Newsletter 28.10.25 | From Deep Tech to Purpose: Europe’s Next Decade in Motion

This week’s conversations span from Nordic labs to European boardrooms, where family capital, frontier science, and AI ambition converge to shape the continent’s next wave of innovation.

This week, we’re zooming in on the builders shaping Europe’s next decade. From Denmark’s first deep tech fund to Finland’s family-backed venture lab, to the rise of impact capital and the scaling of B2B champions.

Anders Kjær of PSV Hafnium guides us through how the Nordics are transforming science into sovereignty, and Matti Rönkkö at Kiilto Ventures demonstrates that century-old family capital can drive climate innovation. Alexandre Mars at Blisce makes the case for freedom and purpose as a key competitive edge for Europe. Meanwhile, Notion Capital’s Stephen Chandler, Jessica Bartos, and Stephanie Opdam reveal how Europe’s growth-stage founders are finally playing offense on a global stage — powered by conviction, AI, and execution.

Then on This Week in European Tech, Dan, Mads, and Ben Prade dive into the undercurrents shaping the ecosystem - secondaries, sovereign LPs, manufacturing AI, and the hard math behind DPI and liquidity.

It’s a reminder that headlines won’t win Europe’s next era, but by patient capital, deep expertise, and founders bold enough to lead from here.

With 💖

David & Andreas

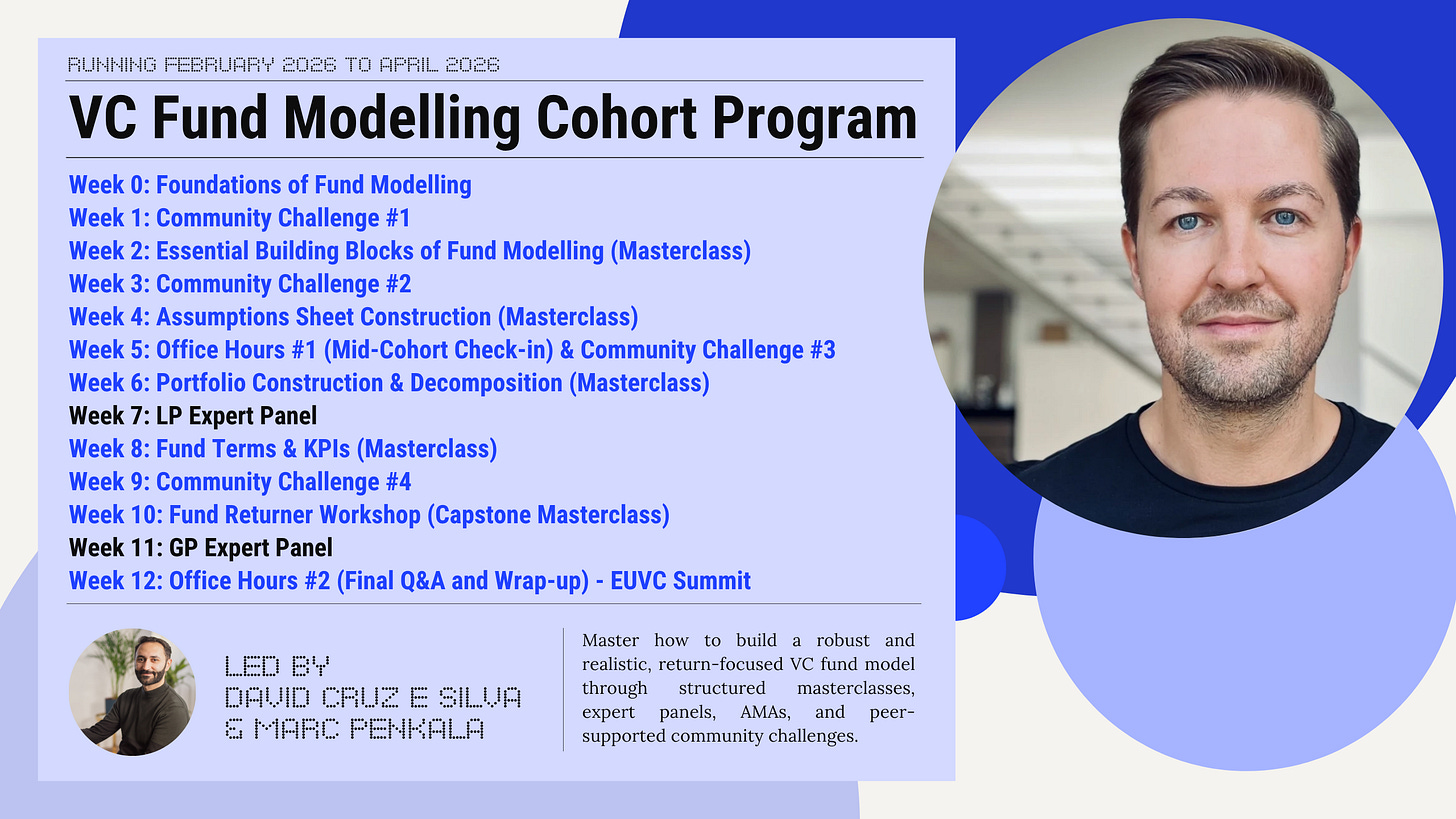

Everyone builds fund models. Few trust them.

Join the Fund Modelling Cohort by EUVC × āltitude.

Table of Contents

🎧 Podcasts of The Week

✍️ Insights of The Week

🎧 Podcasts of The Week

Anders Kjær, PSV Hafnium: Building Denmark’s First Deep Tech Fund & the New Nordic Innovation Advantage

On this episode, Andreas talks with Anders Kjær, General Partner at PSV Hafnium, Denmark’s first dedicated deep tech fund — built to turn science into sovereignty.

From energy and bio solutions to compute infrastructure, Anders unpacks how the Nordics are turning research excellence into real industrial advantage. Together with Andreas, he dives into what makes Nordic deep tech tick — a blend of academic rigor, entrepreneurial grit, and a legacy of manufacturing know-how.

We explore how PSV Hafnium partners with DTU and leading scientists to back founders ready to cross the chasm from lab to market — and why Europe’s deep tech resilience isn’t about defense, but about autonomy, capability, and conviction.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Matti Rönkkö, Kiilto Ventures: Family Capital, Industrial Know-How & Sustainable Built World

Matti Rönkkö, Managing Director at Kiilto Ventures, the venture arm of the 100-year-old Finnish family business Kiilto, proves that legacy and innovation don’t have to be opposites.

From Rocket Internet to running a family-backed venture arm, Matti shares how Kiilto Ventures blends industrial know-how, family capital, and VC pace to back startups building a more sustainable built world.

Together, they unpack how Kiilto Ventures invests across materials, hardware, and software to tackle construction’s biggest challenges — carbon, circularity, health, and inefficiency — and why the next generation of climate tech founders must win on performance, price, and purpose.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Alexandre Mars, Blisce: From Serial Entrepreneur to Impact VC - Rethinking Freedom, Purpose & Europe’s Tech Future

Alexandre Mars, founder and CEO of Blisce, one of Europe’s pioneering B Corp-certified venture funds and a rare voice bridging entrepreneurship, philanthropy, and policy.

From bootstrapping his first company at 17 to building and selling multiple startups across Europe and the US, Alexandre has lived both sides of the entrepreneurial spectrum: the grind and the freedom, the exit and the after.

In this conversation recorded at Italian Tech Week, he reflects on what it really means to align wealth with purpose, how Blisce evolved from a family office into a transatlantic impact platform, why defining “impact” too narrowly risks missing the point, and how Europe’s next tech era will depend on the union of capital, culture, and conviction.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

Stephen Chandler, Jessica Bartos & Stephanie Opdam, Notion Capital: Scaling European Growth Companies with Founder Quality & AI Insight

Andreas talked with Stephen Chandler, Jessica Bartos, and Stephanie Opdam from Notion Capital to unpack the launch of their new Growth Fund — a milestone that signals Europe’s B2B ecosystem is ready to scale on its own terms.

From early-stage specialists to scale champions, Notion’s next chapter is about backing founders who’ve proven product-market fit and are now building for global category leadership. Together, they explore what “founder quality” really means at growth stage, how AI is reshaping enterprise software, and why Europe’s best companies don’t need to leave to lead.

This is a masterclass in execution, endurance, and evolution — from Series B to IPO.

🎧 Listen on Apple or Spotify — or queue it for later with chapters ready to go.

This Week In European Tech with Dan, Mads and Ben Prade

We’re back with Dan Bowyer and Mads Jensen from SuperSeed, joined by Ben Prade of Bullhound Capital, for a no-filter look at the week shaping European venture — from fundraising fatigue and secondaries-as-a-service to AI’s trillion-dollar appetite and China’s robotics surge.

Ben brings the operator–investor view from Bullhound’s deep tech and AI practice, helping us make sense of where Europe must fight: liquidity, automation, and the capital stack that fuels them.

Together, they unpack the real dynamics behind the headlines — why DPI is king again, how sovereign LP mandates shape markets, and what it’ll take for Europe to compete in the new age of physical AI and manufacturing sovereignty.

We’re mapping the biggest challenges in fund modelling. Add your perspective (3 min)

✍️ Insights of The Week

To bootstrap, or not to bootstrap? Stories from founders who’ve been there

By Oliver Vagg, Senior Associate, Early Stage Banking

Key Insights

Bootstrapping: a self‑funded growth path—preserves founder control and avoids dilution.

Building this way works best with revenue-driven models, lean teams, and strategic use of equity or contract talent.

Founders interviewed (e.g., Amman Ahmed of Music for Pets and Tom Hacquoil of Pinpoint) highlight trade‑offs in scalability, pace, and ownership.

Choosing to bootstrap fundamentally reshapes a startup’s journey. Rather than chasing external capital, founders grow through customer revenue or strategic debt—delaying or avoiding fundraising entirely. Oliver Vagg draws on interviews with founders like Amman Ahmed, who scaled Music for Pets to an eight‑figure exit while maintaining flexibility, and Tom Hacquoil, CEO of Pinpoint, who leaned on equity-first hiring and revenue reinvestment.

This approach emphasizes control: founders retain equity and decision-making power—but at a cost. Growth is slower, budgeting is tighter, and scaling is harder. To compensate, many lean into contract or remote talent, equity incentives over high salaries, and highly disciplined operations.

The article punctuates this with the wisdom that “Fundraising is no longer the default,” and that founders must be intentional: What kind of business do you want to build—fast and externally funded, or steady and self-reliant?

The New Space Age is Near

Since forever, it has been the destiny of humankind to explore the frontier – and today’s frontier is space. Similar to the Internet 30 years ago, space tech is just emerging, although the building blocks have been around for longer, and Q3 2025 space tech investments have hit a record $3.5b value, driven by new demand, better tech, and new regulations. The decrease in cost/kg launched into space, miniaturization of electronics, and better energy sources have allowed for an acceleration of space development, starting with Low Earth Orbit (LEO) satellites. The proliferation of smaller, cheaper LEO satellites has led to 40% yearly growth in operating satellites, projected to continue until at least 2030.

This new class of satellites has enabled many new, exciting use-cases. Earth Observation allows satellites to capture optical, radar, SAR, RF, thermal, and hyperspectral data for applications like forest monitoring, city planning, ship tracking, disaster monitoring, and defense tech. Other uses include high-speed internet (Starlink), in-orbit Bluetooth connectivity (Hubble Network), microgravity manufacturing (Varda, Space Forge), and in-orbit data centers (Starcloud). New launch providers like Blue Origin, RocketLab, Firefly, Isar, Space Pioneer, and Skyroot join Arianespace and SpaceX. Satellite manufacturers like EnduroSat, Apex, Kepler, and Gomspace join traditional players such as Airbus, Thales, and Lockheed.

As space infrastructure expands, challenges multiply. ESA’s Space Environment Report shows an acceleration of all tracked objects in orbit, creating demand for debris removal, maneuvering, and monitoring solutions. Companies like Flow Engineering, Epsilon3, and Charter Space address financing, tracking, and insurance, while in-space manufacturing startups like Dcubed, Solestial, and Redwire simplify deployment. Space has become a defense priority—Earth Observation services like ICEYE have proven crucial during the Russian war in Ukraine. Beyond LEO and GEO, humanity looks ahead to asteroid mining, Mars colonies, and deep space exploration. The future starts again tomorrow.

Where operational expertise and innovation work for you.

Where Europe’s venture capital LPs & GPs connect — curated, high-impact networking | Buy tickets now!