The pivotal role of fund accounting: risks, compliance, and strategic necessities

by Matias Collan, CEO of ACE Alternatives.

Guest post by Matias Collan, CEO of ACE Alternatives.

The pivotal role of fund accounting: risks, compliance, and strategic necessities

Consider the scenario, ABC Fund with a strong portfolio of AI and deeptech companies begins preparing for their next fundraise. Their existing portfolio companies are performing well. Yet as institutional investors conduct their due diligence, concerns emerge, not about the fund's investment thesis or returns, but about their accounting infrastructure. Inconsistencies in NAV calculations, unclear expense allocations, and improperly classified financial instruments raise red flags. What should have been a straightforward path to Fund II becomes an increasingly complex challenge, revealing how accounting oversight can undermine even the strongest investment track record.

This scenario illuminates a critical truth: the foundation of venture capital success often lies not in deal-making prowess, but in the precise machinery of fund accounting that operates behind the scenes.

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

The trust equation in Venture Capital

Venture capital operates on a foundation of trust. Limited partners entrust fund managers with billions of dollars to identify and nurture breakthrough companies. This trust, however, rests on a complex infrastructure of precise financial reporting, accurate valuations, and transparent operations, all enabled by robust fund accounting and tax reporting.

The stakes have never been higher.

As venture capital has evolved from simple equity investments to complex financial instruments like SAFE notes and convertible securities, the accounting infrastructure supporting these investments must evolve in parallel. Yet many funds continue to treat accounting as a mere back-office function, a perspective that can prove catastrophic.

The cascade effect

Consider the case of ABC Fund that discovered their SAFE notes had been misclassified under local accounting standards. What began as a technical oversight cascaded into a series of complications.

First came the regulatory scrutiny. The SEC and local authorities launched investigations, resulting in substantial fines. Then emerged the investor lawsuits over NAV calculations, followed by media coverage that questioned the fund's operational competence. Finally, and most damagingly, institutional investors began withdrawing from discussions about the fund's next vehicle.

The cost of these failures extends far beyond immediate financial penalties. The real damage occurs in three critical dimensions:

Regulatory consequences

Regulatory agencies in Germany maintain rigorous oversight through strict compliance requirements, with non-compliance triggering a perfect storm of consequences. BaFin audits over AML compliance, Bundesbank investigations following failed or incoherent monthly reports, and BZSt investigations due to failed FATCA or CRR filings can severely impact a fund’s operations. Moreover, failing to meet AML requirements can result in immediate fund freezes, creating operational paralysis.

Legal vulnerability

Fund managers' fiduciary duty to their LPs demands meticulous financial oversight. NAV manipulation accusations, expense allocation disputes, and improper distributions can spark litigation that damages both operations and investor relationships. These legal challenges often emerge at the worst possible moments; during fundraising or key investment periods.

Reputational damage

In venture capital, reputation functions as currency. When LPs lose confidence due to financial inconsistencies, their willingness to reinvest evaporates. This damage becomes particularly acute when seeking institutional capital, as pension funds and endowments conduct extensive due diligence. A history of non-compliance can permanently limit access to these crucial sources of capital.

Building the Foundation Right

The solution lies not in reactive measures but in building robust accounting infrastructure from the start. This includes:

Mastering complex valuations

The valuation of illiquid, privately held startups presents unique challenges. While methods like mark-to-market adjustments and DCF analysis provide frameworks, the key lies in consistent application and documentation of methodologies.

Navigating new financial instruments

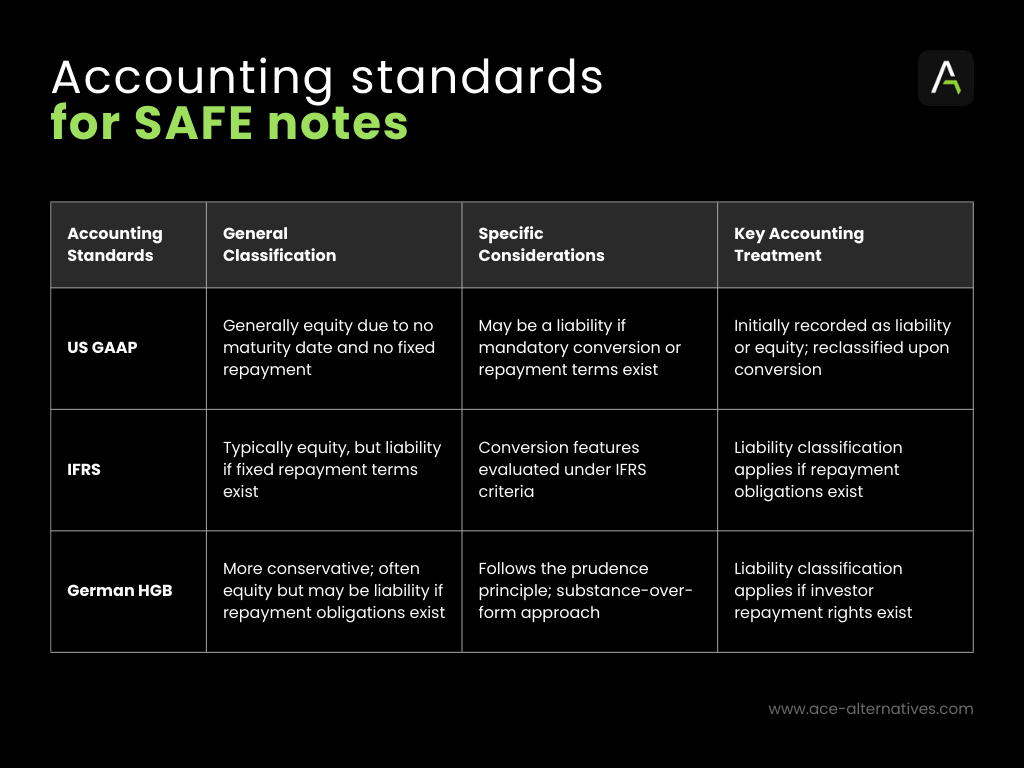

SAFE notes and other modern financing instruments require sophisticated accounting treatment, as their classification varies significantly under US GAAP, IFRS, and German HGB. Misclassification can distort valuations, compliance, and investor transparency. While US GAAP generally treats SAFEs as equity, liability classification may apply if repayment conditions exist. IFRS evaluates conversion features, while German HGB, with its conservative approach, often favors liability classification. Successful funds stay ahead by building adaptable systems that ensure accurate valuation, compliance, and proper disclosure across jurisdictions and accounting standards.

Accounting for Financial Instruments

While SAFE notes have gained traction as a financing tool, VC funds rely on a range of financial instruments to structure deals, manage risk, and optimize returns. Each of these instruments carries distinct accounting implications, which vary across different regulatory frameworks such as US GAAP, IFRS, and German HGB. Misclassifying these assets can distort financial statements, affect NAV calculations, and lead to compliance risks.

The table below provides an overview of how equity instruments, convertible debt, mezzanine debt, and derivatives are accounted for under different standards.

Managing Investor Dynamics

As funds welcome new investors or handle LP transfers, proper rebalancing becomes crucial. This process demands precise NAV calculations, equitable equity reallocation, and careful consideration of tax implications. Funds that excel in this area build stronger relationships with their LPs, creating a foundation for future fundraising success.

Enter the new era: Real-time fund accounting designed by ACE Alternatives.

Rather than relying on end-of period accounting for quarterly or annual reports, today’s GPs, institutional LPs and regulators demand continuous visibility into fund performance.

A real-time accounting system enables seamless tracking of investments, cash flows, and revaluations as new funding rounds occur.

This shift transforms fund operations from static snapshots to a dynamic, continuously updated financial picture, allowing fund managers to identify and resolve potential issues before they escalate.

ACE Alternatives is leading this transition by integrating fund administration with real-time accounting capabilities. As Felix von der Planitz, CEO of ACE TAX Co-CEO of ACE Alternatives, recently highlighted in his article, these systems enable instantaneous NAV calculations, dynamic performance metrics, and enhanced compliance monitoring.

By leveraging advanced accounting technology, fund managers can not only meet regulatory demands but also improve their internal financial monitoring, strengthen LP relationships and improve fundraising outcomes.

The Path Forward

The venture capital industry continues to evolve, with new financial instruments, regulatory requirements, and investor expectations emerging regularly. Funds that thrive in this environment recognize fund accounting not as a necessary task, but as a strategic imperative that enables sustainable growth.

The most successful funds take a proactive approach, often partnering with specialized firms like ACE Alternatives that bring deep expertise and the required tech infrastructure to fund accounting, regulatory compliance and tax reporting. This investment in infrastructure pays dividends through enhanced investor confidence, regulatory compliance, and operational efficiency.

In the end, VC success stories are built not just on identifying promising startups, but on the robust accounting infrastructure that supports these investments. As the industry faces increasing scrutiny and complexity, this hidden foundation becomes more critical than ever to fund survival and success.