Future of work & learning VC Emerge launches oversubscribed Fund II at $73M, the consumerisation of climate and more

Learn directly from Emerge VC, Eka Ventures, Teklas Ventures, Nebular VC and other leading European VCs.

Another packed newsletter for you. Let’s get into it.

We’ve got some standout submissions on the community insights platform to share, plus upcoming workshops in the EUVC community you won’t want to miss.

For those of you interested in late-stage high profile deals, we have gotten access to xAI, Anthropic and Anduril that are all closing over the next few weeks. Reach out to andreas to hear more.

To get featured, go here.

Emerge's Jan Lynn-Matern on launching an oversubscribed Fund II at 73M USD & shaping the future of work

In this episode of the EUVC podcast, Andreas sits down with Jan Lynn-Matern, Founder and General Partner at Emerge, a global pre-seed fund backed by over 100 leading operators in the future of work and learning. Jan shares Emerge’s mission to democratize access to opportunity for early-stage founders, providing not just capital but deep expertise and a community of seasoned professionals.

Together, Andreas and Jan dive into how AI is transforming work and education. They discuss Emerge’s investment philosophy and focus on impact, the importance of nurturing curiosity from a young age, and Jan's insights on the European market and its dynamics. Jan sheds light on the evolving landscape of education, the challenges and opportunities posed by generative AI, and how these shifts are redefining job markets. The conversation explores the critical need for adaptability and upskilling within organizations to keep up with technological change and how AI could become a powerful tool for enhancing learning and career development.

This episode offers a nuanced look at Jan’s journey, Emerge’s investment approach, and the unique role AI plays in reshaping the future of work, learning, and access to opportunity.

✍️ Show notes

Why we are here — Emerge Manifesto

Emerge is a $73m pre-seed fund backed by 100+ of the world’s best future of work and learning operators. AI is fundamentally reshaping how we learn, find and do our jobs, and the companies that harness this shift will define the future. Our vision is to democratise access to opportunity by being a catalytic partner for early-stage founders focused on this seismic shift.

We were the first specialist future of work and learning investor in Europe. Over the past decade, we have made 80+ investments in companies now valued at over $2b and impacting more than 31M people worldwide.

The reason we do what we do is because we got lucky. We’re the kids of immigrants, refugees and working-class parents, and we were lucky to receive world-class education and training that gave us access to career opportunities our parents could only dream of.

Now we are on a mission to support the most important transition the world will see this century. The opportunity to live up to your full potential should not be a privilege but a right for everyone.

What we offer founders

Our mission is to be the best first cheque for founders

We have designed a three-pronged value proposition for pre-seed founders: we write big cheques, early; we match you with world-class operators to enable you to move faster; and we’re in your corner during future fundraises.

1) We write big cheques, early: The most important thing early on is to act fast and make bold moves, but you can only do so if you don’t have to worry about fundraising. Unlike most pre-seed investors, we are unafraid to write significant cheques ($500k — $2.5m) into pre-revenue, often pre-product companies — to enable you to focus on building.

“Emerge’s process was fast and they took a high conviction bet on us very early on. With our first institutional round, that was exactly what we were looking for. Together with the incredible support of their VPs, we knew Emerge was the perfect fit for us.” — Richard Weiqi Zhang, co-founder at Solvely Labs, which develops AI agents for learning

