EUVC newsletter - 23.06.2025

Europe stops apologizing. Now we lead. Tune in for a week packed with FO talk, Quantum nerd out, the US-EU relationship and how Toyota's growth stage fund Woven Capital is making its mark in Europe.

There’s a quiet reckoning unfolding in European venture—equal parts ambition, urgency, and introspection.

On one side, geopolitics is loud: war, satellites, quantum, defense, and tariffs signaling that Europe must own its technological future or risk being sidelined. On the other hand, there is a deep, grounded push for thoughtful scaling—from family office playbooks and LP strategy to the nuanced craft of GTM and CVC alignment. We’re not just reacting to macro forces—we’re rewriting the rules from the inside out.

This week, we hear voices that push against isolationism, double down on global thinking, and remind us why deeptech, climate, and category creation aren’t luxuries—they’re imperatives. From Frontline to Quantonation, from Dario de Wet to Nicole LeBlanc at Woven, this is what it sounds like when Europe stops apologizing and starts leading.

So as you dive in, ask yourself: What does bold look like in your corner of venture? What stories will we tell about this moment, five years from now?

The alliance is awakening, it’s time to rebel ✊

With 💖 David & Andreas

Table of Contents

🎧 Podcasts of The Week

SUMMIT TALK | Breaking the “Europe vs. US” Myth with Will McQuillan at Frontline

LP: Cracking the LP Code: Dario de Wet on Building a Global FoF from Europe

CVC: Nicole LeBlanc on Corporate VC, Strategic Alignment & Value Creation at Scale

Path to Market: From Zero to Market Leader, A CRO’s GTM Playbook [Seedcamp Series]

✍️ Insights Article of The Week

🎧 Podcasts of The Week

Quantum Is Here: Europe’s Deeptech Moment

Welcome to a new episode of the EUVC podcast, where we bring you the people and perspectives shaping European venture. This week, Andreas is joined by Christophe Jurczak, Managing Partner at Quantonation, the world’s first dedicated quantum technologies VC fund.

Together, they unpack the tangible, applied promise of quantum technologies—far beyond the hype—and discuss why Europe may still win in this deep tech arena if capital (and courage) show up at the right time.

This week’s themes:

Real-world quantum use cases in health, energy, climate, and security

The rise of quantum internet and the race to secure communications

How interdisciplinary talent makes or breaks applied quantum ventures

Why late-stage capital remains quantum Europe’s biggest bottleneck

Here’s what’s covered:

01:30 Quantum Is Real: Health, energy, climate & security

02:45 Quantum Drug Discovery: Pascal & Qubit Pharmaceuticals

05:00 Simulation Power: Designing less toxic, more effective molecules

06:45 Quantum Internet: Unhackable infrastructure deployments in NYC & Berlin

08:30 Why Encryption Is Under Threat—And What Quantum Does About It

10:00 No Cryo, No Labs: Room-temp quantum machines are here

11:45 Talent Mix: Why computer scientists + physicists = startup advantage

13:30 ML on Quantum Hardware: Graph ML and novel quantum algorithms

15:00 Europe’s Competitive Edge: IQM, Pascal, and more

16:30 The Real Risk: Growth-stage capital and the transatlantic gap

18:00 Quantonation’s Vision: A future late-stage fund for European quantum

19:00 Final Thoughts: Sci-fi vibes, real-world traction, and a rallying cry

Watch it here or add it to your episodes on Apple or Spotify 🎧. Chapters for easy navigation are available on the Spotify/Apple episode.

SUMMIT TALK | Breaking the “Europe vs. US” Myth with Will McQuillan at Frontline

At the EUVC Summit, Will McQuillan of Frontline delivered a keynote that flipped the script on the increasingly popular narrative of Europe needing to "decouple" from the US. With data points, historical context, and a call to action, Will urged VCs and founders to resist isolationist instincts and double down on building global companies, despite rising geopolitical noise.

Rather than succumbing to isolationist trends, this talk urges the venture community to reclaim a global mindset, reminding us that the best companies are built across borders, not within them.

Whether you're in venture, policy, or portfolio support, this is your reminder that global ambition still matters—and it’s up to investors to make it possible.

Here’s what’s covered:

00:50 US Revenue Reliance: A warning or a reality check?

02:30 The Case Against Isolationism: Why Europe can’t afford to go it alone

04:15 Historical Proof of Collaboration: From deep-sea cables to the Large Hadron Collider

06:00 Policy vs Practice: Why builders must rise above political narratives

08:10 VC’s Role in the Globalization Equation: Making international scale possible again

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Brought to you by Affinity – Exclusive dealmaking benchmarks

What can Affinity data on almost 3,000 VCs from 68 countries reveal about how VCs performed last year and how dealmaking will continue to evolve?

Cracking the LP Code: Dario de Wet on Building a Global FoF from Europe

In this conversation, David Cruz e Silva sits down with Dario de Wet, Founding Partner of LTV Capital, a next-generation fund-of-funds reshaping the LP-GP landscape through intentional, hands-on support for emerging managers, especially in underserved and global markets.

Together, they unpack what it takes to stand out as an emerging venture capital manager today, how limited partner sentiment is shifting across continents, and why democratizing access to venture capital remains fraught with friction.

Here’s what’s covered in the podcast:

03:10 Becoming the Best Emerging Manager: Intentional Positioning

06:05 What LPs Actually Want: Archetypes, Risk & Regional Nuance

09:30 The Ubuntu Foundation: Building Africa’s Emerging Managers

12:45 US vs Europe: Why Dario Still Bets on Europe

15:20 Strategic Value in Venture: More Than Just Capital

18:35 The Power of Narrative: How Emerging Managers Stand Out

26:30 The “1000 Funds” View: Pattern Recognition from UVC

28:45 Strategic Sessions, GP Coaching & Market Signal Loops

31:20 Should LPs Just Invest in the U.S.? Dario’s Response

39:15 If You Made It This Far… The Real Secret to Success

📺 Watch the episode here, or stream it on Spotify or Apple Podcasts—complete with chapters for easy navigation 🎧

↓ Meet Dario at the EUVC community LP AMA Register below to attend ↓

Make an impact with the bank made for the innovation economy

We know building relationships and building businesses go hand-in-hand. With our sector expertise and tailored solutions, we’ll connect you with what’s next.

Nicole LeBlanc on Corporate VC, Strategic Alignment & Value Creation at Scale

In this episode, Andreas Munk Holm and Jeppe Høier sit down with Nicole LeBlanc, Partner at Woven Capital, the $800M growth-stage CVC fund backed by Toyota. They unpack what it takes to drive real strategic and financial outcomes in corporate ventures—and what founders and GPs often get wrong when working with CVCs.

Nicole shares how Woven structures its global operations, works hand-in-hand with Toyota’s business units, and leverages a portfolio success team to shepherd startups through complex corporate dynamics. She also breaks down Woven’s investment logic, from hydrogen to lunar rovers—and why corporate alignment shouldn’t come at the cost of independence.

Here’s what’s covered:

00:40 – The structure of Woven Capital & its relationship with Toyota

03:00 – How Toyota Ventures (early-stage) and Woven (growth-stage) complement each other

09:45 – Building internal bridges: the Portfolio Success team model

13:15 – Toyota’s internal incentives (and the carrot vs. stick approach)

15:10 – The CVC cultural challenge: Japan, US, and Europe

21:40 – How to spot a “red flag” CVC as a founder

31:30 – Toyota Open Labs: a new playbook for startup-corporate collaboration

34:00 – Woven’s LP strategy: investing in funds for access, insight & geography

39:00 – Learnings from fund investing: what CVC LPs need from GPs

42:00 – Final advice for startups and corporates alike

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

Path to Market: From Zero to Market Leader, A CRO’s GTM Playbook [Seedcamp Series]

In this new episode of Path to Market, our Director Natasha Lytton and co-host Micah Smurthwaite, Partner at Pipeline Ventures, sit down with Tim Bertrand — a three-time GTM leader who’s scaled companies from just a few million to hundreds of millions in revenue. Currently serving as President of HAProxy, Tim previously held sales leadership roles at Acquia and Project44, and brings deep insights into category creation, founder-led sales, sales hiring, and international expansion.

Tim walks us through his career of building sales engines from the ground up — including Acquia’s leap from $2M to $200M+ ARR — and explains why he keeps coming back to the early-stage trenches.

He also shares actionable advice for founders: when to hire (and who to hire) in your first sales roles, how to think about pricing in new markets, how to align product and GTM, and what great onboarding and sales coaching look like.

Here’s what’s covered:

05:00 Early-Stage Sales: Why Tim Keeps Coming Back

07:12 Structuring Your First Sales Hires

09:44 Traits of Great Early-Stage Sellers

13:00 Does Domain Expertise Matter?

15:28 Best Practices for Sales Onboarding

17:48 Sales Methodologies: MEDDICC & BANT

22:14 Creating Real Urgency in the Sales Cycle

30:23 Value-Based Pricing & Market Signals

38:09 Building a Business Around Open Source

42:16 Sales Methodologies for Founders

43:40 Hiring a CRO: When & What to Look For

You can watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation are available on the Spotify/Apple episode.

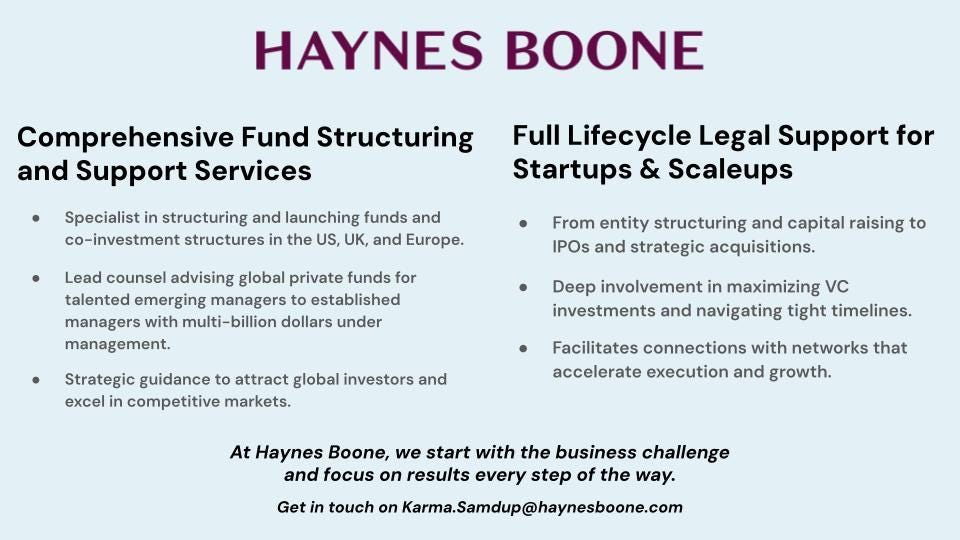

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

This Week in European Tech with Dan, Mads & Lomax

Welcome to a new episode of the EUVC podcast, where Dan Bowyer and Mads Jensen of SuperSeed and Lomax from Outsized Ventures gather to unpack the macro forces and micro signals shaping European tech and venture.

This week, the trio tackles one of the most geopolitically charged, capital-heavy, and morally complex episodes yet:

The global reshuffling of power: Israel, Iran, Russia, and Ukraine

Why defense is back—and what it means for VCs

Europe's space ambitions and what the ESA's new satellite project signals

China's trade plays and Europe's vulnerability in rare earths

AI, IPOs, and why founders might want to stay private longer

Surgical robots, ambient AI, and who’s building the future of healthcare

Plus: Daniel Ek gets flak, SPACs sneak back, and why VCs are now speed-running $15B deals in one week.

Here’s what’s covered:

02:00 War & Markets: Iran, Israel, oil prices & Bank of England holds

06:00 Defense Budgets: Why Europe is (finally) spending

10:00 VC Taboo: Why investing in weapons gets complicated fast

15:00 EIF Restrictions: Sex, gambling, and no defense

20:00 The Rise of Helsing: Europe’s $12B defense unicorn

24:00 Strategic Autonomy: Europe’s new military satellite constellation

30:00 ESA vs. Starlink: Earth observation gets serious

34:00 China, Trade Wars & Rare Earths: Why Europe’s exposed

40:00 EU-US Tariffs & Trump’s Pharma Threat

42:00 IPO Boom: Chime, Circle, and the SPAC comeback

47:00 CMR Surgical: UK’s $4B robot exit—is that enough?

53:00 Lessons from Intuitive Surgical & deeptech M&A

56:00 Deal of the Week: Nabla’s AI for clinicians, Helsing, and Scale AI’s lightning-fast cash

01:02:00 Founders in Government: Alex DePledge & Matt Clifford’s impact

01:05:00 Meta’s AI Transfers: Zuck goes full football transfer window

Watch it here or add it to your episodes on Apple or Spotify 🎧. Chapters for easy navigation are available on the Spotify/Apple episode.

✍️ Insights Article of The Week

Enterprise Software Snapshot: Navigating the Evolving Funding Landscape

Key trends shaping the funding landscape:

Fewer Deals, More Capital: VC deal count is down, but investment volume is up—investors are backing fewer, higher-quality later-stage startups (Series C+ now takes up ~⅔ of funding).

AI & Fintech Lead the Pack: Megarounds dominate, fueling momentum and signaling strong investor confidence.

Venture Debt on the Rise: 40% of deals now include venture debt as founders seek growth with less dilution.

💡 Founder Tips:

Explore venture debt as a strategic funding tool.

Prepare for late-stage readiness—investors want proof of scale.

If you're in AI or fintech, ride the wave and show your relevance.

Behind the Scenes of a Family Office

Idriss Dahbi’s path into investment and portfolio management began not with a plan, but through lived experience first as the son of Moroccan entrepreneurs in Vienna, then as a close advisor within the Studen family’s international agribusiness. What started as a front-row seat to a founder’s journey evolved into a broader role shaping the family’s diversification strategy and helping build their family office from the ground up.

Today, Idriss leads with a pragmatic mindset shaped by early lessons in direct investing and a growing focus on risk-managed, values-aligned capital allocation. He balances fund-of-funds, public markets, and thematic strategies in areas like health and food, while actively engaging with a peer network of family offices across Europe. For him, it’s not just about investing, it's about building a legacy through thoughtful, long-term decision-making. Read on to find out more about his journey.

Green is the new gold: Climate tech funding explained

Climate tech is breaking out of its niche—and fast. With over $70B invested globally in 2023 alone, it’s now a major driver of economic growth and innovation.

🚀 From clean energy and carbon tech to food systems and mobility, VCs are chasing both impact and returns. But climate founders need more than capital—they need patient partners, blended funding models, and a deep grasp of policy-driven markets.

Dive into this strategic breakdown by Bailey Morrow (HSBC Innovation Banking)

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

Dario combines deep institutional, operational, and investment expertise, investing in early-stage companies and funds. Recognized as a "40 Rising Star under 40" by VCJ, he actively contributes to the industry.

Before founding LTV Capital, Dario co-led fund investments at Anthemis Group, a top fintech investor, where he developed early-stage fintech plays with BBVA and pioneered a media-financial services fund. His background also includes spearheading international expansion at emerging markets fintech JUMO and contributing to the creation of ROAM, now Africa's largest classifieds group.

Academically, he holds a Master of Business Science in Finance from the University of Cape Town; his dissertation on "Tencent Holdings Limited" is widely downloaded and cited.

Outside of work, Dario is a former 125cc motorcycle racing champion who now advises the Finetwork Mir Racing Team, supporting young talent in motorsports. He is driven by a passion for empowering others and fostering change in the emerging manager VC ecosystem.

↓ Meet Dario at the EUVC community LP AMA Register below to attend ↓