Today, we're happy to welcome you to Francesco Simoneschi, Co-Founder and CEO at TrueLayer and angel with 60+ investments. In this episode, Francesco dives deep into his experience going from VC to angel investing, the nuances of angel investing, shedding light on some counterintuitive lessons he's learned along the way. He delves into the importance of trusting your instincts when assessing early-stage startups and why sometimes, early traction can be a red flag.

Francesco also shares his strategies for making international investments and the value of building a network of trusted insiders in unfamiliar territories. Plus, he reflects on the soft skills and leadership qualities that he wishes he had focused on earlier in his career.

Jump to the parts that matter most to you and watch our core highlights below 👀

00:02:52 - On Starting TrueLayer in Italy

00:05:54 - Francesco’s 60+ angel portfolio & striking a balance as an operator

00:07:30 - The complementarity of angel investing and being an operator

00:08:44 - Angel Investing in the FinTech Ecosystem

00:09:12 - Balancing Excitement and Discipline in Investing

00:11:00 - Reflections on Investing in a Marihuana delivery startup

00:14:16 - Investing in The Development of Wetware Computers

00:15:45 - On The Drive of Entrepreneurs

00:17:12 - Accessing European Capital for Early Stage Opportunities

00:18:34 - Investing in Various Industries

00:20:01 - Diversifying Portfolio as a Tech Entrepreneur

00:22:54 - Balancing Risk and Fun in Angel Investing

00:24:10 - Assessing Founders and Key Ingredients

00:22:44 - The Importance of Financial Savvy and Diversified Portfolios

00:24:26 - Mitigating Financing Risk

00:26:16 - Investing Based on Value and Learning

00:28:16 - Investing in Early Stages and Venture Funds

00:30:08 - The Importance of Diversification

00:32:03 - Trusting Your Instincts in Angel Investing

00:34:00 - Capturing Signals in Investment Strategy

00:35:48 - The Reality of Bridge Rounds

00:37:39 - The Importance of Discipline in Angel Investing

00:39:17 - Playing the Long Game

00:41:11 - Importance of Soft Skills and Leadership in Education

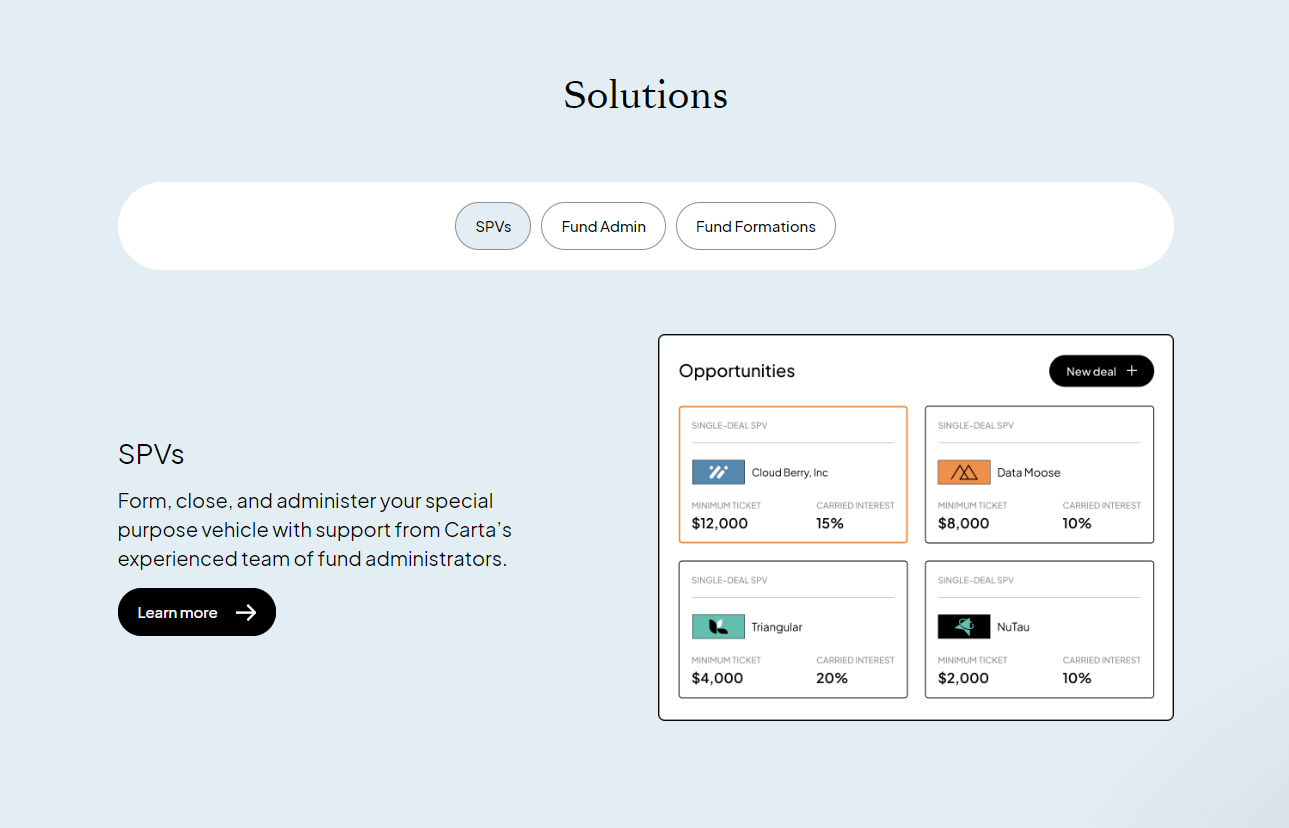

This episode was made possible by our friends over at Carta - the easiest way to launch & run your fund and syndicates. It’s no secret that we at eu.vc are happy and heavy users of the Carta platform as it allows us to be creators turned angels without bogging us down in back-office hassle of investing.

For a very special treatment, go here to let the Carta team know you’re coming from the eu.vc community 🤗