EUVC Newsletter | 02.12.22

Read on for end of '22 GP/LP reflections, EUVC founders named VPs of Isomer, a deep dive on FoFs, insights on building angel syndicates and the answer to the Q: "is VC power screwed?" 🤔

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective. In today’s edition, we cover:

Listen & subscribe to the accompanying Lowdown podcast here 🎧 where we covered the announcement of David & Andreas as VPs of Isomer Capital & the coming reign of Gen Z VCs with Linda Võeras, Freddie MacPherson, Dan Bowyer, David Cruz e Silva, Andreas Munk Holm and the always magnificent Cathy White at the helm 🎙️.

Do let us know if you have news, opinions or GIFs you want us to share on the Lowdown! We’re here to amplify the EUVC community 📣

This week’s partner 💞

This newsletter is brought to you in partnership with Vauban, a Carta Company 💪 Vauban is the easiest way to launch & run your venture investing. An all-in-one integrated solution to form syndicates, VC funds, & co-investment SPV programs built for scale and has facilitated over $1bn of capital invested in companies such as Revolut, Bolt and AirBnB.

If you haven’t yet checked it out, Vauban is now making it even easier to launch your angel syndicate with their new product called Atom. With Atom, angels can band together to launch an SPV for just $2K + 2% of the raised capital (up to US$200K). To learn more, go to Vauban.io/euvc/ and mention EUVC for a loving treatment!

We run a sub-community of European syndicate leads, so if you’re looking for some sparring, don’t hesitate to reach out! We’d love to get to know you.

with 💖 David Cruz e Silva

This week’s events 🥳

Untold Stories

Our good friend Csongor Biás (handsome guy with the toddler below 👇) put on Untold Stories for the first time this year. Unfortunately we couldn’t be there, but happy to see Enis from 500 EE, Bogdan from Underline and Borys from Smok on stage.

If you care about VC in CEE - make sure to reserve the days for next year!

SuperInvestor: What EUVCs are talking about as ‘22 winds down

David and I being on a self-enforced event celibacy for the rest of the year, we unfortunately couldn’t attend this one either. But our friends at Isomer did and wrapped up the key learnings of the panel they hosted. Here are their reflections:

The panel began with a discussion on 2021 prices, the current outlook on valuations, and what exit options remain available. There seems to be a lingering ‘hangover’ for investors who overindulged 2021, and trouble is looming. One panelist observed that several VCs have taken the precautionary approach of applying a 10% write-down across portfolios, whilst another commented that there may be more trouble hidden in portfolios than current figures suggest. All shared the view that whilst valuations will likely continue to experience a healthy correction, the European ecosystem is resilient and the general outlook is optimistic.

The case of Klarna was discussed, perhaps as an indication of what’s to come. The company recently closed funding at a valuation that was roughly 85% down from the prior year. One panelist noted that venture has never been about averages, loss ratios are inevitably due to increase, and it would be blind optimism to hope that things that have been going this well, for this long, would trend upward forever. Those investors overspending in the last few years are soon going to pay for it, whilst another panelist observed that investors new to venture investing tend to also be quicker to drop companies when things get tougher.

How are you thinking about portfolio construction?

Capital loss ratios in the next four years was another key talking point, with most suggesting it’s too early to predict changes so far in advance. There was no forewarning with the war in Ukraine, nor the pandemic. “Some recent rescue rounds are dressed as growth rounds” said one panelist who estimated that “it’s likely that 50% of some manager’s portfolio companies are worth zero”. The question is, which ones?

Discussions turned to how portfolio construction should be approached. Growth investors will double down on stable cashflows, in contrast to early-stage investors. However, one concern highlighted with this approach is the potential for lack of agility. “Reacting fast is key, the companies that will fail are those that have too much cumbersome infrastructure and can’t move quickly when needed to address shifting landscapes.”

Rescue rounds, yay or nay?

When is it prudent to do a rescue round, when is it a bad idea? One panelist offered that if a company needs this to scale, it is probably not worth it. However, it could be appropriate for a company that’s achieved product market fit, has a solid customer base in one core market, and has overextended itself to expand into new geographies. In this case, you can cut the expansion and channel the rescue cash into the core business to survive.

When thinking about extending runways, the key question is what’s at the end of the runway? Looking further in the future, what kind of exit could be on the horizon? One panelist observed that the main buyer profile currently is corporates engaging in M&A; IPO activity has esentially stopped. 2021 was certainly an anomaly, where many funds distributed amounts equal or greater to what they drew down from investors. Despite looming challenges, 2022 has seen a strong year for the birth of unicorns. However as one panelist pointed out, none of the challenges encountered in 2021 and 2022 had the problem of a recession being layered on top, making the outlook for 2023 more uncertain.

Will record dry powder in Europe carry through these choppy waters?

The panel commented on the dramatically reduced pace of deployment, partly because “no one knows how to price anything”. This highlights the importance of identifying the good, the bad, and the great. There is a hope that VCs’ dry powder is used for more opportunity investing in 2023, and fewer rescue operations.

Perhaps even more important than the capital is the need for experience and wisdom. Panelists commented that “if companies are hurting now, it will only get worse”. Younger investors and founders may struggle to get through this downturn as they have become used to freely available capital and consistent growth. Now is a time where new managers and founders need to have around the table “older folks who have lived and operated through multiple market cycles”.

Where are the opportunities in 2023?

Some sectors are much more resistant to the current headwinds. One investor commented that anything related to climate and cybersecurity, for example will continue to do well. And in areas that are more vulnerable, entrepreneurs are finding ways to stay afloat. One speaker mentioned that 25% of their portfolio was consumer-focused businesses, which are holding up well due to inflation and the flexibility in the US market to pass on price increases to customers. But in places like Europe, where regulation is tighter, those companies face challenges.

Meanwhile allocators investing in VC funds are also seeing opportunities in the current market. One confirmed their plan to continue to deploy into funds addressing the energy crisis, as recent geopolitical developments have highlighted the importance of diverse and reliable energy sources. Another allocator rounded the session off by commenting that “we’re in a wonderful buyer’s market, with more time to analyse opportunities, and less competition”.

The general sentiment seems to be that despite some very real challenges, Europe has the right ingredients for a market favourable to investors: great entrepreneurs addressing real problems, and pricing coming back down to a reasonable levels.

This week’s podcasts 🎧

The European VC, #133 Alan Poensgen, Antler

Today we are happy to welcome Alan Poensgen, Partner at Antler, a global early-stage VC active in the major startup ecosystems across six continents. Alan has an extensive experience in building and scaling technology businesses. He was previously MD and Co-Founder at Westwing, a home & living e-commerce company, and one of Europe’s few e-commerce IPOs of the past years. Before Westwing, he built the software development hub at Rocket Internet, and was CEO of a SEA e-commerce company, along with working for a VC and starting his own company in Spain.

In this episode you’ll learn

The story behind Antler Berlin & how they institutionalize the friends and family round

How Alan found his way into venture and how he thinks about building founding teams

Why Antler isn't a hypothesis-driven investor and what this mean for their strategy & operations

How Alan navigates the thin line between helping and meddling

A deep dive on the multiplier effect and flywheel of serial entrepreneurs

The European VC #132 Charlie Graham-Brown, Seedstars

Today we are happy welcome Charlie Graham-Brown, CIO & Co-Founder of Seedstars, a platform that educates thousands of tech founders each year and facilitates the scale-up of high growth companies. Charlie is an investment professional and entrepreneur focused on emerging and developing markets, responsible for global seed stage VC investments.

In this episode you’ll learn

Exactly what Seedstars is and how it’s grown to become one of the dominant global players in creating and funding entrepreneurs in emerging markets

How Charlie has put together an investment strategy to double down on the emerging markets and how that differs from developed marked investing

How Charlie thinks about geo-political and currency risks as a VC

How Charlie has thought about putting together his LP base to serve his goals

This week’s GIFs & Memes 🙊

🚨 View the newsletter in browser to watch the films without it being a mess. Promise it’ll be worth it.

VCs guiding their portfolio companies on how to raise a financing round in 2022 vs What it's actually like to raise a round in 2022

Originally shared by David Citron.

MBA grads filling out the diversity section in the VC associate job application to increase their chances of getting hired in 2022 be like:

Originally shared by David Citron.

LPs to their fund managers when they find out what they invested in the last two years…

Originally shared by Trace Cohen.

