EUVC Newsletter | 23.06.23

Gen Z being Gen Z, The astounding women GP talent in Europe, Learnings from meeting with 1000+ VCs, the commoditization LP lead lists and why Dubai might be your next destination.

Welcome to the GP/LP newsletter of Europe🙏

Firstly a heartfelt welcome to the 87 newly subscribed venturers who have joined since our last post! If you haven’t yet, join the 9,743 LPs, VCs & Angels that do or share it with your besties🤗

Table of Contents

Upcoming events:

Expand Northstar - the ultimate startup and investor connector event

TechBBQ - where hygge and tech meets

Gen Z VC being so Gen Z

Revelations from a SuperVenture Dinner that Haunt the Palate of My Mind

LP thought leader Samir Kaji on 14 common themes from meeting with 1000+ VCs

Is Dubai really such a big thing?

The Commoditization of LP lead lists

This Week’s Partner: Luca Faloni 💫

In our last post, I celebrated that the days when Southern Europe was just a holiday destination seemed to be behind us - luckily, Italy’s days of making us all look a million times sharper than our local tailors could ever manage aren’t.

As such, I’m happy to introduce you to this week’s partner: Luca Faloni - a premium menswear brand dedicated to creating timeless products for you to love for years to come.

Experience for yourself with free shipping & returns 📫

Upcoming Events

Expand North Star in Dubai - the ultimate startup & investor connector event.

15 - 18 October, Dubai

Investors are turning to new relationships as we continue to face challenges in a downturn. Join Expand North Star to discover Dubai, the UAE and the rise of the Global South ecosystems.

Gain insights on market access opportunities, and the latest on ADGM, Mubadala, and Catalyst Partners, as well how DFDF are transforming the global investment landscape with $1 billion target for assets under management by the end of 2024. You’ll connect with the people driving The UAE's digital economy to grow more than $140 billion in 2031and Dubai’s recently announced ambitious $8.7 trillion economic agenda for the next decade, known as D33.

TechBBQ - where hygge meets tech

September 13- 14, Copenhagen

7500+ attendees, 2600 startup reps, 340+ speakers, 620+ Scaleup reps , 880 investors and 150+ media reps. Clearly, TechBBQ has become the heartbeat of the startup and innovation ecosystem in Scandinavia. It began as a humble BBQ gathering for tech enthusiasts and entrepreneurs in 2013, but has since evolved into a large-scale summit that draws attendees from around the world for two days of inspiration, networking, and growth.

Gen Z VC being so Gen Z

So instead of the usual meme to start us off, this time I’ll put a screenshot from my WhatsApp this morning.

What can I say, other than this is definitely Gen Z being so Gen Z 🤷♂️ maybe with the added curiosity that it’s surprisingly un-woke.

Needless to say, by posting this, we’re not endorsing anyone “totes getting nakes”.

Revelations from a SuperVenture Dinner that Haunt the Palate of My Mind

A journey through ambivalence, dualistically intelligent guts, gourmet delights and women changing the word euro for euro.

Emerging from SuperVenture, there was a singular dinner that left an indelible mark on the restless soul of your very own LP hypeman. After two days of choking on canapés and lobby pitches by VCs that looked all but comfortable in their newly acquired suits, SuperVenture had left my gut filled with the perfect mixture of exhilaration and skepticism.

Fitzgerald is often quoted for having said that the test of first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function. By that standard, I guess I can now conclude that my gut is quite the genius.

So with that feeling in our tummy, David and I embarked on our journey to what would prove a memorable evening with the backdrop of Berlin’s vibrant graffiti-laden streets and smoky beer gardens, contemplating the question if we’re truly pushing boundaries or just feasting on the illusion of progress?

With abandoned e-scooters, dust-filled and polluted air, and constant twittering in our pockets, it seemed to us that only our ambitions and trust in the managers we had just spent the day with could account for our optimism.

That, and the fact that we were headed for a dinner party exclusively for women GPs and the LPs committed to supporting them. Put on by none other than our good friend Gina King from Supernode Global.

Chenelle Ansah, Managing Partner, LightPace VC

Yana Abramova, Founder, Pretiosum Ventures

Nicole Büttner, CEO, Merantix Momentum

Isabella Fandrych, Co-Founder and Partner, Nucleus Capital

Sonia Fernandez, Partner, Kibo Ventures

Dörte Hirschberg, General Partner, Climentum Capital

Alina Klarner, GP / Head of Ventures, Impact Shakers

Isabelle O Keeffe, Partner, Sure Valley Ventures

Mandy Nyarko, General Partner, Future impact ventures

Rubina Singh, Deeptech fund manager, Octopus Ventures

Thea Messel, GP, Founder, Unconventional Ventures

Pauline Wink, Managing Partner, 4impact capital

Emma Whittingham, Associate Director, Octopus Investments

Merve Zabci, Managing Partner, Metis Ventures

Amidst an epicurean cacophony of buzz and clinking of champagne flutes, we sought out the continent’s brightest who despite all common sense haven't sold their souls to the promise of surefire success in the corporate world but instead believe in the slow burn of raising in this weird market of 2023. Let’s all salute these individuals.

We met one of the local leaders, Nicole Büttner, GP at Merantix one of Europe’s AI early-stage investors backed by institutional investors such as Transpose and the W.K. Kellogg Foundation, currently working on their new 100M EUR fund that leverages the Merantix AI Campus with 80 teams and ecosystem with close to 1000 members working in AI/ML located in the heart of Berlin.

We met Sonia Fernandez, Partner at Kibo Ventures and founder and leader of MercadoLibre, Match.com, VP of the Stanford Alumni Association in Spain and member of the International Women Forum group.

We had long conversations with Rubina Singh from Octupus Ventures and Emma Whittingham from Octopus’ First Cheque Fund which cuts £100k pre-seed tickets across Europe (which by the way is managed by Kirsten Connell (ex-Seedcamp) and Maria Rotilu (ex-Hustle Fund).

And finally, we found ourselves (yet again) at the table of Dr. Isabella Fandrych, GP of Nucleus Capital, of which David and I are long and proud cheerleaders. You will not find a better micro VC focused on getting capital to the right people solving the world’s most pressing systemic challenges to planetary health.

This team juggle period tables and term sheets better than like no other, so don’t hold back. If you want an outlier in your portfolio, here’s one.

Cheers Berlin, amidst your tumultuous history and resilience, you’re a city of reinvention, a place where artists, misfits, and rebels have always found solace, pushing boundaries and challenging conventions. Once again, SuperVenture week, lived up to your spirit and hopefully the seeds of future history were once again planted in the lobby of the Palace Hotel.

And also in the hallowed halls of Bocca di Bacco, thanks to Gina, our host for the evening.

Samir Kaji on 14 common themes from meeting with 1000+ VCs

LP Hypeman’s note: No idea why I fell over this 10 month old post the other day, but rockstar as ever, Samir leads the thought of the field with this list of learnings from having met with 1000+ VCs. Pay attention, there’s not many writing from his vantage point 👀

Playing the "game" they can win, and not getting moved into a game that plays into someone else's strengths

Ok with being on an island (non-consensus) and being wrong

Realizing they are going to be wrong more than right, and that is ok. Anti-portfolio market cap is usually > portfolio cap even for best firms

Are conviction based, but not stubborn and willing to be swayed

Constantly re-inventing themselves

Understanding that new, younger talent is required to balance the field. Too many older VC's use anecdotes from the past guide for the future. It's why firms miss out on many great deals.

Understand that winning sometimes simply comes down to being relatable and likeable.

Really value LP relationships, and put themselves in the position of an LP

Think about all aspects of the venture business; team building, culture, operations, compliance.

Are shareholder-focused. Founder friendly often requires direct and focused feedback.

Actually listen. Many VC's don't listen to the founder to understand the business well enough to help. While well intentioned, much "help" often checks a box of "we're being helpful"

Care only about carry, not fees for personal balance sheet. I've met many GPs at firms that have scaled that have near the same annual salary from the early days.

Know portfolio math inside and out.

Are great at knowing when to make exceptions on investments.

On the 13th point, we recently interviewed Anubhav from the #1 portfolio modeling tool Tactyc for the eu.vc podcast. Keep your eyes out for that and listen to Samir’s conversation with him below. Too many take #13 too lightly.

Is Dubai really such a big thing?

As you may have gathered from our upcoming events section of this newsletter, we’re headed to Dubai for the North Star summit in October (hit me up if you are too!). In that connection, we’ll be taking an extra look at the opportunity the region represents for European VCs and LPs. So for today’s newsletter, let’s ask the obvious question: Is Dubai really such a big thing?

Well.. we all know there’s nothing like herd behavior and signal, so let’s start with Jason Calacanis’ reflections from his first ever visit to the region this year:

it reminds me of like, you know, Silicon Valley in the early days where everybody's doing something and it's incredibly cosmopolitan.

Jason Calacanis, All-in podcast #128

And honestly, credits from one hypeman to another, I think Jason puts it well in the ensuing conversation:

I think basically they have 20 - 30 years to convert the oil economy into a technology capital allocator economy. And so they want to make evergreen funds to invest. They haven't had a chance to invest in venture capital because most venture capital, there weren't that many. They were fully allocated and there was no opportunity. Now with what's happened in the United States in this pullback and sort of the cycle starting over again, I think there's an opportunity for them to invest in some funds and start relationships.

Jason Calacanis, All-in podcast #128

Start relationships? Sounds like a pretty good reason to be thinking about Dubai these days 🤔 Stay tuned to the upcoming editions as we dive deeper!

The Commoditization of LP Lead Lists

I recently shared Andre’s post How to find new LP investors for your fund at scale (+ list of top 46 LPs in German VC funds) and commented that this works for Denmark (and many other European countries as well".

A couple of days later this pops up on LinkedIn:

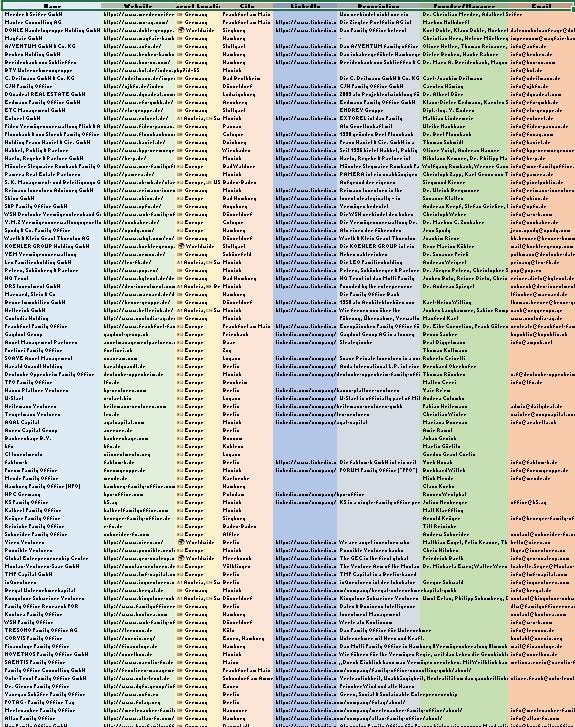

📢 The List of 100 Family Offices in Germany

Want to connect with Family Offices in Germany?!

This free list saves you a lot of time and energy! It includes:

✅ An introduction about the Family Office

✅ Target Locations

✅ HQ Location

✅ Founder/ Manager

✅ And more...📢 You can download the list here: https://bit.ly/43INYQl

So with LP lists galore - where are we headed? Well, their value will certainly decrease as anything that’s bountiful.

But there’s another consequence. No one likes to be sold cold. I sometimes explain it like this:

I love pizza. I really do. But if the pizza guy shows up on my doorstep offering to sell me his pizza, I’m not sure I love him anymore. Especially not if he follows up repeatedly.

So what’s bound to happen? I have a feeling the 146 FOs on the above-linked lists aren’t in a rush to taste the pizzas they hadn’t ordered. But they’re probably eating nonetheless. Probably something a friend brought over 😏.

Tired of your back-office? So were we...

Take your syndicates or funds to the next level with Vauban’s funds and SPV services - and don’t forget to use this form for a very special treatment 🫠