist made especially for you 👇

LPs - where the money comes from

Now, let’s look at where the money (and part of the problem) come from. ‘Cos unfortunately, male dominance in our beloved VC industry is confirmed at the Limited Partner level.

In the European Women in VC report, they found that only 20% of the LP interactions for VCs are with women. Out of the 20% that are women, only slightly more than half of the women have actual decision-making power (53%).

But what's the role of LPs in all of this? Catherine from Isomer provides an answer:

How does this translate in Catherine’s deal making? 💸

When we invest in VC funds, we scrutinise team composition and dynamics. We expect to see fair practices evidenced in DEI and ESG policies — and most importantly, confirmed by founder references.

Catherine Dupéré, Isomer Capital.

But does the puck really end with scrutinizing VCs? 🤔

We also need to examine our own teams and processes, from hiring, deal sourcing and relationship building to decision making. Are we giving everyone an equal chance? Do we ask important and consistent questions to prospective and portfolio investments? Are we leading by example? How can we do better? "

Catherine Dupéré, Isomer Capital.

At EUVC we’re dedicated to ushering in a new generation of LPs, VCs and Founders. We’re doing so by building LP syndicates designed to democratize access with lower entry tickets than the usual monster tickets.

Hopefully, this will help in making sure that the next generation of investors will more accurately reflect the world we live in.

You can help us on this mission by recommending our LP syndicate for emerging angels, operators & founders to someone you believe will be a changemaker ♥