Thinking back to the hey-days of VC

Film created by Pramod Gosavi

This week’s LP syndicate news 💸

EUVC founders named VPs of Isomer Capital

The move isn’t quite a “traditional” Venture Partner addition to the roster, as the grand plan is for Andreas and David to help VCs build their funds via the EUVC content platform and its syndicates that allow them to build vested communities of founders, operators, angels, and VCs as "Operator LPs.”

Andreas and David have a completely different approach and toolbox to us through their content, events, and syndicate, which will bring immense value to our portfolio, partners, and more emerging managers […] We’ve known each other for quite some time now, and found that we were almost always discussing the same things, working toward the same goal. We simply didn’t get around to formalising the relationship until recently.

Joe Schorge, founding managing partner of Isomer Capital

A broad smile and laugh from Andreas confirmed this statement.

When David and I started looking around for a firm to partner with we did a lot of asking around and there’s one name kept coming up again and again. We’ve admired Isomer for a long time, and now, we’ll be able to bring our offering to even more of Europe’s amazing VCs while working with the best in the industry. By partnering with Isomer, we can go beyond that and support the LP side.

Andreas Munk Holm, co-founder of EUVC

By adding Andreas and David to the team, the firm aims to create a better LP environment in Europe and further support emerging VC fund managers.

Series on Operator LP investing launched

This week we launched the first part of a series on LP investing for operators in our syndicate. Here’s a small sneak peek 👀. Apply to join for access.

Our commitment: we’ll fight for the best deals in Europe

Expect us to launch a new deal every other month. And you can expect a couple of core characteristics:

Top tier performance in sight (i.e. our diligence has proven to us that there’s good reason to believe the fund will deliver >3x);

Some will be emerging (defined as Fund I - III), some will be more established. We love emerging, but we’ve also got amazing established players that we want to back.

Highly collaborative and committed to the syndicate. We look for GPs that share our community’s values as they’re described above. This is both important for the softer reasons, but it’s also imperative when it comes to ensuring co-investment opportunities, knowledge-sharing and network effects.

In other words, we fight to get you:

Diversified exposure to the best in Europe 📊

The best network of high impact investors in Europe

The opportunity to learn and grow with the best in Europe

Oh, and we received some love 👇

“The EUVC team is amazing to work with. They became a trusted partner for us and we’ve gained another 28 LPs, giving our founders more people invested in their success and who are willing to open their respective networks. And accidentally, they’ve also grown to become our favorite gif supplier 💪”

Late-night LP convos with Chris Wade

Chris Wade is a founding partner of Isomer Capital (and the OG of European Venture)

This week, Chris was a bit held up by some busy days in Japan. Nonetheless, we made our weekly wrap up convo happen. And damn am I happy we did! ‘Cos Chris was on stage at SuperReturn Japan discussing global Venture Capital with some heavy hitting colleagues,

Tianna Nguyen of Rigel Capital, VC & PE (Asia)

Alan Feld of Vintage Investment Partners, Fund of Funds (US /Israel)

Nobuyuki Akimoto of AT Partners, Fund of Fund (Israel/US)

All moderated by Allan Chan of Happiness Capital.

With a panel like that, I of course had to ask Chris:

What can we learn from more than $4.500 M FoF AUM 💰 and 45 years of FoF experience ? 🤔

On some points, there was broad agreement:

At the fund of fund level, we’ll all be co-investing in some of the same next generation global technology companies. With venture capital being a global business where entrepreneurs start their business in one region and build it in another, we need to accept that at some point, .

The Venture market in 2022 is one we that is easier to understand on the LP level than the one in 2021. When unrealised returns were approaching 3x because of inflated company valuations, it was simply just harder to make new manager selections. What’s real and what isn’t!?

In the coming year or two, we will see GPs fail to raise new funds. Just as it happened in 2008 and 2001.

For the best GPs (and their respective LPs) the more normalized 2022 market will represent once-in-a-vintage investment opportunities.

Quality of GP portfolio companies significantly better in 2022 than previous VC market corrections as seen by many companies being able to dial back spend and become cash generative.

With most industry sectors less than 10% digitized the long term opportunity for technology startups is bright!

But there were also some points that led to some debate:

The public market recovery was expected to occur within anything from 12 to 36 months and was essentially driven by the panelists’ views on whether we’d see a hard or soft landing for the macro economy. Chris observed that it seemed that the greater your exposure to the US, the more bearish you are.

There was broad agreement that we should all expect a reduction in overall LP capital, but there was a range of views on how this would impact new managers raising in 2022. It seems new sectors such as climate change funds will benefit from an increased LP focus going forward.

Following the panel, the panelists huddled up for a status on the ongoing World Cup match between Japan and Spain. Japan eventually beating Spain - as they also did Germany. Compared to major European countries, Japan only spends ~10% on its national team. Consequently, a fitting VC analogy could be made: the aspirations of any individual, company or country is only bounded by their own belief.

GP/LP Q&A 🤔

Trying out a new section here. LMK what you think in poll below and feel free to shoot Qs for next week! 💌

Q: When evaluating an emerging manager for potential investment, do you view the emerging managers having venture partner roles as positive or a distraction?

João Vale de Almeida, August: As long as there’s not a conflict of interest, it's only an expression of being embedded, having strong partners, etc. But conflicts of interest - including capacity, needs to fit with the fund in question.

Q: Given the current market, how should I navigate my first close as a first-time manager - be more conservative to ensure a working MVP or close ASAP?

Stephan Heller, AQVC: For emerging managers, I recommend doing a first close fast and starting investing. Show your deals and then raise more. If you plan a bigger first close to get to enough fee etc. then it might take very long and you lose momentum.

João Vale de Almeida, August: Always better to come to market with a few investments completed. Also inside the fund your raising for.

This week’s stories 🗞️

Fund of Funds - why they’re so important for Europe.

So, this week it was announced that David and I were made Venture Partners of Isomer Capital. And by now, you probably know that we’re big on Fund of Funds for Europe and that we’ve built our own model of value-add LP syndicates to bring a new LP-product to Europe.

But why is it that Fund of Funds are so important for Europe? Let’s dive in.

This week, Jonathan and he’s team put out a new article announcing that they had closed a deal with Castlegate Investments and provided a good answer the Q above.

The seed and early stages of investment have historically been of less appeal to traditional institutional investors (for example: pension funds or non-VC specialised asset managers) due to its specialist geographical focus and the inference that early stage is a niche—often necessitating additional risk for investors. Molten sees this as an opportunity.

In other words: to unlock the big LP money for European VCs, we need Fund of Funds. Similarly this week, ISS Insights underlined this saying that they see the trend of LPs allocating more to FoFs increase for three reasons:

Propelling the ascent will be a trifecta of factors. The first one is demographics, and investors’ focus on retirement. The second factor is the expectation of continued market volatility, which will lead to a preference for all-weather solutions. The third influencer is the outsourcing of investment decision-making by an increasing number of advisers, who will priortise planning and the provision of other value-added services in their practices (the “advice alpha”).

Fund of Funds as all-weather solutions

Let’s just double click on that “all-weather solutions” point through a small case study.

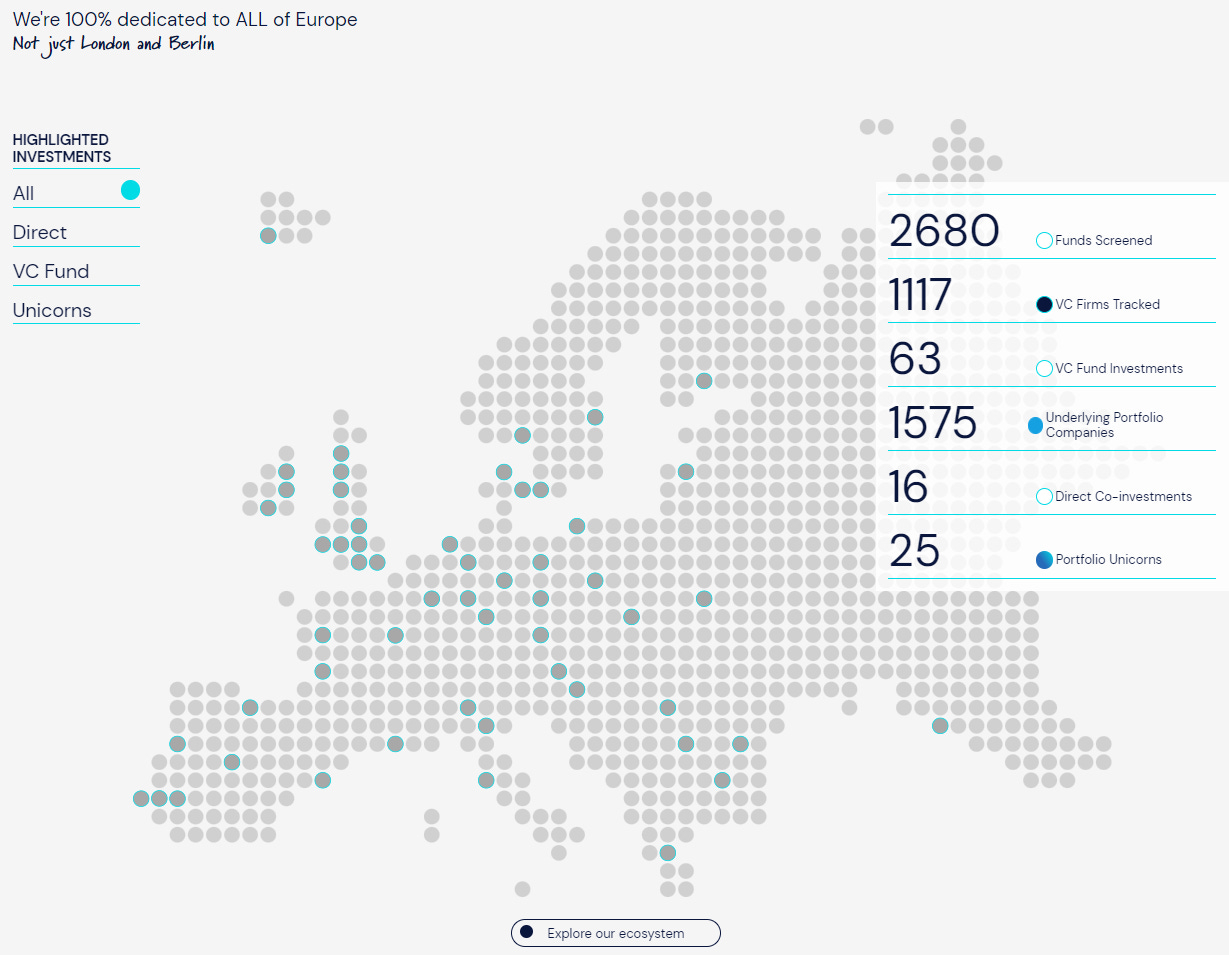

As a firm, Isomer Capital has supported 1,575 companies across more than 40 countries and 63 funds. Two years ago, Isomer launched its £220M Fund II which, by now, has given LPs exposure to 541 companies across 37 countries through almost 30 funds.

Similiarly, Molten’s FoF programme began in the UK and have since expanded across much of Europe. So far, they’ve invested in over 27 local funds covering Europe.

Joe Schorge, managing partner of Isomer Capital puts the reasoning like this:

European entrepreneurs do not get their first professional money from the household-name VCs run out of the European super-hubs, they get it from what I like to call The Local Digital Champions.

Or to put it as Molten did in their article:

Nothing beats having feet on the ground and being part of a local ecosystem.

What is more, major hubs such as London, Paris and Berlin still have momentum, but virtualisation increasingly enables regional hubs to compete. EU cities with one-billion-dollar unicorns climbed from just eight in 2011 to 65 in 2021[1] as US Funds continued to increase their share of European VC—from 22% to 37% over the same period[2].

The European market therefore likely has untapped potential for further growth—especially for the angel, seed and early stages

And just as geographic diversification is important, so is thematic. Molten provides a cool overview of the split in their portfolio:

The best partner to access European tech

Another important part of the FoF proposition to LPs is the ability to leverage their exposure to the innovation ecosystems and verticals, which allows them to become their a key partner to access European tech:

We run multiple fund strategies to provide our LPs with access at every level of the venture value chain […] and we work closely with our LPs to create programs and solutions tailored to specific needs - be that market insights, assistance to corporate programs or full-fledged separate accounts.

Pull out from Isomercapital.com

Or as exemplified in the below overview of the Isomer fund strategies:

So what does all this mean for GPs?

Well, just as understanding the investment strategy of a VC allows a founder to check for fit, so should the strategy of an LP. In other words, as a VC seeing this, you should, above all, think:

Do I fit the early stage VC program?

Highest yielding should inform you that you should (obviously) be a good bet for outstanding returns (typically >3x)

Diversified exposure should inform you that you should fit into some type of slot in the investment strategy (typically geo/vertical/size). In our webinar with Acrobator Ventures we saw that part of their success in raising was attributable to the fact that they covered a geo that many LPs didn’t have sufficient exposure to.

Commit early should tell you that you’re invited to reach out early. Some inside information also allows me to reveal that this is both in terms of fund number and stage of the raise.

Trusted partner tells you that you’ll also be weighted on your build a (mutual and strong) trust relationship.

But the illustration should inform you of more than this. You should also see the other parts and think how you can add value to these strategies of the LP:

Direct co-investments should inform you that the LP is looking to co-invest with you and your ability to provide them access to deals AND information to be well prepared for these co-investments will give extra points. Additionally, you should note it says co-invest which means they’ll never be a competitor to you (more than you can say for all LPs).

Secondary investments should inform you that there’s an opportunity to leverage the partner towards your portfolio, your LPs and, even yourself, in case you’d need to liquidate GP commits or carry positions (for a good reason). But it should also tell you that the LP appreciates that you can give them exposure to these opportunities.

Separate accounts and strategic investor program should inform you that the LP has its own LPs that are looking for more than just returns - how can you add value to this?

Partnership model should, once again, emphasize that the LP wants more than a transactional relationship.

Do you need to provide all this? I’m sure not. A solid expectation for a 5x fund can get you a long way. But checking these other boxes will definitely improve your chances of getting that dough 🍩

How to Start an Angel Syndicate - a series of insights by Odin & Angel School.

Patrick and Jed has joined forces to put together a series of articles on starting an angel syndicate. I’m enjoying it but since you’re either NOT raising syndicates and for that reason don’t care at all or ARE raising syndicates and for that reason should read the whole series, I’ll simply just add the links and a fun gif to keep your day happy.

- For part 1 (why bother), go here.

- For part 2 (foundations), go here.

- For part 3 (how to start), go here.

Power Screwed?

Evan Armstrong put out a blistering critique of venture capital and argued that the industry is ripe for disruption. Not sure I agree with him all the way, but definitely an interesting and provocative read.

Here’s his main line of argument:

Huge funds require huge outcomes - will there be enough?

The data point that the industry has over-indexed on is the power law, in which a large majority of returns will be generated by a tiny subset of players. It applies to venture funds (where the top 5% of funds significantly outpace the median).

We have now reached a point in the startup ecosystem where for large VC funds, a startup achieving a billion-dollar outcome is meaningless.

To hit a 3-5x return for a fund, a venture partnership is looking to partner with startups that can go public at north of $50B dollars.

In the entire universe of public technology companies, there are only 48 public tech companies that are valued at over $50B.

Simultaneously there are close to 1,000 venture funds all trying to find these select few. This is a huge problem.

The problem is inevitable, due to rational choices by individual players that rig the game to lead to a bad outcome for everyone (Remember Nash?)

Startups: “The best investors are only interested in the biggest opportunity so I have to swing for the fences.”

VCs: “The only investments that matter are the top 1% so price doesn’t matter.”

Limited partners: “The only funds that return are the top 5% so I want to give as much money as possible to blue chip firms.”

All of these choices make sense on the micro level, but on the macro level, they’re breaking the system. This applies to VC funds too.

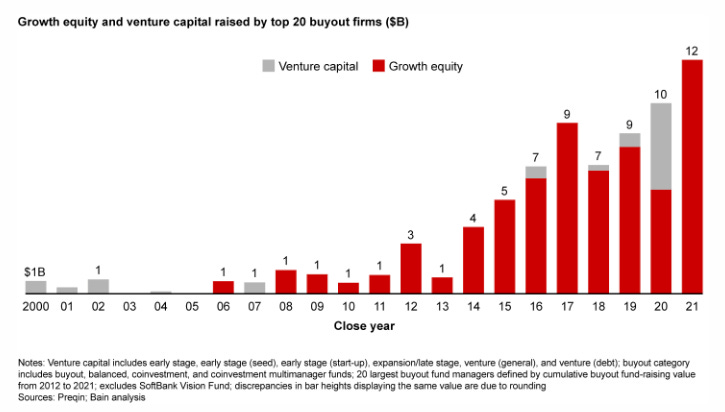

Evan then continues into an argument that the AUM-game is leading funds to grow (unsustainable)

Because VCs receive 2% of their assets under management every year as a fee, adding a growth fund became a great way to give yourself a fat raise.

To add to the mania, hedge funds and private equity funds pushed into startup investing to also do growth equity.

Keep in mind that all of these funds are still competing to find and fund the top 1% of companies. Put this all together, and enormous amounts of additional risk will be accepted at later stages and valuations will skyrocket.

To then, on the GP/LP side conclude:

It’s tempting to subscribe to the heroic stereotype of venture capital: the lone contrarian, bucking social convention, and investing in entrepreneurs when no one else believes in them is the mythos of the VC. Unfortunately, this tale wildly diverges from reality.

Power law logic, coupled with soaring AUM, welded with growth equity funds, has resulted in a venture strategy that will compress returns. Mega-funds ($500M+) accounted for 77% of capital raised by venture funds in the first half of 2022, with an average fund size of $317 million.

Since LPs are fighting to put as much money as possible into these funds they get the double whammy of having multiple funds concentrated in the exact same failing companies.

Uncorrelated used to be a word LPs loved, multiple distinct winners across multiple funds with little to no overlap. Those days are long gone and with it an invaluable principle of traditional portfolio construction.

and on the founder side conclude:

If you want to build anything less than a $50B company, this product is not meant for you. To be fair, this venture product does work for some! It is still a good way to make money if you’re building or funding enormous companies. But the product continues to move upmarket and is abandoning significant fiscal opportunity. What is more important is that it doesn’t work for most companies.

and for the future, chart out a “new” path

The original name for venture capital was adventure capital. Technology’s life-giving veins used to be lined with copper and silicon. It was the spark of the soldering gun, the ring of the hammer that were the sensory signals of Silicon Valley. In dilapidated workshops and musty garages, tinkerers tried to make cool stuff and see where that took them.

An incredible adventure does not require summiting Everest. It can be as simple as ascending to the top of your local hill. If you happen to end up at the top of a mountain, great! But adventure only occurs when you don’t know the destination. VC is designed for breakthrough technologies, not for all successful technology businesses. When a sector goes out of favor or proven technologies become commonplace, VC funding dries up. Entrepreneurs deserve an asset class that supports them in whatever journey they end up taking.

So why do I say that I’m not sure I agree with Evan?

Well, I’m not sure what he talks of is all that new. I meet, and invest, in plenty venture funds that don’t exhibit the characteristics of the mega funds he describes. In fact, I recall a workshop with a handful of European GPs this week on portfolio modelling where one said:

“I don’t want to run a strategy based on hitting an outlier, if I do I am contingent on that JUST to hit my target. And I want to outperform, so the outlier must get me outperformance, not just expected performance.”

In fact, I’d venture to say that most VCs I meet are providers of Adventure Capital! Financiers of the future helping give life technologies that never would see the light of day with out them.

Will their portfolio model follow the power law? I expect so. Will it require their startups to turn out as 50bn€ monsters? Not at all.

But are they VCs? Absolutely.

So is VC “power screwed”? Absolutely not. At least not in the part of the venture value chain I live.

In my part of the value chain, the tinkerer in the garage still reigns supreme 👇

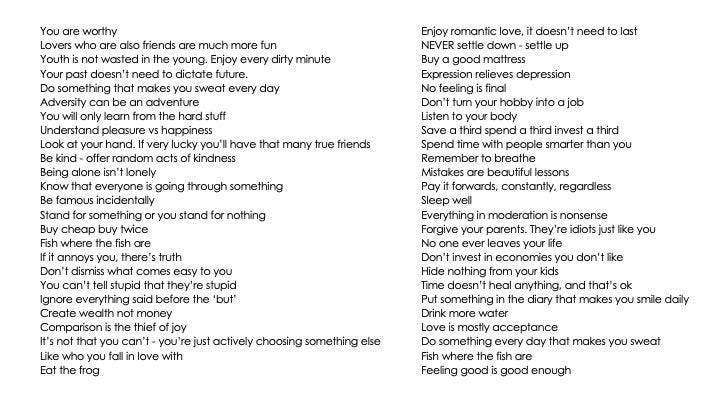

Learnings from a 50 YO dude’s B-day 👴

I am eternally grateful to the hugely intelligent trail blazers who bother to pause their life to think for a bit. And then share what they come up with.

Dan Bowyer did just so this week in connection to him turning 50.

While I’m sure he’ll kick me for the title and emoji following this post, I wanted to share his pocket phrases as he noted them down for his kids to see (though I’m confident that they will be quicker to chuck them than any of his loyal followers on LinkedIn … at least, I know I wasn’t too receptive to my father’s wisdom).

Happy birthday, Dan.

Thx for sharing.

Keep going 🙏 .

This week’s funds 💵

We are more than thrilled to see the launch of the new OTB Fund II, a €150M fund that will be used to directly invest in early growth #deeptech companies developing #innovative breakthroughs with R&D in Europe in the following sectors:

🚀 Enterprise AI automation🚀 SpaceTech 🚀 FinTech 🚀 Cybersec 🚀 ClimateTech

“We believe that deeptech is the new frontier of global competition where Europe can actually play a leading role. OTB Ventures will continue to play an active role in further strengthening the sustainable competitive edge of European deeptech ecosystem based on its large talent pool.” - Adam Niewinski, OTB GP

🇸🇪 Scania Growth Capital - SEK 2b, fund 2, B2B, CVC - Stockholm

🇱🇺 Alpha Intelligence Capital - $100m, fund 2, first close, ai - LUX

🇵🇱 bValue Fund - €72m, fund 3, late-stage, first close - Warsaw

🇬🇧 Pact - £30m, fund 1, seed, female-led - London

🇵🇹 Indico Capital Partners - €25m, fund 4, opportunity - Lisbon

🇵🇱 Simpact Ventures - 100m PLN, fund 2, early-stage - Warsaw

Section powered by the InnovatorsRoom.

This week’s hires 👩💼

💻 First Momentum Ventures - VC Associate - Online

innvtrs.com/3OwhMsA

🇳🇱🇩🇪 World Fund - Climate Investment Fellowship - Amsterdam, Berlin, Cologne, Munich innvtrs.com/3AT0Y9s

💻 Vesputi GmbH - Founder Associate - Online innvtrs.com/3VujJIu

🇩🇪 elvah - Chief of Staff - Berlin innvtrs.com/3tYU0fe

🇬🇧 SCOR Ventures - Operations & Investment Analyst - London innvtrs.com/3ALyqim

🇪🇸 Demium - VC Associate - Valencia innvtrs.com/3V5FbDO

🇩🇪 Homeday GmbH - Chief of Staff - Berlin innvtrs.com/3F4afOJ

🇩🇪 Speexx - Chief of Staff - Munich innvtrs.com/3AJlgSK

🇩🇪 Helpling - Chief of Staff - Berlin innvtrs.com/3gB8LSy

🇩🇪 FLEX Capital - Associate Strategy & Company Dev - Berlin

innvtrs.com/3tVeq8X

🇬🇧 Deep Science Ventures - Head of Scoping Venture Creation - London

innvtrs.com/3gO0HOo

🇩🇪 marta - Entrepreneur in Residence - Berlin innvtrs.com/3ETczqg

🇬🇧 AlbionVC - ESG Internship - London innvtrs.com/3AX5e82

🇫🇷 Marble - Venture Internship Program - Paris innvtrs.com/3i92xtk

Section powered by the InnovatorsRoom.

Thx for reading and being awesome 💗 we love you for it.

What others are saying 💬

"I am really enjoy reading to The Lowdown newsletters every week, I never skip any of them. In fact its one of the few weekly newsletters I read at all. The Lowdown newsletter really stands out with the relevant information that happened in the VC investing during the week, nuggets, commentary and it is all provided with the EUVC style that includes really spot on comments and also humor 😊 These guys constantly spit out the best content related to EUVC investing out there"

- Dag Ainsoo, GP & CFO of Startup Wise Guys