EUVC Newsletter | 24.01.23

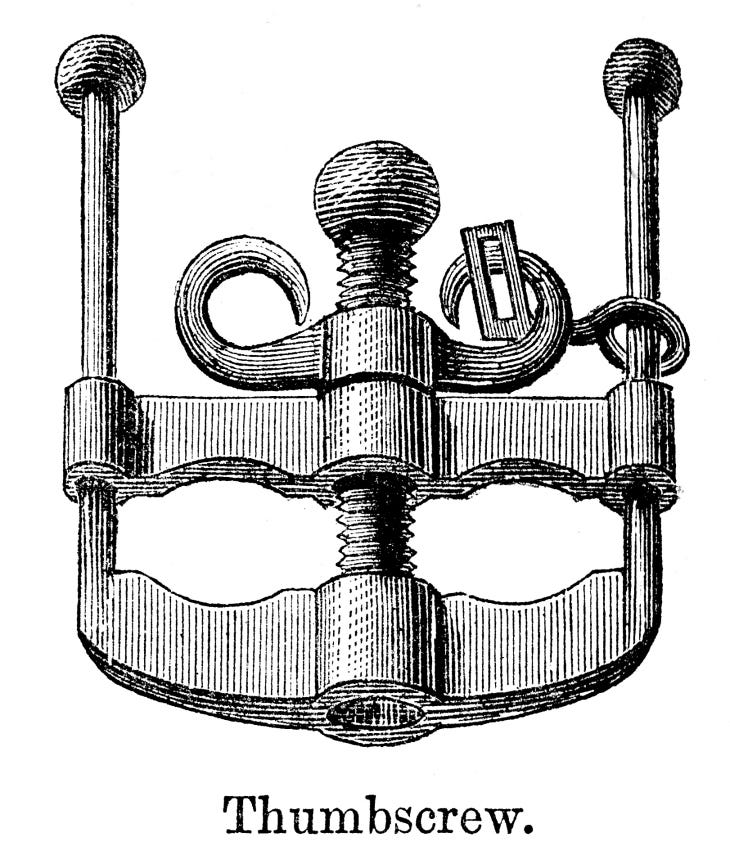

Will European LPs turn on the thumbscrews? How can angels leverage LP syndicates, and how to learn, help and cope in portfolio company shutdowns. Read on for this and much more 👀

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

And a heartfelt welcome to the 153 newly subscribed venturers who have joined us since our last post! If you haven’t yet subscribed, join the 7,406 angels, VCs and LPs 👇

And help us connect European venture by sharing the below super promotional pre-written email with your friends 💖 we’ll buy you a 🍻 next time we meet for it!

Do ping us if you have news, opinions or memes you want us to share. We’re here to connect & amplify the European Venture community 📣

Table of Contents

Hotlinked table of contents for your pleasure and ease below - click-away!

⌛ This afternoon VC Exclusive: Track Record Deep Dive with Michel Geolier, CEO of Betterfront

Affinity Campfire Conference Berlin

#147 Annie Theriault, Cross-Border Impact Ventures

#146 Michiel Kotting, Northzone

#10 Developing sustainable cities - a founder’s view - Natalia Rincón, CHAOS

Angel LP Syndicate Insights💸

What are Angel LP Syndicates?

Pacenotes participates in Series C round of Anyfin

Ending a dream 😢 Learning how to do it differently

Will European LPs turn on the thumbscrews? 🤔

3 reasons why CEE is in it’s prime 📈

Hack for your Stack 🖥️

Gravity is the only all-in-one platform with billions of data points on founders and startups that help you stay one step ahead of the technology trends, funding insights, and companies and founders you need to know.

Unlike other data providers, Gravity tracks new company launches and all funding events each month while diving deep into the key insights around the founders of these companies in an easy-to-use dashboard that helps you uncover their FounderDNA™ - founder characteristics such as prior exits, past experiences and much more!

They also include all founder contact info so think of them like Pitchbook + LinkedIn + ZoomInfo but for early stage founders no one knows about.

For all EUVC readers, feel free to sign up for free and take advantage of the 14 day free trial!

This week’s events 🥳

THIS AFTERNOON 👉 VC Exclusive: Track Record Deep Dive with Michel Geolier, CEO of Betterfront

Tue, Jan 24, 2023, 3:00 PM - 3:45 PM

Join us for a true deep dive on how to create and present your track record as a VC with Michel Geolier, founder of Betterfront.

We will cover everything from:

🤔 Why track records are so important

💾 What data's required

📈 What the track record should cover

⛔ Top 3 mistakes made by VCs

🧙♂️ Why storytelling is key and how to compensate for a thin record (so far).

About Michel & Betterfront:

Michel is the CEO and co-founder of Betterfront, a B2B vertical SaaS company dedicated to private markets. Previously, Michel led due diligence and fund managers selection for the Siemens’ pension fund. He started Betterfront out of his frustration of poor alternative investment analytic solutions.