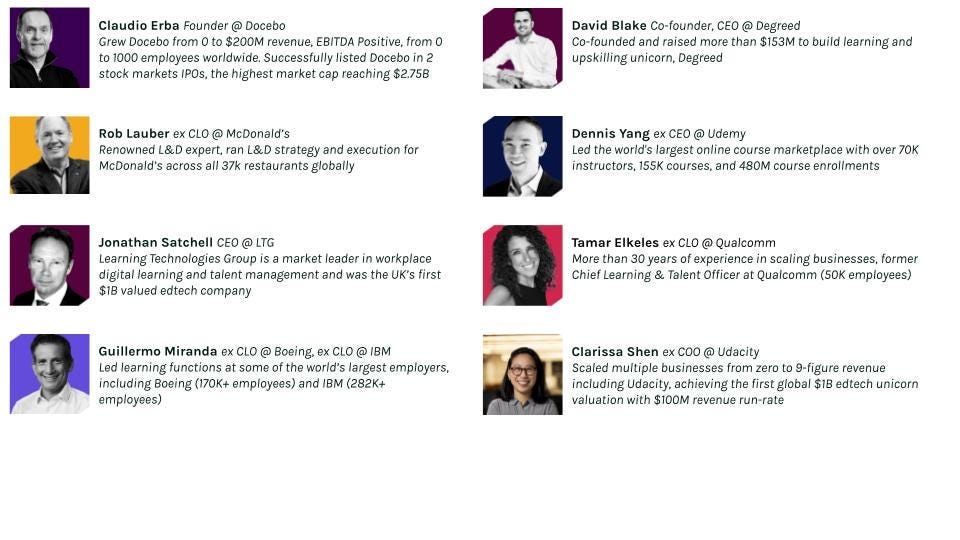

2) We match you with world-class operators: You will learn from those who have been in your shoes and have built 50 of the top 100 future of work and learning companies in the world. We match you with mentors, advisors and even independent board members from our community of 100+ Venture Partners, spanning every future of work and learning category, to accelerate your path to product-market fit and Series A. Every company we invest in directly benefits from this community and our resulting portfolio NPS is a stunning 90.

“Being able to rely on some of the world’s leading entrepreneurs in our industry for detailed advice on topics such as product expansion, positioning and pricing has massively accelerated our learning. Getting Emerge as a pre-seed investor was like getting a one year headstart on our competitors.” — Dominik Mate Kovacs, founder and CEO of Colossyan, the global AI video company

3) We’re in your corner during subsequent fundraises: When the time is right, we move mountains to raise your next round. As of today, an incredible 80% of our fund investments have gone on to raise up-rounds following our initial investment, raising from the likes of Index, Maveron, Lakestar, Partech, Iconiq, Earlybird, Localglobe, First Round and Founder Collective.

“Emerge were our first investor at pre-seed and have introduced us to the lead investor of every subsequent round, inclusive of our Series B. They have been so crucial to our success.” — Ben Drury, co-founder and CEO of Yoto, the global early years consumer brand

In short, we are the market experts you need to help you go from startup to IPO.

➡ Building a company transforming the future of work or learning? Get in touch! The easiest way to do so is to send us your deck via our simple Typeform, here.

What are we looking for?

When we say early, we mean early. While traction is always helpful, we primarily look for founders who we believe can change the world, pursuing big ideas in market categories we believe in.

Founders who will change the world: We look for founding teams with the propensity to think big, the ability to move fast and the skills to create value. Throughout our investment process, we build a detailed picture of your founding team — how you think and execute, and how you have challenged the status quo.

Big ideas in market categories we believe in: We are a thesis-driven investor. As market experts, we think as deeply about the market opportunities founders are pursuing as they do. We deeply understand every area we invest in, with strong confidence that our specialist knowledge can add value. Read the ‘request for startups’ section of this manifesto to learn about our current interest areas. Our thesis constantly evolves and this document is not updated in real-time, so if your idea is not represented in the list but you are building something exciting in this space, get in touch with us anyway.

If we are convinced these two factors are in place, we are ready to partner with you, no matter how early you are on product or traction.

Our investment process, from the founders’ perspective

Get in touch: The easiest way to get in touch is to send us your deck via this link.

Exploration: If we see a fit, we will arrange a first call with one of our investment team, often followed by a demo walk-through.

Monday Meeting: The next stage is to present to all three Partners at a Monday Meeting, after which we give you a strong indication of how likely we are to make an offer and you will start meeting some of our Venture Partners as potential matches. This can be as soon as one week after our first call.

Investment Committee: The final stage is our investment committee meeting, in advance of which we will work collaboratively with you to build a deeper analysis of the opportunity.

Term sheet: 2–4 weeks after our first call, you receive a term sheet from us and get matched with the best Venture Partners for your journey.

Our investment thesis

A new world

Will robots steal our jobs? The short answer is: yes, they might, but if we can adapt, we’ll get a better one.

AI is changing everything — it’s a general purpose technology, so it affects every aspect of how we live, learn and work. Some parts of our jobs will be automated, some augmented and the rest will be performed by people who can work most effectively alongside AI. These changes are bigger than anything we’ve seen since the Industrial Revolution.

In addition, AI will add more to global GDP by 2030 than the current output of the United Kingdom. That growth will create plenty of good jobs (up to 50 million), many of which will be in new types of occupations that haven’t even existed before.

In a nutshell: the world of work is transforming, fast. It’s a fact that if you don’t adapt to this new world, you will be left behind — and what worries us is that people don’t have access to the tools, skills and confidence they need to do so.

That’s why we’re investing in companies that empower people to Learn, Navigate and Work.

Learn

To be adaptable, you need to start with strong interdisciplinary knowledge and be able to learn new things constantly and fast.

That’s simply not what’s available to most people on the planet. Why? Access to education varies widely across all dimensions—relevance, cost, and quality.

Using the power of AI, companies in our “Learn” segment catalyse huge improvements in education at all levels by making personalised learning accessible to every learner at near-zero marginal cost.

2. Navigate

Given AI's disruptive nature, our jobs and roles will change much more frequently in the future. Already, we are experiencing twice the pace of occupational transitions as before the pandemic. Workers need to improve their knowledge of when to switch jobs or careers, where to go next, and how to get there.

In parallel, organisations will need to constantly reinvent themselves to keep pace with changes in technology and society, creating a massive talent management challenge: who to hire, who to develop and how, and which roles to cut.

Companies in our “Navigate” segment work with both employers and candidates, using AI to improve the efficiency and quality of some of life’s most important decisions: who we work with.

3. Work

The future is defined by an increasing social divide between those who can use AI to increase their productivity and those who try to compete against it. Today, most of AI's benefits accrue to technology companies and the few people working for them. Making AI's power accessible to everyone is one of the biggest opportunities of our time.

As AI takes over more and more complex tasks in knowledge and services industries, our roles will shift to become broader, expect us to do more with less and focus on high-value tasks like innovation, decision-making and managing risk. Doing well in these roles will require us to build expertise in multiple domains and be literate in using AI to automate high-value tasks that relate to our roles.

Companies in our “Work” segment empower individuals by building easy-to-use tools that enable people in all professions to collaborate with AI and to do more with less — and empower organisations to fuse work and learning to allow for constant transformation and upskilling.

The opportunity of a lifetime

These Learn, Navigate, and Work segments represent disruptive innovations in markets such as supplementary education, edtech software, talent development, hiring and recruitment, and workforce productivity, totalling $1.5 trillion in today’s spending.

And the signs are clear: we are witnessing a Cambrian explosion of new startup creation in these markets. The stakes are massive and the opportunities to create great value are real — and we’ve never been more excited to invest in founders in this space.

With that in mind, we invite you to read on for our Requests For Startups below, where we detail specific investment concepts that we are particularly excited by.

1. Request For Startups — Learn

Intro

Using the power of AI, companies in our “Learn” segment catalyse huge improvements in education at all levels by making personalised learning accessible to every learner at near-zero marginal cost, across the following market categories for young and adult learners:

Tech for young families — Intersection of the $57B educational toys market [source] and the $250B global early years education market [source].

Higher education/K12 B2C supplemental — $14B study tools market [source] and $10B online tutoring market [source].

Educator tools and co-pilots — $6B teacher professional development market in the US alone [source], while the teacher training market is expected to reach almost $33B by 2028 [source], as the world needs to add more than 7M teachers a year on average [source].

Self-improvement — $44B personal development market [source] and $3.2B online life coaching market [source].

Language learning — $21B global digital language learning market [source].

To support our portfolio companies in these categories, our Venture Partners include entrepreneurs and executives who have built some of the most successful consumer learning products worldwide.

Highlighted Emerge Venture Partners in this segment

Let’s go deeper into each segment and explore the kinds of companies we intend to back in each one.

Tech for young families

Parenting is life’s toughest gig. Funding for early years settings is insufficient (only 6% of public education spending), mental health problems in kids are on the rise, and support from immediate family is ever decreasing because of urbanisation and the increasing mean age of first-time parents. Solutions are needed to support young families with school readiness, language and skill development, play, sleep, nutrition and building healthy home and digital environments.

“AI-driven solutions are poised to catalyze growth in early learning spending, as they provide new opportunities to tailor learning to each child and support parents’ capabilities as their children’s first teachers. Moreover, public investment in educational technology solutions for young children will increase as governments globally recognize the opportunity to improve outcomes for all young children, especially those from underserved communities.” — Sunil Gunderia, CIO at Age of Learning and Venture Partner at Emerge.

Request for startups:

Physical/digital for early years development: Services that combine physical and digital experiences to engage the child/family and build lasting habits. Examples: Yoto, Edurino.

Interactive, personalised edutainment: Interactive and personalised learning experiences, from literacy to numeracy to edutainment.

AI parenting assistants and tools: Personalised and affordable assistance for parents that builds confidence and reduces stress at home.

Safe social networks: Alternative digital environments for kids that allow safe interaction with content and friends

Emerge portfolio companies in this category

HE/K12 B2C supplemental

All students face exam pressure, but the learning support they receive differs widely, both in school and at home. As a result, parents and young learners are increasingly looking for solutions outside the formal education system, creating both a huge commercial opportunity and a design imperative to build solutions which actively foster educational equality. Accessible supplemental learning support is required to level the playing field.

“Students were the first to adopt AI en masse. They are hungry for the independence AI tools provide, and in particular AI-powered features that don’t just provide quick answers but meaningfully support learning. I believe these kinds of tools will provide all students with the support they need to excel.” — Stephen Jull, ex-CEO at Epic! and Venture Partner at Emerge.

