Good morning! On today’s agenda, we have a new packed newsletter for you that includes:

Looking for more insights? Here are some great articles and news from the venture community that you should check out.

Before we dive into the podcast, you might want to check out our next masterclass session on VC Fund Performance Benchmarking. Last seats available! 🔥

Benchmarking is more than just numbers - it’s a critical tool for GPs and LPs to measure performance, position funds effectively, and align with market expectations.

Join us for this 2-hour masterclass designed to demystify VC benchmarking and provide actionable insights to navigate key metrics like IRR, TVPI, DPI and PME.

Led by Joe Schorge, Managing Partner of Isomer Capital, this session will help you understand how LPs think, how benchmarks are created and - most importantly - how to use them to evaluate performance, communicate results, and position your fund confidently in the market.

InMotion Ventures' Mike Smeed on aligning corporate venture capital with strategic transformation

In this episode of the EU CVC podcast, Andreas and Jeppe, our in-house CVC expert talks with Mike Smeed, Managing Director at InMotion Ventures, the corporate venture capital arm of JLR (Jaguar Land Rover).

InMotion Ventures is one of the most active corporate investors in the UK, with a global presence from the UK, Bay Area, and Tel Aviv. The team focuses on Seed to Series A investments, with typical cheque sizes ranging from $250K to $2M, and has the flexibility to participate in Series B rounds when there’s strong strategic alignment with JLR.

Mike and his team back exceptional startups in climate, industrial, and enterprise technologies. Today, we’ll explore how InMotion Ventures leverages venture investing to accelerate innovation, the unique opportunities within their focus geographies — UK/Western Europe, North America, and Israel — and the role of corporate venture capital in driving impactful solutions.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.

Work with the communications experts for European tech and venture.

CEW Communications is your storytelling partner. Our creative experts work closely with you to get your message seen and heard by the right audience. Start telling your story, today. Use “WeLoveEUVC” to save 10% on fees in January.

✍️ Show notes

Mike’s favorite project at InMotion and why?

The reset… on returning from an assignment in China I was asked to lead InMotion Ventures’ reset, closely aligning the corporate venturing unit to the new strategy for JLR (Reimagine).

As we’ve seen in other CVC units, they wanted an insider to lead the fund and maximise the links with the parent company

There’s nothing we havent touched in the last 2 years. Our thesis, our relationship with our portfolio, our platform, we’ve moved office location, new website, branding, relationship with JLR…

We have made 23 investments (including 11 new portfolio companies) since that period and are now one of the most active corporate investors in the UK, and the second most active climate tech OEM investor in Europe

Principles of InMotion

In our reset we spent as much time on what type of investor we wanted to be, as we did on the type of investments we wanted to make.

We are strategically focussed in the areas we look to invest, but each investment decision is based its financial merits.

Its important to us as a small fund, that we brought our personalities to InMotion Ventures, figured out what we wanted to be famous for, and the value we feel we can bring.

As a corporate investor our USP is clear: our ability to support startups in their development through links to JLR, and the wider Tata Group. That is the one thing we can do that no other investor in the world can - whilst we don’t guarantee this, 90% of our active portfolio are engaged with JLR in some way. In a sector where everyone is claiming to add value, this data point is one we’re particularly proud of.

We also have strong networks in both the automotive, and more general CVC & VC ecosystems in which we operate. In fact, we invest alongside JLR’s competitors on a regular basis. This can be helpful in supporting future raises.

We also wanted to focus on early stage investing, unlike many CVC’s our bell curve is in Seed to Series A. This is both for pragmatic & philosophical reasons (e.g. we don’t write the biggest cheques & corporate resistance to startups lower at early stage.

We also knew that we needed a decision making framework and governance that satisfied our parent in a heavily regulated industry whilst allowing us the agility and speed that’s required to compete for the best deals.

Example. How one of these principles drove a successful initiative?

Going to pick 2 - our value add & network. We have recently been invited to join two hugely exciting deals that would not have been possible before our reset.

1. One from a number of investors who recommended us as a strong member of the cap table in a deal that had already closed. Being invited to co-invest alongside Tier 1 funds after a round has closed is a signal that we’re doing something right.

2. In another deal we joined a round following our outreach, but in depth due diligence on us by the founder. They validated our claims with the market, and heard that we walk the walk. Having others validate you is an a true marker for success.

Challenges in implementation & how Mike overcome them?

Momentum is everything in VC. Being an active investor, who delivers against its reverse pitch is crucial, to our parent, founders and fellow investors. This is a relatively small world and people talk. Getting started was key - we made some great investments early on and have 3X’d the number of portfolio companies engaged with JLR.

Three learnings from Mike’s journey at InMotion.

1. Know why you’re there.

2. Over communicate - CVC is not well understood in the UK & Europe

3. This is the best job i have ever had.

A turning point. A specific moment that encapsulates your learnings journey.

About 12 months in, there was a light bulb moment… We were bringing investments to the table that were further from the parent company's core. A colleague at JLR said, “if they’re that good, why would they want to take money from us….” this showed us the progress we’d made, sometimes it’s hard to see it when you live it every day.

Deep Dive on CVC Model

How the CVC model operates at InMotion?

IMV is a wholly owned subsidiary of JLR, an off-balance sheet evergreen fund.

3 board directors with DOA to approve up to an agreed annual capital deployment

Investment thesis focused on the Climate, Industrial & Enterprise technologies that are critical to JLR’s strategic transformation; in the UK. Western Europe, Silicon Valley & Israel.

Early Stage investor, Seed to Series A, although model permits later stage investments (can invest alongside a business unit).

We work with BU’s on technical diligence and confirmation of strategic roadmap – but do not require a contract in place, there is no guarantee of working with JLR (has to stand up in its own right in terms of price and performance) – but if we do our job correctly you’d hope to see a collaboration between the companies.

Spent as much time on what type of investors we want to be, as well as what type of investments we want to make….

Value in introductions to JLR (& Tata Group), our network in UK, and territories we operate, first OEM/Enterprise investor.

Brought learnings from VC in decision making speed, have processes in place with Investment Panel/Committees to support decisions.

Metrics and examples that highlight the success of the CVC model.

90% of our active portfolio are engaged with JLR in some way – 1/3rd have either a contractual relationship (customer/supplier) or in a stage of the procurement process (RFI/P/Q).

We’ve brought adjacencies to Automotive – Verax, Beyond Math….

CVC & active investing is the gateway to the startup ecosystem – get access to much more to support the venture clienting spaces (much often more close to the core).

Investments and Jaguar Land Rover Fit

Examples of recent investments and explain how they strategically align with Jaguar Land Rover's goals.

Ev.Energy; Cesium Astro; Beyond Math, Chipflow; Verax.

Achievments from these investments that show their impact.

Access to unique & entrepreneurial talent: speed to market ; cost efficiency & risk sharing compared to the parent doing it themselves.

Co-development opportunities: JLR able to shape early-stage products in a way that actively impacts their goals, without demanding exclusivity.

Relationship with startup: acting as the translator between two very different types of entity – moving at different speeds, talking a very different language (therapist).

Cultural change: some leaders running towards us (others running away!).

Drivers of success

Internal and external drivers that contribute to InMotion success.

We exist to invest in exceptional startups to increase the pace of innovation and the delivery of JLR’s strategic transformation.

We have an agreed financial metric for “fair returns”.

Success judged on impact we are having on the parent co: through startups we invest in, their progress within JLR (as well as the wider Tata Group) and those we introduce to the company.

Also providing insight into the startup ecosystem, eyes and ears into developing technologies, ajacancies etc.

Also judged on impact we are having on the portfolio: how has our investment allowed them to scale: access new markets (automotive), validated their products with SMEs, helped raise future funds through association with leading OEM.

A success factor that surprised you and contributed significantly to InMotion's achievements.

VC/CVC is not very well known in the UK vs. the US. Whilst 7 out of the Top 10 listed companies in the US were VC/CVC backed, that’s 0 in the UK – been surprised by the way people in the parent company have come towards us.

Collaboration with Jaguar Land Rover

How inMotion’s work directly benefited Jaguar Land Rover?

Chipflow – semi-conductor crisis, bespoke chips at relatively low volumes. Was something that JLR “might” want to look at in a few years. We made the investment and within 6 months had designed a custom chip (would normally have taken X years and $X millions), now looking forward to doing this to the next step and producing it.

Back to the timescales – being an investor keeps JLR at front of mind, in a heavily regulated industry, things take time, startups more likely to be patient with an investor rather than a “normal” customer.

Verax AI: As part of JLR’s Generative AI strategy the business is implementing safeguards to make AI ethical, secure and risk-managed. Met Leo and immediately recognised the impact they could have on JLR’s ability to leverage Gen AI in a responsible way, but also understood the huge potential financial upside of investing. Became first strategic investor on the cap table in a matter of weeks, followed on in seed a few months later. JLR and Verax now collaborating as design partners on the startup’s first product, the Verax’s Control Centre, with the JLR data team shaping the Verax product so it is built in a way that directly gives them the visibility and control they need.

Portfolio companies whose growth particularly stands out, especially in terms of synergy with Jaguar Land Rover.

Bumper: regularly award winning, amazing business model, expanding within JLR dealerships.

Zeelo: met through a seed programme we were running in 2016. Impressed by their ability to leverage AI to accurately predict demand and identify routes. Gave them office space, invested again at Series A and Series B. Following extensive R&D and product development our team connected Zeelo with JLR’s property team. Zeelo began offering commuter services to the 5,000 JLR employees commuting to and from the Gaydon HQ in 2018. InMotion Ventures was the first corporate investor on the cap table, and in 2018 JLR became the startup’s first enterprise customer. Today JLR is one of Zeelo’s largest customers, last year experimented with EVs, and now we’re exploring rolling out the service to other sites in the midlands. Today Zeelo is global leader in transportation services, half a million rides per month, on the Financial Times FT 1000 list and recently launched in USA.

Journey in venture

Early experiences shaped Mike’s career in venture capital.

I have a finacial background, worked in Frankfurt, Geneva, London, Shanghai and New York – so suppose I was destined to be involved in invrstment at some point.

I have found my niche at the periphery of large organisations, rather than in the Core keeping the lights on.

Finance roles mean you are used to having a foot in each camp (BU team and finance team) being punched in the face from both sides.

Also fascinated by creative people – I am not creative in the slightest but always admired them.

A defining moment.

I have them quite regularly now, as our external & internal comms plan is highlighting the value the CVC can bring to new audiences.

A personal challenge of failure & how Mike overcame it.

Our first IC - Dec 2022. 4 investments discussed, 0 approved - and sent packing. Was meant to be the Christmas party day and the team were all sat in a meeting room unsure where to go from there. One of the loneliest days of my professional career. We overcame it through incredible hard work, and we haven’t had one rejected since!

Advice to young people in the industry.

A piece of advice for young people.

This is a relationship business as much as a financial one. see the value in building and nurturing relationships, do what you say you’re going to do and be prepared that 99% of an investment is incredibly boring!

A personal advice that is needed to succed in this field.

Authenticity is critical, this is not a game. Founders are putting everything on the line in support of their vision and treating them with respect and fighting their corner, is our job.

Invest in people you genuinely like: this is a long game, you work with founders for 5, 7, 10 years. You have difficult conversations, often at unsociable hours. In an industry where you can literally choose who you work with, do not underestimate the value of picking decent people. And that goes both ways

An actionable advice to implement right away.

Listen - a lot. There are lots of resources out there on CVC, however your parent will govern how your CVC operates, there is no one model that works.

Give thought to what genuinely interests you, understand when to say no. This is a super competitive industry. It is notoriously difficult to break into. There’s a temptation to jump at the first opportunity. However, as an investor you need to be all in on your thesis. Only join a fund that is investing in something you’re genuinely passionate about, if you don’t, it’s going to be a very taxing job.

Most counterintuitive learning

The most counterintuitive thing learned in corporate venture.

How open and collaborative it is. We are more likely to invest with JLR’s competitors than we are with any other CVC or VC. That is at extreme odds with the corporate attitude to liaising with competitors.

CVC leaders are incredibly generous in terms of time - many have spent time with me, youtube & GCV are incredible resources.

Why was this learning unexpected? How did it change Mike’s perspective on the industry?

Working in a corporate bubble its easy to think that its the centre of the universe - in CVC and VC we know that some of the issues we are trying to solve are beyond the resources of individual funds or companies - it will only be solved by working together.

10 Impact Ideas for 2025

Guest post by Estia Ryan, Principal & Head of Research at Eka Ventures. | Originally published on Eka Ventures Newsletter.

Welcome to the first 2025 edition of our weekly ⭐

We’re bringing you 10(ish) ideas for 2025 across our thesis areas. These range from rumoured IPOs in climate & health, to new price paradigms in direct-air-capture, and finally to AI workers across the largest consumer areas including health & sustainability.

Did we miss a theme? Reply, comment, and/or let us know your thoughts. We’re always keen for a discussion (estia@ekavc.com) 👋

Our hypotheses for 2025 🗞️

Let’s see if we can do better this year compared to last year’s predictions (retro post coming soon…).

Prediction: there are a number of high-profile IPOs across climate & health

This is a pretty consensus prediction. There are many names flying around as being potential candidates for an IPO in 2025. For example, Crunchbase reported that Hinge Health (initially broken by Business Insider last April) could be filing for an early 2025 IPO. We have internal bets on who else might be coming to market, but will be keeping those to ourselves for now 🤐

Theme: global climate policy at a crossroads

A new US president has the potential to re-set the scene for the global climate policy landscape. There are lots of impacts here: what happens to the EU green deal, where does China fit in with its broader climate strategy, and how does the US navigate pre-existing commitments?

Regardless, we are still incredibly excited about investing in our Shared Value thesis, where innovators unlock both impact & financial scale in lockstep. We view these areas as less dependent on policy & regulation, which means they should be sheltered from the broader climate policy landscape.

Prediction: drastic new price set in direct air capture

We anticipate the cost to remove carbon dioxide to get reset in 2025. There are a number of factors at play here: for example, the world’s largest facility for carbon removal is set to open in Texas this year… But we are also excited about many other (stealthier) factors!

Theme: AI agents get big in climate: sustainable supply chain sourcing, energy optimisation… something else?

We’re excited to see new innovations within climate & AI agents. We’ve backed two incredible companies who are on the edges of these markets:

Axle Energy who are decarbonising the grid using residential assets.

Sourceful who are helping brands better source sustainable packaging.

Is there something else we’ve missed? Get in touch 👋

Prediction: green data centers find their ceiling.

AI & the green data center boom as a definite (missed) theme of 2024. There have been many articles about how capex investment into AI seem to be very high relative to the expected value out.

Will OpenAI find a way top optimise compute? We’ve heard of initiatives which can now queue jobs for 24h and find optimal running times to better optimise for energy consumption and and grid loads.. unconfirmed!

Theme: Social shopping gets even bigger

TikTok shop & other social shopping platforms (WhatNot, Tilt) have exploded this year. I joined the craze a few weeks ago and bought my first few items on TikTok shop (supplements were 50% off!). TikTok actually released a pretty in-depth report on its social shopping in August last year - take a read.

There is a nuanced debate here when it comes to sustainability vs. fast fashion. On the one hand, these platforms are great for showcasing vintage & second-hand purchases. On the other hand, they can also fuel massive over-consumption and impulse buying. Let’s look to 2025 to see what the net impact turns out to be.

Prediction: The NHS app gets major updates and 40%+ people log-in in one month

This is a very fresh & unfolding story as there have already been some headlines on this in the BBC as of this weekend (Jan 5th). The NHS app is rumoured to:

Allow patients who need non-emergency elective treatment to choose from a range of providers (inc. private sector).

85% of acute trusts will be able to view their appointments on the NHS app (intended to come into place in March).

For context, 78% of the 18+ population is registered on the NHS app, and 19% are using it on a monthly basis.

Theme: AI health stack proves serious ROI at scale in the UK & US health systems across admin and treatment & delivery

Copy-past from last year… but we think there will be at least 5 “obvious” & “no-brainer” examples of AI helping deliver ROI at scale. We’re really excited about companies within the Eka portfolio here including:

Isla: digital pathway platform leveraging AI to support patients.

Oxcan: enabling curative lung cancer treatment through earlier detection.

Flok: the UK’s first AI physiotherapy clinic.

Theme: New major innovators in consumer health & wellness using AI unlocks across verticals like nutrition, community, or family organisation

We’re currently conducting a very large dive on AI agents within wellness, consumer, and broader health. So far we’ve mapped 40+ solutions across agents, companions, and broader software and believe this will be a key focus into 2025. Building here? Reach out 👋

Prediction: Alcohol alternatives get big (>£100m of revenue) in Europe & UK (probiotics, non-alcoholic, other)

Spacegoods and Xoxo grew really quickly last year. We’ve spoken about a UK/EU drinks champion for a while, but so far no one has reached the scale of Olipop in the US. Is this the year it changes…?

Prediction: GLP-1 either: (1) gets a reality check [and/or] (2) are the future of addiction treatment

We saw some bubblings of GLP-1 controversy last year when a nurse died two weeks after taking Mounjaro. There have been 23 suspected deaths linked to the drugs in the UK since 2019. There may be more examples of unknown risks arising this year…

And/or we may discover GLP-1s have many more benefits than are currently being touted. For example, there have been claims that GLP-1s could be helpful in addiction treatments and mental health conditions.

For now, we will still admire the amount of buzz & hype there seems to be around weight loss treatment..

Bonus: Interesting third-party predictions we loved!

Fred Wilson: “Apple and Google will leverage their existing market power to surpass OpenAI/ChatGPT in consumer AI prompts by the end of 2025.”

Susie Stanford: “Consumers will still feel the pinch on non-discretionary (groceries), but their thirst for experiences will only grow, aided by digital book-ability. If consumer health also gains wallet, I suggest apparel gets squeezed … or down traded (Shein/Temu or vintage)?”

Christoph Janz: “Startups will solve the “last mile problem” of AI”.

The whole Eka team is looking forward to another year meeting & working with incredible founders who are disrupting the hardest societal problems across climate and health.

✍🏽 Week in Impact Articles

Monday: UK Government reassures Ministers of plans to boost energy storage at scale

Tuesday: Your health - which way will AI go in 2025?

Wednesday: NVIDIA accelerates humanoid robotics development

Thursday: NeueHealth to become a private company after $1.3B acquisition

Friday: The promise of residential VPPs

📊 3 Key Charts

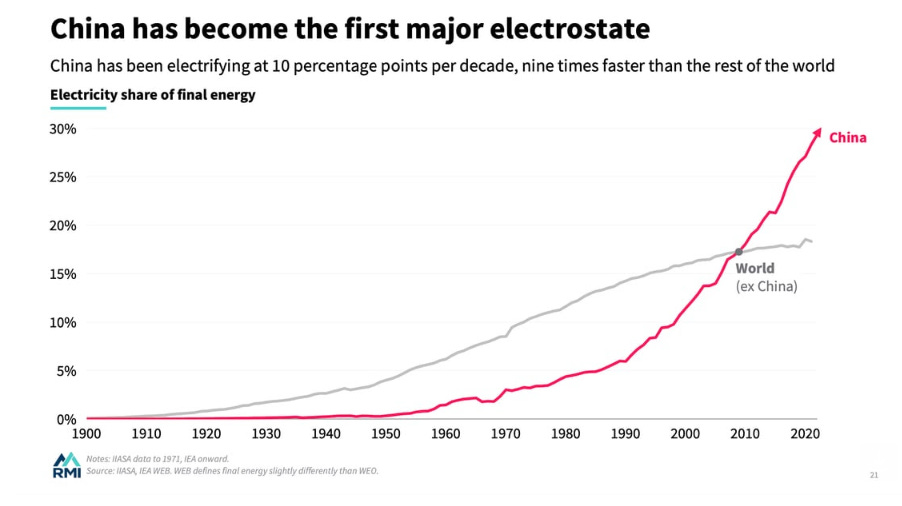

⚡️ Supercharging electrification in China

🔋 Crossing the chasm: BESS systems in China get below $100/kWh

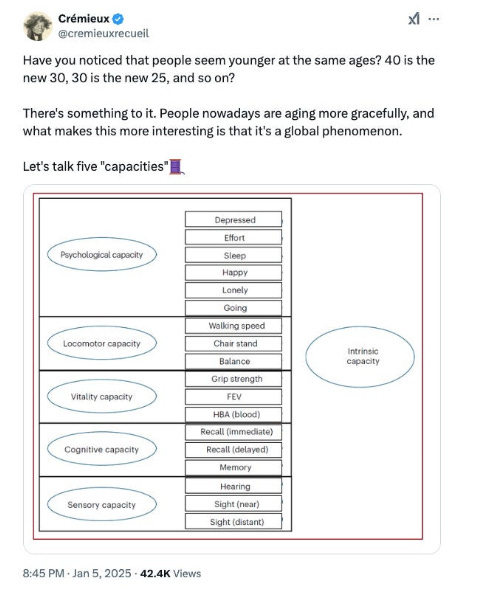

👶 On ageing & longevity…

Four Tasks for 2025

Happy New Year, everyone! I hope you had wonderful holidays and a great start into 2025. I am excited for what the next 12 months will bring - I hope you feel the same way.

For Cape May, January is an interesting month. There’s of course a number of typical beginning-of-year topics, such as 2024 account reviews as well as getting started on tasks that clients had requested but not needed before the new year. But on the new business side, things actually tend to be slower: Clients are either focused on their operating companies, or they already sold their business and are taking January off, leaving cold Berlin for warmer destinations - where their investment portfolio is typically not their first priority. All in all, it makes for a great month to set our strategy for the new year.

So if you’re looking to make 2025 a great year for your portfolio - what should you look out for? Let us share with you what we think are the four key tasks to get your portfolio in order for the upcoming year.

The 13 European startups that became unicorns in 2024

2024 was not a fertile year for European unicorns. Just 13 startups hit a billion-dollar valuation, compared to 69 in 2021 and 47 in 2022. Still, it was an improvement on 2023, when just seven joined the stable.

The return of megarounds helped. In 2024, 136 startups raised more than $100m, according to Sifted data — a long drop from the 241 picked up during the heady days of 2021, but an improvement on 2023 when just 86 startups raised more than $100m, according to Dealroom.

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

💬 EUVC Community | LP AMA with AQVC’s Marius Weber

Join us for an exclusive AMA session with Marius Weber, Founding Partner at AQVC.

After a history as a co-founder of startups and a manager of several VC funds over the last 15 years, in 2021 Marius Weber partnered with his long time friends Marcus and Oliver and co-founded AQVC, a tech enabled asset manager for Venture Capital which is divided in two departments.

This AMA is part of our ongoing series of small-group sessions designed to foster deep, meaningful discussions within the VC community. Participation is free for members of our community, but spots are limited. Reserve your spot now to ensure you don’t miss this opportunity.

Emerging fund managers face countless challenges when setting up and structuring their first VC fund. The process is complex, daunting, and full of pitfalls, from navigating legal frameworks to engaging with the right service providers, the foundations you lay now will shape your growth trajectory.

That’s why we’re planning an exclusive 3-hour masterclass designed to equip emerging managers with the insights, strategies, and tools needed to tackle these challenges head-on.

✍🏻 EUVC Masterclass | Marketing & VC Fund Narrative

Your brand is everything. It’s what sets you apart, helps you win the best deals, attract LPs, and ultimately drive your growth. For emerging fund managers, building a credible brand and establishing the right marketing foundations early on are game-changers. Yet, many don’t know where to begin.

Your fund’s narrative is what makes the difference between an LP glancing at your deck or deciding they’re ready to write a check. It’s your brand that makes LPs feel confident they’re partnering with someone who knows how to make magic happen.

We’re planning a masterclass on building strong marketing foundations with a top industry leader. If enough people show interest, we’ll make it happen.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

GoWest | 📆 28 - 30 January 2025 | 🇸🇪 Gothenburg, Sweden

Investors Summit Bilbao 2025 | 📆 11 - 12 February 2025 | 🇪🇸 Bilbao, Spain

0100 DACH 2025 | 📆 18 - 20 Feb 2025 | 🇦🇹 Vienna, Austria

0100 Europe 2025 | 📆 02 - 04 April 2025 | 🇳🇱 Amsterdam, The Netherlands

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany