Today, we're happy to welcome you to Renaud Visage, co-founder and ex-CTO of Eventbrite, one of Europe’s biggest tech successes and the event platform we’ve all used. Eventbrite IPO'd in 2018 and Renaud left the company in 2021 and is now investing full time out of Paris where he focuses on investing in climate tech startups and on building a ClimateTech Growth Fund where Renaud’s experience from scaling Eventbrite is one-of-a-kind.

With more than 75 angel investments to date, Renaud brings a level of operational experience and the skill to help founders solve complex technical problems like none other. On top of this, Renaud is a Venture Partner with the renowned seed firm Point Nine.

Jump to the parts that matter most to you and watch our core highlights below 👀

00:02:26 - Challenges of Building Eventbrite

00:04:20 - Renaud's Angel Investing Journey Begins

00:05:25 - Renaud's Accidental First Deal

00:06:52 - Lessons from Angel Investing

00:09:10 - Renaud’s Investment Thesis and Strategy

00:11:28 - Renaud's Value-add for Founders

00:12:48 - Evolution in Finding and Evaluating Investment Opportunities

00:14:00 - Doubling down on Impact Investing

00:16:45 - Going from early to growth stage investing

00:19:40 - Generalists vs specialists in Climate investing & investing in hardware

00:21:56 - Networks and co-investing in the climate space

00:24:55 - The lack of European growth stage financing in climate

00:25:30 - Renaud’s core learnings from Angel investing

00:27:00 - The importance of your value prop and network as an angel

00:29:10 - Follow-on investing as a venture investor

00:36:05 - Renaud’s most counterintuitive learning

00:37:30 - Top tips to angels wanting to invest internationally

00:39:30 - Advice to his own 10 year younger self

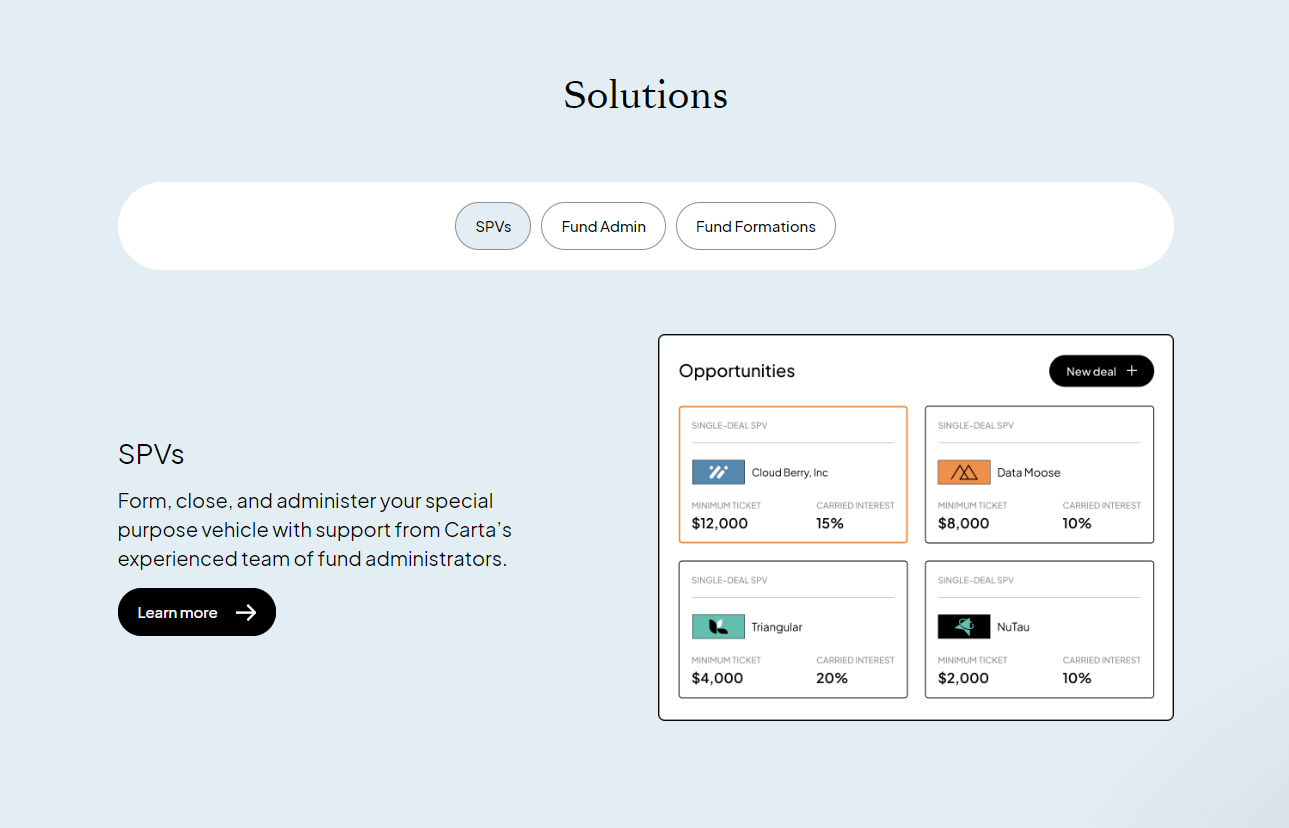

This episode was made possible by our friends over at Carta - the easiest way to launch & run your fund and syndicates. It’s no secret that we at eu.vc are happy and heavy users of the Carta platform as it allows us to be creators turned angels without bogging us down in back-office hassle of investing.

For a very special treatment, go here to let the Carta team know you’re coming from the eu.vc community 🤗

Renaud’s Journey Into Angel Investing

So I love building … From 2006 I was building Eventbrite as the CTO and we IPOed in 2018, and then at the end of 2021, I felt that I had exhausted my value to the company and needed to do something else. So I embarked on my investment journey. I had been angel investing since 2014, but have done it a bit more aggressively since 2020 and then switched to doing more impactful investments over the last 18 months or so.

Renaud’s Investment Thesis & Strategy

So I had zero strategy or, or thesis at the beginning. I think like a lot of angel investors who are, a lot of entrepreneurs who are still very busy with their companies, you take that as a bonus to the community, the fact that you can give back.

Renaud’s Core Learnings from Angel Investing

I think no matter the stage, you still have to bet on the team. This is the core of the company. They define the culture, the way of doing business.

🔫 The Quickfire Round 🔫

What is the most counterintuitive thing you've learned since you started angel investing?

Perhaps there's a common misconception that doing more deals automatically leads to improved skills in the field. It's natural to assume that when you're just starting out, your proficiency may be lower. However, I've discovered that this isn't necessarily the case. In my experience, when I wasn't operating at a large scale, I was more selective in the deals I pursued. I focused on quality over quantity.

In contrast, during 2020 and 2021, when there was a flurry of activity, I found myself engaged in numerous cookie-cutter deals. These deals often involved operators transitioning from one company to another, identifying promising niches within the SaaS industry. While these opportunities appeared lucrative, they often led to less diligent decision-making because they matched familiar patterns.

As a result, I may have taken fewer risks and missed out on exploring more attractive spaces with greater potential for future gains. It's easy to become complacent when you're constantly repeating the same types of deals simply because they're familiar. This pattern can emerge when you engage in too many deals.

Now what will be your top tip to Angels wanting to do more international investments?

Perhaps considered old-fashioned, but attending events remains a valuable strategy, not necessarily to connect with startups, but to engage with fellow angel investors. It seems that as a group, we don't network enough. Despite being listed on the cap tables of various companies, it's rare for angel investors to foster genuine and collaborative relationships.

There's a growing trend of angel groups, and I'm a member of one called the Whispers, comprising around 10 to 11 individuals who share deal flow informally and somewhat disorganized fashion. However, angel investing can be a solitary pursuit otherwise, so building a network is essential. This network can include other angel investors or founders within your existing circles or even from different countries.

I've dedicated significant time to evangelizing, even across Europe. This effort has allowed me to cultivate numerous relationships by attending events, sharing my journey, and imparting insights about scaling. As one of the few angel investors with a background as a CTO, I believe it's crucial to identify your unique selling point, just as you would in software development, and emphasize that. Establishing relationships with venture capitalists (VCs) is also important.

VCs often seek individuals who can provide value, so it's essential to figure out where you can offer value. While VCs may not have the bandwidth to make numerous introductions, they might facilitate a few if they find it beneficial. However, filling the cap table isn't typically their primary responsibility.

Therefore, it's crucial to position yourself as someone capable of delivering specific value and cultivate relationships with a select few VC firms that can provide the type of deal flow you're interested in, particularly within your preferred sectors. This approach can serve as a recipe for accessing higher-quality international deal flow, as the competition remains fierce within individual countries.

And finally, what advice would you give to your own 10 year younger self?

Perhaps, consider being more vocal and explicit about your investment approach. Clearly state that you practice agile investing and specify your investment preferences, such as the types of startups you support (X, Y, Z) and your preferred stage (pre-seed, for example). Define your positioning statements and mission if you have one. Explain your strategy for achieving your goals and turning angel investing into a genuine business endeavor.

While you don't need to market yourself aggressively or in a way that doesn't align with your personality, establishing a clear investment identity can be beneficial. Such clarity could have helped me access better companies earlier and make wiser investment decisions when I was just starting out.

And don’t forget to go here to receive a very special treatment when heading over to Carta to get the hassle-free back-office for your fund and SPVs that you’ve always dreamt of 🫠