EUVC Newsletter | 11.9.23

Why we love community-based venture funds, why WaterTech is a thing, Getting Graphy with ML, Geek Ventures and scouting as a newsletter 📬

Welcome to the EUVC Newsletter 🗞️

Join us in welcoming 3,099 LPs, VCs & Angels who have subscribed since our last post (yes, it’s been a month since our last ‘real’ newsletter)! If you haven’t yet, join the 15,275 insiders that do & share it with your besties🤗

Table of Contents

Upcoming events

Why we love community-based venture funds and how we think about them 🤔

Why WaterTech 💦 is a thing and how Nucleus taps the opportunity

Getting 'Graphy' with ML 🤖 : Graph Neural Networks by Ramon Vigdor, GP at Acrobator Ventures

Geek Ventures 🤓 launched with 23$ in the bag.

Morningflow - scouting as a newsletter

This week’s partner: HSBC Innovation Banking

HSBC Innovation Banking provides commercial banking services, expertise and insights to the technology, life science and healthcare, private equity and venture capital industries.

From first-time founders to the funds that back them, innovators rely on us for deep expertise, endless energy, agility, and connections that help them to build organisations that better our world.

Upcoming events

Virtual events we’re hosting

The Impact of AI on VC | 📆 Sep 26, 2023, 12:00 PM - 1:30 PM CEST

Winning in The Secondaries Boom | 📆 Oct 31, 2023, 3:00 PM - 4:00 PM CEST

In-person events we’re attending

Expand North Star in Dubai | 📆 15 - 18 October | 🌍 Dubai

How To Web | 📆 4 - 5 October | 🌍 Bucharest | 🤌 Use HTW15EUVC for 15% discount

Web Summit | 📆 13 - 15 November | 🌍 Lisbon

Why we love community-based venture funds and how we think about them

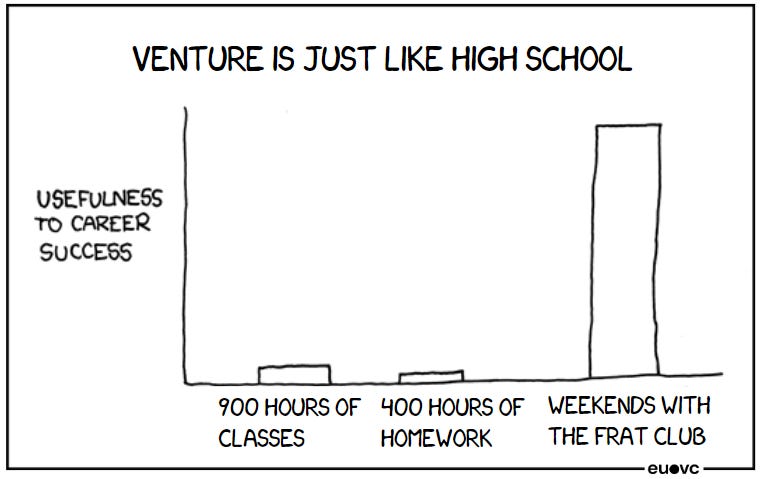

There are few industries where network plays as central a role as in venture. Why? It’s all about access baby. And community-based firms understand this and are built to leverage it.

And there’s no shortage of VC firms wanting to build community. Often around their LP-base. It’s such a ‘natural thing to do’ - you have a group of high-powered people who have committed to you, so why not leverage that? Fact of the matter is that it isn’t as simple as it might sound.

True community building takes time, effort and care, though. There’s no point starting this work unless it helps you meet strategic goals and you’re going to start something you continue.

Sarah Drinkwater, Common Magic in A Starter Kit For Building Community Strategy

So how do we think about community-driven firms? Sarah Drinkwater, Solo-GP of Common Magic and one of Europe’s leading community-focused VC investors, has made a framework to think about community-driven startups which can easily be retrofitted to think about VC firms building community.

The first thing to asses is the strength of the firm’s core community building blocks:

A powerful mission; something people want to rally around, even if not much rallying has happened yet (Like Crypto, Culture and Society DAO; I joined right when it was announced as the idea of space to discuss the implications of crypto on society was too interesting to pass up)

OR a good product; something that gives utility or joy, that people want to use (for example, Progression helps managers and their reports have more transparent conversations around career development).

Ideally you’ve got, or are on the way to having, both.

With that in hand, the great community-based VC should also know their core community stakeholders, ensuring they understand them and can deliver value to them. To do this, Sarah provides the below example of two core stakeholders from her days in consulting, which you’ll be able to easily retrofit for the analysis of a VC firm. Here, of course you want to look for signs of in-depth understanding.

Now, how about the tactics? Let’s dive into Sarah’s framework.

Tools; what you need to have in place to hold space, connect, understand and measure. E.g. Platform (think Discord, Slack, etc.), internal education, values/code of conduct, metrics.

Rituals; what you need to test to create a sense of belonging and nudge contribution. Onboarding, norms, regular formats for meetings, feedback mechanisms, etc.

Moments: what could work to reiterate values and shout about the community to a far broader audience. Think events, big publications, announcements, etc.

So, when evaluating a VC to whom “community is central”, these are some of the core things to look for. Are these in place already? Are they being executed well on? And as a final litmus test: is the community being built with it’s members, rather than for them?

Communities are built with people not for them.

Sarah Drinkwater, Common Magic

In Europe, we’ve got some managers that truly excel at this. Obviously, Sarah being a community mastermind is bound to build an amazing community around Common Magic. Here are three examples of very different firms we admire:

Seedcamp’s Nation and Expert Collective has grown to be a fully-fledged economy of 1,000+ founders, experts and operators enabling them to stay continuously deliver outstanding value to founders and investors.

Cocoa with our beloved co-host for the Super Angel series on the eu.vc podcast Anthony Danon, has one of the most powerful fintech angel networks out there and connects the dots like none-other.

Nucleus Capital has built a community of specialists within Programming Biology, FoodTech, and Industry Decarbonization that they leverage systematically to source, diligence and add value.

And finally, there’s a special subbranch of community-led firms that we at eu-vc as creators are excited to work with, namely those firms that are built with communities of creators, athletes and influencers. At the peak of venture’s bull run, such firms seemed to pop up every other day making it quite an exercise to weed out the bad apples. Today, it’s much less so, and there’s some very strong firms out there. Here are two within sports that we find particularly worth mentioning:

The Players Fund founded by athletes for athletes with involvement by the who’s who in cricket (Ben Stokes, the England Test cricket captain, Stuart Broad, Jos Buttler, KL Rahul) and Premier League footballers Chris Smalling, Serge Gnabry and Hector Bellerin.

Origins founded by Blaise Matuidi and Salomon Aiach to backing legendary consumer founders with an unfair advantage from pre-seed to series A. We invest $100k to $500k in consumer tech startups and also come with the power of influence of our LP’s and their 160,000,000 followers.

Why WaterTech is a thing

LP Hypeman’s note: This week, a nice but also disturbing LP update dropped into my inbox 📬. The scarcity of clean water due to climate change, affecting over a billion people and driving industries heavily reliant on freshwater, highlights the need for innovative solutions as global water demand continues to rise. Where others see threats, our good friends at Nucleus see opportunities for innovation. So with no further ado, let’s hear from Isabella exactly why WaterTech is a thing 💦.

Let’s look deeper at wastewater specifically, as this was the topic in the LP newsletter.

Water, one of the most important resources for humans to survive, is also an essential resource for industries to thrive. And while our planet is covered with water, 97% of it is salt water.

Of the available freshwater that we withdraw, nearly 90% is used for industry and agriculture. Yet, the global demand for freshwater continues to rise unabated, driven by population growth and rapid urbanization.

Desalination has emerged as a viable solution to meet the escalating water needs of communities and industries worldwide. Desalination plants extract salt and other dissolved solids from seawater to produce freshwater.

While the desalination industry offers a remedy to the growing demand for freshwater, some downsides involve adverse effects of "brine" (waste water rich in salts and minerals) and high energy intensity. But these challenges also offer massive new business opportunities. New leaders in this space will develop innovation in the freshwater extraction process, reducing or valorizing waste streams and lowering the energy demand, e.g., through novel membrane technologies. With a growing demand for clean hydrogen (which will need to be produced in the global south, where freshwater is inherently scarce), this industry is ready for a new wave of innovation.

All in all, seems WaterTech is a thing - just any technology that’ll allow countries to decouple from dependencies on regions with whom future relations can be hard to foretell.

Getting 'Graphy' with ML: Graph Neural Networks

David’s notes: Today we’re delving into Graph Neural Networks (GNNs), a transformative concept that promises to reshape how we perceive data relationships and innovation, with our dear friend Ramon Vigdor 🙌 from Acrobator Ventures.

Ramon's insights offer a new perspective on GNNs, a concept that's more than just nodes on a graph; it's about the connections that breathe life into data points. From recommendation systems to drug discovery, GNNs are revolutionising industries that thrive on interconnectedness 🕸️.

Today, I’m highlighting an advance in the Machine-Learning world, and this time, one that’s not yet on everyone's lips, but will be, and very soon indeed - take my word for it. I’ll start with the basic theory and applications in the field of Graph Neural Networks. But first things first.

Unlocking the graph: data points go beyond plain vanilla

On the right we can see two examples of very familiar data structures: separate data points having some fixed features. For example, on the bottom right we see six such points for representing the Projected and Actual Cash Flow of Monthly Income and Expense.

Are these data points related in any way? Well - they obviously are. Presumably, these points originate from the same company, and cover the same time period. A machine learning algorithm, when presented with lots of such data points, may be able to learn some of the correlations between the features. In this case we might be able to predict better future projections from given actuals.

But the relationship between the points is hidden from the algorithm. All the ML model receives is a list of data points, each with values for their features.

Now take a look at the bottom left. Here we have three data points: Man A, Woman B, and a car. Obviously these points would have different structures and features. For example, the man would probably have an Age, and Health Status, the car would have a Brand and a Value, etc. But the essential difference with the previous example is that here, the relationships among all data points are represented explicitly.

The man A is Married to B, and also Lives with her. She owns the car, while he Drives it. Since these are explicit relationships, ML models can now learn a lot more about the data. And when we expand this to millions of data points with thousands of possible relationships in any direction from each node we get a lot of new explicit information indeed.

But we cannot use just any vanilla neural network models for that. We need Graph Neural Networks.

GNNs: Graph Neural Networks

As a result of intensive research during recent years, the models of neural networks specifically designed for learning from graph data have been steadily gaining popularity. The first applications have proven their advantages in fields where explicit relationships make up the critical mass of the data itself. Such is the case with Recommendation Systems (Uber Eats, Pinterest), Traffic Predictions (Google Maps), Social networks and Drug Discovery (MIT Lab).

So what’s in it for us?

From our point of view, it is clear that the potential of GNNs has not yet been fully applied to a vast list of use cases. Startups are only now popping up that are solving problems with the use of GNNs.

Take for example the case of programming languages. The relationships between all the entities in a source code may easily be represented by a graph. And since these relationships hold so much more information than the mere listing of source code text, it makes sense that better code debuggers, analyzers and generators can be built on top of the graph data using GNNs.

Enjoyed these insights? These are the types of insights we uncover from being an LP, as investors don’t usually line up at our doors to share their insights. By marrying our investing, talking and writing, hopefully these learnings will help you on your journey in venture 💡 Want to explore more?

Geek Ventures launched with 23$ in the bag.

Wanted to give a shout-out to Ihar Mahaniok, founding partner of Geek Ventures for his launch in late August 🚀

To TechCrunch, Ihar pointed to the amazing talent of Europe saying what I’m sure many of you are saying to your colleagues on a daily basis:

“Talent is equally distributed, but opportunity is not,” Mahaniok told TechCrunch via an email interview. “I want to create more opportunities for the amazing talent that originates everywhere in the world. Lots of them end up moving to the U.S. where they have the best environment to grow the business and then often grow their teams in countries of origin, which creates amazing job opportunities for talented people there.”

Read the full launch article by TC here.

We’ve met the founder of Morning Flow 👆 this past month, and he’s doing something cool. Register on morningflow.io to get in the loop 📬 .