EUVC newsletter - 02.06.2025

Fierce debates, solo GP wisdom, fundraising gems, and AI-driven consumer insights—this week has it all!

Editor’s note:

OMG—I usually try to stay humble, but this week's lineup is just too good not to brag a little! Sorry, but YIKES, it's a great one.

First up, "Size Matters—or does it?" This fierce debate on fund sizing at the EUVC Summit had the room absolutely buzzing. Exactly the kind of vibrant, provocative discussions I dreamt of when we built the summit.

Then, we have a special check-in with Finn Murphy, diving deep into the journey of making it as a solo GP. Finn is an original character through and through—always insightful, never dull.

Very much in the same inspiring vein, we sat down with Etienne from Intuition to explore the future of consumer markets in the age of AI, enriched by lessons from his professional sports career. Absolutely fascinating.

And, don't miss another brilliant installment of our Fundraising Dialogues, featuring LP Evan Finkel alongside the ever-engaging Carmen Alfonso Rico from Cocoa. Honestly, even I find myself replaying these conversations—they're that good.

Plus, in case you missed it, last week we announced the EU CVC Summit happening at TechBBQ this year. Super excited for this gathering of corporate venture minds and innovation leaders. Make sure you're there!

with 💖 Andreas & David

Table of Contents

🎧 Podcasts of The Week

LP / EUVC Summit: Size Matters — or does it? The Great LP Debate

VC: Kasper Hulthin on Breaking the “Better” Myth & Building Food for the Many

GP: Finn Murphy on Nebular, Going Solo, and Why the Next Great VC Firm Starts with You

VC: Cyril Gouiffès on What It Takes to Be a Real Impact Fund Manager

VC: Etienne on Intuition, Going Deep on Consumer, and What Founders Can Learn from Pro Athletes

✍️ Insights Article of The Week

Central & Eastern Europe: The Next Frontier for VC & Startups

The new warfare: fast procurement, focus, and robots – Eveline Buchatskiy (D3 VC)

Join us for the inaugural EU CVC Summit at TechBBQ — the place where corporates meet venture | August 26 - 28, 2025 in Copenhagen

We’re bridging the worlds of VC & CVC like never before. During TechBBQ in Copenhagen, we’re launching the first-ever EU CVC Summit—blending our signature fast-paced, no-fluff EUVC summit format with intimate deep-dive roundtables.

🎟️ One ticket = access to EU CVC Summit + full TechBBQ days → grab it here.

🔥 Founders on stage:

Heini Zachariassen (Vivino), Kasper Hulthin (Podio & Peakon), Herman Haraldsson (Boozt), Bjarke Ruse Sejersen (Go-Autonomous)

🏢 Top CVCs & Corp Innovators:

Gina Domanig (Emerald), Nicolas Sauvage (TDK Ventures), Mike Smeed (Jaguar Land Rover’s InMotion Ventures), Alokik Advani (Fidelity), Crispin Leick (EnBW), Katharina Poehlmann (Maersk), Marcus Behrendt (BMW iVentures), Nicole LeBlanc (Woven Capital (Toyota), Petr Mikovec (CEZ’s Inven Capital), Georg Reifferscheid (REWE) as well as execs from Novo Nordisk, Terma, Ørsted, PwC, Carlsberg, GN, BEUMER, Chr. Augustinus and many more.

💸 VCs shaping the future:

Fred Destin (Stride), Hampus Jakobsson (Pale Blue Dot), Christian Tang-Jespersen (ACME), Samuli Siren (Redstone), Sebastian von Ribbentrop (Join Capital), Thijs Povel (Dealflow)

🎓 Academic minds:

Charlie Wayward (Global Corporate Venturing), Francesco Di Lorenzo (CBS)

🌊 This one’s gonna make waves. Don’t miss it. grab your tickets here.

🎧 Podcasts of The Week

Size Matters — or does it?

At the EUVC Summit, a high-energy panel cut through the noise on venture economics—trading fund performance hot takes for sharp insights on the messy mechanics behind early-stage investing.

From the role of fund size in shaping returns to the misunderstood math of emerging manager outperformance, panelists tackled big questions: Why $20B is the new benchmark, how attrition skews Seed-to-A outcomes, and why LPs value access as much as alpha. The verdict? Venture isn’t built on averages—it’s built on outliers. And if you're still clinging to "Top 10" rankings without understanding incidence math, you might be missing the point entirely.

Google — Start building today with GCP and receive from $2k to $350k in Google Cloud credits

Günther & Enrique on Redesigning Capital for Circular Futures & Europe’s Systemic Sustainability Shift

In this episode, Andreas Munk Holm is joined by Günther Dobrauz-Saldapenna and Enrique Molina from Chi Impact Capital to explore how capital can be deployed with purpose to accelerate the circular economy. From personal stories to portfolio-level insight, this conversation shows how values-based investing can be compatible with venture returns.

Günther and Enrique unpack the urgency of systems change, how storytelling shapes capital flows, and why they believe Europe’s sustainability movement is at a critical inflection point, despite the headwinds.

Here’s what’s covered:

02:18 Chi Impact Capital’s Holistic Investment Thesis

03:27 Günther’s Journey: From PwC to Circularity Champion

05:34 Why Capital is the Catalyst for Circular Innovation

06:37 Narratives, Regulation & the Sustainability Backlash

08:50 Storytelling, Identity & Investment Decision-Making

13:30 What ‘Conscious Capital’ Really Means

17:17 Case Studies: OceanSafe, Vital & ID Genève

22:53 Designing Products for Reusability & Impact

25:41 The Financial Returns Behind Circular Success

29:45 Tensions in Consumer Behavior: Circular vs. Fast Fashion

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Brought to you by Affinity – Exclusive dealmaking benchmarks

What can Affinity data on almost 3,000 VCs from 68 countries reveal about how VCs performed last year and how dealmaking will continue to evolve?

Kasper Hulthin on Breaking the “Better” Myth & Building Food for the Many

In this episode, Andreas Munk Holm talks with Kasper Hulthin, co-founder of Kost Capital and Future Five, to unpack what it takes to build food startups that change the system. Kasper argues that creating better food is not about crafting the perfect health product for the elite, but about designing for impact, scale, and real-world distribution.

They explore why traditional VC models often fail food startups, how founders can balance purpose with platform thinking, and what it means to move beyond “more alternatives” into a world of more and better.

Here’s what’s covered:

00:45 – Why “more” food options don’t always mean “better”

03:30 – Why optimizing for Whole Foods isn’t a scalable strategy

06:20 – The ketchup analogy: exclusive vs. inclusive innovation

10:15 – Scaling challenges: distribution, regulation, perception

14:05 – What founders miss about consumer routines

17:50 – Building platforms, not just products

21:10 – The role of storytelling in transforming food narratives

25:00 – What “better” really means: nutrition, access, equity

Make an impact with the bank made for the innovation economy

We know building relationships and building businesses go hand-in-hand. With our sector expertise and tailored solutions, we’ll connect you with what’s next.

Jeremy Uzan on Chasing Pure Performance, Generalist VCs & Why Europe is Ready for Science-Driven Founders

In this episode, Andreas Munk Holm is joined by Jeremy Uzan, co-founder and GP at Singular, for a look at how a “plain vanilla” approach to venture—driven by deep founder focus and relentless performance orientation — can be a powerful advantage.

Jeremy also shares his evolving views on European talent, the rise of Paris as a startup epicenter, and why he believes we’re only just beginning to unlock the entrepreneurial potential of Europe’s scientific minds.

Here’s what’s covered:

02:00 – Should Generalist VCs Still Exist in Europe?

07:10 – Fundraising Like a Founder: How LPs Backed Fund I and II

14:00 – Why Generalist Isn’t a Weakness—It’s Strategic

16:25 – Diversification vs. Focus: Squaring LP Needs with Performance

21:15 – Temporary Specialists: Sprinting Deep Into Sectors

24:20 – From Zero to One on Markets: Learning via Founders

27:15 – European Talent Post-COVID: What’s Changed

30:00 – Paris Joins the Core of the European Ecosystem

35:15 – The Rise of Science Entrepreneurs in Europe

39:00 – Why Bio is the Next Big Tech Frontier

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Where operational expertise and innovation work for you.

End-to-end coverage of Fund Admin, Tax, Accounting, Compliance, ESG, and more—enabling you to focus on what matters most: supporting visionaries and maximizing LP returns.

Finn Murphy on Nebular, Going Solo, and Why the Next Great VC Firm Starts with You

In this episode, Andreas Munk Holm sits down with Nebular GP Finn Murphy. From launching Nebular after FTX’s collapse to backing AI, data centers in space, and fossil startups, Finn shares the unpredictable and highly personal journey of building a fund from scratch. A manifesto for curiosity-led investing emerges, as does a bold vision for reshaping European venture and policy.

Here’s what’s covered:

01:25 Leaving Frontline, Launching Nebular, and Solo GP Life

03:45 Fund One in the Nuclear Winter of VC Fundraising

06:30 A Thesis of Curiosity: No Theme, Just Timing, Talent & Tails

09:50 From Healthcare Ops to AI Teddy Bears to Fossil Markets

16:10 Strategy Drift, Authenticity, and Embracing the Unknown

18:30 Being a Solo GP Without Being Alone

21:00 How Long Can You Be Great? A Venture Career as Athletic Peak

27:30 Europe vs. US: Talent, Incentives, and Risk Appetite

35:40 Project Europe, EU Inc & Why Attitude Is the Real Bottleneck

44:00 Yes, Tech Should Get Political

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

From flexible fund structures to seamless reporting, Mara makes raising, onboarding, co-investing, and LP reporting effortless. They’re doing it for us, reach out if we should connect you.

Cyril Gouiffès on What It Takes to Be a Real Impact Fund Manager

In this episode, August Solliv and Douglas Sloan speak with Cyril Gouiffès, Head of Social Impact Investments at the European Investment Fund (EIF), to explore what distinguishes authentic impact fund managers from the growing crowd. From team composition and investment discipline to LP expectations and impact integrity, Cyril shares a candid perspective shaped by years of experience at the intersection of public capital and private markets.

Together, they unpack what EIF looks for when backing emerging impact managers, why team dynamics matter more than ever, and how the market can defend against “impact washing” as the sector matures.

Here’s what’s covered:

01:00 – Why Cyril’s early influences shaped his mission-driven investing lens

04:15 – From altruism to efficacy: lessons from failed NGO models

06:20 – The rise of genuine dual-performance funds post-2014

08:45 – Why team quality is the #1 differentiator in impact VC

17:30 – EIF’s role in supporting first-time, emerging managers

20:10 – Why impact metrics must tie to the business model

23:15 – The dangers of forgetting your impact thesis post-fundraise

26:00 – Impact failures vs. financial failures: lessons learned

28:00 – Why LPs must stay engaged beyond the fundraising stage

33:15 – State of fundraising: too many funds, not enough capital

35:20 – The call for impact pioneers: back to the original thesis

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation on the Spotify/Apple episode🎧

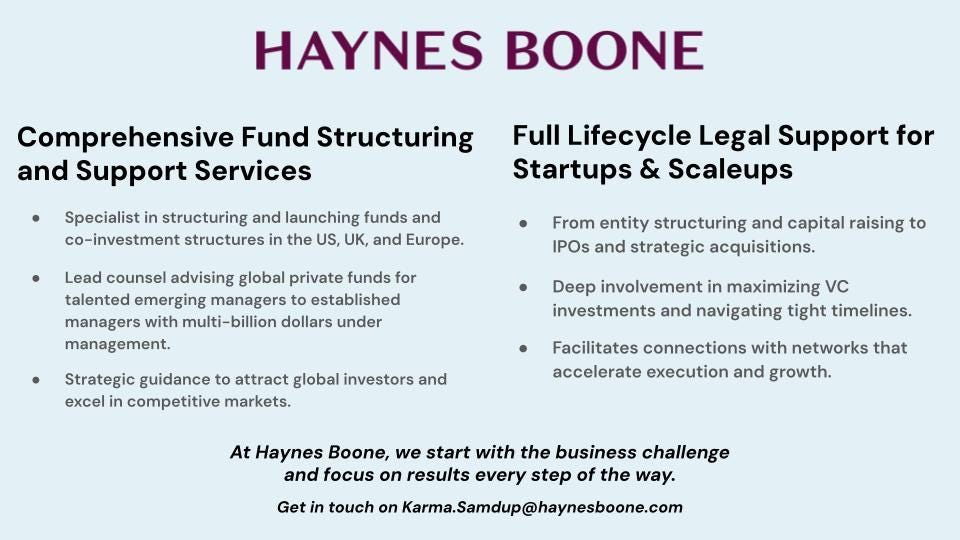

Haynes Boone brings deep expertise in fund structuring and full lifecycle legal support for VCs, GPs, LPs, and startups across the US, UK, and Europe. As trusted advisors to emerging and established fund managers alike, they know what it takes to build and scale in competitive markets, making them the perfect backers of this high-caliber award.

Whether you're launching Fund I or navigating late-stage growth, Karma, Vicki, and the team at Haynes Boone are ready to help you.

Evan Finkel, Carmen Alfonso & Andreas Munk Holm on Fundraising Fog, LP Red Flags & the Real Meaning of “Edge”

In this episode of the EUVC podcast, Andreas Munk Holm is joined by LP Evan Finkel and Cocoa’s Carmen Alfonso to explore the gritty, unvarnished truth about what it takes to raise a venture fund today. They unpack the fundraising myths that mislead first-time GPs, the pitch deck traps that instantly raise LP eyebrows, and the misunderstood concept of “edge” that too often becomes just another slide.

Together, they dive into the uncomfortable but essential lessons that don’t get talked about enough—why brutal feedback is a gift, why preparation is a differentiator, and why your real superpower probably doesn’t look good on LinkedIn. From fake timelines to founder references and chocolate brand storytelling, this one’s for every emerging manager looking for clarity in the fog.

Here’s what’s covered:

03:04 Why Brutal Honesty in Venture Matters More Than Ever

05:44 The Myth of the Effortless Fundraise (and Who It Hurts)

08:04 Preparation Is a Superpower—Not Just Talent

12:48 What LPs Want to Know

16:23 The VCX Framework: Edge ≠ Thesis

19:55 Superpowers Are Personal—Not PR

26:58 The Case for Being an Outlier (or Not Doing VC at All)

30:22 How LPs Evaluate GPs on Call #1

35:47 Red Flags in Decks That Make LPs Cringe

41:52 Polish vs. Substance: What the Deck Signals

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

Etienne on Intuition, Going Deep on Consumer, and What Founders Can Learn from Pro Athletes

In this episode, Andreas Munk Holm sits down with Etienne, co-founder and GP at Intuition—a new €10M fund focused on pre-seed and seed investments in consumer, prosumer, and B2B2C startups across Europe and the US. From chasing the NBA dream to raising a fund for overlooked sectors, Etienne shares the founder's journey behind the fund, his obsession with AI-native products, and why consumer investing needs a new generation of believers.

Here’s what’s covered:

02:20 From Pro Basketball to Founding Intuition

05:11 Discipline, Resilience & Pain Tolerance: The Athlete’s Edge

08:30 Why Obsession Beats Talent Every Time

13:13 Recalibrating After Burnout: Life Beyond the Grind

19:13 Why Building a Fund Is Just Another Startup

24:41 Building a Portfolio to Survive Volatility

36:46 The Return of the Capital-Efficient, Profitable Company

41:14 Why Intuition Plans to Stay Small (on Purpose)

46:00 Create Like a God, Connect Like a Human: The New Founder Paradigm

50:11 Multitask or Die: Surviving in the Agentic Age of AI

📺 Watch the episode here or stream it on Spotify or Apple Podcasts—now with chapters for easy navigation 🎧

🧠 Insights Article of The Week

Central & Eastern Europe: The Next Frontier for VC & Startups

From Bucharest to Budapest, Warsaw to Vilnius — Central and Eastern Europe is buzzing with entrepreneurial energy. The region’s mix of technical talent, lean operating models, and global ambition has quietly laid the foundation for what could be Europe’s next big venture story.

But are we paying attention?

In this report, Eleven Ventures and JEME Bocconi dive into:

🌍 Why CEE startups are born global — and what that means for scale

🧠 How engineering-heavy teams are building deep, defensible tech

💸 The funding gap: Why international capital is flooding in, and local VC still lags

📉 Legacy risks: From brain drain to unstable policy environments

🚀 What it will take for the region to reach escape velocity — and why now is the moment

The New Warfare - Fast Procurement, Focus, and Robots

In a world where battlefield innovation often lags behind boardroom ambition, Ukraine is rewriting the rules. At the heart of this transformation is D3 Venture Capital, a Ukraine-focused early-stage fund led by Eveline Buchatskiy, former VP of Special Projects at airSlate and a resolute believer in the power of engineering to defend democracy.

Want to learn how a top LP navigates the industry? Join us on 12th June at 12 PM - 1 pm WEST for an exclusive AMA session with Daniel Keiper-Knorr.

Daniel is a founding partner at Speedinvest, where he leads limited partner relations and fundraising at both the fund and portfolio levels. With a career spanning investment banking, entrepreneurship, and venture capital, he started as a stockbroker and private banker at Erste Bank in Vienna and Credit Suisse in Zurich before transitioning into the startup world.

As a co-founder of 3united, he played a key role in its growth and eventual acquisition by VeriSign.

Since 2007, Daniel has been an active angel investor, bringing hands-on expertise in sales and business development to early-stage ventures. In 2011, he co-founded Speedinvest, leveraging his extensive experience to support founders and drive investment success.

↓ Register below to attend ↓

Such a 🔥 line-up!