Watch the replay here 👀 and hit the button below to sign up to join the next live show on September 9th at 8 PM CET 📆 👇

Join us for our EUVC Syndicate dinners 🥂

We can’t start this without inviting you to join us at TechBBQ as we’re putting together an EUVC syndicate dinner at Day-1 (i.e. Wednesday the 14th) 🥳

You’ll get to experience the power of LP syndicates first-hand as you’re seated with the best European early-stage VCs & angels while partaking in a lively roundtable discussion on pan-European investing - with 500 Global & Startup Wise Guys in the hot seats.

All while being treated to an amazing private dinner in the cellars of Les Trois Cochon (yes, 3x 🐷 … Copenhagen is hipster, even in French).

Afterwards, we'll go for drinks before heading on to byFounders' after-party (note: remember to register for this separately on eventbrite!

Not at TechBBQ? We’ll repeat the success at the following tech conferences:

Budapest in connection to How To Web (Sept. 20 - 21)

Prague in connection to Engaged & Disraptors (Oct. 10 - 11)

Lisbon in connection to WebSummit (Nov. 1-4)

Join the EUVC Syndicate for first dibs 👇

How to build an accelerator-VC fund?

We’re diving deep with Alexa Balkova, partner and head of portfolio at Startup Wise Guys on Monday 5th at 3 PM CET. Join us or watch the replay here.

Let’s face it. I the current market turmoil, web3 has only gotten more fascinating to the casual observer - 100 million euro pre-everything rounds, lay-offs, scandals and downright scams. Crypto has everything 🙈 so yet again: crypto steals the show - with a mix of actual educational stuff 🧠 and some of the usual just for giggles 😹

Cherry on NFT lending models

Despite all the hype and media attention, to most of us, true understand of crypto, web3 and blockchain remains elusive. Cherry has taken a good stab at helping us get a fundamental grasp of NFT lending models. Take a sneak peek below 👇

The synthesis of NFTs and DeFi promises to unlock utility for all types of NFTs by enabling their use in a host of financial services. A segment within this space that we’re excited about is NFT-backed lending.

Most loans in DeFi today are either overcollateralized with fungible tokens or un(der)collateralized. NFT-backed lending, as the name implies, is a lending structure that collateralizes loans with NFTs.

NFT Lending Models

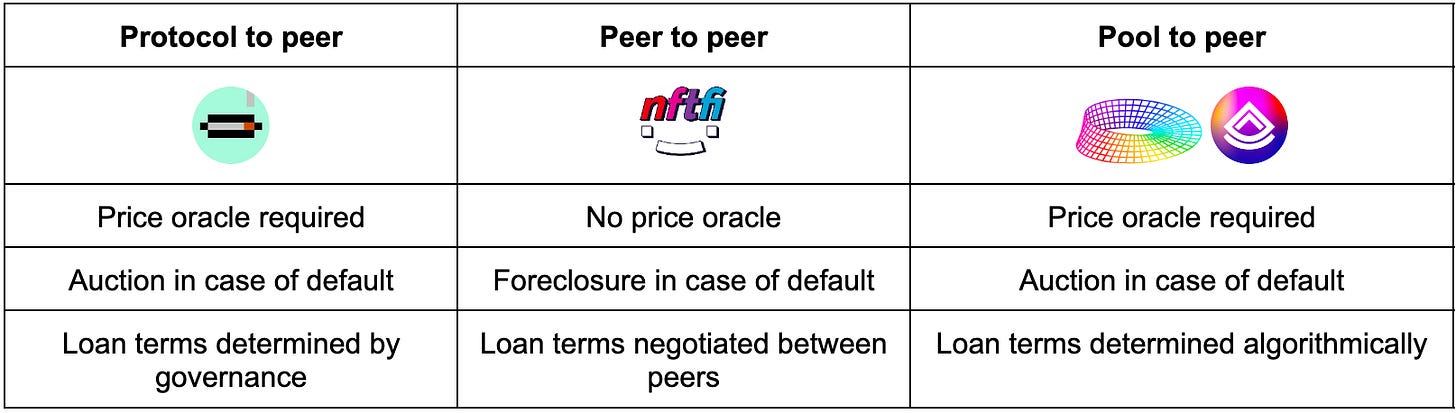

As with fungible token-backed lending, we’ve seen 3 main NFT-backed lending models emerge.

And my favorite section of the article: Why does this matter?

While the thought of having a loan backed by a “monkey JPEG” can seem gimmicky, the implications are profound.

First off, the experience of taking out an NFT-backed loan is far superior to the cumbersome process of taking out loans backed by a physical asset. Visits to a bank branch, lengthy paperwork, and the logistics of dealing with physical assets are replaced with a few clicks at the computer. As we spend more of our time and money online, new rails need to be established that unlock utility for all digital assets that represent an ever-increasing share of our wealth.

Secondly, NFT backed lending won’t be confined to just a subgroup of PFP collections. We’re already seeing RWA (real world assets) such as invoices or mortgages turned into NFTs that can then be used as collateral for loans. Ultimately anything can in theory be represented as an NFT–digital assets like punks or apes, physical assets like property, and intangible assets like credit scores or any other form of reputation.

Another great piece from the thought leaders at Cherry. Thx for making us all a little smarter 🙏

The Ethereum Merge

You’d have to have lived under a 🪨 not to notice there’s something about an Ethereum Merge going on. But what is it and why does it matter? The TL:DR 👇

The Merge is an upgrade to the Ethereum blockchain (fuels the second largest cryptocurrency and other technologies NFTs)

It's expected to take place in September.

Proponents say could boost prices in the long run and significantly change the future of cryptocurrency.

The upgrade will transition Ethereum to the proof-of-stake model, which is a more energy-efficient and environmentally-friendly system.

- Proponents say that the transition will allow the Ethereum network to reduce its energy consumption by around 99%.

The Merge really sets the groundwork for other advancements hoping to be made on the Ethereum network in the future, McCann says. Long term, this could be a "positive catalyst" for ether, he adds.

Whether we’ll see truly groundbreaking innovation come from this it seems we’ll have hold our breath for a little longer. Luckily, we’re well entertained in the meanwhile 🍿🥤.

10.5M$ accidentally transferred (but intentionally spent!)

This one is just for the giggles 👇

Cryptocurrency trading platform Crypto.com accidentally transferred $10.5m to an Australian woman when processing a $100 refund, and failed to notice the error for seven months.

The court heard that $1.35m of the money had been used to buy a four-bedroom home in Craigieburn in Melbourne’s north in February, and the ownership of the property was then transferred into the name of Manivel’s sister, Thilagavathy Gangadory, who lives in Malaysia.

While the misuse of next gen tech can be captivating, this article had me reminded of Alexander Lange’s unwavering commitment to remind us that fraud, fakes and other illegalities in crypto only make up a fraction of the activity in the space.

Yet again, it seems that the misbehavior of a small fringe might draw the attention of all of us. We know how the story goes and we’re at risk of ending up with another set of misconceptions dominating the common public’s views of something brave & new.

What the hell is going on. And maybe more importantly; what is going to be going on? 🤔 We try and make a bit of sense of the news in this spot. Let’s see where we get to…

Forcing a recession - WDYT?

First thought when seeing this is: how does what happens in the US matter to us in Europe? Dan gave us his thoughts:

Powell is basically saying that they will force a recession which will create the right circumstances for calming the economy down. And this will have a deep impact on client behavior which for sure will travel to Europe and startups in Europe need to be mindful of that - and preempt it.

And continues:

I think the first thing we have to consider is the impact on client behavior and not necessarily the investor group’s behavior. If you’re in startup mode and selling to clients that are up against inflation, rising interest rates and are in fear-mode, I think you need to pay close attention.

What do you think? Tag us wherever on LinkedIn and we’ll for sure join the discussion!

Another round of layoffs - what does it all mean?

In the Startup Lowdown show, Dan opened this segment by saying “I think the thing is that Snap just aren’t the cool kid anymore”. Check out Ryan Broderick at The Information’s take on it:

Unfortunately, the same weirdness that has fueled its pipeline of innovation may have also become a liability. As it enters its second decade, Snap Inc. (Snapchat’s parent company, which incorporated in 2016) finds itself at a crossroads—a more dangerous one, perhaps, than it has ever faced […] The downturn has led Spiegel to a moment of truth unlike any he has faced before. He might even have to decide, once and for all, what kind of company Snap actually is: Is it a messaging app? A social platform? An augmented reality incubator? A hardware company?

To read a thorough work on Snapchat’s current perils, I highly recommend this piece.

But again, what does this matter for the rest of us? Dan weighs in:

Any startup seeing these headlines and think about how to survive this dislocation and disruption of the times need to consider how they cut back but also how they set the metrics to grow […] Snap coming out saying they’re losing 20% of the workforce has a big hidden segment that isn’t said explicitly in much of the news coverage.

The question is: is Snap laying off 20% of their work force just another tech giant coming to terms with realities - and the current market is just lending a hand in getting c-suites to face it?

The demise of Venture Capital - or not?

The non-VC specialized press (yurk! 🤢) has featured various scribbles on the demise of the VC model (software not being protectable, the big wins of winters past being gone, etc) but here’s a piece from our beloved specialized press The Information calling bullshit:

[S]uggesting that these changes represent a permanent structural shift in the fundamentals of venture is ludicrous. If, say, a restaurant chain were underperforming, would we say it’s because the restaurant model is flawed? Or would we not first guess that the restaurant needed to serve better food?

Instead, Del zeroes in on the biases of the industry:

When presented with clear data on their own ineffectiveness, venture capitalists often resort to quibbling with minutiae such as the research design of individual studies, or inaccurately accusing researchers of neglecting to consider the power law’s exponential effects. But the body of research demonstrating their flawed thinking is overwhelming.

Also taking a deserved swing at LPs:

It’s not just venture capitalists who are backing the wrong people—it’s their investors as well. As Ryan Hoover, Weekend Fund’s general partner, wrote last month, “The key to closing a first fund is to build credibility through social validation,” expanding your network via friends and friends of friends until you’ve become the ultimate insider. But if the best founders tend to be differentiated outsiders who challenge consensus thought, it follows that the best investors would be those best positioned to recognize the latent value in nonconsensus ideas and not-yet-ripe markets.

This made me recall a couple of quotes from Catherine Dupéré and Joe Schorge from Isomer Capital published in the European Women in Venture Capital:

When we invest in VC funds, we scrutinise team composition and dynamics. We expect to see fair practices evidenced in DEI and ESG policies — and most importantly, confirmed by founder references […] We also need to examine our own teams and processes, from hiring, deal sourcing and relationship building to decision making. Are we giving everyone an equal chance? Do we ask important and consistent questions to prospective and portfolio investments? Are we leading by example? How can we do better? "

Joe backing this up 👇

"We need to push for transparency and strong policies to create equal opportunities for development and promotion. VC firms with lasting success are those that carefully build the next generation of investors and consciously open the partnership to a diverse range of genders, ages, ethnicities, life experiences, and socio-economic backgrounds. We’ve all got more work to do. "

Navigating GP-LP relationships in the current market

SS&C, Intralink and Privatequitywire have put out a report on navigating GP/LP relationships and the temperature in the market. The TL:DR 👇

The outlook for growth in the PE space is encouraging as LPs move beyond the barriers created by the COVID-19 pandemic as well as an array of headwinds including inflation, talk of a looming recession, rising interest rates, the Ukraine conflict and supplychain challenges.

Hesitance around virtual due diligence processes has faded as LPs hire new managers they have not yet met in person.

On the ESG front, Europe continues to lead the charge. However, North America is hot on its heels when it comes to diversity and inclusion as investor consciousness around these issues is rising.

GPs, LPs and service providers that have endured the challenges of the past two years have emerged with stronger processes, more robust business practices and deeper client relationships. LPs and GPs have adapted to the new environment and have found new ways of interacting that are beneficial to all parties involved. This shift is resulting in an industry that is more nimble, efficient, effective and collaborative.

And what better than a visual slide to wrap that up? 👀

Obviously, a topic close to our heart as we’re pioneering LP syndicates to connect European GPs to powerful investors all across the continent (✊). This week we dived into it a bit on the back of Sifted’s article 👇

Syndicates are the hot new trend (oh really?)

First of all, whether it’s “new” or “a trend” and not just a natural development of the ecosystem and something that’s in fact been going on pretty much forever in the ecosystem is something that can be argued (🤷♂️) but that’s not the point we wanna make.

Firstly, it’s amazing that the infrastructure in Europe is finally getting to a point where deals can be made quickly, efficiently and with pretty much as many investors as you want (#THX Vauban, Odin, Bunch, and all the rest of you who are responsible for us seeing a new entrant into that market every day). @Angels out there still putting together SPVs with your lawyer and managing the co afterwards, reach out if you’d like to get plugged in 💝.

Secondly, an actual NEW trend is that we’re starting to see syndicates being built into VC funds. Some do it themselves, some do it with the fresh new platforms (some love for Carbon Equity and Further from our side) and some do it with us.

It’s incredible to see the caliber of people we see joining us in the EUVC syndicate.

👷♀️ >50% are Founders & operators.

👼 >40% are VCs & angels.

🏆 >20% are Ecosystem champions.

💰 >10% are Limited Partners & Fund-of-Funds.

And they all report joining us for three simple reasons:

🤝 To build network and relationships across Europe.

📖 To build insights & skills.

🤑 To get exposure to the asset class that we all love

What can we say? We just love seeing the European digital Sand Hill Road being created 😍

This week saw the feature of two amazing VCs with each a 100M€. Check them out and remember to ping us if you wanna nominate someone for this spot 💌

Inovo

Who doesn’t love a Notion-built website? 😍 #respectthehustle

Especially, checkout

Green Generation Fund

Founded by two female GPs, Janna Ensthaler & Dr. Manon Sarah Littek, announced their 100 M€ fund last month. Let’s hear it from them:

Our actions in the next three years will define how we will live as humankind in the decades and generations to come. It’s a turning point to a liveable future and we believe that the solutions will be found in disruptive innovations and bold moves from strong entrepreneurs in the field of green tech and food tech. We want to select and back these entrepreneurs and be part of the solution.”

Dr Manon Sarah Littek to EU Startups.

And from Janna.

“I am convinced that we can make the German and European economy fit for the future, above all, by identifying the ecosystems of the future today and then building them up as quickly as possible in competition with other regions of the world and occupying them for ourselves. Our food tech and green tech investment categories are two of the most important future industries of the coming decades.”

Janna Ensthaler to EU Startups.

Read the original announcement here.

Who’s hiring?

An entirely incomplete list, but this week we had spoken to some friends hiring, so we wanted to feature it. Ping us if you’d like the same 🙏

We're building the go-to place to access the hottest European VCs at radically lower tickets than ever before - come join us! ✊