EUVC newsletter - 28.04.2025

Announcing the EUVC Awards Newcomer Finalists, Spotlighting Europe’s Emerging Managers, Deep Diving into the Fundamentals of VC Fund Building, and Strengthening the Bridges Across Europe.

Welcome to this week's EUVC newsletter! David and Andreas here—with big news: The finalists for our EUVC Newcomer Award have been revealed! And we’ve got more awards news as we spotlight Reece Chowdhry from Concept Ventures, a standout finalist in our Emerging Manager category.

We built the EUVC Awards to elevate Europe's VC ecosystem, bringing international attention to our region's boldest innovators. At this year’s EUVC Summit, top media outlets including CNBC, Bloomberg, Financial Times, Forbes, and Sifted will join us to share important messages from industry leaders and celebrate our winners. We're incredibly proud of this milestone—thanks to everyone who helped make it possible.

We also explore corporate venture capital's vital role in our ecosystem through an engaging conversation with Marika King from PINC, the CVC arm of Paulig, discussing purpose-driven investment strategies.

On the practical side, we've got an essential discussion with Karma Samdup and Vicki Odette from Haynes Boone covering critical fund management topics, including fund structuring, LP negotiations, compensation strategies, and partner transitions.

Continuing our popular fund modeling series, focusing this week on assumption sheets, portfolio construction, and decomposition.

And be sure to sign up for our upcoming LP AMA with James Heath—expect bold, unfiltered insights on LP strategy and the specialist investment landscape.

Enjoy this edition!

With 💝 David and Andreas

Table of Contents

🏆 The wait is over — meet the EUVC Awards Newcomer Finalists!

🎧 Podcasts of The Week

VC: Concept Ventures’ Reece Chowdhry on reimagining Europe’s pre-seed landscape with lead investments

VC: This Week in European Tech with Dan Bowyer, Mads Jensen, and Andrew J. Scott

✍️ Insights Articles of The Week

🏆 The wait is over — meet the EUVC Awards Newcomer Finalists!

Backed by top-tier LPs and bold visions, these funds are proving their theses one deal at a time. 👉 Hit play for the big reveal of the 4 finalists! 👀

Who should win? 🔥

Check out the criteria below, then let us know your pick!

This award celebrates funds that had their first close within the past year and quickly gained momentum. We're spotlighting bold newcomers bringing fresh ideas and real traction to Europe's venture scene—right from day one.

The winner will be announced live at the EUVC Summit & Awards Show on May 14 in London. Sponsored by HSBC Innovation Banking — the bank made for the innovation economy.

🎧 Podcasts of The Week

🎙 Finalist Spotlight: Concept Ventures’ Reece Chowdhry on reimagining Europe’s pre-seed landscape with bold lead investments

In this episode, Andreas Munk Holm talks with Reece Chowdhry, Founding Partner of Concept Ventures and a finalist in the Emerging Manager of the Year category sponsored by Fundcraft.

Reece shares his journey into early-stage investing and how his approach to pre-seed funding—writing big lead checks when others hesitate—helps build trust and momentum with founders from day one.

Here’s what’s covered:

03:17 Reece's Early Investment Journey

06:35 Building Concept Ventures: Challenges and Successes

17:33 The UK Pre-Seed Ecosystem and Future Plans

23:38 Collaborative Investment Strategies

24:29 The Importance of Founders in Pre-Seed Investing

26:10 Father-Son Partnership Dynamics

28:52 Public Markets Insight in Venture Capital

Reece will also take the stage live at the EUVC Summit & Awards Show in London, where we'll celebrate the finalists and winners.

The Emerging Manager of the Year award recognizes the most promising fund managers building from Fund I to Fund III — a celebration of strong financial performance, innovation, ecosystem impact, transparency, team culture, and bold leadership.

Cocoa's Carmen Alfonso Rico & Integra GA's Evan Finkel on How LPs Build Conviction When Evaluating Emerging Managers

In this episode of the EUVC podcast, Andreas talks with Carmen Alfonso Rico, a self-described VC turned angel at Cocoa Ventures, and Evan Finkel, Head of Venture Capital Investments at Integra Global Advisors.

Evan outlines a framework for how LP expectations evolve across different fund stages, highlighting key criteria like thesis clarity, team credibility, track record, and consistency of execution. Carmen shares her experience raising Cocoa Fund I during a peak market and the challenges of navigating a very different environment for Fund II. Together, they explore practical strategies for targeting the right LPs, understanding different LP profiles, and managing long-term relationships.

Here’s what’s covered:

11:36 Challenges in the European LP Ecosystem

29:51 Long-term Commitment and Strategy

38:46 Evaluating the Product: Key Considerations

39:54 Importance of Historical Track Record

41:22 Decision-Making Process in Investments

54:14 The Role of LPs in Fund Management

01:02:15 Challenges of Being a Fund Manager

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

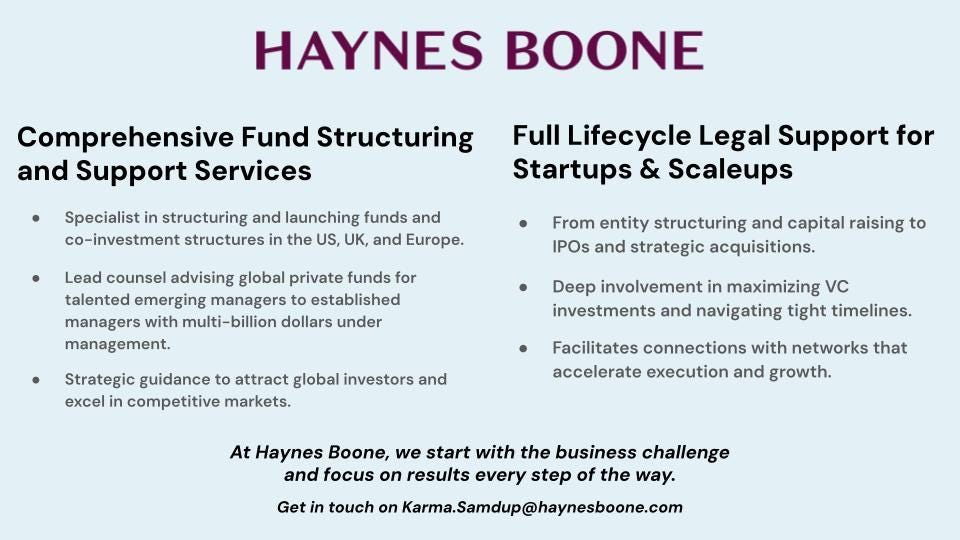

Haynes Boone’s Karma Samdup & Vicki Odette on Fund structuring, LP negotiations, compensation strategies, departing partners, and much more.

In this episode, Andreas Munk Holm talks with Karma Samdup, Head of Private Funds and Venture in Europe in Haynes Boone's London office, and Vicki Odette, Partner in Dallas and New York, at Haynes Boone.

Drawing on their experience advising fund managers and limited partners, they discuss the legal considerations in launching and managing venture capital funds. They also provide a detailed overview of key issues, including fund structuring, regulatory compliance, cornerstone LP dynamics, GP commitments, default provisions, and expense policies. They also provide practical guidance on compensation models for key employees, utilizing side letters, and negotiating with various types of investors.

Here’s what’s covered:

03:59 The Importance of Legal Expertise in Fund Management

10:58 Key Legal Considerations for Fund Managers

26:31 Navigating LP Negotiations

35:57 Effective Communication with LPs

40:48 Compensation Strategies for Key Employees

45:00 Hiring from Competitors: Best Practices

47:11 Protecting Your Firm from Departing Employees

We’re proud to welcome back Haynes Boone as the official sponsor of the Firm of the Year category at the EUVC Awards.

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

Marika King (Head of PINC – Paulig’s CVC) on How Purpose-Driven CVCs Drive Early-Stage Innovation and Corporate Synergy

In this episode of our CVC series, Andreas Munk Holm and our CVC in-house expert, Jeppe Høier, talk with Marika King, Head of PINC, the corporate venture arm of Paulig.

Marika shares how PINC was born to accelerate core innovation and deliver long-term impact across health, sustainability, and food security. She explains why PINC goes earlier than most CVCs and how they leverage Paulig’s R&D and cultural DNA to validate, support, and scale startups. Marika also offers candid reflections on governance structures, founder dynamics, and how her journey through burnout shaped her values as an investor.

Here’s what’s covered:

03:10 Early Stage Investments and Validation

16:54 Governance and Structure of PINC Ventures

24:00 Lessons in Structuring a Corporate Venture Fund

26:34 Understanding the Role of a CVC

27:03 Misconceptions About CVCs

28:49 Flexibility and Patience in CVC Investments

31:29 The Importance of Founder-Friendly Approaches

37:10 Marika's Journey into Venture Capit

This Week in European Tech with Dan Bowyer, Mads Jensen, and Andrew J. Scott

Welcome to a new episode of the EUVC podcast, where our good friends Dan Bowyer and Mads Jensen from SuperSeed in a discussion with Andrew J. Scott, Founding Partner at 7percent Ventures, cover recent news and movements in the European tech landscape 💬

Here’s what’s covered:

03:05 AI and Autonomous Driving Innovations

07:18 European Investment Trends

12:01 Breakthroughs in Food Tech

17:31 Environmental Impact of Meat Production

18:50 Challenges and Future of Lab-Grown Meat

20:44 OpenAI's Ambitious Acquisitions and Antitrust Issues

29:07 Exciting Deals and Events in Tech

LP AMA with James Heath — In Search of Depth: Reflecting on Specialisation in Europe’s VC Landscape

Across Europe, more GPs are choosing focus over scale - building specialist funds with domain conviction in climate, deep tech, or fintech. But is specialisation a real edge, or just another cycle of VC positioning?

In last week’s piece, we unpacked:

– What the performance data actually says

– Why LPs are warming to (but still cautious about) niche plays

– What founders want—and when deep expertise helps or hurts

📆 And on May 19, we’re bringing in LP James Heath (dara5) for a members-only AMA.

James recently published “Why Specialists Will Win the Next Decade of Venture”—and we’ll be digging deeper with him live.

You’ll want to be in the room for this.

Not yet a member? Join here

✍️ Insights from the trenches

The essential building blocks of a VC fund model - Part 2

by David Cruz e Silva, an operator turned angel LP and founder of eu.vc, and Marc Penkala, General Partner at āltitude

In this second part of our fund modeling article series, David and Marc go deeper into the three most critical building blocks: Assumption Sheet, Portfolio Construction, and Portfolio Decomposition. If you think modeling a VC fund is about plugging numbers into a spreadsheet, think again.

Key takeaways:

🧠 The Assumption Sheet: the logic engine behind your fund — not just what you assume, but why

📊 Model every scenario: with or without follow-ons, with or without Power Law — flexibility is king

🏗️ Portfolio Construction: build your timeline from teaser checks to follow-ons, and match capital deployment with real strategy

🔍 Decomposition: simulate every startup’s journey — winner, write-off, or flatline? Map it all out and layer in KPIs like NAV, IRR, TVPI & MOIC

🛠️ Build a flexible model: real-world portfolios never move in a straight line — your spreadsheet shouldn’t either

Bridging Succession & Innovation: A New Path for SMEs

by SME Tech Leaders

When a startup builder meets an SME successor, sparks fly. In this edition, Bastian Faulhaber shares how his venture and solar startup journey led him to launch a modern search fund, buying and transforming profitable SMEs across Germany. With 1.2M businesses soon to face succession, this is more than a generational shift; it’s a once-in-a-generation opportunity.

Key takeaways:

🔁 Buying an SME can be a smarter path than starting from scratch — and far less risky than chasing the next VC round

🛠️ Gen AI is reshaping sourcing and operations — Bastian’s team uses AI agents to identify, analyze, and approach target companies

💬 “Only 20% of SMEs have a real digital strategy,” and that’s where new owners can unlock real value

🤝 Platforms like DealCircle + proactive outreach = a modern matchmaking engine for SME succession

🧠 Advice for software founders: Speak the SME’s language, and show up with deep respect and domain expertise

📚 Big inspiration: Michael Brehm (Redstone) — proof that drive and generosity can coexist

Defence Tech in Europe: The Time is Now

by Underline Ventures

On the 3rd anniversary of the war in Ukraine, and amid rising geopolitical fractures, Europe faces a defining moment: rebuild its defence capacity, or fall behind. In this must-read piece, Bogdan Iordache outlines why defence tech in Europe isn’t just back, it’s critical.

From drones to digital warfare, from prime contractors to hyper-specialised innovators, a new generation of defence tech founders is emerging. And they’re not waiting for permission.

Key takeaways:

📈 $5.2B raised in defence tech across Europe in 2024 — 5x growth in six years

🌍 NIF-backed startups are scaling — without U.S. capital, driven by EU urgency

💥 A new NATO spending wave? A 1% GDP bump = $200B more in annual EU defence budgets

🧱 Defence fragmentation across 27 MoDs remains Europe’s biggest barrier to scale

🤖 AI, autonomy, and smart manufacturing are reshaping modern warfare tech stacks

🔁 The opportunity? Modernise defence AND reinvigorate Europe’s industrial base

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list. Hit us up if you’re going; we’d love to meet!

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany

Would love to chat if keen? The coin presale is now open, round 1 of capital raise discounted until 30 June 2025🌱: all details, presentation video, AI chatbox and investment link in this post: https://www.linkedin.com/posts/fairgradeforests_safeguarding-forests-through-private-blockchain-activity-7318778906965131265-s34E

Some info about what we do including open source: Fair Grade Forests: Safeguarding forests thru private blockchain. Agroforestry, Carbon Credit. Papua New Guinea Owned, Open Source (https://github.com/fairgradeforests) 2025 is Fair Grade Forests' 10th birthday!