Request for startups:

AI authoring tools for learning materials: Tools that give learners content creation superpowers, enabling them to transform textbooks, lectures and notes into personalised and interactive learning materials such as mind maps, flash cards, presentations, and more. Example: Algor.

AI study buddies: Tools that increase access to personalised study help by mimicking the actions of a good tutor, distributed either directly to consumers or via schools and publishers. Examples: Solvely, Foondamate.

Twitch for education: Live interactive lessons from big brand teachers/schools. Example: MyEdSpace.

Group-based online extracurriculars: Democratising access to extracurriculars through group-based online delivery.

Emerge portfolio companies in this category

Educator tools and co-pilots

In an environment of restricting budgets and increasing expectations, educators must do more with less. We have seen an impressive pull from this demographic for workflow solutions that meaningfully save time and cost or improve learning materials’ interactivity and relevancy.

“Education institutions are embracing AI to reduce the burden on educators and reduce cost. AI will soon become part of every major work flow in formal education settings.” — Mary Curnock Cook, former CEO UCAS and Venture Partner at Emerge.

Request for startups:

AI-automated academic assessment: Tools that automate the evaluation of academic assessments, saving institutions significant time and money. Example: Cadmus.

Chat-to-institution: AI chatbots that allow students to speak to their university’s HRIS, LMS and customer/student support function 24/7. Example: Learnwise.

AI-enabled authoring tools for educators: Tools that radically speed up the process of creating high quality learning and classroom materials for educators. Example: Algor.

AI co-pilots for academic tutors: Infrastructure tools for tutors and/or tutoring agencies that help them scale high quality tutoring delivery.

Emerge portfolio companies in this category

Self-improvement

If ever there was a category of learning solutions that truly applies to the mass market, this is it. Yet most self-improvement spend goes toward non-technical products and services such as books and 1:1 sessions with therapists and coaches. AI is creating the opportunity to scale preventative interventions that address the same pain points but are significantly more cost-effective.

“AI is disrupting the self-improvement market by creating highly personalized solutions that produce step-function better outcomes, can reach mass adoption, and at a much lower cost!” — Ajay Varia, founding engineer MasterClass, former COO @ Emeritus, and Venture Partner at Emerge

Request for startups:

AI life coaches: AI-powered tools that dramatically reduce the cost of delivering high-quality life/career/relationship coaching.

Spiritual education: Hyper-personalised learning and coaching experiences that help people connect with their spiritual selves and find meaning. Example: Niyyah.

Relationships education: Hyper-personalised learning and coaching experiences that help us build and maintain strong romantic relationships and friendships. Example: Kuddl.

Adulting and financial education: Tools that enable users to learn about and better manage their finances.

Mental health/health education: Tools that create healthy habits and skills to improve mental and physical health (e.g. socio-emotional, sleep, nutrition) before these issues become bigger problems.

Emerge portfolio companies in this category

Language learning

An estimated 1.5B people are learning a second language, globally. Digital language learning has seen two major iterations over the past 25 years: version 1 was pre-recorded content (Rosetta Stone) and version 2 was gamification (Duolingo). AI has ushered in the third major iteration: avatar-based language learning.

“AI has enormous potential to make digital language learning solutions even stronger and unlock the next wave of adoption.” — Bernhard Niesner, Founder and former CEO Busuu, and Venture Partner at Emerge.

Request for startups:

AI-powered pronunciation and language learning: Solutions that enable language learners to practise speaking — by far the most desirable language-related skill — with an AI avatar at near zero marginal cost.

➡ Building a solution focused on learning that corresponds to any of the above ideas? Get in touch! The easiest way to do so is to send us your deck via our simple Typeform, here.

2. Request For Startups — Navigate

Intro

Companies in our “Navigate” segment work with both employers and candidates, using AI to improve the efficiency and quality of some of life’s most important decisions: who we work with. We see disruptive potential across the following market categories:

Career navigation/pathways — $14.5B career counselling market [source], augmented by a $1.7B outplacement services market [source].

Talent sourcing — $141B talent acquisition and staffing technology and services market [source].

Talent assessment and selection — $22B talent assessment market [source].

To support our portfolio companies in these categories, our Venture Partners include entrepreneurs who know how to build for and distribute to employers, and enterprise and mid-market CHROs and CLOs who have bought such services throughout their careers.

Highlighted Emerge Venture Partners in this segment

Let’s go deeper into each segment and explore the kinds of companies we intend to back in each one.

Career navigation/pathways

Choosing a career has never been more exhilarating — or more intimidating. A person’s first job greatly influences their future earning potential and overall career trajectory. However, most young individuals lack access to quality advice on this subject. What’s more, not all entry-level jobs offer the same level of support and development opportunities. For example, by 2027, an ‘alternative workforce’ of freelancers, temporary contract workers and crowd workers is expected to become the majority of the US workforce but contingent workers are often unable to develop skills that will get them further in their careers. Considering the significance of first jobs for career and life trajectories, it’s crucial to find solutions that can equalise opportunities in this area.

“It’s said that talent is everywhere, but opportunity is not. With the added reality that careers are no longer linear and work is increasingly borderless, giving individuals equitable access to tools for career discovery, counsel, preparation and navigation becomes more essential. These exciting technologies do just that, and in a way that cultivates curiosity, self-awareness, and increased confidence.” — Natasha Davidson, former CMO EMEA Coursera and Venture Partner at Emerge

Request for startups:

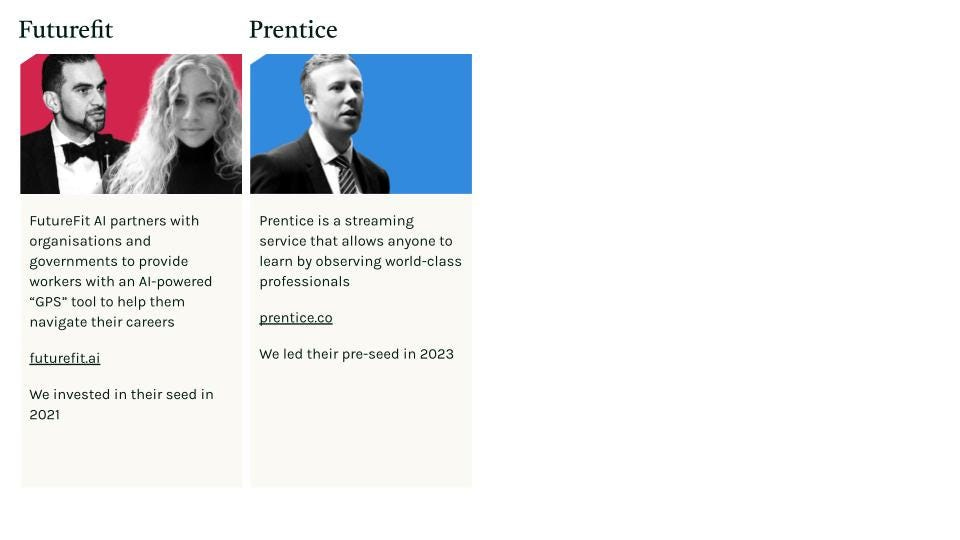

AI-enabled career navigation tools: Tools that accurately match end users with career paths and roles, based on a deep understanding of skills, personality and macro factors. Example: FutureFit.

AI career coach: Tools that level the playing field and allow candidates to represent themselves best during the hiring process.

Entrepreneurial upskilling: Resources, communities and guidance focused on a massively underserved segment: small business owners and creators. Example: Prentice.

Emerge portfolio companies in this category

Talent sourcing

Accessing talent has never been harder. Hit by an $8.5 trillion global skills gap, an ageing working population and competing for talent against global competition, many industries need a full overhaul of their talent pipeline to increase the net supply of talent.

“Bridging the skills gap requires millions of people to commit to build new skills and potentially enter new career paths. That is difficult to achieve. I’m excited about products and services that are creating the infrastructure for that massive shift to happen.” — Christina Sass, Founder of Andela and Venture Partner at Emerge

Request for startups:

AI talent sourcing: Tools that save recruiters time by automating the search for and connection with potential talent, and managing the employer brand.

EmployerEd: Generating candidate pipeline through some form of job simulation, e.g. Employer-tech-stack-linked bootcamps; Digital mini-internships; Employer-branded talent academies. Example: Academy.

Verticalised job boards: Nextgen job boards that are sector-specific and own more of the value chain, including vetting candidates and supporting better matches.

Producers of skilled manual labour: Bootcamps, migration solutions, and staffing providers that increase the net supply of manual skilled labour and connect it with high-value jobs. Example: Varm.

Emerge portfolio companies in this category

Talent assessment and selection

There is no one formula for calculating the cost of a wrong hire or the cost of making the wrong promotion, but no matter how you look at it: it’s huge. Yet today’s methods for evaluating potential and performance are either subjective (interviews, 360s) or unscalable (expensive talent agencies). Meanwhile, the introduction of AI into the hiring process (on both sides) has made it more difficult to evaluate candidates authentically and free from bias.

“Leaders have long struggled to match talent with roles, and traditional, costly methods like psych-driven assessments or interviews have barely evolved in 50 years. Now, SaaS tools, skills analytics, and AI are revolutionizing hiring by offering a scalable, cost-effective way to find the best talent for any role, from entry-level to C-suite. Once this approach is refined and scaled, it will transform hiring, save organisations money, and create immense value for those who deliver it.”— Mike Priddis, Founder and former CEO of Faethm, and Emerge Venture Partner

Request for startups:

AI talent management and selection: Tools that enable recruiters to interact with talent at scale and make more accurate hiring decisions, including chatbots, automated interviews, interview co-pilots and automatic candidate assessment. Example. Popp.

Job simulation assessment: Assessing candidates based on customised work sample tests, graded fairly by AI, to enable hiring based on a person’s true skills and potential, not their CV. Example: Skillstrust.

Company-specific models for skill assessment: Connecting all of a company’s performance, goal management, and career development data to build a company-specific model that can power other use cases like hiring, performance coaching/feedback and career progression.

AI governance solutions: Tools that enable HR to monitor the use of AI models throughout the HR function to prevent biased decision-making.

Emerge portfolio companies in this category

➡ Building a solution focused on career navigation, hiring or talent mobility that corresponds to any of the above ideas? Get in touch! The easiest way to do so is to send us your deck via our simple Typeform, here.

3. Request For Startups — Work

Intro

The future is defined by an increasing social divide between those who can use AI to increase their productivity and those who try to compete against it. Companies in our “Work” segment empower individuals by building easy-to-use tools that enable people in all professions to collaborate with AI and to do more with less — and empower organisations to fuse work and learning to allow for constant transformation and upskilling. This will eliminate repetitive, dull work and free people to spend time on high-value tasks like innovation, decision-making and managing risk.

We see enormous disruptive potential for technology companies across several market categories:

Workforce development — $396B corporate training market and $46B online degrees and micro-credentials market [source].

AI co-pilots and knowledge management — $558B knowledge management market [source].

To support our portfolio companies in these categories, our Venture Partners include entrepreneurs who know how to build for and distribute to employers, and enterprise and mid-market CHROs and CLOs who have bought such services throughout their careers.

Highlighted Emerge Venture Partners in this segment

Let’s go deeper into each segment and explore the kinds of companies we intend to back in each one.

Workforce development

Workplace upskilling and reskilling — especially when focused on enabling people to use AI at work — are mission-critical capabilities for all organisations that want to stay innovative and retain talent. But high-quality development opportunities like coaching and skills development are expensive and, therefore, have historically been accessible only to the top echelon of professionals; the rest of the workforce is stuck with unengaging MOOCs and mandatory compliance training. As a result, only 30% of employees at risk of job displacement from AI and technological changes received training in recent years.

“To develop the workforce, we need to move beyond static L&D content libraries toward a technology ecosystem that provides workers with insights, guidelines and coaching in the moment, while collaborating with others. We’re in a Cambrian moment of L&D — the space will be unrecognisable five years from now.” — Claudio Erba, founder and former CEO of Docebo, and Venture Partner at Emerge.

Request for startups:

Digital empowerment: Tools to upskill and enable professionals to use AI, no-code and RPA, and to get the most out of sophisticated software. Example: Mendo.

Flight simulator for interpersonal skills: Interactive learning experiences that create safe environments in which to train for high-stakes situations or complex interpersonal skills, such as sales, leadership and negotiation — from voice to avatars to XR. Example: Replicate.

Business communication co-pilots: AI that improves business communication skills through feedback and automation, including both written and verbal work outputs, from emails to business calls to proposals.

Authoring tools for L&D and learning designers: Innovative authoring tools that turn boring L&D content into interactive avatars, AI tutors or even facilitator-less group activities. Examples: Sparkwise, Engageli, Colossyan.

Low-cost performance coaching/mentoring: Platforms that radically decrease the cost of delivering coaching/mentoring to employees at all levels of the corporate pyramid, such as using trainee coaches, p2p coaches or AI.

Frontline worker management tools: Shopfloor-level management systems that are used by frontline workers 24/7 to track tasks, competencies, development, safety compliance and more, leading to greater productivity, transparency and development opportunities.

Emerge portfolio companies in this category

AI Co-pilots and Knowledge Management

Companies always seek ways to increase productivity in an increasingly competitive global market. AI tools that streamline workflows and improve the flow of information promise to do just that.

“The workforce is continuing to adapt to new ways of working and learning. It’s a critical time for companies to leverage collective intelligence for competitive advantage.” — Tamar Elkeles, former CLO Qualcomm and Venture Partner at Emerge.

Request for startups:

AI-powered knowledge management: The average knowledge worker uses 40–60 different apps. Knowledge management tools designed for the enterprise allow users to query disparate information silos through a single interface. Examples include both horizontal and verticalised solutions (e.g. Causaly).

Improving access to academic knowledge: Processes and tools that make academic research more accessible and approachable.

AI-powered second brain: End-user focused tools for frictionless capture and categorisation of ideas, actions and new information, allowing for just-in-time retrieval.

AI co-pilots: Vertically specialised AI systems that augment skilled human labour to streamline repetitive workflows.

AI-powered digital workers: Automated digital workers trained on your company’s data that execute repetitive tasks, e.g. in SDR or recruiting roles.

AI-powered expert marketplaces: The next generation of expert marketplaces, using AI to improve the speed/quality of matches as well as the acquisition and evaluation of experts.

Emerge portfolio companies in this category

➡ Building a solution focused on the future of work that corresponds to any of the above ideas? Get in touch! The easiest way to do so is to send us your deck via our simple Typeform, here.

Become part of Emerge

If you’ve made it this far, you probably care very deeply about innovation in this space. Here are some ways in which you can get in touch and/or follow us:

Send your deck: If you want to change the world of work of learning, no idea is too early for us. Get in touch with us at this link.

Portfolio careers: if you’re looking for roles in the world’s best future of work and learning companies, look no further. Search our portfolio companies’ job board here: careers.emergecapital.vc/companies.

Keep your ear to the ground: Sign up to our newsletter and receive best in class tactical insights, market deep dives and invites to our special events — once a month, straight to your inbox. Sign up here.

The Consumerisation of Climate (Part 2)

Guest post by Estia Ryan, Principal & Head of Research at Eka Ventures. | Originally published on Eka Ventures Newsletter.

In this series on the Consumerization of Climate, we’re diving into three key sub-themes: circular consumption, sustainable brands, and enabling technologies.

This week, our focus is on sustainable brands: companies rethinking how products are designed, produced, and consumed to reduce their environmental impact.

We’re looking at two examples within fashion & footwear: Patagonia and Hylo. These two companies are innovating on material design in order to meet changing sustainable consumer demand.

What consumers care about (TLDR: price, functionality, sustainability) 🗞️

Consumers are looking for sustainable alternatives for each of their products*. Each core consumer category has seen an emerging sustainability pioneer:

*Consumers are willing to switch to more sustainable brands if (in decreasing order of importance):

They are price competitive or cheaper than the incumbents.

They are price competitive or more expensive than the incumbents but have better functional performance.

They are more expensive than the incumbents and are more sustainable.

This is the rough decision matrix which consumers will face in both of these categories. This is obviously very crude and there are lots of switching combinations, but is the simpler form of the decision matrix.

I want to flag a few caveats here.

Zara buyers wouldn’t switch to Patagonia too because it’s a different offering (fast fashion vs. higher quality outdoor wear isn’t exactly a substitute. But it is still ‘mainstream’ fashion and in order to have sustainable fashion we need to have a Zara-like player at scale which is developing sustainable fashion. That’s why we’ve put it here but there isn’t a perfect solution.

Allbirds & Hylo buyers might not have previously been Adidas buyers, which is a similar argument to (1). There might be a distinct consumer category within sustainable footwear, but over time this should become mass as the sustainable option becomes more obvious. This also means that there might be some interplay between Allbirds & Hylo given they’re going after similar customer segments.

At Eka, we believe that all large consumer categories will have at least one large sustainable brand winner. We’ve backed Hylo in footwear, and other service companies like Byway which is transforming the way consumers travel.

Let’s now go deeper into Patagonia & Hylo and see what sets them apart.

Patagonia: putting sustainability the core of fashion 🌍

Patagonia is the iconic sustainability brand. Patagonia is known for its high-quality outdoor gear, and increasingly also its gilets worn by workers in professional services (Soho - we’re looking at you!).

Patagonia has a few initiatives across its business including:

Material Innovation: Patagonia uses recycled fabrics, organic cotton, and innovative, eco-friendly materials like Yulex natural rubber in its wetsuits. 100% of their down is responsibly sourced (see below).

Circular Economy Commitment: Their "Worn Wear" program encourages customers to repair, reuse, and recycle their products. By keeping items in circulation longer, Patagonia helps reduce the demand for virgin materials, cutting down on carbon emissions and waste. This ties into our issue last week on circular economy.

Activism: Patagonia is as much an environmental activist as a brand, often donating profits to environmental causes and using its platform to advocate for systemic change in areas like public land protection and climate policy.

McKinsey wrote an interesting profile on Patagonia last year titled: Patagonia shows how turning a profit doesn’t have to cost the Earth, which was an interview with Patagonia founder Yvon Chouinard.

On a more personal note, I’m a huge fan of their climbing vests & jackets and have bought these on multiple occasions from Worn Wear and charity shops across the UK. The performance genuinely feels in a different league compared to the other outdoor clothing companies.

Hylo: a fresh take on sustainable footwear 👟

Like Patagonia, Hylo is reimagining how products are made, with a focus on sustainable performance footwear. Hylo produces sneakers made from natural materials that are both biodegradable and sourced from renewable resources.

Their strategy includes:

Bio-Based Materials: Hylo uses materials like recycled PU foam, recycled polyester, and natural rubber which reduces the carbon footprint associated with traditional footwear manufacturing.

End-of-Life Solutions: To close the loop, Hylo offers customers the opportunity to return their worn-out shoes, which are then recycled into new products or repurposed. This program is called Hyloop and was launched earlier this year.

Low Carbon Impact: An average shoe is responsible for roughly 14kg of CO2e. The Hylo range of shoe is closer to 6-8kg of CO2e per shoe depending on the model.

Hylo is carving a niche in the market for consumers who want performance, comfort, and durability without compromising on sustainability.

What’s next for sustainable brands

While sustainable brands are gaining momentum, challenges remain across pricing and performance. Scaling up the use of sustainable materials, efficient supply chains, and maintaining cost competitiveness while prioritizing environmental goals can be difficult. This is why the Shared Value model interests us the most, i.e. understanding how impact and economics can come in lockstep.

Looking ahead, we expect that more brands will follow in the footsteps of Patagonia and Hylo, developing sustainable alternatives in their respective industries. As more companies embed sustainability into their operations, consumers will have greater access to high-quality, sustainable options.

What to watch in the consumerisation of climate…

In the next part of this series, we will delve deeper into the enabling technologies that are supporting the shift toward more sustainable consumption, including innovations in logistics, energy, and waste.

For now, it’s clear that sustainable brands are no longer a niche category. Instead, they’re becoming the future of consumption. Whether it’s through innovative materials, circular business models, or deep environmental commitments, companies like Patagonia and Hylo are reshaping the way we think about consumer goods.

As always, feel free to reach out if you’d like to discuss this further at estia@ekavc.com 🌱

Monetary Premium & Investment: Europe & US Divergence. Part 3.

This piece is a guest piece written by our good friend Owen Reynolds from Teklas Ventures, the VC arm of a family office associated with Teklas.

A major area of discrepancy between Europe and the US is the amount and the way investments happen. From the corporate level to households, investment decisions are made differently thanks to several structural reasons.

The amount of money saved is quite similar across the OECD—of course, with richer countries generally saving more. A difference though is that household savings in the US are funneled not towards true savings vehicles, but rather investments, with a heavy bias towards the home market. In contrast, the adage of old ladies saving cash under their mattresses is real in parts of Europe. The economic consequences are palpable for investors.

Looking Right vs. Being Right

Guest post by Finn Murphy, GP at Nebular VC. | Originally published on Linkedin.

There’s a huge difference between ‘looking right’ and ‘being right’ in venture capital and startups. But because of the duration involved in building these companies, you sometimes have to make sure to be looking, even if it’s at the expense of being.

We’re in an industry heavily driven around brands, momentum and hype. Those that understand this know that being right (also known in the business as ‘making money’) is always a function of time. Those in the business also know you can look right without ever really being right and still raise billions of dollars.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

✍🏻 EUVC Masterclass | Marketing & VC Fund Narrative

Your brand is everything. It’s what sets you apart, helps you win the best deals, attract LPs, and ultimately drive your growth. For emerging fund managers, building a credible brand and establishing the right marketing foundations early on are game-changers. Yet, many don’t know where to begin.

Your fund’s narrative is what makes the difference between an LP glancing at your deck or deciding they’re ready to write a check. It’s your brand that makes LPs feel confident they’re partnering with someone who knows how to make magic happen.

We’re planning a masterclass on building strong marketing foundations with a top industry leader. If enough people show interest, we’ll make it happen.

✍🏻 EUVC Masterclass | Benchmarketing for GPs & LPs

Join us for an in-depth session on VC Fund Terms & KPIs: Mastering Metrics for Fund Success. This workshop will focus on the key performance indicators (KPIs) that drive VC fund performance and the critical timing for measuring these metrics. You’ll gain insights into what matters most to Limited Partners (LPs) and what General Partners (GPs) should focus on internally for effective fund management.

The session will also cover how to set up a comprehensive dashboard, including portfolio tracking, to streamline your reporting and ensure your fund’s success.

Special offer: Join the EUVC Community for 25€ per month and get 100€ off while enjoying access to on-demand masterclasses, tools & templates and monthly AMAs with leading GPs, LPs & experts.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany