Kicking off our efforts to further connect the European VC and Corporate world, we’re talking to our in-house CVC expert and friend Jeppe Høier, uncovering his biggest learnings in CVC, how he thinks about corporates as LPs and the key trends he thinks will impact the industry going forward.

Jeppe Høier is a long-time corporate venturing specialist and former partner at Maersk Growth with more than 80 MUSD invested for a multiple of 3.6x with massive breakout Einride and Forto in the portfolio.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.

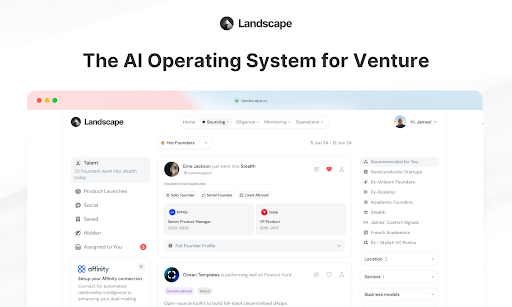

Landscape helps VCs to discover startups earlier than anyone else. They work with leading global venture funds to help unlock full market visibility and discover high-quality founders using the market's widest array of alternative data sources. Investors Seamlessly triage top-of-the-funnel deal flow and automate otherwise manual tasks. Request a free trial to become a data driven VC!

✍️ Guest’s show notes

We believe in giving you our guests' thinking directly and unaltered. Therefore, no changes, no AI, no nothing has been done to the following sections.

The person behind

After 9 years as CFO at Heartcore Capital I wanted to try myself out as an investor and joined Maersk Growth as Investment Partner in 2018. I made 14 invested invested more than USD 80m with a 3.6x multiple.

I’m building an infrastructure fund focusing on balancing the electrical grid as well as talking with Corporates about how they can structure their venture programs to harvest the best from the startup ecosystem. Included in this I’m in close dialogue with business schools about creating an executive masterclass on Corporate Venturing to support the learnings needed to run such a program

Top reasons why you’ve come to love CVC

Through my first decade in VC many of my counterparts had the opinion that CVCs where difficult to work with. They had different decisions structure and where slow on turning around documents etc. This was also why I found it exciting to join Maersk to see if I could help to structure it in a different way.

My 5 years with Maersk taught me differently. I found that when the start-up / Corporate collaboration is structured right then you get massive synergies for Start-ups as well as the Corporate. We supported start-ups with Assets, Brand, Customers, Data and Expertise.

Corporations can really excel the development of start-ups and being an investor making this happening is such a big joy

3 biggest learnings in CVC for VCs engaging with CVCs

Understand weather they are strategic or financial investors and if they do follow on rounds

Understand their decision structures.r. Are they balance sheet investors and how does their decision framework look like.

Understand if they do Fund of Fund investments and under what circumstances.

3 biggest learnings in CVC for Corporates thinking about establishing a CVC (or already running one)

Average life time of a CVC is 3.7 years which indicates that many mistakes are made on the way.

Make sure to create a full Venture Program to understand where you want to engage with the ecosystem. Do you want to invest into other funds to learn, do direct investments, incubation or Corporate Clienting or acceleration

Make sure to create a differentiated workforce. Hire experts that are used to engage with the start-up ecosystem to get easy access.

Corporate LP investing… what’s your take here!?

I’m very pro towards Corporates doing LP investments. This can give them access to geographies where they do not necessarily have people on ground.

It can give the early access to new technologies such as the latest wave in AI.

And for first time CVCs it can give ecosystem access as well as a good understanding of what processes needs to be in place as you build you internal Venture Program.

Trends in CVC in Europe these days.. what are you seeing?

We unfortunately still see a lot of restructuring (close-downs) of CVCs. As markets have been hard in the past couple of years a lot of CVCs have been cost cutting leading to severe layoffs in many CVCs. This is a very early sign that their program was not structured and integrated the right way.

I see a lot of interest in areas such as Sustainability and AI. This is really remarkable and especially a close collaboration in the Sustainability sector is important as Corporate / Start-up collaboration in Climate tech is important to ease FOAK (First of a kind) investments also know as the valley of death. This can be done through LOIs or off take agreements as well as access to expertise that can secure lower rates of failure.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

VC Portfolio Management: Capital Deployment and Reserve Planning

📅 Tue, September 24 | 4:00 PM - 6:00 PM CET | Lecturer: Anubhav Srivastava, Tactyc

Venture Debt: Structuring & Deal Terms

📅 Tue, October 8 | 11:00 AM - 1:00 PM CET | Lecturer: Hemal Fraser-Rawal

Benchmarking Session for GPs & LPs

📅 TBD - preregistration open now | Lecturer: To be announced 🤫

Got ideas or requests for future topics to cover? Let us know here.

📺 Virtual events coming up

Mastering the sell-side of secondaries | 📆 Tue, Sep 3, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This session will delve into the fundamentals of the secondaries market, distinguishing between direct and fund secondaries, and identifying key stakeholders such as employees, founders, LPs, GPs, and intermediaries. Alberto will share his sophisticated buyer process, including his quantitative scorecard approach and detailed due diligence. Learn how to prepare assets for sale, understand valuation techniques, navigate legal and regulatory considerations, and stay ahead of market trends.

Investing and scaling in Portugal and beyond | 📆 Wed, Sep 4, 2024, 3:00 PM - 4:00 PM (CET) | Register here

Delve into key topics such as navigating the Portuguese investment landscape, empowering women-led startups, and scaling businesses beyond borders with global best practices. Learn about pioneering innovation in tech companies and be inspired by real-life success stories of Portuguese scale-ups. Engage directly with industry leaders, gain cutting-edge strategies, and understand how global trends intersect with local opportunities.

GP Roundtable: Leveraging AI in Portfolio Monitoring & Management | 📆 Mon, Sep 9, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This roundtable is a must for GPs looking to get an edge using AI. By tapping into AI-driven analytics and predictive modeling, VCs can unlock hidden trends and streamline their operations. Plus, tackling early risk assessment can save portfolios from tanking 💥. It's about staying ahead in a cutthroat world.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

Nordic LP Forum & TechBBQ | 📆 11 - 12 September | 🌍 Copenhagen, Denmark

How to Web | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 October | 🌍 Dubai, UAE

Invest in Bravery | 📆 21th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany