EUVC Newsletter | 27.02.23

The state of Tech in Ukraine 1-year in, Reflections on VC Suckage, wet powder, VC funding's impact on exit routes, and - of course - an ode to rockstar female founders and ex-operators ✊

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

Firstly, a heartfelt welcome to the 98 newly subscribed venturers who have joined us since our last post! If you haven’t yet subscribed, join the 7,885 angels, VCs and LPs that do 🤗

Love European Venture? Help us connect the ecosystem 👇

Do ping us if you have news, opinions or memes you want us to share. We’re here to connect & amplify the European Venture community 📣

Table of Contents

Open in browser for clickable ToC 👆

LP Musings w. Chris Wade: A Unified Theory of VC Suckage - where we at?

Uplink: This is how rainwater can save our cities from the water crisis

Angel LP Insights: EUVC not featured on Signature Block’s Alternative Investment Platform map 🎉

Support the Medicine for Ukraine Foundation

Since March 2022, we have been helping Ukrainians to get the medicines they need. The Foundation's founder is the Liki24 company, which has been an expert in the pharmaceutical market of Ukraine since 2017.

Go here for details about the project & pledge your support ✊

We will be very grateful for any help!

Slava Ukraine!

This week’s events 📅

Affinity Campfire Conference Berlin

We all know the best secrets come out at campfires 🏕️

Join 50+ VCs in Berlin on Friday 28th at Affinity's Campfire event for some honest conversations about how VCs remain successful in the face of the current market shift.

Panel Discussion | Navigating the new investment landscape in 2023

Tom Hughes, Senior Regional Director, Affinity

Andre Retterath, Partner, Early Bird VC

Leopold Walde, Partner, Armira

Said Alib Haschemi, Investment Manager, HV Capital

Maciej Lehmann, Analyst, Future Energy Ventures

A full night dedicated to VC, canapes (🫒+🍈) and drinks. What's not to like!? 🤷♂️

Date February 28, 2023 | Venue Factory Berlin Görlitzer Park

Lohmühlenstrasse 65, 12435 Berlin

The Rise of Angel LP Syndicates 😇

Date April 11, 2023 | 15:00 - 15:45 CET | Venue LinkedIn Live

This week’s podcasts🎧

The European VC, #157: José del Barrio, Samaipata

Today we are happy to welcome José del Barrio, Founding Partner of Samaipata. Before joining the early-stage pan-European VC fund, José was the co-founder of La Nevera Roja, the leading food-delivery platform in Spain, which sold to Rocket Internet for $100 million in 2015. José has also worked at PWC and Accenture in Strategy and M&A Advisory.

In this episode you’ll learn:

VC Brand building from one of the best brands in the space

Why you must build your brand for founders and not LPs & how to balance personal and firm brand

What’s behind Samaipata’s ethos of go beyond, think big and stay real

How José thinks about building LP relationships from first touch to conversion and beyond

The European VC, #156: Anne Solhaug Tutar, Antler

Today we are happy to welcome Anne Solhaug Tutar, Partner at Antler Nordics, former entrepreneur and startup expert. At Antler, Anne has made more than 40 investments in early-stage startups and was named Company Builder of the Year in 2021 as well as top 10 Leadership Talents 2021 in Norway by E24. Anne's entrepreneurial background comes from Turkey where she founded one of the country's first health food FMCG with customers such as Starbucks and Carrefour.

In this episode you’ll learn:

How relocating to Turkey led Anne into entrepreneurship and then VC

How hustling as an entrepreneur carries into the hustle of being an emerging VC

How Antler Nordic has built a model to optimize collaborating with industry

GIFs & Memes 🙊

Emerging VC pitching big LP

Try something different in ‘23

GP trying to get LP to act on co-invest opportunity

While not a GIF or MEME, this did make a father happy to see 👇

LP musings w. Chris Wade 🧠: A Unified Theory of VC Suckage

By Chris Wade, founding partner of Isomer Capital (and European Venture’s #1 LP OG). Get to know Chris in our two-part episode on his journey & thinking 🎧.

In March 2005, Paul Graham wrote A Unified Theory of VC Suckage - and at the same time launched Y Combinator in Cambridge, Mass.

It’s been some time, so I thought I’d give you my take on it ⏰. But first, let’s recap The Theory of VC Suckage:

VC Fund managers are greedy and raise huge funds solely because of the fees they generate

VC investment managers can only manage a limited number of companies

Therefore the VC ram excessive amounts of capital into companies that in most cases cannot deploy

Excessive capital = Excessive valuations making impossible to sell the companies with founder outcomes that would greater than if the founder had not raised the capital

Founders that do not play ball to Graham’s view are mostly fired and replaced with VC-tame CEO.

So: 18 years in, what’s the score? 🤔

I think it’s fair to say that we do have examples that support Mr Grahams observations. But it is also worth saying that very large funds require even larger returns, ie. it’s not all about the fees.

Mega returns require a partnership with founders and bad VC behaviour is communicated to entrepreneurs faster than grease lightning.

The 2001 internet bubble burst modified bad behaviour and indeed killed many VC firms, as did 2008 and no doubt 2022 will.

Larry Page and Sergey Brin (Sept, 1998) refused small VC cheques in their seed round making a strong argument for why swinging a fat wallet can be important

The melting pot of US Venture capital post-2001 calls for introspection on some of the core pillars of VC:

🤏 Small vs Big Cheque 🦣💡VC Mentorship vs Interference ☝️

🧠 Knowledgable vs Vacuous VC 🐑

And finally, providing a nice philosophical backdrop, at the same time as Paul Graham launched YC and his infamous Unified Theory of VC Suckage, Peter Thiel launched his fund, deploying the exact opposite strategy following the “How much do you want?”- and “Hands off”-principles.

Appropriately, Peter Thiel called his fund Founders Fund.

So where are we today?

At yet another inflection point in VC where the jury is out to vote 🧑⚖️

Uplink: This is how rainwater can save our cities from the water crisis

We’re proud supporters of the WEF’s Uplink, the open innovation platform for people and the planet 🌍. Learn more here.

Climate change with massive rainfall, extreme heats and droughts put pressure on cities. Growing populations increasingly ask for greener living space. We need to (re)act to climate change and build livable and loveable cities.

See how rainwater can be harnessed to save our cities from the water crisis👇

LP Syndicate update: EUVC not featured on Signature Block’s Alternative Investment Platform map 🎉

Insights & updates from Europe’s leading Angel LP syndicate community 🚀. Apply to join the fam 🤗.

So this week, we had the honor of not being listed on Weekend Fund’s market map for Alternative Investment Platforms.

And we’re celebrating 🥳

Why? Because we’re a community, not a platform.

While we’re providing democratized access to the best funds in Europe for hundreds of founders & operators that otherwise wouldn’t be able to put their money where their life is, we’re not a retail play.

So if you want to join a vested community of angels, operators & VCs brought together to back the next generation of European founders, don’t hesitate to apply to join the community 🤗

Speaking of democratized access, I just wanted to send my love in the direction of Asbjorn Holmlund’s and his team’s work with getting Wefunder launched in Europe. As TC said in covering the launch:

More players in the market is good news for both U.S. and EU startups alike.

The move, notes Tommarello, co-founder of Wefunder in the TC article:

Startups can now raise equity crowdfunding rounds in both the United States and the EU, essentially doubling the total capital they are allowed to raise with the vehicle on a yearly basis. The added competition also means that businesses have more optionality on terms — and maybe that crowdfunding will reach a new echelon that finally quiets criticisms around the quality assurance of companies who take this financing route.

Needless to say, at EUVC we're happy to see their entrance to the EU, as their mission to democratize access to start-up investing, goes hand-in-hand with our own vision of giving investors access to invest in top-tier VC funds.

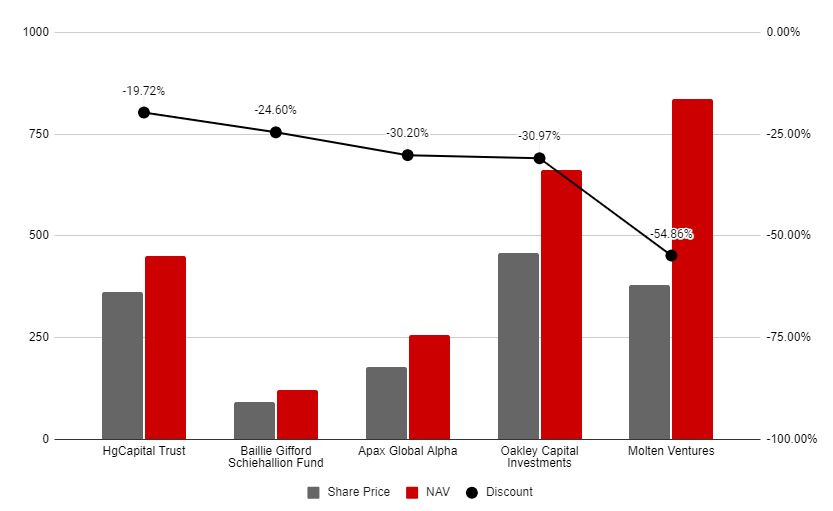

And finally, Jan Voss, Head of Family Office @BLN Capital pointed everyone’s attention this week to the fact that some pretty good bargins can be made on publicly traded VC and PE firms these days:

There is a niche where investors can buy into PE, VC and other alternatives at very small tickets. Let me introduce you to the world of traded closed-end funds: Funds that raise money i.e. through an IPO for a certain investment strategy but that don't offer redemptions like mutual funds or ETFs. Instead, investors can buy or sell their shares in the fund on a stock exchange. And as so often, when more people sell than buy, closed-end funds trade at a discount to their (self-reported) "net asset value".

In the current environment, discounts can be substantial. For "blue chip" PE funds such as Hg and Apax, we see 20-30% discounts to their net asset value, or up to 50% in the case of VC firm Molten Ventures. However, the discounts fluctuate substantially. Baillie Gifford's Schiehallion trades at a ~25% discount, but traded at an 30%+ premium as recently as April 2022. Savvy traders might see this as an interesting opportunity to buy low, sell high.

However, be warned: Funds can trade at substantial discounts for long periods of time. Managers are usually incentivized on NAV rather than share price, so they have little incentive to spend money on NAV-reducing initiatives. In one recent case, a fund saw a massive drop in share price, but managers still received their massive NAV-based performance bonus - paid in heavily diluting shares. As they are often "externally managed" like a mutual fund, investors have little means to influence manager behavior, and activist investors are often too big to play in the space (as one friend told me, if a large hedge fund can only invest 100mn. in the space, it is simply not worth their time and effort). And in all of this, we're not even debating whether the NAVs they report are accurate - but that's a different topic.

So why take a look at the space? For me, it is an interesting opportunity to gain access to private equity exposure through a "co-investment" with some of the most successful funds in the world. Additional fees make it less attractive than an outright fund investments (for which I am not rich enough just yet anyways), but I can sell out of it at any time. I'm not trying to make a quick profit, but want to hold on for the long term, building a little PE allocation in my personal account.

This week’s stories 🗞️

The EUVC Lowdown on The State of Ukranian Tech One Year Into the War.

Today marks one year since Russia launched its full-scale invasion on neighbouring Ukraine. Since then, tens of thousands of people have died, entire cities have been destroyed and millions left Ukraine. This week’s show was dedicated to discussing where we are one year on, Ukrainian entrepreneurship, the state and role of VC in Ukraine and where we’re headed.

Joining us for the show were some of Ukraine’s most prominent investors, founders and ecosystem champions:

Kateryna Hrechko, CEO of the Ukrainian Tech Ecosystem Overview

Anton Avrinsky, Co-Founder and CEO at Liki24

Elena Mazhuha, Investment Director at Flyer One Ventures

Sasha Yatsenko, Principal at SMOK Ventures

This week, I saw the below post by Alexandra Govirukha from Sigma Software Group, that I wanted to share together with Cathy’s episode above:

Kyle Harrison: Dreaming Of Dry Powder - the emergence of “wet powder”

Kyle Harrison, General Partner at Contrary, wrote a great piece on why the dry powder we’ve all been reading about in the news is turning wet. Read on for a summary or the full article here.

Wait what? 👇

“LPs care about not losing money. VCs care about raising their next fund. The best thing for both parties in the capital allocation value chain is NOT speed. If VCs start aggressively calling capital, LPs may find themselves unable to come up with the cash to satisfy those capital calls. If VCs invest, and then the market takes longer to correct than expected, their returns could be lower.”

or as stated beautifully by Maren Bannon:

So what’s up with that LP incentive?

Michelle Valentine, the CEO of Anrok, explains the reality that most LPs are facing. Because they don't invest cash into venture funds at the beginning, a LOT of that dry powder isn't just sitting on the side lines, its been hunting for yield in the interim.

"Remember those LPs who still had two-thirds of their capital obligations to venture firms outstanding and decided to invest in short-term holdings to earn interest in the meantime? Their short-term holdings are now worth a fraction of what they originally expected. They may be forced to sell positions at a loss. In some cases, they simply may not have the capital to commit."

As a result of this mismatched dynamic of LPs that have overly illiquid portfolios, dramatic underperformance, and liquidity demands (like paying out pensions), a lot of VCs have started to refer to this dynamic as "wet powder."

What about the VC incentive, how’s that also about being slow? Doesn’t IRR drop as you wait?

Here's an important nuance. IRRs don't start until VCs call capital. So for example, if someone raises a fund in January 2018, and doesn't invest in a company until December 2019, the clock on their IRR starts December 2019, not January 2018.

A somewhat common practice in private capital funds (PE, VC, etc.) is to use a subscription line of debt to manage their cash flows. In normal times, LPs don't want to be getting capital calls every few weeks, its just a logistical nightmare. So VCs will have a line of credit. When they make an investment, they can draw down debt, make the investment, and then at the end of a quarter or so, they can aggregate all their investments, make one capital call from their LPs and pay back the debt.

Technically, the difference of a few weeks doesn’t have an impact on returns, and are just a cash flow mechanism. But if those debt lines are drawn out longer, and longer, they could be used to artificially inflate returns. The debate of IRR, MOIC, and other benchmarking metrics for venture funds is a hot topic.

What Does This Mean For Venture Capital?

In some ways, the increased pressure on capital allocation is a good thing. Hucksters, tourists, scam artists, and wanna-bes get washed out. When the going gets tough, the not-tough find other jobs.

But there are some not-so-great implications of this bifurcation. One thing I liked about the 2021 hype was the shift of power from VCs to founders. As that starts to correct, VCs can very easily retreat to what is "tried and true." Established repeat founders from groups similar to themselves.

The fear is that venture limitations will limit access to capital for people and companies that should be getting more capital, not less. Peter Pezaris, SVP of strategy and experience at New Relic, described venture this way:

“Venture capital simply cannot stay frozen for long, and we’ll see renewed investments by the end of 2023. The record amount of dry powder at VC funds must be deployed according to schedules and in search of returns for investors. The VC community is driven by rumors and groupthink. All it will take to unlock a furious wave of pent-up demand is one person investing and sparking everyone else’s fear of missing out.”

The easier it is for VCs to defer to "rumors and groupthink," the less likely they are to be innovative. And if there is one thing we need more of in venture, its thinking that is less like more of the same.

Amen to that, Kyle 🙏

Jason M. Lemkin: Reflections on VC funding’s impact on necessary exit routes

Jason put out a great post reflecting on the impact taking VC money has on the necessary exit route for founders and digesting how they should/could think about this before raising venture capital. A great read for any angel or VC - either for themselves or to share with (aspiring VC) founders.

During the Boom Times, no one really worried too much if raising VC capital at a $50m, $100m, or even a $1B valuation limited your exit options. Really, we all stopped talking about it, for the most part.

Fast forward to today, the IPO markets are shut, and VC rounds for the most part are frozen at the Series B and later levels.

It brings back an age old question we stopped asking too much in 2021: Does Raising Venture Capital Limit Your Exit Options?

VCs are expecting a positive return on their investment. They dream for 100x their money, hope for at least 10x their money, are OK with 5x, and will settle for 2x-3x. And even 1x, if the company fails or deeply struggles.

So if you raise money at say a $50m valuation, and want to sell for $40m … yes, that’s a problem.

But …

Three things.

#1. If the exit price is at least 2x-3x the total amount raised, it can be worked out.

It may be messy and painful. No one may make a ton of money, especially employees (unfortunately). But there is usually enough to find a way to work it out if you want to sell for at least 2x-3x the amount you’ve raised. If you raise $100m at a $500m valuation, and sell for that same $500m, the terms can be restructured, they may even have to be. Same if you sell for $50m after raising $10m? Not a great exit, but everyone still makes money. But selling for $50m ... after raising $50m? Beyond painful.

#2. Make sure you are committed to an exit of at least 2x-3x the valuation of the last round. Be serious and intentional here.

Way too many founders treated this all as a game in the Boom Times. Raise at $100m! Be a unicorn! Hooray! But if you’re a unicorn, you’re making an insane commitment. That’s to being worth at least $2B-$3B, and ideally, $10B. Very, very few are or really will be. Thoughtful founders leveraged these times, but many of the rest are trapped in the commitment they made.

#3. More importantly, be careful about raising VC money if you don’t need it or can’t deploy it very effectively. Venture fundraising should not be done because it can be done. This is the mistake so many founders made in the Boom Times of late ’20-early ’22. You should only raise Venture Capital if you have to, or it’s “cheap”.

If you need VC $tosurvive,don′tworryaboutit.Itiswhatitis.IneededVC$ to get both my start-ups off the ground. So — why worry? And take VC $$$ if you can deploy it truly effectively.

But don’t take VC money just because you can. >> That’s the real trap <<. So many fell into this trap in the Boom Times.

And especially, don’t take too much if you don’t know what to do with it. It’s very, very expensive capital.

You don’t give up all your exit options when you raise VC.

But you have to commit to selling for much more than the last round valuation.

At least take a pause and think more about that in today’s world. When even many of the best in SaaS aren’t even worth $1B anymore.

Rockstar female founders

Wanted to give a shout-out to everyone mentioned on Gesa Miczaika from Auxxo’s post from this week. Keep rocking ✊

We need more role models for female founders - especially for the future generations! To contribute, I assembled a list of German female founders with exits below (four of them are also in the photo). Please feel free to add anyone you can think of in the comments. A big Congratulations and Thank you to the great women mentioned below!!!

- HelloBody with Monique Hoell

- ctrl QS with Mirja Silverman

- Erdbär with Natacha Neumann

- Contentserv with Patricia Kastner

- Amorelie with Lea-Sophie Cramer

- Parity Technologies with Jutta Steiner

- Honeypot with Emma Tracey

- Parlamind with Tina Kluewer

- Teleclinic with Katharina Juenger

- Fox&Sheep with Verena Pausder

- Saxonia Systems with Viola Klein

- Planetly with Anna Alex

- Ratepay with Miriam Wohlfarth

- Ankerkraut with Anne Lemcke

- Premium Group with Anita Tillmann

- PlusDental with Eva-Maria Meijnen

- Eyeota with Kristina Prokop

- M.Asam with Mirjam Asam

- Digidip with Sabrina Spielberger

- Cluno with Christina Maria Polleti

- KptnCook with Eva Hoefer

- Makerist with Amber Riedl

- nebenan.de with Ina Remmers

- LemonCat with Doreen Huber

- Biontech with Özlem Türeci

- Rigontec with Annegret de Baey-Diepolder

- Corrux with Laura Tönnies

- Tandemploy with Jana Tepe and Anna Kaiser

- Mrs. Sporty with Valerie B.

- Kitchen Stories with Mengting Bönsch (Gao) and Verena Hubertz

- Nui Cosmetics with Swantje van Uehm

- Bears with Benefits with Marlena Hien

Let's celebrate the achievements of these women together!

Ex-operators launching VC firms & FOs

While on the lists of people to know, Sifted put out a list of ex-operators launching their own FOs and VC firms. Check ‘em out below and if you’re an LP, pay attention to the VC firms as some of them are currently raising.

Prima Materia, set up by Daniel Ek, the founder of Spotify. It has invested in AI defence company Helsing, Ek's own startup Neko Health, and two VC funds.

Pink Capital and Starstrike Ventures, set up by Lea-Sophie Cramer, the exited founder of online sex shop Amorelie. They have invested in several startups, including Catchys, Eve, and iPrice.

Illusian, a family office set up by Ilkka Paananen, the cofounder and CEO of Supercell. Its portfolio includes Wolt, Hopin, and Swappie.

Yellow Fund, a VC firm announced by Oscar Pierre, the cofounder of Glovo. Its website was taken down after the article on the fund was published.

Interface, a new venture capital firm founded by Christian Reber, the founder of Pitch, Superlist, and Wunderlist, and Niklas Jansen, the cofounder of Blinkist. It invests in pre-seed and seed-stage startups working on B2B software, AI, and deeptech, and has already made 12 investments.

Zinal Growth, a family office set up by Guillaume Pousaz, the founder of Checkout.com. Its investments include Wayflyer, Yokoy, Pledge, and Pachama.

Diamond Hands Ventures, an evergreen investment company set up by the cofounders of Austrian crypto exchange Bitpanda. It invests in blockchain and crypto startups and has invested in Tatum, Copper, and Payable.

This week’s funds 💵

Section powered by Cathy White.

UK-based Amadeus Capital Partners and Austria’s APEX Ventures launched the Amadeus APEX Technology Fund. The collaborative fund will see €80M invested into early-stage deep tech startups, predominantly in the DACH region. You might remember that in recent weeks we’ve seen the German and French governments announce funds and pledges to invest in Deep Tech and other new VC funds have emerged - suggesting Deep Tech is one to watch this year.

As is Climate Tech…Contrarian Ventures, a European climate tech fund secured €25M from the European Investment Fund as part of a €100M target fund it is raising.

Speedinvest launched a €3M fund of funds programme to back emerging managers. 50 % of the programme will be invested into funds led by women and other diverse GPs. The fund of funds is being led by Deepali Nangia. Speedinvest also welcomed Sameer Singh founder of breadcrumb.vc, and an Atomico Angel, as Venture Partner to its Marketplaces & Consumer team!

Other fund announcements

🇱🇺 European Tech Champions Initiative by 5 EU Members & European Investment Bank (EIB) - €10b, late-stage, fund-of-fund - Luxembourg

🇫🇷 Partech - €245m, fund 2, 🌍 Africa, first close - Paris

🇩🇪 Planet A Ventures - €160m, fund 1, final close, impact - Berlin

🇸🇪 Monterro - €150m, fund 5, 🌍 Nordics, B2B-SaaS - Stockholm

🇬🇧 Counteract - £35m, fund 1, decarbonization, first close - London

🇬🇧 Ocean 14 Capital- £26.6m, blue economy - London

🇸🇦 Flat6Labs - SAR 70m, seed - Riyadh

This week’s hires 👩💼

Section powered by the InnovatorsRoom.

EUVC is hiring a junior to midlevel IR. Hit up David to apply 💌

Analyst for Underline Ventures 🕵️

Our good friend Bogdan is hiring a killer analyst to join his new firm Underline Ventures 👇

What is Underline Ventures?

Underline Ventures is a venture capital seed fund that partners at the earliest stages with Eastern European founders building high-growth startups with global ambitions.

We help founders define the right strategy, milestones, and priorities in their company's journey from seed to series A, and support them in connecting with capital and talent, under their terms.

We're a newly launched fund with the spirit of a startup run by professionals with deep roots and experience in the Eastern European technology and venture landscape. We launched Underline Venture in the spring of 2022, but we have been investing, and building startup programs or companies for over a decade. We are still at the beginning of our journey and have many more things to build together.

What will you do?

As an investment analyst, you’ll connect with some of the most exciting Eastern European startups and help us identify the ones which match our investment criteria. You’ll also support the decision-making and investment processes, and the startups in the fund’s portfolio.

Your main responsibilities will include:

You will be the first point of contact for many of the startups reaching us – you will interview founders for an initial evaluation of their proposals and present the most relevant of them to the partners

You will be supporting the decision-making process with research and analysis on a particular sector, technology, or business

You will be supporting the investment administrative process, by creating the relevant documentation or presentations

You will support the reporting process by developing presentations and reporting materials

You will provide support to the companies in our portfolio by connecting them to the relevant partners, venture partners, EiRs in our team, and larger operator/experts network

Together we can build the best sourcing and screening processes, using networks, critical thinking, and technology, and in time you can evolve toward a more senior investment role.

Who are you?

We are excited to work with hard-working, technology-interested, ambitious people who are ready for a deeply meaningful job. We appreciate intellectual curiosity and raw initiative, and we’re looking for pirates rather than marines.

You have:

A proactive problem-solving mentality, can think independently and take initiative

Great people skills, and are able to connect directly with founders and build trust from the first interaction

Great attention to detail, are happy to research different topics and work in spreadsheets

A deep interest in the startup and business of technology space, and you’ve maybe already started or worked in a startup

A good understanding of how startups and venture capital works

Previous first-hand experience working with or supporting founders is a plus, along with founder experience.

Reach out to Bogdan if you’re the one.

Other jobs in European VC

🇬🇧 Octopus Ventures - VC Analyst B2B Software - London innvtrs.com/3YCX3HJ

💻 Horizan VC - Partner - Online innvtrs.com/3E3C8FK

🇬🇧 4BIO Capital - VC Analyst - London innvtrs.com/3Yzml9V

🇨🇭 eBay - Senior Associate - Bern, Geneva, Zurich innvtrs.com/3lCSDSu

🇬🇧 Laser Digital - Principal - London innvtrs.com/3YzVuKQ

🇩🇪 SumUp - Chief of Staff - Berlin innvtrs.com/3S1qwsB

🇬🇧 Cell Capital - VC Analyst / Associate - London innvtrs.com/3YQ7dox

🇩🇪 Bertelsmann SE & Co. KGaA - Chief of Staff - Bielefeld innvtrs.com/3Ed58uv

🇩🇪 FoodLabs - Venture Building Associate - Berlin innvtrs.com/3YzNMjF

💻 First Momentum Ventures - VC Analyst - Online innvtrs.com/40WNo0l

🇩🇪 Next Big Thing AG - Chief of Staff - Berlin innvtrs.com/3XwjrRT

Thx for reading and being awesome 💗 we love you for it.

Thank you for the feature! Glad it's insightful.