In this episode, Andreas Munk Holm talks with Oleg Bibergan, co-founder of S16VC, a venture capital fund built on the foundation of a tight-knit founder community. Oleg shares the story of how S16 began in a Moscow apartment he shared with fellow founders, where casual poker nights evolved into startup discussions, business clubs, and an informal incubator.

Here’s what’s covered:

01:18 Alex's Entrepreneurial Journey

05:17 Oleg's Background and Investment Experience

06:50 The Birth of S16: From Poker Nights to a Tech Incubator

10:37 Building a Global Community and Fund

11:48 The Fund's Unique Approach and Strategy

19:37 Productizing the Fund: Technology and Community

29:36 Investment Success and Future Goals

Watch it here or add it to your episodes on Apple or Spotify 🎧, with chapters for easy navigation available on the Spotify/Apple episode.

Adventures and Deep Connection Await 💞

Step beyond the ordinary into a retreat that challenges and transforms you—as a partner and as an individual. Ten couples will embark on an adventure of reflection, connection, and shared resilience, guided by nature and a like-minded community. Traverse mountains, navigate the sea, and embrace stillness under the Corsican sky. This is not an escape—it’s a chance to be fully present, together, in adventure & in life.

✍️ Show notes

Who is S16VC?

S16VC is a global early-stage venture capital fund built by founders, for founders. Born out of a grassroots community that started in a shared apartment on Shmitovskiy 16th Street in Moscow, the fund is rooted in a decade-long tradition of tech builders supporting each other. Co-founded by Oleg Bibergan (ex-Goldman Sachs investor), Alex Shamis (serial entrepreneur), and Miro founder Andrey Khusid, S16VC brings together a network of over 150 founder-LPs and has backing from top-tier institutions including Sequoia Capital.

With over $100 million in assets under management across two funds, S16VC has invested in more than 70 companies, including breakout successes like Synthesia and Oyster. The fund’s investment model is designed for scale, leveraging a decentralized, global community to source, assess, and support startups. At its core is a “credible referral” system—warm, high-trust introductions from founders and operators—which serves as the primary engine for deal flow. S16VC treats every founder request as its own, offering hands-on support backed by playbooks, internal systems, and a collaborative LP base. The fund’s mission is simple: empower mission-driven founders to make the world more awesome through technology and community.

Here’s what’s covered:

01:18 Alex's Entrepreneurial Journey

05:17 Oleg's Background and Investment Experience

06:50 The Birth of S16: From Poker Nights to a Tech Incubator

10:37 Building a Global Community and Fund

11:48 The Fund's Unique Approach and Strategy

19:37 Productizing the Fund: Technology and Community

29:36 Investment Success and Future Goals

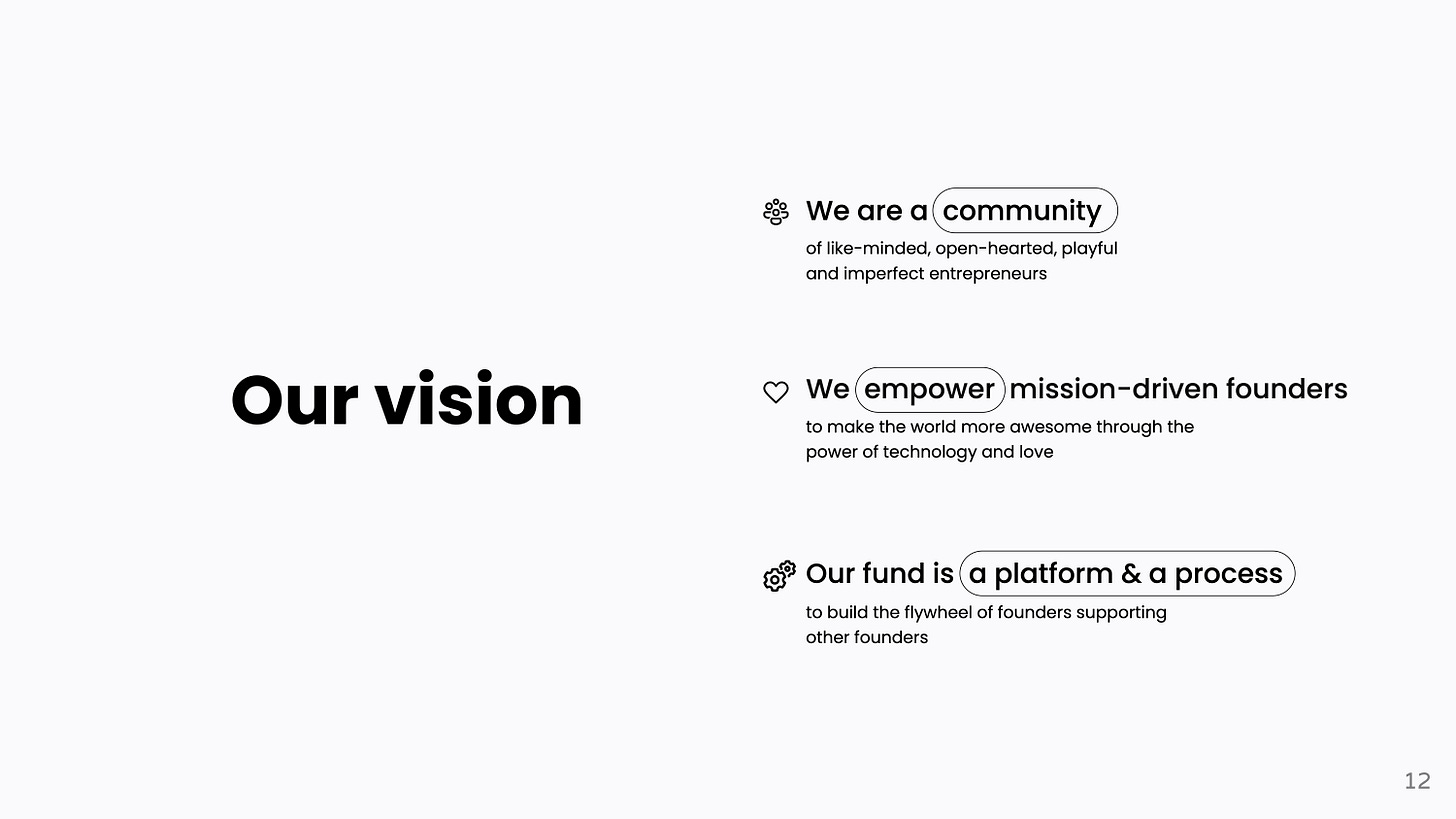

s16vc vision

We are a community of like-minded, open-hearted, playful, and imperfect entrepreneurs.

What seems like just a couple of dozen words, took us five [super fun] workshops with Sherali Karimov and countless hours of discussion and word-crafting to formulate. This vision reflects more than 15 years(as of 2024) of community building and entrepreneurship experience, and offers guiding principles for the future. Here, we unpack our vision statement.

"We are a community of like-minded, open-hearted, playful, and imperfect entrepreneurs."

It started in 2008, when three friends and roommates opened the doors to their apartment at Shmitvosky Lane 16 to like-minded individuals. With no reputation, agenda, motivation, or means to impress, we naturally welcomed others to spend time with us. Over time, we realized we had unintentionally built a community. Without formal rules or memberships, shared values and like-mindedness kept us together, and people began calling themselves members of our unofficial tribe. For years, even after hundreds of people started calling themselves members of the s16 community, when asked how to join, we honestly replied that we didn't know.

Upon reflection, we saw that our "members" were broadly entrepreneurs—people with a strong sense of ownership, actively contributing ideas and leading initiatives. Not surprisingly, most became successful founders or reached C-level roles in their careers.

Lacking the means to impress, we discovered the value of imperfection—a paradox for perfectionists. At our business clubs and events, guests naturally jumped in to help with organization and small tasks, fostering a sense of equality, participation, and belonging. This imperfection extended beyond our apartment to create collaborative co-livings and conferences, where nearly everyone became a co-creator. Embracing imperfection equalizes and unites us all. And it helps to explain the dirty dishes at the apartment :)

We empower mission-driven founders to make the world more awesome through the power of technology and love.

As our community and businesses matured, more accomplished founders and operators joined us. However, when we started gathering at an apartment in 2007, almost everyone was as green as a frog. Over time, a statistically improbable number of early members built large companies or became partners and GPs at various funds. I recall that when we all met, the most funded startup among s16vc co-founders had raised just $50k. Reflecting back, we believe the community was the common denominator behind the high success rate.

While the community empowered us, it did so in ways that cannot be quantified. There are two types of people in the world: those who believe founders need help and those who believe the best founders will succeed without it and can even be crippled by too much assistance. While the community offers a tangible hand with issues ranging from introductions to various advice, the impact of this help on founders’ success is debatable. It is certainly nice to have access to almost anyone in the world through a few handshakes or be able to get answers to any question within minutes, but it is still incremental and rarely has a decisive impact on the destiny of a startup. What is indisputable, in our opinion, is the intangible component. A single encounter can alter the trajectory of one’s life. Imagine being surrounded by a group of like-minded entrepreneurs, many of whom are leaps ahead of you. The sheer exposure to “what awesome looks like” role models provides an unquantifiable amount of inspiration, neural training, and motivation to keep up —chemical, cell-level forces more powerful than any amount of funding or introductions. This is what “empower” stands for in our vision. Having access to off-the-record, often inappropriate stories of epic fails also helps.

There are many ways to make the world a better place. We chose to follow our passion and what we believe to be the most powerful and exponential forces: technology and love. We believe only crazy and obsessed founders have the strength to persevere and make an impact—the mission-driven kind.

Our fund is a platform and a process to build the flywheel of founders supporting other founders.

This is the most challenging, exciting, and strategic part of the s16vc vision. Imagine planting a seed, watching it grow into a tree, and then seeing it spread its seeds to eventually become a forest. We first observed this phenomenon in our community. s16 began as simple gatherings at an apartment with late-night poker games and endless conversations about our startups. However, as we wrote in Part 1, our community members are builders—people with a strong sense of ownership and boundless energy. Having absorbed the community DNA, they started organizing new initiatives. Over next years, those apartment talks evolved into business clubs, two-week-long co-livings, festivals, local chapters, a Burning Man camp, and our off-the-record roaming conference—all initiated and led by different people who got “stuck” in the community. Rituals, processes, and even some rules were devised to support new initiatives in a way that preserved trust and affinity. The community became the first version of the platform, with processes that enabled its members to build on top of it. It turned into a flywheel where the more initiatives were launched, the more like-minded people could join without sacrificing the close-knit affinity of small groups limited by the Dunbar's number.

All VC funds have a natural flywheel: if you do what you promise, the more founders you fund, the more other founders they will refer to you, and if they succeed, the more LPs you’ll attract over time. However, we want to take our flywheel further by replicating the organic growth and evolution of our community. In 10 years, there will be over 500 portfolio founders and LPs in the s16vc ecosystem. Many of them will absorb our DNA and values. Some will want to start a business that could benefit from the s16vc ecosystem: finance, legal, and physical infrastructure, as well as the s16 community affiliation. This could include a region or sector-specific fund, a co-working space, a local incubator, a multi-family office, and more. Building any one of these initiatives from scratch and alone is extremely difficult and not nearly as much fun. Starting within s16vc and the broader community, leveraging the infrastructure, and potentially securing anchor capital not only makes it easier to launch new initiatives but also strengthens each existing business node in the ecosystem. This is what we mean by creating a platform and process to build a flywheel of founders supporting other founders, with s16vc as the first commercial node. In our vision, the people who will launch new initiatives are those who’ve been with the community for many years. For that reason, there’s no rush to move faster than the natural rhythm of community development.

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere, complete with presentations, templates, and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

💬 Community event | LP AMA with Herve Cuviliez | ⏰ April 23, 1:00 PM - 2:00 PM GMT+2 | 💻 Online

Know what’s going on inside LPs heads can be difficult some times. Our series of LP AMAs allows you to ask all the questions you normally hold back. Join our exclusive AMA with Hervé Cuviliez, co-founder of ID4 Ventures, in a small-group, interactive setting where you can ask real questions and get real answers.

Why attend?

Get direct insights from a seasoned LP with 20 years of experience

Learn practical tips and strategies to elevate your fundraising game

Build connections with fellow VCs and LPs in an intimate setting

Available for Members Only, Subscribe below

Join us at the EUVC Summit & Awards Show

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany