EUVC Newsletter - 16.06.2025

On exits, edge, and moments and pieces that make you question everything.

Some weeks, the threads pull together on their own. This is one of those weeks.

We’ve got a spotlight on what it means to leave well—whether that’s offboarding as a VC partner, redefining your edge, or stepping back to question the game entirely.

Fred Destin did that, live on stage at the EUVC Summit. What he gave wasn’t a keynote—it was a gut-check for anyone building or backing the future. If you weren’t in the room, now’s your chance.

This theme of reckoning runs deep: Gloria from Puzzle and Kamel from Varsity unpack solo vs team dynamics in fund building. Serial 🦄-founder Rina opens the door on emotional exits, joining and leaving the dark side and how to win in games.

And then ofc, this was the week of our new playbook on the “VC edge”. Check it out — It's more mirror, than map🪞.

So whether you’re scaling, fundraising, or just searching for your own clarity—this one’s for you.

Scroll slow. Listen deep. Reflect hard.

With 💖 David & Andreas

Table of Contents

🎧 Podcasts of The Week

GP: Gloria Baeuerlein at Puzzle Ventures & Europe’s Solo GP Revolution

Pitch: Kamel Zeroual on Building Europe’s Next Powerhouse Seed Fund

EUVC Summit | Leaving a Meaningful Life in Tech with Fred Destin at Stride, VC

VC: Patric Hellermann & Andreas on the famed “VC edge” aka differentiation

CVC: Zack Weisfeld on Ignite Deep Tech & Reinventing Corporate Venture

VC: Joe Seager-Dupuy & Mike Martin on Why Consumer AI Is Europe’s Next Breakout Frontier

✍️ Insights Article of The Week

Diary of an Emerging Manager - Part 6: The Four Fundraising Fantasies (and How They Died)

The Elusive VC Edge Is Here: A Playbook To (Actually) Define Your Edge as a VC

Early-stage investing for Europe’s defense sovereignty – Eric Slesinger (201 Ventures)

Rina Onur on Offboarding as a VC Partner, Istanbul’s Gaming Boom & the Tug-of-War Between Building and Investing

In this episode, Andreas Munk Holm sits down with Rina Onur, co-founder of Peak and formerly of 500 Istanbul, for a raw and rare conversation about stepping back as a VC partner—and what it takes to switch hats between operator and investor. Together with Enis Hulli, they unpack the story behind Rina’s exit from fund management, her next chapter with Spyke Games, and the unique DNA behind Turkey’s explosive gaming ecosystem.

This one’s both personal and analytical—a crash course in partnership dynamics, performance-driven ecosystems, and what founders truly need from their VCs (and what they don’t).

Here’s what’s covered:

02:00 Rina’s Back-and-Forth Journey: From Private Equity to Peak, Back to VC, and Out Again

08:20 The Emotional Weight of Short-Term Partnerships

11:15 How to Offboard Gracefully as a VC Partner

13:10 What Rina Hated About Venture Capital

15:25 Fundraising Fatigue & Convincing Dozens vs. One

21:40 Why Gaming Became Turkey’s Breakout Sector

24:15 Local vs. Global Success Stories: Turkey, Poland & Beyond

29:50 Serial Founders vs. Untapped Talent: The Two Sides of Portfolio Building

36:30 Geographic Advantage: Why Local VCs Still Matter

41:30 State-Backed Ecosystems: What Works, What Doesn’t

49:00 A Candid Ending: Offboarding, Vulnerability & Starting Over

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Brought to you by Affinity – Exclusive dealmaking benchmarks

What can Affinity data on almost 3,000 VCs from 68 countries reveal about how VCs performed last year and how dealmaking will continue to evolve?

Gloria Baeuerlein at Puzzle Ventures & Europe’s Solo GP Revolution

In this episode, Andreas Munk Holm talks with Gloria Baeuerlein, founding partner of Puzzle Ventures, about building a solo GP model rooted in high-conviction, ultra-early B2B investing. From AI-native SaaS pricing to capital-efficient pre-seed strategies, Gloria breaks down how she’s crafting a differentiated firm in one of Europe’s most competitive venture environments.

They unpack why capital is commoditized, how solo GPs can outperform larger seed funds, and what it takes to design a fund around personal strength, not industry templates. If you’re building a fund, raising one, or just want an inside look into how modern venture firms are architected, this one’s for you.

Here’s what’s covered:

03:20 How AI Is Reshaping SaaS: Delivery, Pricing, and UX

07:30 Pricing Models in Construction Tech and Outcome-Based Sales

09:45 The Shifting VC Landscape: Seed, Multi-Stage, and Angels

12:30 Differentiation in VC: Finding Your True Value-Add

14:40 Building a Fund Around Strengths, Not LP Preferences

22:50 The Competitive Landscape: Seed Funds vs. Solo GPs

24:15 Operational Differences: Solo GPs vs. Multi-Stage Funds

30:00 Fund Model, Ownership, and Return Expectations

38:20 Firm Building as a Solo GP: Who to Lean On

42:26 Will Puzzle Always Be a Solo GP Fund?

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on the Spotify/Apple episode🎧

Make an impact with the bank made for the innovation economy

We know building relationships and building businesses go hand-in-hand. With our sector expertise and tailored solutions, we’ll connect you with what’s next.

Kamel Zeroual on Building Europe’s Next Powerhouse Seed Fund

In this episode, Andreas Munk Holm sits down with Kamel Zeroual, GP of Varsity, one of Europe’s boldest new funds out of Paris. Varsity is making waves—not just for their ambition to build a pan-European fund with global aspirations, but for already closing € 120 M+ toward a first-time fund targeting € 150 M.

Kam breaks down what makes Varsity different: a team with deep operator and investor experience, a track record spanning over 100 startups, and an agnostic but conviction-led strategy focused on next-gen SaaS, fintech, healthtech, and climate.

🎧 Here’s what’s covered:

00:00 – Introduction to Varsity and team background

03:34 – Track record and investment thesis

05:57 – Varsity’s investment strategy

07:08 – Paris roots, pan-European vision

09:57 – Sector focus and founder-first logic

13:53 – Why generalist funds still matter

18:00 – The case for a €150M seed fund

22:23 – What convinced LPs to back Varsity

25:53 – Final reflections and EUVC Awards recognition

Watch it here or add it to your episodes on Apple or Spotify 🎧. Chapters for easy navigation are available on the Spotify/Apple episode.

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

EUVC Summit | Leaving a Meaningful Life in Tech with Fred Destin at Stride, VC

If you came expecting a neat keynote, you were in for something else entirely.

What he gave us instead in fourteen minutes was part sermon, part therapy, and part existential gut check for anyone shaping the future.

Here’s what stuck:

“This isn’t a rehearsal.”

Fred opened with vulnerability: standing in front of his peers, in a room that lives and breathes venture, ready to say the uncomfortable things.

He asked us to zoom out—to consider the power we hold as people who don’t just fund companies but shape the narratives that shape the future.

“We sit in the cockpit alongside the founders. That’s where creation happens now. That’s our canvas.”

But with that power comes disorientation. Because the world we’re building into? It’s fragmented. Conflicted. Loaded with moral confusion.

From flexible fund structures to seamless reporting, Mara makes raising, onboarding, co-investing, and LP reporting effortless. They’re doing it for us, reach out if we should connect you.

Building GTM Teams with Gia Scinto, Talent Partner at The Cole Group [Path to Market – Seedcamp Series]

In this episode of Path to Market, Seedcamp’s Natasha Lytton and Pipeline Ventures’ Micah Smurthwaite are joined by Gia Scinto, Partner at The Cole Group and one of the most seasoned go-to-market talent experts in tech. Gia has helped build out executive teams at category-defining startups like Stripe, Airbnb, Datadog, Canva, and Confluent — and previously led talent at Y Combinator and Andreessen Horowitz.

Gia shares hard-earned lessons from years of recruiting top-tier GTM leaders and partnering directly with founders at every stage, from pre-seed to IPO. In this conversation, she breaks down how to hire your first sales leader, how to evaluate candidates for stage fit and values alignment, and how to avoid common hiring pitfalls that can cost startups months of momentum.

From sales methodology and hiring frameworks to founder mindset and onboarding tactics, this episode is packed with tactical insights for founders, operators, and investors alike.

Here’s what’s covered:

02:34 Building the First GTM Talent Function in VC

06:25 From a16z to YC: Supporting Founders Across Stages

09:42 First Sales Hire vs. Later-Stage Leadership

13:38 The Anatomy of a Great Recruiting Process

22:26 Best Interview Questions for Sales Roles

29:45 How to Pitch Senior Candidates at Early Stage

33:39 What GTM Leaders Want to Hear

44:35 Why Sales Hires Fail — and How to Avoid It

47:36 Systems, Team Design & Ops from 0 to $10M

51:42 Advice for GTM Candidates: How to Pick Your Next Role

You can watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation are available on the Spotify/Apple episode.

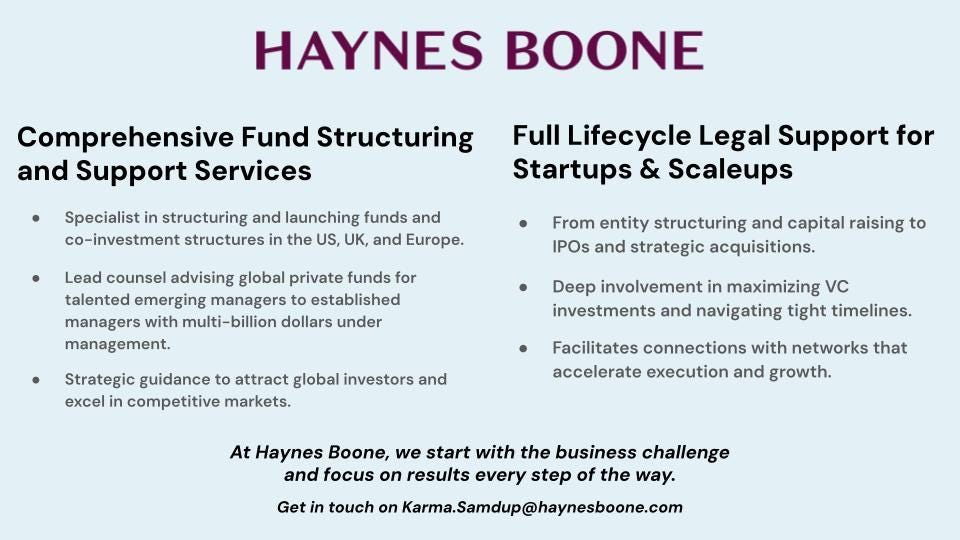

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

Moments Lab Raises 24M USD

In this episode, Andreas Munk Holm sits down with Philippe Petitpont, co-founder & CEO of Moments Lab, and Gökçe Seylan, Principal at OXX, for an insider conversation on the future of video AI and how Europe is producing vertical champions with real traction.

Fresh off a $24M scale round, Philippe walks us through the evolution of Moments Lab from metadata indexing to full AI-powered video agents. Gökçe shares why this was a must-invest opportunity for OXX and what the company’s journey reveals about product-market fit, global GTM, and the rise of vertical AI platforms in Europe.

This one’s a must-listen for anyone building at the intersection of AI, SaaS, media, and enterprise.

Here’s what’s covered:

04:00 Understanding 1 Million Hours of Video: Why AI was the only answer

07:00 Why ChatGPT Can’t Win This Market: Vertical depth vs. horizontal power

10:30 Real Video vs. Synthetic Content: Where emotion, IP, and accuracy still rule

16:00 Rights Management in Video AI: How Moments Lab handles ownership at scale

21:10 What Is Agentic AI? From prompt to production, with real content

27:30 The VC Perspective: Why OXX backed this team at scale

31:00 From Startup to Scale-Up: Going enterprise, going US

36:30 Business Model Design: Why they price by hours, not seats

44:00 Scaling from Seed to Series A+: Building infrastructure, not just growth

49:30 Being a European Deeptech Founder: Talent advantages, GTM challenges

54:30 The Rise of European Vertical AI: Legal, industrial, cyber—and now video

Google — Start building today with GCP and receive from $2k to $350k in Google Cloud credits

Jon Coker on Building Systemic Impact, Why Shared Value Wins & The Founder Learning Curve (ImpactVC spotlight series)

In this episode, Adriana Stan is joined by Jon Coker, founding partner at Eka Ventures, to unpack how the team behind the £68M Fund I has backed 21 early-stage companies driving systemic change in consumer health and sustainable consumption.

They dive into the team’s shift from MMC Ventures to launching a new kind of impact fund, the lessons learned from backing 3 unicorns, and why founder learning velocity is Jon’s No. 1 metric for long-term success.

Eka Ventures is an early-stage VC fund with a clear mission: to back the founders building a more equitable, sustainable future with business models that scale both shareholder value and societal return.

Here’s what’s covered:

01:50 Jon’s journey from analyst to co-managing partner at MMC

05:15 Launching Eka Ventures: why impact needs its own home

08:30 Choosing the themes: consumer health & sustainable consumption

12:45 Building conviction around shared value

16:00 Distribution in health: why access is half the battle

19:25 Generalist vs. Specialist: where Eka fits in

23:10 Fund I analysis: what worked and what didn’t

27:45 Operating in the “real world”: why it’s harder, but worth it

30:10 Lessons from unicorns and founder growth

34:00 The problem with how VCs evaluate “team”

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation. 🎧

Patric Hellermann & Andreas on the famed “VC edge” aka differentiation

In this special episode, we welcome back Patric Hellermann to dive deep into the concept of edge in venture capital. This isn't your average discussion on differentiation—it's a methodical breakdown of what creates enduring alpha for fund managers, grounded in Patric’s experience building Foundamental, a B2B-focused early-stage VC.

This episode is for anyone asking: How do I build an edge that scales? You’ll leave with answers rooted in practice, not theory.

Here’s what’s covered:

02:30 What Makes an Edge? Why Most VCs and LPs Struggle to Answer

06:15 The 4 Steps of VC Value Creation: Sourcing, Picking, Winning, Managing

12:45 What Founders Want: How to Make Yourself the First Call

17:10 DPI Over Hype: Why Patrick Optimizes for Liquidity, Not Likes

21:20 Empathy, Proximity & Pattern Recognition: What Most European Funds Get Wrong

28:35 Pan-European Funds & the Pitfalls of “Routine-Free” Investing

34:40 Why Distribution Beats Product: Lessons from Category Leaders

41:25 Fund Design That Scales: GPs with Domain Depth Over Generalism

53:30 Prioritization as a Superpower: How to Build With Focus

1:00:45 National vs Global Champions: How LPs Think About Risk and Follow-On Capital

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Zack Weisfeld on Ignite Deep Tech & Reinventing Corporate Venture

In this episode, Andreas Munk Holm and Jeppe Høier sit down with Zack Weisfeld, the founding force behind Intel Ignite (now Ignite Deep Tech), to explore the evolution of one of the most respected deep tech accelerators in the world. From reinventing how corporates engage with startups to pioneering a "co-founder as a service" model, Zack shares what it takes to build real bridges between enterprise and entrepreneurship.

Here’s what’s covered:

03:10 Why Intel Chose to Spin It Out—And How the Ecosystem Reacted

06:15 The Three Pillars: Seed, Pre-Seed, and Ideation Programs

08:00 What Most Corporate Accelerators Get Wrong

11:40 Co-Founder as a Service: A New Model of Acceleration

13:25 Why Corporate Mentorship Works When Done Right

19:40 Lessons from 14 Years of Building Accelerators

26:20 How Mentorship Creates Internal Champions

30:15 Aligning Startup Success with Corporate Transformation

35:10 Why Mental Health Support for Founders Is a Strategic Imperative

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on Spotify and Apple 🎧

Joe Seager-Dupuy & Mike Martin on Why Consumer AI Is Europe’s Next Breakout Frontier

In this episode, Andreas Munk Holm is joined by Joe Seager-Dupuy and Mike Martin, General Partners at True Global, a £1B investment firm focused on consumer and retail, to explore how AI transforms how consumer businesses are built, scaled, and experienced.

They unpack why consumer AI is more than a buzzword - it's unlocking entirely new market categories, reshaping broken UX flows, and expanding the definition of addressable markets. From agentic software and hyper-personalized health stacks to defensibility through data, brand, and workflow, this episode offers a deep dive into how to build and invest at the intersection of frontier tech and human behavior.

Here’s what’s covered:

07:27 Exploring Consumer AI Innovations

14:47 Challenges and Opportunities in Consumer AI

20:27 The Path to Agentic Business Models

25:27 Building Optionality in AI Products

26:23 Case Study: Superhuman's Agentic Email System

28:10 The Velocity of AI Announcements

31:10 Defensibility in Consumer AI

39:15 AI's Impact on Consumer Company Operations

43:07 The Disruption of Incumbents by AI Startups

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on the Spotify/Apple episode🎧

This Week in European Tech with Dan, Mads & Lomax

Welcome to a new episode of the EUVC podcast, where Dan Bowyer and Mads Jensen of SuperSeed and Lomax from Outsized Ventures gather to unpack the macro forces and micro signals shaping European tech and venture.

This week, the trio dives into:

Why cyber preparedness is a growing boardroom concern

The overlooked fragility of Europe's energy systems

How automation, AI, and policy are colliding in the UK

Europe's capital gap—and the uncomfortable truth behind it

Plus: OpenAI margins, startup resilience, and robotaxis in London

Here’s what’s covered:

02:00 Cybercrime as a Macro Risk: Are We Sleepwalking into Crisis?

06:10 Iberian Blackouts & Energy Fragility

09:00 Immutable Ledgers, AI & Infrastructure Resilience

11:15 UK’s £2B AI Action Plan: Where’s the Real Bravery?

14:20 Nuclear Woes: The True Cost of Delay

17:40 Marginal Cost Pricing & the Renewable Conundrum

20:30 Tesla’s Robotaxi Vision & a $40K Price Tag

22:00 Wave x Uber Deal: Level 4 Autonomy Comes to the UK

24:00 Brexit’s AV Dividend? The UK Races Ahead of the EU

26:30 Europe’s Capital Gap: Funding or Fundamentals?

29:00 OpenAI’s Gross Margins & Startup Implications

31:30 Incumbents Strike Back: Why Big Tech Moved Faster

34:00 Startup Opportunity in the Next Wave of AI

35:40 European vs. US Startup DNA: Who’s Built to Win?

📺 Watch it here or add it to your episodes on Apple or Spotify 🎧. Chapters for easy navigation are available on both platforms.

🧠 Insights Article of The Week

What’s Driving M&A in EdTech?

The EdTech sector is entering a new phase of strategic consolidation after rapid growth during the pandemic. In 2024, M&A activity is expected to rise again, driven by lower private market valuations, buy-and-build strategies from private equity firms, and incumbents seeking to expand their offerings. Investors now prioritize sustainable business models, recurring revenue (especially SaaS), high engagement, and clear ROI metrics, particularly for institutional buyers.

AI is playing a key role in accelerating this transformation, enabling personalized content, real-time tutoring, and operational efficiencies that make EdTech companies more scalable and attractive for acquisition. As the market matures, expect more cross-border deals, interest in niche verticals like vocational training, and increased scrutiny around financial fundamentals.

Diary of an Emerging Manager - Part 6: The Four Fundraising Fantasies (and How They Died)

This one’s for the fundraisers in the trenches. In Part 6, Venture Whisperer serves up a truth bomb: getting your first “yes” is the easy part. What follows? A soul-searching, inbox-refreshing, ego-testing rollercoaster of a ride.

Key insights from the episode:

The illusion of “money people” – Gala vibes, angel energy... but no check. Turns out, half the “potential LPs” don’t have the capital.

The ghosting is real – Even warm intros and heartfelt follow-ups disappear into the void. Moral of the story: it’s a numbers game. 800–1,400 meetings? Yep, that tracks.

Unique ≠ easy – A bold thesis might turn heads, but it also requires next-level storytelling to make it land. If grandma gets it, great. But can an LP back it?

It hurts. But it’s worth it. – It’s hard. It’s humbling. It’s exhilarating. And even through the silence, rejections, and doubts, the love for the game keeps burning.

Big respect to all emerging managers still standing. You’re not alone. And yes—this can be your ikigai.

The Elusive VC Edge Is Here: A Playbook To (Actually) Define Your Edge as a VC

We’re thrilled to launch a project that’s been brewing for a while:

📘 The Elusive VC Edge: A Playbook to Define & Test Your Edge

Created by EUVC in collaboration with our friends at Floww, this report tackles the question we ask every single week on the pod: “What’s your edge?”

It’s a real question, and one LPs are asking more than ever — but to be fair, far too many don’t have a good answer for.

We’re excited to announce the release of our latest white paper, The Elusive VC Edge, developed in collaboration with Floww and Patric Hellerman from Foundamental.

This short and sweet guide addresses a pivotal question in venture capital: “What’s your edge?” Drawing insights from more than 400 pod EUVC pods and real-world investment experiences, we've crafted a roadmap to help you articulate and validate your edge through seven questions. Check it out below and listen to the pods applying the framework inside 🎧

Early-stage investing for Europe’s defense sovereignty – Eric Slesinger (201 Ventures)

Eric Slesinger’s career has always been grounded in public service and solving complex, high-stakes problems, from engineering for U.S. national security to redesigning Europe’s defense future. After nearly six years with the CIA, where he worked at the intersection of intelligence and engineering, Slesinger turned his focus to venture capital. He founded 201 Ventures, a $22 million early-stage fund that backs founders advancing freedom and autonomy in Europe.

Underline Ventures spoke with Slesinger about what it means to build at the frontier of freedom and autonomy in Europe, why lobbying should be seen as a natural part of democratic systems and policymaking, and how a startup mindset can help redefine the future of defense.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.