This week we’re welcoming “The Seed”-podcast with Dan Bowyer from SuperSeed to the eu.vc family of podcasts 🤗 In this show, we’ll cover recent news and movements in the European tech landscape. This week, we Dan was joined by Exited founder, Angel and LP Alex McDonald from Sequel.co, his co-founding GP Mads Jensen from SuperSeed and of course Andreas for a short opening remark.

Read on for the core take-aways

UK Rejects EU Youth Mobility Scheme

The UK government has turned down a proposal for a youth mobility scheme with the EU, allowing 18-30 year olds to work and study freely for up to three years. Despite 58% public approval, both major parties rejected the idea. Mads speculated this might be "politics as usual," with Labour fearing accusations of rolling back on Brexit promises. Alex McDonald called it "very sad," suggesting it misses an opportunity to welcome more talent and investment to the UK. Both hoped this might be an opening position for negotiations rather than a final stance.

AI: A Growing Concern for Big Business

A recent report shows 56% of large US companies now view AI as a potential risk, up from 9% in 2022. Mads acknowledged the validity of these concerns, comparing potential AI disruption to how the internet impacted companies like Blockbuster and Sears. Alex McDonald, however, cautioned against heavy-handed regulation, arguing it often benefits incumbents and stifles innovation. He suggested we're still "probably five years away from really having to take some of those concerns seriously." The discussion touched on California's proposed AI regulation, with Mads noting its potential watershed moment in placing liability with model developers

UK AI Funding Controversy

The UK Labour Party's decision to scrap a £1.3 billion AI funding initiative proposed by the Conservatives. Alex hoped this might be a short-term move, with Labour potentially rebranding and relaunching a similar initiative soon. Mads provided context about the UK's current financial constraints, suggesting the cut might be part of broader budget balancing efforts.

The reported "Silent Startup Recession”

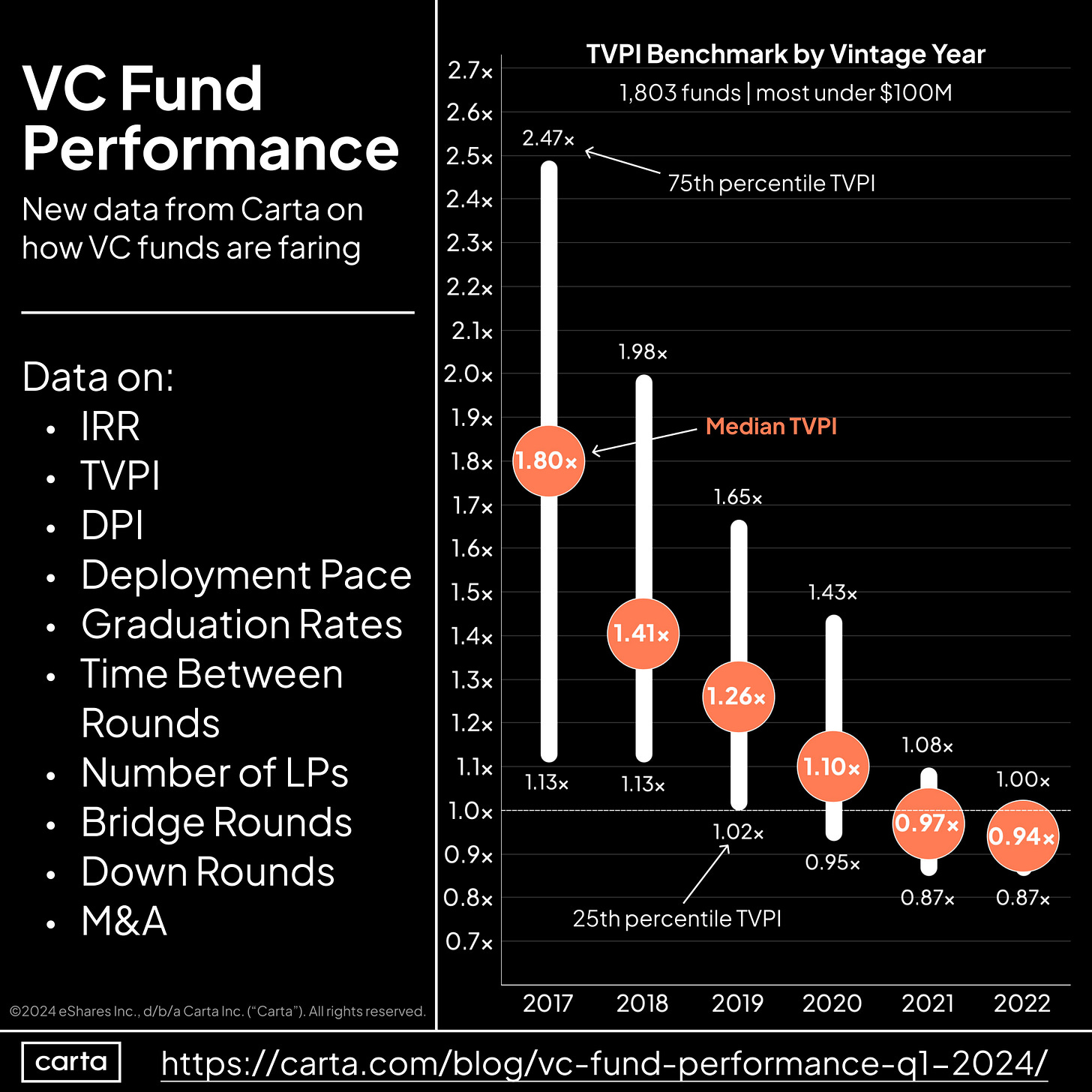

Alex McDonald provided crucial context to recent Carta-data showing a 60% increase in startup shutdowns. He pointed out this follows a similar increase in new startups formed in 2021-2022, arguing it's part of the natural startup lifecycle and a matter of startup land returning to normal.

Mads added that the absolute numbers aren't as high as too many headlines suggest, and that fewer startups were shutting down in 2020-2021 due to abundant funding, so this data truly underscores that we’re simply resetting to norms.

The Virtue of Patience in VC

Alex McDonald shared insights from David Clark of Vencap, noting that "funds that optimize for generating some DPI in the first five years ended up being the worst performing funds." He emphasized that patient investors who accept the cyclical nature of venture capital tend to perform best in the long run.

VC Returns: Light at the End of the Tunnel?

After a two-year drought, VC funds showed a modest 0.4% return in Q4 2023 according to Pitchbook data. Mads characterized this more as a "leveling off" than a true rebound, emphasizing that the industry needs to adjust to longer timelines for returns and more focus on company building. He stated, "It's back to working with founders to build great businesses... which can take 18, 24, 30 months."

Stay tuned for next week's episode, where we'll continue to bring you insights from the forefront of the startup and VC world.

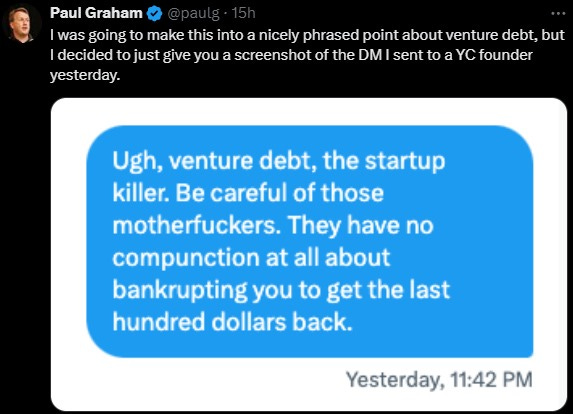

Masterclass on Venture Debt: Structuring & Deal Terms with Hemal Fraser-Rawal, GP at White Star Capital

In case you think there’s more to venture debt than Paul Graham…

…Join us for an in-depth session on Venture Debt specifically for senior VCs😁

We’ll cover all essential aspects of venture debt, from its origins and rationale to detailed discussions of deal terms and geographic variations important to be aware of. Designed with senior VCs in mind, this masterclass will offer practical insights and strategies that’ll improve your decision-making when it comes to leveraging venture debt in your portfolio.

Key Learning Points

Understanding Venture Debt: Grasp the fundamental principles and the strategic reasons behind using venture debt in investment portfolios.

Deal Structuring: Learn about the typical structures, pricing, and common features of venture debt term sheets.

Strategic Benefits and Drawbacks: Analyze the pros and cons of venture debt from an investor’s perspective.

Exploring Alternatives: Discover other credit-like financial products and understand their similarities and differences.

Geographic Considerations: Gain insights into the geographic nuances of raising venture debt and its implications.

Special offer: Join the EUVC Community for 25€ per month and get 100€ off while enjoying access to on-demand masterclasses, tools & templates and monthly AMAs with leading GPs, LPs & experts.

Who should participate

This advanced workshop is ideal for General Partners, Emerging Fund Managers, Established VCs, and Family Office employees interested in enhancing their knowledge of venture debt and its strategic application in venture capital.

Time Commitment

This is a 2-hour online workshop consisting of:

Venture Debt Overview including what is venture debt, why and where it originated, and its importance and relevance in today’s ecosystem.

Deal Terms including structuring traditional venture debt, pricing, warrants, and common features.

Conditions, covenants, and security packages in term sheets, and the benefits and drawbacks of taking on debt from a GP's perspective.

Alternatives and Geographic Differences including an overview of other credit-like products in the market and their comparison to traditional venture debt.

Geographic variations in raising venture debt with a macro overview and specific considerations.

Your instructors

Hemal Fraser‑Rawal is a seasoned investor in private debt markets, with experience ranging from Leverage Finance to Growth Lending. At White Star, he brings innovative approaches to support entrepreneurs in achieving their ambitions. Prior to White Star, he was a Principal at Claret Capital Partners, deploying over €80 million annually into early-stage companies across Europe.

David Cruz e Silva is the founder of eu.vc, Europe’s Venture Community, and an angel LP supporting European early-stage funds and their breakout companies. His unique experience and positioning are invaluable for emerging VCs and LPs navigating European VC.