Newsletter 17.11.25 | Inside the Engines of European Venture

From fund models to secondaries, from purpose to policy, this week’s conversations reveal how Europe’s venture ecosystem is maturing beyond momentum into mastery.

This week we’re dialing into what really drives returns in venture, not just the deals, but the people, incentives, and structures behind them.

From life sciences funds with zero bankruptcies to investors redesigning global systems, and from Turkey’s gaming explosion to Europe’s evolving tech landscape, this issue is all about the edges where conviction, creativity, and capital meet.

On the pod, Mariette Roesink shows how Curie Capital blends scientific rigor with milestone-driven investing to produce both breakthroughs and billion-dollar outcomes. Patrick Odier & Enrique unpack why circularity, materials, and nature-based systems aren’t ESG trends; they’re the next profit pools. And Dan, Mads, Lomax & Andrew zoom into the Baltics to explore how optimism, permissionlessness, and geopolitical pressure are reshaping Europe’s venture game.

Plenty of substance, plenty of signal, so be ready to buckle up.

Hope you enjoy.

With 💖 David & Andreas

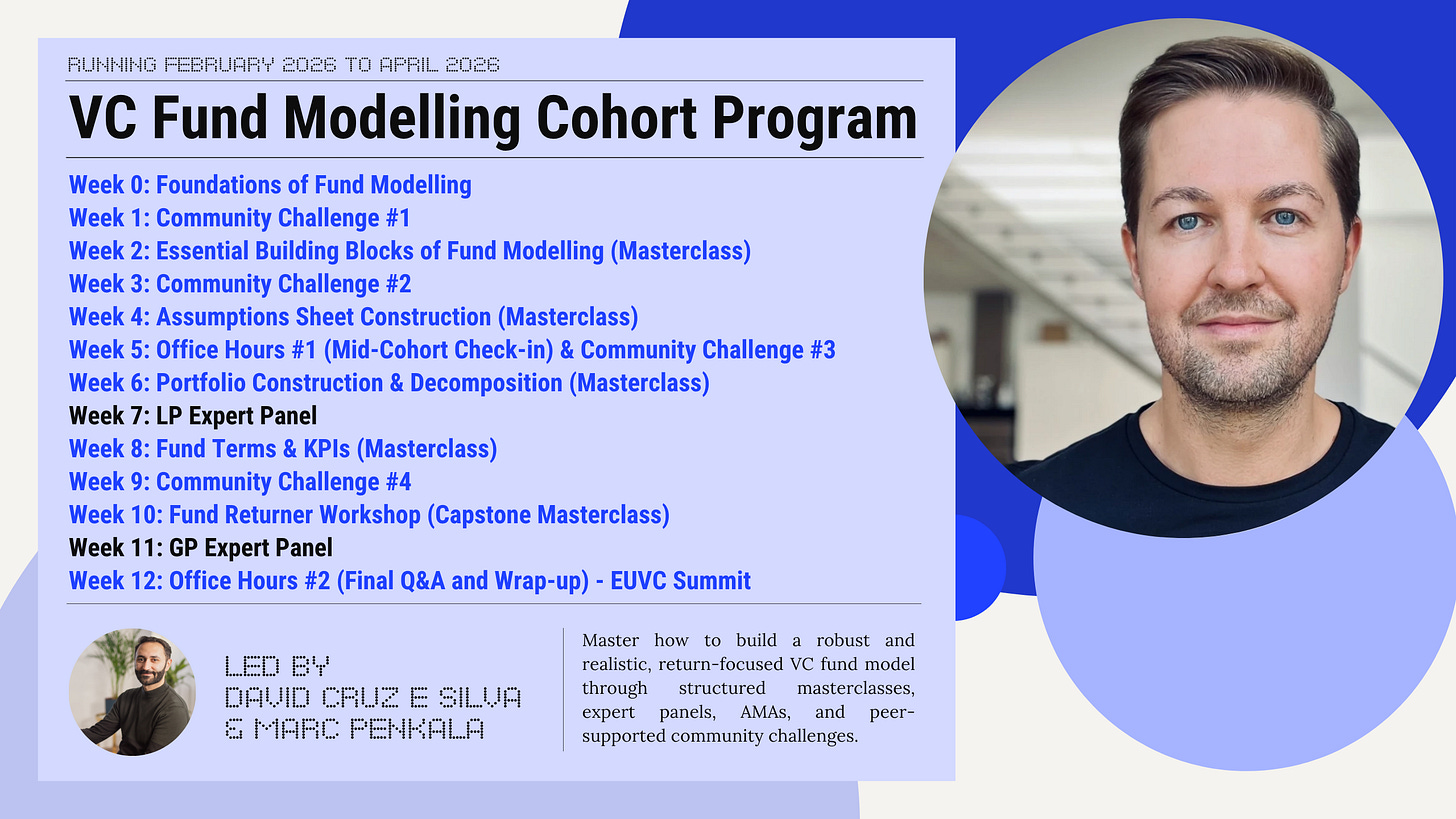

Ready to build a fund model that impresses LPs?

Our 12-week Fund Modelling Cohort is designed for emerging fund managers, allocators, and professionals who want to learn how to build a robust, LP‑ready model from scratch. This isn’t just a series of lectures — it’s a hands-on, interactive experience where you’ll create and stress-test your own fund model with real-world feedback from experienced GPs and LPs.

This cohort isn’t just about learning theory. You’ll walk away with a real, tangible fund model that you can use to raise capital, structure deals, and make key financial decisions.

Seats are limited so don’t miss out on the opportunity to build the fund model that could take your venture to the next level.

Still unsure, watch the teaser to our renowned Essential Building Blocks masterclass.

Table of Contents

🎧 Podcasts of The Week

🎧 Podcasts of The Week

Mariette Roesink, Curie Capital: Backing Life Sciences, Unicorns & Zero Bankruptcies

Welcome to a new episode of the EUVC Podcast, where Andreas Munk Holm sits down with Mariette Roesink, Co-Founder of Curie Capital, the life sciences fund inspired by Marie Curie herself. Built on scientific rigor and conviction, Curie has already backed two unicorns, raised €200M across its portfolio, and boasts zero bankruptcies out of 25 investments.

Mariette explains how Curie blends patient impact with investor returns. “People think life sciences is binary,” she says. “But with milestone-based investing and early pharma partnerships, you create multiple value inflection points — not coin tosses.” With GPs investing their own family capital, alignment and integrity define the fund’s DNA.

From Acerta Pharma’s $11B exit to TargED’s breakthrough stroke therapy, Curie proves Europe’s life science edge is both intellectual and financial. As Mariette sums it up: “The innovation is here — and so is the upside.”

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Patrick Odier (Lombard Odier & Building Bridges) & Enrique, Chi Impact Capital: Three systemic plays to underwrite now

Welcome to a new episode of the EUVC Podcast, where we dig into how finance can move from managing risk to redesigning systems. Fresh off Building Bridges 2025 in Geneva, Andreas and Enrique sit down with Patrick Odier, Chairman of Lombard Odier and Chair of Building Bridges, to explore how investors can back circularity, materials, and real-economy partnerships not as philanthropy — but as alpha. Odier’s message is clear: the transition isn’t a cost center; it’s a competitiveness strategy.

Patrick walks through the shift from exclusion to opportunity: the world is moving from WILD (wasteful, idle, lopsided, dirty) to CLIC (circular, lean, inclusive, clean). That reframing opens three massive arenas — energy systems, nature and land-use, and materials. “Materials sit at the origin of every product,” he notes. “Technology plus industrial partnerships now make it an expansive investment universe.” From plastics and cement to refill models and advanced recycling, these aren’t niche ESG plays — they’re emerging profit pools.

For Odier, the transition belongs to private markets: venture, growth, PE, and industrial partnerships working together to de-risk innovation. “If a business is going to be successful, it’s because it’s going to be sustainable,” he says. The takeaway? Back the companies redesigning their models now — because future-fit economics always win.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

This Week in European Tech with Dan, Mads, Lomax & Andrew

Welcome to a new episode of the EUVC Podcast, where we zoom in on the Baltics with Jone Vaitulevičiūtė, Managing Partner at Firstpick VC, joined by hosts Dan Bowyer, Mads Jensen, and Lomax Ward. Together, they explore how Lithuania’s founders blend bootstrapping grit with global ambition — and why early conviction is rewriting the rules of European venture.

Jone shares how Firstpick spun out from Startup Wise Guys to back founders at the very first line of code. “It will never get cheaper than pre-seed,” she says, “but it will also never be riskier.” From Matt Clifford’s call for “permissionless growth” to Lithuania’s €300M defense play, the team dissects how politics, productivity, and AI all intersect across Europe’s fast-changing tech landscape.

As Mads puts it, “The mother of greatness is permissionlessness.” Lomax adds: “Some of Europe’s most important AI companies are the ones no one has heard of.” The message is clear — from Vilnius to London, Europe is learning to build boldly again.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

What does compensation look like in Venture Capital?💰

We’re bringing back the VC Compensation Benchmark, and if you work in the industry, we need your help to make it even better.

Last year, we gathered 400+ responses from 24 countries, including both VCs and CVCs.

✅ 100% anonymous.

🚫 No emails or personal data collected.

👉 Take 1 minute to fill out the survey:

Most of the stories in venture are about founders and VCs...

But behind every great fund, there’s women writing the checks behind the checks.

That’s why we’re proud to partner with FOV Ventures on the Female LP Pathways Survey 2025 - the first deep dive into what drives (and blocks) women from becoming LPs.

If you’re a female LP or an aspiring one, take 6-10 minutes to add your voice. Your answers will help us:

👉 Map the untold stories of women in venture capital.

👉 Build better data for new LP structures and syndicates.

👉 Open the door for more women to step into the LP role.

Every response helps write the Female LP Pathways Report, and yes, it’ll be fully open for everyone to learn from.

@fov-ventures @tesi @unlockvc @ada-ventures @kvanted

A small step toward better fund models (for all of us)

We’ve been digging deep into fund modelling across - through masterclasses, podcasts and countless GP/LP conversations. One thing is clear: everyone’s wrestling with similar challenges, but almost nobody talks about them openly.

So we’re pulling together a shared snapshot for the whole community. Not an ask — just something we’re building together so we can all get a clearer picture of where the real friction points are in fund modelling today.

You can read about it here but, more importantly, please add your voice 👇.

We’ll gather the themes and share them back with everyone. No fluff - just striving continuously to raise the bar and giving Europe’s venture ecosystem the signal it’s been missing.

Grateful to be building this with you all.

Where operational expertise and innovation work for you.

Where Europe’s venture capital LPs & GPs connect — curated, high-impact networking | Buy tickets now!

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

Regarding the article's insights, it's truly wonderfull how you unpack the real human and systemic engines of venture, which is so important for Europe.