EUVC Newsletter | 16.12.22 🗞️

Key GP/LP reflections on Atomico's report, how Seedcamp brings transparency to the startup legal journey, thoughts on demo days, Seed at Scale, Tranched investments and how not to be a jerk 💩

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective 💸.

This week is a special one for us as it’s our 2nd birthday at EUVC 🥳 and we got a very special video as 🎁 orchestrated by Joe Schorge and our producer Taisa 💝.

Thx so much for kind words Miguel (EIF), Itxaso (Notion), Andrea (Molten), Carmen (Cocoa), Bertie (Blue Wire Capital), Benjamin (Lunar), Helery (Honey Badger), Romain (Satgana), Cathy (CEW Communications) 🙏 We love you.

In today’s edition, we cover:

Hotlinked table of contents for your pleasure and ease below - click-away!

#1 Roxanne Varza, Station F (inaugural episode! 🎉)

#136 Oliver Holle, Speedinvest on building a Seed VC at Scale

#135 Gil Dibner and David Peterson, Angular Ventures on their origin, thesis & navigating the downturn

#134 Guillaume Fournier, Credo Ventures on succession planning, building strategic relations in VC & strategic LP tickets

Listen & subscribe to the accompanying Lowdown podcast here 🎧 where we covered founder burn-out with Dan Bowyer, David, Andreas and the always magnificent Cathy White at the helm 🎙️.

Do let us know if you have news, opinions or GIFs you want us to share on the Lowdown! We’re here to amplify the EUVC community 📣

This week’s partner 💞

This edition of the EUVC newsletter is dedicated to the Global Ukraine Foundation which brings together business leaders and investors with a mission to:

● Unite, grow, & support responsible leaders building a legacy of global impact

● Build a modern and global Ukraine as a part of our global impact

Our current community of 25 ambassador members collectively manage and/or oversee more than $300 billion in investable assets, and we’ve helped over two dozen entrepreneurs to date - including 21 from Ukraine!

If you’d like to join our tight knit community, you’re welcome to apply for membership on our website at www.globalukrainefoundation.org. Global Ukraine Foundation members, who we call ambassadors, can get involved in many different initiatives, ranging from our support of humanitarian NGOs to our own mentorship program and endowment that we’re launching in 2023.

For all EUVC readers who decide to apply, we’re waiving the requirement that a

current member refer you. Simply indicate that you found us in this newsletter 🙌.

This week’s events 🥳

On Thursday 3 - 4 PM CET we hooked up with Cathy White, founder and CEO of CEW Communications to pick her 🧠 for tricks to land a cover story 📰.

Here’s a small taste of Cathy’s advice:

Why Public Relations is like going to the gym

I would literally spend thousands (and I have…) to try and get immediate results at the gym, and people do the same for media appearances.

But both come with the same truth - it takes time and commitment, to see small differences AND THEN the bigger wins.

Just like one session in the gym doesn’t mean I can eat five Mars bars (yum), a one off announcement doesn’t mean you’ll necessarily appear in the FT.

PR is a muscle you need to keep working at. So time to hit the gym 🏋️.

What we listen to 🎧

The Super Angel Podcast, #1 Roxanne Varza, Station F

Today, we're happy to welcome you to Roxanne, Director of Station F in Paris, an one of Europe’s absolute leading startup havens. Roxanne is broadly recognized as one of the most influential figures in the French if not the European startup ecosystem. French media have called her the "young empress of startups", the "queen of tech", and "the new pope of high-tech and startups in France." Roxanne is an Iranian-American who grew up in Silicon Valley, was formerly a journalist and startup ambassador before being headhunted to spearhead the development of Station F.

In this episode you'll learn:

- All about Roxanne's angel journey

- What's been Roxanne's most memorable moments investing

- What angel investing has given Roxanne professionally and personally

- How Roxanne thinks about investing cross borders and being a "baby LP" in VC funds

The Super Angel Podcast #0 Teaser

Welcome to the Super Angel Podcast - a podcast dedicated to angels backing the next generation of European unicorn founders. Whoever they are and wherever they may be.

With our podcast you'll hear from founders, operators, and executives who have been part of the journey behind Europe’s biggest tech success stories and how they’ve leveraged that to become European Super Angels.

Ultimately we wanna see if this podcast can help us connect with more amazing people across Europe. We’re here for you, ready to connect and take it to the next level.

The European VC, #136 Oliver Holle, Speedinvest

Welcome to a very special episode of EUVC where we dive deep with Oliver Holle, founding and managing partner of Speedinvest, for a one-of-a-kind (and super nerdy) discussion on Speedinvest’s newly launched fund 4 of 500M€! Speedinvest is one of Europe’s hands-down best seed stage investors and a household name in the industry that takes a perfectly oiled and scaled investing machine to be able to achieve. So stay tuned for some unique insights from the man who’s built it and who continues to pioneer innovation in our ecosystem.

In this episode you’ll learn

Why Oliver believes a new model is needed to deliver on the promise of Seed at Scale

A rare look under the hood of Speedinvest talking everything from carry, remuneration, decision-making structures and much more

Why and how Oliver has built Speedinvest around five core beliefs: 1) VC is a team sport, 2) Expertise is essential, 3) Being pan-European has a lot of perks, 4) VC is more than picking, 5) Large portfolios managed well offer better diversification and top performance.

The European VC #135 Gil Dibner and David Peterson, Angular Ventures

Today we are happy to welcome David Peterson and Gil Dibner, from Angular Ventures.

Gil is the General Partner and Founder of Angular. He has been an active venture investor focused on enterprise technology companies born in Europe and Israel since 2005. As a venture investor and angel, he has backed over 30 companies. Prior to founding Angular, Gil was a Partner at DFJ Esprit and a Principal at Index Ventures in London, where he helped manage their pan-European seed portfolio.

David is a partner who, prior to joining Angular, was employee #16 at Airtable, where he led growth and partnerships, developing full-stack GTM strategies and scaling the company to over 500 employees, grew from zero to 200,000 customers, and reached a $5.77B valuation.

In this episode you’ll learn

The founding story of Angular Ventures and how Gil & David think about complementarity in their partnership

How Gil & David think about navigating the current market climate & why they leaned into their biggest bet ever this July

Why Gil advises that alignment is kept front and center for emerging managers raising their fund

The European VC #134 Guillaume Fournier, Credo Ventures

Today we are happy to welcome Guillaume Fournier, partner at Credo Ventures, a venture capital company focused on early stage investments in Central Europe. His mission is to identify and back the most interesting early stage companies in the region, support them in their growth plans (including expansion to the U.S. and global markets) and help them to achieve their objectives.

In this episode you’ll learn:

The founding story of Credo, what’s behind the name and what took Guillaume from London to Prague - and what’s made him so happy about that move

Why Guillaume would rather spare on a deal that he ends up competing with than forego the honest conversations with fellow VCs

How Guillaume thinks about building strategic VC relationships and the role of strategic LP investments

All about how Guillaume thinks about succession planning in VC

The UrbanTech VC #07 With crisis comes opportunity - a real estate CEO’s view - Jürgen Fenk, Primonial REIM

Today we are happy to welcome Juergen Fenk, CEO of Primonial Reim, a key player in the European real estate asset management sector. They are fully aware of the impact of real estate on the planet and society. Primonial integrates Environmental, Social and Governance issues in the company’s operations and in the investment solutions that they manage.

In this episode you’ll learn:

What the general impact of the high inflation environment means for urbantech stakeholders and the real estate industry in particular with Juergen Fenk being an advocate or ESG

We will also discuss the opportunities that the current market environment poses for ESG focused market participants

Churn FM Ep 188: Eleanor Dorfman (Retool)

Tackling churn in a downturn

Today on the show we have Eleanor Dorfman, Sales Leader at Retool. In this episode, Eleanor shares her experience in balancing priorities in her roles sitting at the intersection of sales and success. We then ran through how Segment and Retool approach tackling churn in a downturn along with the 5 questions sales and success teams should always be able to answer about their customers at any point in their lifecycle and we wrapped up by discussing how adding friction to onboarding can be a great way to increase activation and retention.

GIFs & Memes 🙊

🚨 View the newsletter in browser to watch the films without it being a mess. Promise it’ll be worth it.

David spotted a real life unicorn/pegasus offspring 👇

Seems that Google has overtaken ChatGPT in language processing 👇

Solo VC in Action 👇

Tiger Global After Downsizing 👇

Generalist VC Explaning Tech Investment Made in ‘21 👇

Late-night LP convos w. Chris Wade 🧠

Chris Wade is a founding partner of Isomer Capital (and the OG of European Venture)

I don’t think a soul in VC has missed that Atomico came out with their infamous State of European Tech report. Exciting. And something I had to pick Chris’ brains on. So I called up the OG and heard what he had to say when reading the report.

As ever, Chris was full of energy.

Andreas: So, Chris. It’s been one hell of a year, just to recap:

European Tech Groups lose $400bn in value following the tech crunch.

Europe has produced 70% fewer new Unicorns this year than in 2021.

Capital invested in European tech is down 18% on last year (2021).

14,000 tech employees have been laid off in 2022.

So tell me, what does the OG think about all this? 🤔

Chris: First and foremost, Andreas, I think we should seriously consider buying positivetimes.com .. that said, let’s dive into each point you’re raising:

Europe has produced 70% fewer new Unicorns this year than in 2021.

So, according to the Atomico report, 31 new unicorns were created in 2022. That’s nearly 50% more than the last 5 year average excluding 2021. So really, I can only conclude that the fact that there were 100 Unicorns in 2022 says more about hyper valuations than actual valuable company creation.

Capital invested in European tech is down 18% on last year (2021)

Now lets look at the numbers again. In 2020 we had $40bn invested and in 2022 $80bn. With ‘22 down 18% that means that ‘21 was +$100bn. While $80bn is obviously less, it’s 4x the 2020 number !

14,000 tech employees laid off in 2022

Before we go crazy over this - and understand me correctly, I feel horrendous for the damage this has caused to the people affected - but on a more systemic level, I urge everyone to remember that in 2021, all board room and VC conversations were constantly revolving around one topic: it's soooo hard to find people and costs are horrific! So in that lens, a tech layoff does sound like the solution to a fundamental problem in company building. And maybe the most hireable people already have new jobs ??

So in conclusion, we must remember (or rather, realize) that 2021 was an aberration where FOMO ruled. I spoke at length to this in our joint webinar back in March stating that “FOMO has left the room” (watch it below 👇).

What is more, it’s undeniable that there’s continued long term growth in one the world’s most interesting venture market (i.e. EU!).

Yes. Valuations will be volatile and will go down. But this is just a point in time. If the company fundamentals continue to grow, then so will the long term valuation.

Ultimately the only time at which a private company’s valuation matters, is at the point the company is acquired.

So what’s left to say? Welcome to the positivetimes.com, I guess.

We’re pioneering Operator LP Syndicates to back the best VCs in Europe with money, passion and .

GP/LP Q&A 🤔

Do feel free to shoot Qs for next week’s edition! 💌

Last week, João and Stephan Heller were so kind to provide answers to the two below questions. Since then, two highly respected players in the Fund of Fund space pitched in on the Qs, hear what they said:

Q: When evaluating an emerging manager for potential investment, do you view the emerging managers having venture partner roles as positive or a distraction?

Vuk Vignjević, RSJ Investments: I think that it is a good way for GPs to try out working with someone officially and see whether he/she would be fit to their team, strategy, founders to partner up later. Also, it can be useful to add additional knowledge and skillset to the team – sector/topic expertise etc. But, if skills that VP brings to the team are very important for the team´s thesis, I would challenge motivation of VP why not to join the VC fund full-time/on partner level. On other hand, I would definitely not recommend having too many VPs, advisors etc. and putting their names, logos in the decks, just to look better, for us this is not a good sign.

ChatGPT (particularly insisting to pitch in): When evaluating an emerging manager for potential investment, having venture partner roles can be viewed as both positive and a distraction. On the positive side, having a venture partner role can indicate that the emerging manager has experience working with other experienced investors, which can be beneficial for their investment decisions. Additionally, having a venture partner role can signal that the emerging manager has access to a network of potential investments, which can be beneficial for finding and evaluating potential investments.

On the other hand, having a venture partner role can also be viewed as a distraction, as it may indicate that the emerging manager has additional responsibilities and commitments outside of their investment activities. This can potentially impact their ability to focus on their investment activities, which could be detrimental to the performance of their investments. Therefore, it is important to carefully consider the potential benefits and drawbacks of an emerging manager having venture partner roles when evaluating them for potential investment.

Q: Given the current market, how should I navigate my first close as a first-time manager - be more conservative to ensure a working MVP or close ASAP?

Vuk Vignjević, RSJ Investments: I know that it is more difficult to reach but I prefer the bigger first closings. We generally do not mind joining a fund during its first closing. But if it is too small compared to the target size, we might consider it to be risky – question of minimum viable fund size, calling to much capital for us etc.

I am not a big believer in saying to GPs: let´s see how you do a first couple of investments and if we like it, we might join in later closing. This job is about creating conviction in the team, not particular portfolio investments and it takes years and vintages to change perception, not months. Honestly, I think the odds that something will drastically change with a couple of investments are small.

Biggest risk [for the manager] associated with this is the possibility of losing a good opportunity, but there are ways how to prevent that – warehousing etc.

ChatGPT: The best way to navigate your first close as a first-time manager depends on a variety of factors, including the current market conditions and the specific characteristics of your investment strategy. In general, it is important to carefully consider both the potential risks and rewards of your investment decisions, and to make decisions that are aligned with your investment goals and risk tolerance.

In the current market, it may be advisable to be more conservative in your approach to closing a deal. This could involve taking the time to thoroughly evaluate potential investments and ensuring that they align with your investment criteria, rather than closing a deal as soon as possible. By taking a more conservative approach, you may be able to reduce your exposure to potential risks and improve the chances of success for your investments.

On the other hand, if you believe that the current market presents a unique opportunity for your investment strategy, you may decide to close a deal as soon as possible in order to take advantage of this opportunity. In this case, it is important to carefully assess the potential risks and rewards of your investment decision, and to ensure that you have a clear plan in place to manage any potential challenges that may arise. Ultimately, the best approach will depend on your specific investment goals and the characteristics of your investment strategy.

This week’s stories 🗞️

Seedcamp launches Seedsummit to simplify the startup legal journey 🚀

Starting a company is hard. There are so many hurdles to overcome, and today’s macro-environment certainly doesn’t make things any easier. However, Seecamp believes that there are steps that can be taken to ensure that companies starting up today can do so with practical guidance and support to avoid expensive mistakes down the line.

Seedsummit is a collaborative effort by law firms and early-stage VCs to support European founders by bringing transparency to the key legal documents needed when starting and building a company.

On a mission to make the lives of founders easier, Seedsummit offers a free, one-stop shop for a startup’s legal journey from the moment they incorporate to their first institutional round. The European initiative focuses initially on founders incorporated in the UK, France, Portugal, Denmark, and Germany, with more countries to come in 2023.

“When I first became a founder, legals were a black box to me. Seedsummit gave me the confidence to know what to look out for when I started working with a lawyer,”

Says Imi Faghmous, Co-Founder of Inovia Bio, one of Seedcamp’s portfolio companies.

Started in 2009 with an open-sourced term sheet, the Seedsummit initiative has since evolved into a full-stack platform featuring key documents across Europe’s main startup hubs. Legal documents include a founders’ agreement to help jumpstart company building, employment documents, and privacy policies to build out the business, and financing documents to raise a first institutional round.

“Seedsummit is a community effort to make the essential legal matters more fair, affordable, and transparent for founders,”

Says Carlos Espinal, Managing Partner of Seedcamp and one of the initiators of Seedsummit.

“In our current macro environment, where startups need to preserve capital, the Seedsummit initiative offers much-needed support to streamline speed and costs. Furthermore, as the European tech ecosystem matures, the legal framework also needs to evolve to better serve founders’ needs and ultimately support the sustainable growth of the whole ecosystem.”

Kate McGinn from the Seedcamp investment team adds:

“Too frequently do we come across founder documents that are unnecessarily complicated and not in the best interest of a founding team. Seedsummit serves as the go-to-resource for early-stage companies to get more transparency about what ‘good’ looks like when it comes to early-stage legals. I’m excited about a future in which founders know what legal terms they can push back on whilst building and raising their first institutional round”

Partnering with Seedcamp are a set of incredible, long-term partners among Europe’s top law firms, with contributors including Orrick, Withers, Mazanti, Goodwin, and Cooley and VC industry friends such Northzone, Molten, Cherry Ventures, Episode 1, and Tiny VC supporting the initiative.

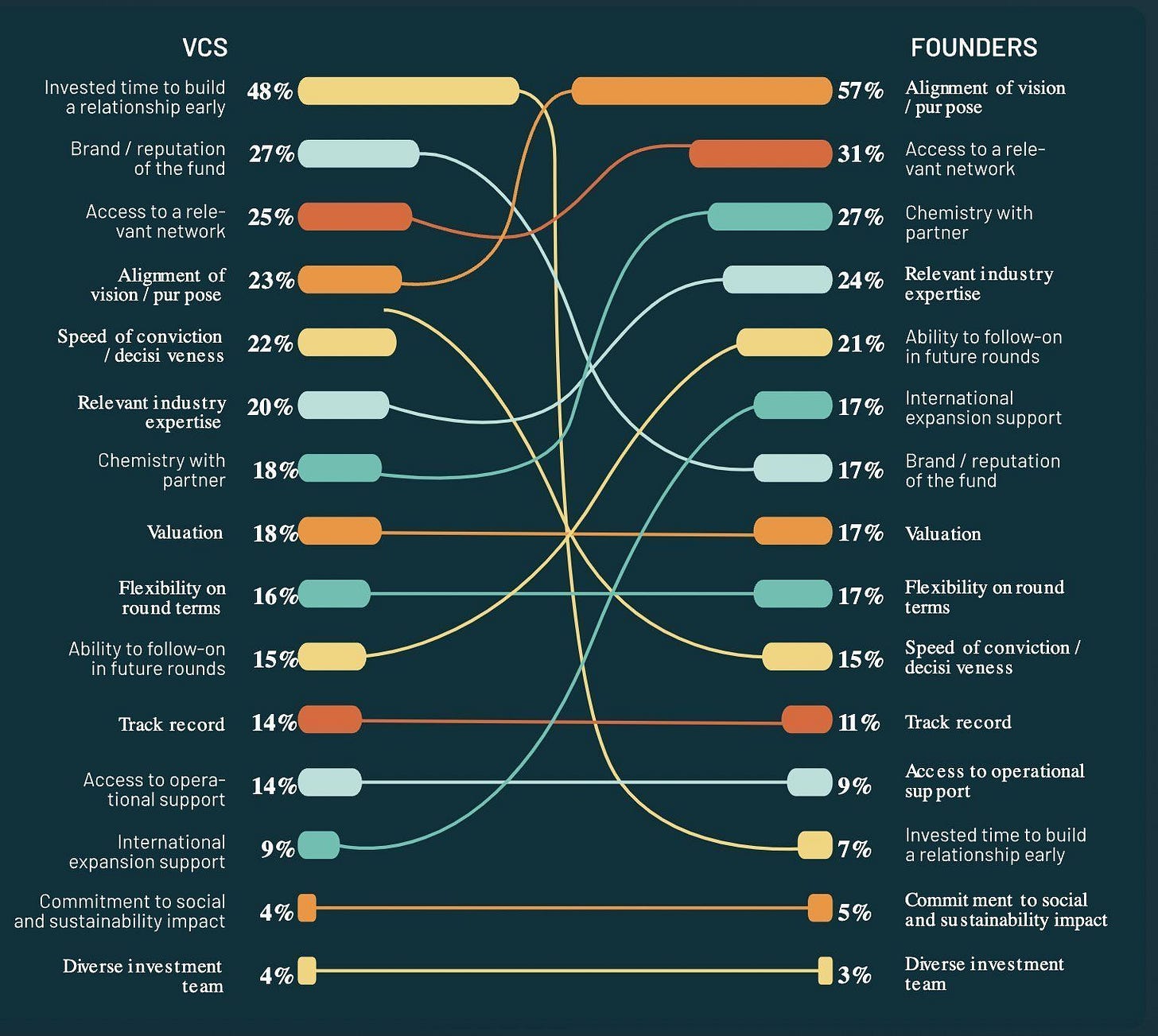

The best chart in Atomico’s State of European Tech report

Andreas from btov Partners really hit the nail with this one👇

This is one of the most interesting charts from the new State of European Tech 2022 report. It compares what founders are looking for in a VC versus what VCs think.

Bottom line: Founders don’t want to be best buddies with their VCs, they don’t think that building a relationship early is important, and they are not terribly impressed by a VC’s brand. What they really want is a reliable business partner who truly understands what kind of company they’re trying to build and who can help them do it — in specific, tangible ways.

So why do VCs think that early relationship building is important? First of all, it’s useful for them to see how a company develops over time and if the team keeps its promises. Besides that, it’s relatively easy to do. Many VCs don’t put much effort into actually understanding industries and companies, instead opting for superficial relationship-building rituals. Most founders I know hate the dreaded “update call” (and I certainly did when I was a founder) where they have to answer the same cookie-cutter questions over and over. The VC thinks they’re building a relationship. The founder thinks it’s a waste of time, but necessary to keep options open for future rounds.

I think we as the European VC industry have a lot of room for improvement. We need to go beyond empty rituals and do a lot more work on actually understanding sectors, industry dynamics and companies. That’s the best way to support great founders.

But this cuts both ways. Founders also should get a lot more selective about the investors they spend time with. I’m always surprised by how many founders approach me who apparently have no idea what my areas of specialization are. Many come on calls entirely unprepared, with no idea who our firm is and what we do. That’s not how you pick a long-term business partner.

More than capital: the value of angel groups

This week, Sifted wrote an article on the growth of angel groups as investors.

As Abbas says, there’s an obvious reason to why founders are finding the offering sexy:

“It’s not merely capital that the startup is getting from angel groups or syndicates, but smart money that gives them access to investors and supporters with broader strategic value adds,”

Abbas Kazmi, founder of the Power of N, a syndicate made up exclusively of Newton Venture Program alumni.

But Gabriel from Vauban also points out that the boom in online communities is increasing acccess for people and allowing many more to follow interests, passions and topics that resonate with them:

“The rise of online communities has helped facilitate building a community of like-minded individuals for venture investing,”

And your best friend Andreas, i.e. yours truly, chimed in, stating that even VCs are embracing angel groups:

“The smartest VCs recognise the power of investors isn’t necessarily connected to the size of their wallet. For that reason, we’re partnering with them to provide access and unlock the value-add of these powerful angels, without having to require them to invest the minimum ticket of the fund.”

Andreas Munk Holm, cofounder of EUVC.

And Yoann Benhacounm, founder of angel group Upscalers, added that most of Upscalers’ members join not just because they want to invest, but because they want to create new relationships:

“We believe that to have a thriving startup ecosystem, experience from past founders and VPs at the most successful scaleups needs to be accessible and transmittable to the next generation of founders,”

Yoann Benhacounm, founder of angel group Upscalers.

Now let’s end it on a beautiful note from Gabriel:

“We find most angel groups are looking to support by giving their time, knowledge, network and capital. The community will naturally grow as you provide members value.”

Using online demo days as a deal sourcing machine

We’ve invited our friends from Inovexus to share with us some of their insights & learnings from leading syndicates into European tech startups with global ambitions on our Insights section 🚀. Here’s a teaser:

The importance of attending live demo days from accelerators cannot be overstated. These events expose you to many high-quality deals, which is invaluable in the investment journey. Accelerators like YC, Techstars, Inovexus, and 500 Global (fka 500 Startups) have all developed rigorous vetting processes for their companies that are presented at live demo days. This ensures that angels are investing in the best possible startups with a fast 💨 process.

God knows there’s plenty shit incubators, accelators and govt funded startup initiatives, so navigating which to pay attention to of course remains a challenge. But no doubt - find and build relations to the right players and you’ve got a treasure trove.

Read Oliver Holle’s thesis “Seed at Scale” for a unique insight into Speedinvest’s blueprint 👀

In connection to the announcement of their 500M€ fund IV, Oliver shared a rare 9-page blueprint to how he thinks about Seed at Scale and how that informs how Speedinvest should be built. Below are excerpts and you can read the paper in it’s full length here.

Oliver also sat down with us at EUVC for an in-depth talk with us on this on Monday. Hot off the press 🔥 check it out here 👇

What the hell is longevity investing - a framework to understanding

Last week we had a really cool conversation with LongeVC's Sergey Jakimov for the EUVC podcast and he brought up how he thought about longevity VC.

I really loved his framework and since VCs tend to be stupidly curious about everything in life, I thought it was quite likely that an investment thesis on extending life itself would be interesting to many of you. So here’s a quick overview of the three main pillars you can use to think about this space:

Public adoption of new technologies making it easier for individuals to track their health and make informed decisions about their longevity.

Age-related diseases, therapies for age-related diseases and early diagnostics

Systemic rejuvenation or what many would call "true longevity" as this is the real scifi stuff that includes the potential for epigenetic reprogramming and gene-editing.

Read Sergey’s full article here.

How to stop being a jerk as a VC in 10 simple steps

Our good friend Borys from SMOK shared an important post this week. Don’t think it’s important? Well, thx if it’s because all the VCs you know aren’t jerks 🙏and if that’s the case, then skip this post and spend the 2 minutes sharing this newsletter with them instead 😁

Last week I gave a keynote at Untold Stories Conference in Budapest 🇭🇺 on why most VCs are jerks (in the CEE region) and how to fix it.

I got great feedback from founders, so I decided to convert the talk into an article: https://lnkd.in/dWXA5HnrMy key points:

1. BE HONEST. Stop saying generic bullshit🐂💩. Either be honest or don’t speak at all.

2. BE FAST LIKE A CHEETAH. 🐆 A fast “no” is the second best answer from a VC.

3. BE TRANSPARENT, AKA DON'T LIE⚖️. If you don’t have money to invest now, say it! If you are already deep in the process with a competing startup, admit it!

4. RESPECT THE TERM SHEET📄. Backing out of a term sheet often means killing the startup. Don’t do that. VC is not PE. A signed term sheet is sacred. Even if you changed your mind.

5. STOP GHOSTING👻 FOUNDERS. Once you engage with a founder, i.e. respond to their initial email with questions or have a call or a meeting, it’s your responsibility as a VC to get back with an answer in reasonable time (2–3 weeks seems to be acceptable).

6. BE PREPARED.💡 Things that are not OK: coming to meetings completely unprepared, not knowing the startup, not reading their pitch in advance, not having a clue why they are even meeting.

7. STOP DISRESPECTING FOUNDERS. Your job is to allocate the money of LPs in best deals possible. The entrepreneur is your client. If you’re condescending, they’re going to leave, regardless how tough the times are.

8. DON'T BE SEXIST.👩 A (young) female founder is not “a girl”, “honey” or “darling”. Stop with the sexism and ageism. We are in 2022!

9. PITCH 🔊 FIRST. If you thought some founders struggle with pitching you’ve never see a VC pitch. You’d be surprised how refreshing it is when you start a meeting with a startup by pitching yourself first. Helps to break the ice and makes you feel like an actual human.

10. SHOW EMPATHY.💓 Be yourself!…. unless you’re an asshole. Then, be someone else!

Founders, it's your job to report bad behavior of the VCs!

Do yourself a favor and visit Landscape or boundwell.io and anonymously describe your experience with the CEE VCs.

Finally, PLEASE TAG a non-jerk VC that you love interacting with in the comments section!

First-time founders will thank you for that!

Check the original post here to see if you were tagged 😁 or go tag someone you love 👏

Tranched investment is a terrible idea. Or is it? 🤔

Mads Jensen from SuperSeed shared an interesting reflection on tranched investments that went a bit against the grain. WDYT?

First, some definitions.

Venture capital investments are, by definition, “tranched”. The tranches are called: Pre-Seed, Seed, Series A, Series B and so forth. Startups are risky little things. Most of them perish before they have a chance to flourish. But there is meaning to the madness. As companies hit milestones (team, product, customers, scale, profit), they become less risky. And as they become less risky, valuations go up.

It might take $100m+ of investment for a company to go from inception to IPO. But writing a $100m cheque to a pre-seed stage startup with a likely failure rate of +90% seems cavalier.And then there is the question of dilution. So instead of investing $100m up front, investors start with a smaller cheque of – say, $500k. And each major milestone then unlocks a higher valuation and the next funding tranche. In other words: tranched investment.

But VC investors often talk about something slightly different when they talk about tranched investment. Rather than tranching investments to major milestones, the idea is to use smaller waypoints. Same idea. But smaller tranches. Now the Seed or the Series A round is no longer a “big cheque” to hit the next major goal. It’s a smaller cheque to hit one or more smaller goals on the way.

At face value, this might seems like a pragmatic approach.

Venture capital orthodoxy is that this is a bad idea. And generally, I agree.

Startups are hard. It often takes superhuman effort and focus to make it to the next major milestone. They are also unpredictable. And founders have lots of pitfalls they need to navigate on the way to that milestone. As a result, the last thing founders need is to constantly worry about whether they will run out of cash in 2 weeks. It’s not good for the founders. And it’s not good for the business.

BUT

What should founders do if there is a mismatch between valuation and desired capital? If they need $4m to hit the next major milestone, but markets currently value their business at $4m pre? Of course, you could give up half of the company. But there might be times when it’s better to do half and half. E.g. half at $4m and the remainder at a higher valuation once a few smaller milestones have been hit.

Most investors would agree that a “fully funded plan” is ideal. Enough capital to get to the next major milestone. With a bit of buffer. That’s the orthodoxy.

But sometimes “best” isn’t available. And in startup-land, orthodox ideals sometimes need to make way for pragmatic alternatives.

In those situations, tranched investment is worthy of consideration.

Who are the hipsters, hackers and hustlers of European VC?

In case you missed it, in our insights section, we published an article together with Joe Schorge on this topic. Check it out to find out why we believe The Three E’s are the equivalents of the three H’s for VC.

This week’s funds 💵

Section powered by the InnovatorsRoom.

🇦🇹 Speedinvest - €300m+€200m, fund 4, early-stage, growth - Vienna

🇮🇳 Blume Ventures - $250m, fund 4, early-stage - Mumbai

🇩🇪 Cavalry Ventures - €160m, fund 3, first close - Berlin

🇫🇷 IRIS - €150m, fund 4, 🌍 Europe, first close - Paris

🇫🇷 Partech - €120m, fund 4, 🌍 Global, seed - Paris

🇨🇭 TX Group AG - CHF100m, fund 1, 🌍 DACH, fintech, CVC - Zurich

🇬🇧 Jenson Funding Partners - Certified B Corp - £60m, fund 1, climate-tech - London

🇩🇪 coparion - Investment Associate - Cologne ❤️

🇬🇧 Supernode Global - Chief Operating Office - London, Online ❤️

This week’s hires 👩💼

Section powered by the InnovatorsRoom.

āltitude are #HIRING a chief of Staff 🚀 Reach out to Marc, Videesha or Ingo to hear more! You would be āltitude’s first hire and on a journey to change how VC is done😍

Find the job post here: https://lnkd.in/efEVmTVT

Any #referral, #repost or #introduction is also highly welcome - just reach out to Marc!

🇬🇧 Generate - VC Associate - London innvtrs.com/3BpNXVm

🇬🇧 Blue Lion Global - VC Analyst / Associate - London innvtrs.com/3FvcM4t

🇩🇪 468 Capital - Chief of Staff - Berlin innvtrs.com/3P9TeG6

🇩🇪🇦🇹 N26 - Chief of Staff - Berlin, Vienna innvtrs.com/3Y56WOz

🇩🇪 coparion - Investment manager - Cologne innvtrs.com/3Pptt4O

🇬🇧 Giant Ventures - VC Analyst - London innvtrs.com/3FJIkDL

💻 Dapper Labs - Chief of Staff - Online innvtrs.com/3FzA89i

🇬🇧 Quantum Light - VC Associate - London innvtrs.com/3FJynW3

🇩🇪 Evalue Family Office - Investment Analyst - Berlin innvtrs.com/3h8PMPm

🇩🇪 coparion - Visiting Analyst Internship - Cologne innvtrs.com/3US0Q1m

💻 Replicant - Chief of Staff - Online innvtrs.com/3iMpRgZ

🇩🇪 Trade Republic - Strategy Associate / Manager - Berlin innvtrs.com/3HhA1jW

🇬🇧 CTVC Ltd - Research Analyst Climate - London innvtrs.com/3FqGXIO

🇩🇪 Eurazeo - Visiting Analyst Internship - Berlin innvtrs.com/3FCzuYA

🇩🇪 Lennertz & Co. - VC / PE Junior Analyst - Hamburg innvtrs.com/3Fbb86F

🇦🇹 Corecam Capital Partners - Analyst / Associate - Vienna innvtrs.com/3HcvZJF

🇦🇪🇳🇱 McKinsey & Company - Associate - Abu Dhabi, Amsterdam innvtrs.com/3UGtmCX

🇨🇭 Pureos Bioventures - VC Analyst - Schwyz, Online innvtrs.com/3VL7R5g

🇺🇸 AngelList - Venture Associate - San Francisco, Online innvtrs.com/3Y6z97w

🇩🇪 Aignostics - Chief of Staff to the CEO - Berlin innvtrs.com/3hjWTVi

🇬🇧 Big Society Capital - Investment Committee Member - London innvtrs.com/3FoTyMO

Thx for reading and being awesome 💗 we love you for it.