Watch the replay here 👀 and hit the button below to sign up to join the next live show on September the 23rd at 9 PM CET 📆 👇

Join us for our EUVC Syndicate dinner in Bucharest 🥂

We can’t start this without inviting you to join us at How To Web as we’re putting together an EUVC syndicate dinner at (i.e. Wednesday the 21st) 🥳

You’ll get to experience the power of LP syndicates first-hand as you’re seated with the best European early-stage VCs & angels while partaking in a lively roundtable discussion on pan-European investing with some of the best VC funds in Europe 😍

All while being treated to an amazing private dining experience on the riviera of Bucharest 🥂😍

Not at How To Web? We’ll repeat the success at the following tech conferences:

Prague in connection to Engaged & Disraptors (Oct. 10 - 11)

Lisbon in connection to WebSummit (Nov. 1-4)

And as always, join the EUVC Syndicate for first dibs 👇

Table of contents

This week’s EUVC podcast episodes

How do we make tech events interesting to VCs?

Axie Infinity, Helium, A16z and the future of VC

A VC’s french summer romance: DPI

Is our new investment world now primed for true innovation

How far we’ve come in European venture

Another C-Suite Fraud Prosecution from Nikola

Starbucks (who can’t release a decent core app) are now trading NFTs!

Patagonia family put business & profits in trust to fight climate change.

Can you make money and do good?

Google loses €4bn appeal - The psychopathy of big business

Down rounds aren’t the end of the world

Northzone raises 1 bn€

500 Istanbul rebrands to 500 Emerging Europe

Let’s get into it 💪

This week’s European VC podcast episodes

Circular Construction on The UrbanTech VC

Doubling down on secondaries from founders

An insider’s view on the MENA region

Navigating the current market - an LPs perspective

How do we make tech events interesting to VCs?

The season of tech events has started and VCs are… busy hanging out in the investor lounge. Hampus Jakobsson succinctly pointed this out to us when we spoke to him at TechBBQ this week (in the investor lounge, of course).

All these people work their #?% off for a full year to put on a spectacular event and then we just hang out with each other in a small enclosed area.

It made us think. What would it take to make an with content that would actually be interesting for VCs to attend?

If you have an idea, let us know. We’re thinking of doing something as exciting as fund model deep dives.

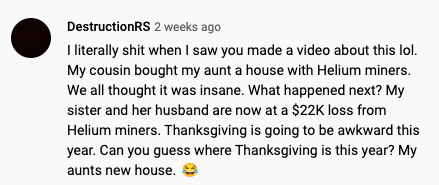

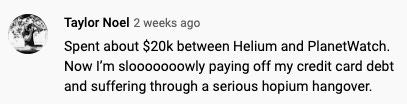

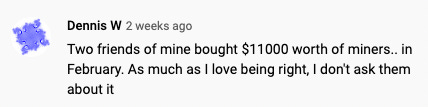

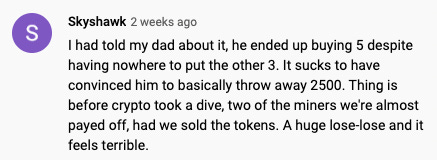

Axie Infinity, Helium, A16z and the future of VC

Dan came across Liron’s Tweets and he couldn’t agree more. Read on for the most opinionated piece of the week.

I’m all for pushing boundaries and trying new things but Andreesen aren’t covering themselves in glory with their recent investments such as Adam Neumann’s Flow, Axie Infinity and Helium. All of which seem intent on sticking it to the man in some way or shape. But which man?!

Dan Bowyer, SuperSeed

Right now it looks like you and I, institutions and the collective ‘we’ are that man. The only winners being Andreesen. Great PR, juicy fees but the industry and wider humanity can swivel?

Personally I think VC needs to move beyond this myopic approach. We, collectively, must push the agenda to make money AND create meaningful positive change for all.

e.g. Arianna Simpson from A16z here on Axie Inifinity is just flat lying - duhhh. Real people who can’t afford to lose anything are losing everything. She can see it’s a Ponzi.

Shameful. Really.

And Dan doesn’t have much more love for Helium ($311m from A16z) - check out Liron’s tweet 👇

A VC’s French summer romance: DPI

A great analysis by Sifted on data from Dealroom (443 M&A deals, for companies launched after 2010, in European tech).

French investors rocking it with most exits from June to August. Bpifrance and Elaia Partners owning it with 5 and 3 exits respectively. Honorable mentions to Global Founders Capital, PreSeed Ventures and Force Over Mass Capital, each with two exits.

Some strong love to PSV 💘 for being represented here with a very small fund compared to their peers.

Other highlights from the article:

Hottest sectors: enterprise software, fintechs and marketing startups.

Top Geos: UK, Germany and France

Is our new investment world now primed for true innovation

The age of growth at all costs is over (for a few minutes, at least). And what this FT article explores is the Startup world beyond the salacious headlines PLUS the fact that it’s right now when innovation can come alive.

Now that easy tourist money has receded (for a while), we can focus on real life moving innovation. Not 5 minute groceries. Or can we?

How far we’ve come in European venture

As our good friend Kjartan Rist from Concentric says:

As the sector gets to grips with a more challenging economy, it’s worth reflecting on how far we’ve come – particularly here in Europe.

20 years ago nobody would have believed that European VCs would become instrumental in backing major tech companies, much less that it would become an important part of the financial system in Europe.

Let’s look at some highlights from this great article by Kjartan:

From tech desert to tech hub: 30 years ago or so European investors were overlooking the potential of emerging tech and Europe as considered a frontier market, not even an emerging market (quoted from the one and only, Mr. Saul Klein)

From weirdos to trendsetters: 20 or so years ago VCs were a rare breed; today we have stronger and stronger ecosystem and the inflow of aspiring VCs is cray cray. It’s great, but also daunting to anyone wanting to start investing as an LP - where to begin!? There’s soon a fund for every startup 🤔

The flywheel effect from early successes: not much to say; the first few successes have bred even more success and tech success stories became breeding grounds for the next generation of entrepreneurs and VCs.

‘Vulture capitalists’ to value-add: Most VCs had little to no operational experience; which quickly created an ‘us and them’ relationship between VCs and founders (as Kjartan explains in the article). Today, we have a whole plethora of GPs with a deep understanding of the ins and outs of building a business who come to VC focused on helping the startups they back - the people who they once were.

European LPs need to catch up: there is still a real lack of institutional support and an over-dependence on public capital. This shallower funding means that bigger tickets are done by US investors and that there are still gaps in areas with longer investment periods (e.g. deeptech).

Another C-Suite Fraud Prosecution from Nikola

Trevor Milton the ex CEO of Nikola is being prosecuted for wire and securities fraud for deceiving investors. Allegedly.

This reminds me of Theranos - Will we ever know what is genuine hope, and what is a flat lie? And at what point did they jump the shark and reality be damned? Or did they?!

Dan Bowyer, SuperSeed

As an aside - There are 2 electric car companies with the same man’s name?! At the very least you’d expect Elon to have a kid with Trevor’s wife. Or does he only do that with friends? Great questions that require pondering…

Starbucks (who can’t release a decent core app) are now trading NFTs!

How far can an enterprise get lost up its own backside? Starbucks think we need a Web3 coffee experience and are soft launching Starbucks Odyssey. An app that enables you to earn and spend crypto as NFTs that convert to virtual and real world experiences. And the app is on a waitlist?!

Don’t worry Starbucks - we can wait.

Patagonia family put their business & profits in trust to fight climate change.

"Earth is now our only shareholder.”

Founded in 1973, Patagonia's sales were worth around $1.5bn this year, while the founder Mr Chouinard's net worth is thought to be $1.2bn.

All to be put in trust with anything not invested in the business going to fight climate change.

We love this and refuse to be cynics. We just love it. More to come please.

Can you make money and do good?

This article had Dan Bowyer go out on a rant thinking about the place of impact in VC investing. Let’s hear it from him.

It’s something that’s on my mind a lot. It’s why I do what I do at SuperSeed but I do constantly ask myself - What is impact? Am I really moving the needle or kidding myself? Should I try and have impact along the way or wait until I’m a billionaire and then give it all away?

As a tiny example - In Copenhagen at #TechBBQ this week discussing a VC / founder matching product with Frederik from Pitchr. Is that impact? Is getting more startups more access to investment impact? Yes it is IMO. Startups are the net creators of opportunities, jobs and the source of innovation. Which is my impact.

My way to change the world for the better for my kids. I think. I hope. To be further explored!

I think many of us feel that way. We’re in VC for our kids. Our planet. Our future.

Google loses €4bn appeal - The psychopathy of big business

Google have had their appeal denied for their latest EU anti-trust lawsuit which states that they used their dominance to quash any potential competition.

When does a startup flip over? When does the corporation incorporate? When does ‘the machine’ then just do what it does and become evil? Or is it evil? Is it perhaps just the purest efficiency? Albeit a little offensive to our sensibilities.

Dan Bowyer, SuperSeed

It’s a bit like the movie iRobot where Will Smith is trying to work out how robots can harm humans when their code is written to the contrary - before working out that they want to remove humans because we are the biggest danger to ourselves. Oh. Woops.

Tbh, anyone arguing big tech shouldn’t be capped by the same anti trust laws that kept big industry in check in the century before are either naïve or compromised by their massive shareholdings in the companies in question.

Down rounds aren’t the end of the world

We’ll leave this to Brad Feld, as he put it better than we could ever do:

For some reason the whole notion of a down round has become this fearful thing. The history of fundraising and raising money for companies is that there are lots of different price points at which money gets raised. Even if you look at the public markets, companies raise money at lots of different valuations, including at lower valuations than previous valuations…so I don’t know why the down round became such a toxic construct. I even heard someone say, ‘Once you have a down round, you’re dead!’. No! People gave you money, so you’re the opposite of dead! You’ve got a chance to keep going. So I would try to change the language around down rounds, and be more realistic about the idea that we were in a cycle where people raised at very high valuations, and future financings in a lot of cases are going to be at lower prices than the last round that was raised.”

Brad Feld at TechStars

Read the full article (and Maëlle Gavet, CEO of Techstars’ 8 other take-aways) here.

Northzone raises 1 bn€

Think just about everyone has seen the news about their new fund. But found this quote interesting.

"The exuberance of the COVID years is gone … In any graph you will see this anomaly that's called 2021. If you just wipe that from your memory and look at valuations and deals from 2018 or 2019 as a growth curve, you will see that it continues,"

Jeppe Zink, Northzone

Interesting to see Jeppe draw a connection between the pandemic and the exuberance seen in VC during 2021.

500 Istanbul rebrands to 500 Emerging Europe

We’re reproducing part of Enis Hulli, General Partner and founder of 500 Emerging Europe here. We’re leading an LP syndicate into their new fund, so obviously, we’re all onboard with how he puts it:

The road to Emerging Europe started with the creation of 500 Istanbul, which we set up in 2016 to invest in Turkish entrepreneurs. As I mentioned in my 2018 post, Turkish entrepreneurs shifted gears to focus on global markets to hedge against local risks, leading to a crop of technology exporting companies with defensible products that can scale globally. We have invested in great companies including Carbon Health, Insider, BillionToOne and Firefly, while building a local portfolio that in aggregate generates more than 95% of its $600M+ revenue outside of Türkiye and has raised $1.1B in follow-on funding–almost all of which from international investors.

As our strategy around finding globally competitive early-stage teams bore results, we realized that these dynamics weren’t limited only to Türkiye. Central Eastern European unicorn success stories are global from the outset. Since 2019, we have made investments in Poland, Ukraine, Romania, Greece, Bulgaria and Hungary, and we’re excited to see portfolio companies, such as Athens-based Plum, emerge as a key UK wealth-tech player.

Enis Hulli, 500 Emerging Europe

Seeing 500 Istanbul grow into what 500 Emerging Europe is absolutely amazing - for us as partners and for the startup ecosystem as a whole.

To join us in the syndicate, read our memo on the substack or sign up directly to the syndicate here.

We're building the go-to place to access the hottest European VCs at radically lower tickets than ever before - come join us! ✊