EUVC Newsletter | 20.3.23

LP reflections on SVB, Secondaries 101, objections Seedcamp have had to overcome, the inaugural Uplink/Villar Summit, Women investing in Tech, Jason Calacanis' Angel model, and much more.

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

Firstly, a heartfelt welcome to the 472 newly subscribed venturers who have joined us since our last post! If you haven’t yet subscribed, join the 8,357 angels, VCs and LPs that do 🤗

Love European Venture? Help us connect the ecosystem 👇

Do ping us if you have news, opinions or memes you want us to share. We’re here to connect & amplify the European Venture community 📣

Table of Contents

Open in browser for clickable ToC 👆

This week’s events

LP Musings w. Chris Wade: Bad things happen in threes (& in March)

WEF/Uplink: Climate Discussions at the inaugural Villars Summit

Stories of the week

This week’s events 📅

SMOK Ventures - the American take on Eastern Europe

Mon, Mar 20, 2023, 3:00 PM - 4:00 PM CET | Virtual event

Join us as we explore how SMOK Ventures approach Eastern Europe and why it seems to be working so well 🚀 and also the changes it's heralding for the ecosystem.

About SMOK Ventures

SMOK is an operator-led US fund investing in top serial founders of the CEE region

SMOK has delivered on its promise of connecting ecosystems with 80% of the money raised by portfolio startups coming other global investors

SMOK has risen to become the first-choice fund among serial entrepreneurs in CEE in less than two years of operation

Named one of the most active CEE seed funds in 2020, and the second most active in Poland (Vestbee reports)

GP team consists of Borys Musielak, Diana Koziarska & Paul Bragiel

Web3 in '23 - where are we headed & how to capture it?

Tue, Apr 4, 2023, 12:30 PM - 1:30 PM CET | Virtual event

Join us as we go ham on Web3 and how to capture the opportunity as a venture investor with some Europe's leading investors: Jan Baeriswyl, Denis Vuckovac and Mathieu Chanson 🧠

We'll dive into topics like:

🎯 How the speakers think about investing in the space

⚖ How to think about private vs public market exposure

🚀 Why some of the biggest opportunities will be in Decentralized infrastructure, Real world impact and Public markets / tokens.

📈 Why the current bear market will give rise to the next generation of giants

🤖 Why being deeply technical and web3 native plays such a big role in the vertical

About Denis Vuckovac, PhD

Implemented a Bitcoin client in Python & built a mobile payments app and a modular Python trading library

PhD @ETH Zurich, Machine Learning

Reviewed speaker applications for the Infrastructure track at ETHDenver

Former Ebay, Bain, Fulrbright, ETHzürich

About Mathieu Chanson, PhD

Built a Liquid Staking Protocol with >2k users and >$1M invested

PhD @ETH Zurich, Distributed Systems with 500+ citations for scientific publications

Published a paper on DApps in 2016

Technical DD for leading traditional VCs

Former McKinsey, Maker, Celo, ETHZürich

About Jan Baeriswyl

Designed tokens worth 100 of millions’

Led the token design team at Outlier Ventures, Web3's largest accelerator

Published 10+ research articles on Web3

Advised Barclays CEO and major traditional VCs on Web3 in 2017

Former Google, EarlyBird, University of St Gallen

Google for Startups Ukraine Support Fund Summit

Date March, 30 | 12:00 - 10:00 PM CET | Venue Google for Startups Campus in Warsaw & virtually.

Google is hosting the Ukraine Support Fund Summit on March 30th, 2023 at their Google for Startups Campus in Warsaw with the goal to help the startups grow further, and to connect them with top VCs, stakeholders and media.

Over 100 representatives of the Ukraine Support Fund startups already confirmed they are willing to travel to Warsaw to participate in the event. Join us in Warsaw and help Ukrainian startups thrive!

Program: a lunch with founders, Ukraine Support Fund program wrap-up, startups lightning talks, and pitching session, followed by a networking party.

Audience: 100+ attendees incl. VCs, media and startup ecosystem builders.

Format: 4-minute pitch for each startup to present their achievements in front of the investors.

Detailed information about those who will be pitching can be found in this presentation (please request access after opening the link).

RSVP to this event here.

This week’s podcasts🎧

The European VC, #158: Carlos Eduardo Espinal, Seedcamp

Today we are happy to welcome Carlos Eduardo Espinal, Managing Partner at Seedcamp, arguably, Europe's leading seed fund, first launched in 2007 to support European entrepreneurs truly compete on a global scale. With investments in over 460 companies including publicly listed Romanian-founded, UiPath, Wise and unicorns Revolut, wefox and Pleo. Carlos is a published author, fellow podcaster and made it onto Forbes Midas List as one of the most influential VCs in Europe in 2018, 2019, 2020 and 2021. You are in for a treat.

In this episode, you will get a rare look into the top four funniest objections that Seedcamp and Carlos have had to endure from LPs on their journey to building Seedcamp to the hallmark it is today.

Objection #1: "Your fund model will break when it goes from 5M to 20M€"

Objection #2: "You're just spraying and praying and your portfolio will be far too big for you to manage"

Objection #3: "Why don't you just invest in the winners?"

Objection #4: "Who led deal X, Y and Z and how will you retain that person and keep him/her motivated?"

And some extra reflections by Carlos on opportunity funds, VC decision-making and incentive structures and firm management.

The European VC, #159: Siim Teller, Lemonade Stand

Today we are happy to welcome Siim Teller, Founder and General Partner of Lemonade Stand. After 20 years growing products in a number of startups (most notably at Skype) in Tallinn, London and Berlin, Siim set up Lemonade Stand in 2019 to invest in early-stage Baltic and East European startups. Lately he’s been looking for AI and Machine Learning applied to boring business problems.

In this episode you’ll learn:

A deep dive on the Baltic ecosystem and the VCs to know in the region

Family Office motivations to do venture and how Siim used LP investments to guard against adverse selection

Reflections on the limitations of the solo GP model

GIFs & Memes 🙊

When the Son of a Tourist Climate VC Wanted a Tesla 👇

The power of co-investors 👇

Most effective fundraising tactic for ‘23 👇

LP musings w. Chris Wade 🧠: Bad things happen in threes (& in March)

By Chris Wade, founding partner of Isomer Capital (and European Venture’s #1 LP OG). Get to know Chris in our two-part episode on his journey & thinking 🎧.

March 2020: Dear GPs, we are entering in lockdown nightmare, and markets are crashing. Could you let us know which companies you're concerned about, specifically those with less than 6 months' runway …..

March 2022: Dear GPs, As you know, Nasdaq is in freefall, and growth investors are fleeing. Could you let us know which companies you are concerned about, specifically those with less than 6 months' runway …..

March 2023: Well, read on 👇

Friday, March 10, 17:00

Dear LP, We wanted to update you on the position with SVB in light of the FDIC decision today. We bank with SVB UK. In the last hour, the CEO of the UK business held a call in which she stated the UK business is a separate entity, ring-fenced and still operational.

Saturday, March 11, 09:00

Dear LP, We wanted to update you on the fast-moving situation regarding SVB UK. It was put into a bank insolvency process late on Friday night by the Bank of England.

Sunday, March 12, 23:00

Dear LP, "FDIC says All SVB Deposits are Safe, Creates New Backstop for Banks."

Monday, March 13, 07:00

Dear LP, The UK government just announced that HSBC has acquired SVB UK and all depositors with the bank are fully protected and will have as-usual access to funds as of today.What happened between Saturday 9:00 and Monday 7:00 can be summed up by one of my colleagues who said, "felt like we were thrown out of a plane with no parachute", or as the understated English VC said: "this weekend was a bit of a nail biter.” So that is how everyone involved felt, but what were they doing about the situation?

Get funds out of SVB, given that SVB UK did not go insolvent and hence cease operation until after the close of business on Friday, March 10. Only those VCs and companies that had exposure or understood the US SVB situation decided to move funds out of SVB UK. This operation also required setting up new bank accounts, which would be hard to do in the time allowed. Many requested fund transfers but spent the entire weekend not knowing if this had happened.

Understanding the risk. In a remarkable amount of activity by the close of play Saturday, March 11, most VCs had a good idea of the companies in the portfolio that were at risk, i.e. funds locked in SVB UK and had major income or expenses unable to be executed. Very frustrating there was very little anyone could do about these risks, but understanding and quantifying them was vital. By late evening Sunday, March 12, Isomer capital had a good handle on the +400 UK companies in our VC portfolio, which is entirely due to the herculean efforts of our VC partners.

Lobbing the UK Government with an incredible sense of mission and purpose, many companies and VC funds (including ourselves) used their voice to highlight the impact of thousands of companies if access to their bank accounts was not restored on Monday, March 13. Doing this required stepping back and explaining the big picture: The importance of startups in an old economy undergoing a digital transition and the fact that many depended on SVB UK to survive.

Finally, a few OG comments on what has been said:

Companies are crazy not to have more than one bank account. The last time there was a bank failure on this scale was in 2008, and if you take the average European entrepreneur age, they were between 10-15 years old when that happened. Further, most startups have limited financial depth and want to maximize the interest rate on their deposits. However, I think many more companies will sign up for an additional bank account in the coming weeks.

Banking Clients of SVB caused the government to step in. So in one sense, this is true. The Government regulator stepped in when there was a significant run on the bank. But then, I think every entrepreneur's prime directive is to not run out of cash. So if you think you're about to lose your hard-earned last fundraise, they can be forgiven for trying to protect it.

Finally, if you are one of those people that think that what we do in Venture Capital is on the fringes of the leading economy. Well, pretty impressive that both in the UK and the US over last weekend, both Governments spent a lot of time supporting the fix on SVB…

WEF/Uplink: Climate Discussions at the Villars Summit

We’re proud supporters of the WEF’s Uplink, the open innovation platform for people and the planet 🌍. Learn more here.

This week, we traveled to Switzerland to attend the inaugural Villars Summit with the amazing ecopreneurs, climate VCs, FO’s and Corporates working hard to save us from ourselves every day 🌍

Apart from being humbled by the task that’s in front of us and the tenacity of the people addressing it head-on, we also came away with the recordings of an amazing episode with the ever-inspiring Rokas Peciulaitis from Contrarian Ventures and Christian Jølck from 2150 👇

If you’re in the climate space, I can only recommend that you get involved with the Uplink initiative. Reach out and we’ll connect you with the right people 🙏

Angel LP Syndicate insights

Insights & updates from Europe’s leading Angel LP syndicate community 🚀. Apply to join the fam 🤗.

#07 David Nothacker, Sennder on his most memorable deals, board construction, investment strategies and how he leverages LP investments.

Today, we're happy to welcome David Nothacker, angel investor, CEO & co-founder of Sennder, a digital truck freight forwarding business. Together with his co-founders, David has built up a team of over 1,000 employees across eleven offices in Europe. In the process, they have been supported by strong investors such as Scania, Accel and Project A, and have secured over €300 million in funding.

In this episode you will learn:

Why David considers his investments into Gorillas and Cargo 1 his most memorable angel deals

David’s learnings from managing startup boards

Why David has two different, yet synergistic, investment strategies: investing early in logistics & supply chain startups and co-investing with VCs in opportunistic deals

How LP investing can complement your angel activities when starting to do more international investments

How angel investing makes you a better, more experienced business leader

Women Investing In Tech

27 March – 26 April 2023

Kicking off on March 27th, the awesome team behind Baltic Sandbox will kick off their Women Investing in Tech program. And we’re immensely honored to have been invited as speakers 🙏 Enrollment for the free program is closed, but the advanced program is still open.

Jason Calacanis’ Angel Portfolio Model Google Sheet

For the third time, here’s yet another take on angel portfolio models 😂 This time one shared by Jason. I promise, this will be the last week with reflections and tools on portfolio models .. not! 🤐

We created an angel investor portfolio model google sheet for folks to model their investment scenarios 👇

If you're an angel investor or aspiring angel, the model can help you determine your initial investment budget and instruct you on how to monitor your returns.

You can try it out at https://launch.co/model

If you want to learn more about angel investing, we're hosting a 4-hour live workshop on March 8th. The workshop covers:

- how to start investing in early-stage startups

- how to find billion-dollar opportunities

- how to support founders and provide value

- how to structure deals & more

Learn more and register at https://lnkd.in/gQuHW6E

Use code FOJ for a 50% discount. All proceeds are donated to charity.

Ukrainian Startup Finmap Secures €1M While Co-Founder Fights on Frontline

At EUVC we’re backing SMOK Ventures and I couldn’t be prouder of the team and the change they’re making. While we do make our investments to make a return, there’s nothing better than seeing our money make a difference as well. Way to go Borys and team! 👊 Reach out if you want to get involved 💌

Today I'm extremely excited to announce our first ever investment in 🇺🇦 Ukraine.

Finmap.online is a startup that delivers a cash flow management tool for small and medium enterprises.

But bear with me... the Finmap story is much more exciting than what they do for a living :)

I first met Oleksandr and Ivan in November 2021 when they were still raising their pre-seed round. While I was impressed by their hustle and growth, I could not invest back then due to the formal restrictions of my previous Poland-centric fund.

We all know what happened in February 2022.

For Finmap the Russian invasion meant not only losing the Russian market (which they cut off completely) and most of the home Ukrainian market (which basically stopped functioning due to the war), but also one of its co-founders, Ivan, who was drafted and joined the Ukrainian army in the fight against the Russian aggressor.

Most entrepreneurs, even the extremely resilient ones, would have given up at this point. But not Alex. Instead of closing down, he made the call to expand aggressively into the European markets. Today Finmap makes a third of its revenue (that's a 300% growth YoY during wartime!) from outside of Ukraine, focusing on Turkey, Poland, Spain and soon the Latin American market.

Alex and Ivan are exactly the kind of entrepreneurs I love supporting as SMOK Ventures. Resilient, fearless, never giving up and always thinking world domination.

I'm super proud to announce that my fund led the most recent round of Finmap, followed by other amazing funds and people like Presto Ventures, Andraž Grahek, Petr Baron & others.

Read The Recursive story about the deal: https://lnkd.in/djmckJ_T

Sláva Ukrayíni! 🇺🇦

This week’s stories 🗞️

Jan Voss: Secondaries 101 👨🏫

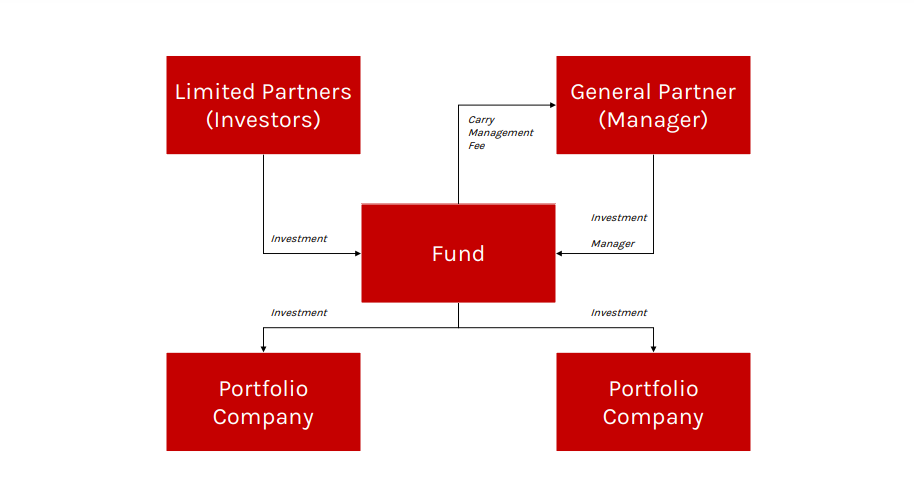

The insights I've shared on LinkedIn so far have been focused on private equity and venture capital funds. Today, we are diving into a third major group of funds that can add value to a fund portfolio, so-called "secondaries funds". They differentiate themselves from funds that invest in "primaries" (newly issued shares) by executing "secondaries" (existing shares).

On the next slide, we see the first (and most common) type of secondaries funds, "LP Secondaries". Here, the fund acquires a stake in a fund from an existing investor (the "LP"). Transactions happen for many reasons, such as restructuring an existing portfolio, selling mature fund stakes, or liquidity needs. Depending on the reason, the secondaries fund might acquire stakes at a significant discount. LP Secondary funds can be very attractive for new fund portfolios as they often acquire mature assets that quickly start distributing cash, which may be used to cover capital calls. It is not uncommon for LP secondaries to only call ~50-60% of an investor's committed capital.

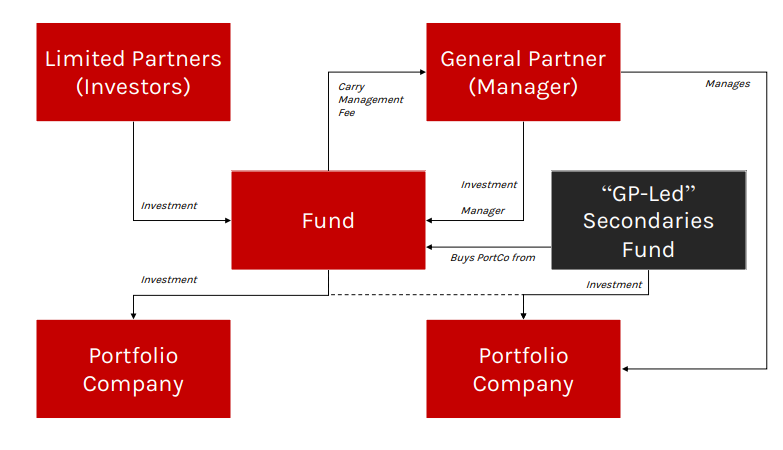

And on the next slide, we see the GP-led secondaries. Instead of acquiring a stake in a fund, the manager instead buys a stake in one or multiple companies in an existing fund. What's special is that the manager selling the company is retained as the manager of his portco within the "GP-led secondary" structure while also maintaining significant incentives (i.e. through capitalizing their carry). GP-leds are driven by conviction in the asset: Managers think that they can't sell the company at a fair price given market conditions, or think they can continue to grow a company for a few more years to realize additional gains. LPs in the existing fund usually have the choice if they want to sell or "roll".

And finally, we look at "GP Stakes". Here, the fund doesn't acquire a stake in the fund or an individual portfolio company, but the manager itself - i.e. a stake in a private equity management company. Its easy to forget how attractive asset managers are as investment: On the day of closing their fund, they have a binding commitment from investors to pay management fee for ten years, AND receive return from carry and their GP investment. However, as they grow, capital needs for expansion and the GP commitment might become too sizeable - which is why they turn to GP-led funds to sell a stake in their firm, and often receive value-add services such as assistance with fundraising.

In today's day and age, its important to know that often funds aren't just one of the three, but become more and more mixed (i.e. LP AND GP stakes). Investors should pay attention to what they are investing in, as the risk on a GP-led deal could be significantly different from investing a large portfolio of LP stakes.

Zoe Mohl: Parlez-vous français? When to decide on company language

This week Zoe from Balderton put out an important reflection on choice of language for founders that’s worth VCs asking their founders to think about - sooner rather than later.

💡Yesterday a French entrepreneur past Series B shared with me that if he could do it all over again he would make English his startup’s native and only language from day 1.

It’s not the first time I hear this. Entrepreneurs trying to break into new geographies, especially the US, have to make this big change and it’s much tougher when their already numerous employees are accustomed to only speaking French. I would add it says something about the company’s culture and aspirations. If they speak English from day 1, they are thinking international from day 1, and that’s a powerful statement 🚀

This week’s Lowdown 💵

powered by Cathy White, our go-to VC comms guru ♥

London-based Spex Capital has launched a €100M fund to invest in health tech companies. The health tech fund will invest up to €5m (£4.4m) into tech businesses globally at the seed to Series A stage.

The Czech government announced plans to create a €55m fund of funds to back three independent VCs — with €15m of the fund going to the AI technology transfer fund, a fund focused exclusively on university spinouts in the field of AI. This is part of the Czech government’s bid to create a better environment for the country’s AI scientists to commercialise their research.

Germany-based High Tech Grunderfonds has closed its fourth fund, valued at

€494 million. It can offer seed tickets up to €1M and invest up to €4M across all financing rounds.

In the Netherlands, QDNL Participations has launched a €15m early stage quantum fund. Covering quantum hardware, communications, and more, the fund will lead rounds in Dutch startups with tickets up to €1.5 million.

In people moves, the former head of McKinsey in Poland, Wiktor Namysł (Namus), is joining Czech VC Orbit Capital as GP. The fund is aiming to fundraise one of central and eastern Europe’s largest VC funds, aiming to close at over €200m to invest in tech scale ups across the region.

Thibaut Ceyrolle has joined Atomico. The EMEA founder of cloud data platform Snowflake, which IPO’d for $33Bn, started as Executive in Residence and is now Partner.

In celebration of International Women's Day on the March 8th we dedicated this Lowdown episode to Women in Venture 🦹.

Equity isn't just a nice-to-have; it's a must-have.

A focus on gender equity must be part of every society's DNA.

And it's critical to understand the difference between equity and equality.

Equality means each individual or group of people is given the same resources or opportunities.

Equity recognises that each person has different circumstances and allocates the exact resources and opportunities needed to reach an equal outcome.

The IWD 2023 #EmbraceEquity campaign theme aims to get the world talking about Why equal opportunities aren't enough. People start from different places, so true inclusion and belonging require equitable action.

Listen to Lowdown episode where Cathy was joined by:

Tong Gu, Founding Partner at Pact

Marieke Gehres, an Early-stage Investor at Earlybird

Clarisse Lam, Associate at NewAlpha Asset Management and Commitee Member of WVC:E, which brings women active in the European VC ecosystem together, in order to affect maximum inclusion and promote positive change 🚀

Thx for reading and being awesome 💗 we love you for it.