Affinity Campfire Conference Berlin

Date February 28, 2023 | Venue Factory Berlin Görlitzer Park

Lohmühlenstrasse 65, 12435 Berlin

Have you wondered how some dealmakers remain successful in the face of a shifting market? Register today and see what Affinity's Relationship Intelligence event, Campfire Berlin, has in store for you on February 28!

This week’s podcasts🎧

The European VC,#147 Annie Theriault, Cross-Border Impact Ventures

Today we are happy to welcome Annie Theriault, Managing Partner at Cross-Border Impact Ventures (CBIV), an impact venture capital firm investing in health technology companies addressing large international markets. Cross-Border focuses on expanding access to world class technologies within North America and Europe as well as to reach people living in emerging economies. Prior to founding CBIV, Annie worked with high impact companies to mobilize more than $100 million in non-dilutive capital as a venture capital investor and advisor.

In this episode you will learn:

How come Cross-Border is one of the funds selected for the Innovative Funds at WEF and what's to come on the Program

Why the only way to make money is with great co-investors

And why any VC telling you they did it all by themselves is full of sh*t

The European VC,#146 Michiel Kotting, Northzone

Today we are happy to welcome Michiel Kotting, Partner at Northzone, a venture capital fund shaped by lives as entrepreneurs and investors. He leads Northzone’s investments focusing on SaaS, marketplaces, healthcare and AI.

In this episode you’ll learn:

The journey from entrepreneur into VC

How Northzone have managed to be relevant to founders as they’ve far outgrown their Nordic outspring

The importance of culture and why the art of investing lies in mentoring people

What emerging themes Michiel sees coming in VC

How Michiel thinks about the tech crash, Northzone’s role and going forward from here

The UrbanTech VC #10 Developing sustainable cities - a founder’s view - Natalia Rincón, CHAOS

Today we are happy to welcome Natalia Rincón, Co-Founder & CEO at CHAOS, a location intelligence platform that provides urban forecasts and insights. Unlike existing visualizing tools and data platforms, CHAOS applies innovative technologies, like GIS, AI & Machine Learning. Natalia describes herself as a bold, tenacious, passionate professional focused in Smart Cities.

In this episode you’ll learn:

that public & private sides are needed to develop sustainable cities

that many of the hotly debated urban planning concepts have been around for decades

why it’s relevant if rich people to ride public transport (or not)

why a business stops growing when it stops innovating

GIFs & Memes 🙊

Look at the bright side of the crisis, these days are (somewhat) over 👇

Even the best overpromise. Can anyone depict the Twitter promise? 🤔

Matt Turck puts it well again 👇

Angel LP Syndicate Insights💸

Insights & updates from building Europe’s leading Angel LP syndicate community 🚀 Apply to join the fam 🤗.

What are Angel LP Syndicates?

An Angel LP Syndicate is, simply, a syndicate of Angels formed to invest into a venture fund at lower tickets than the fund’s minimum ticket (normally +100k).

But why invest into venture funds as an Angel? 🤔

We asked the famed angel and by French Media dubbed “The Queen of Tech” Roxanne Varza, that very question:

First and foremost, I do them to learn. And second, I'm obviously hoping not to lose my money entirely. But I do have to be comfortable with the idea that I could.

What I'm doing [with these investments] is that I learn from those investors who are really deploying at a very different level and scale.

Roxanne Varza, Director of Station F

Asked what type of funds she looks for, Roxanne points out that what really matters is that the fund manager will take the time to:

Share their deal flow.

Share their analysis on why they turn one down but invest in another.

Report at a deeper level than just the core metrics.

It’s really been an eye-opener for me. For example, the Web3 fund that I invested in operates in an area that I don’t know really well. So it's been incredible to watch how she's been evaluating the deals she gets. It’s just been amazing.

Roxanne Varza, Director of Station F

At EUVC, we’ve made it our mission to seek out funds with exactly this type of behavior. While also leveraging our joint experience with our good friends at Isomer screening more than 2.680 funds to invest in 63.

Combined, we believe that we can find the best funds to yield true insights and network expansion as well as solid financial performance.

So what’s a typical use case for these syndicates?

Let’s explore two that we meet quite often:

Deepening your expertise and network within a space you’re already investing in.

Extending your expertise and network to a new space - be that vertical or geo.

In case of the first, you’ll likely already know the VC fund you should be targeting. Or at least of them. In this case, you’ll likely be able to reach out to the GP and make sure you’re in the loop for the next fund. And then, in the meantime, make sure the GP has reason to consider you a value-add LP.

The best funds are oversubscribed and don’t take just anyone onboard.

↳ Especially if you don’t want or can’t make the fund’s minimum commit.

↳ In this situation, you’d need earn your right to the cap table

↳ Just as in any hot startup investment🔥.

In case you’re looking to use LP investments to extend your expertise or network to a new space, it’s first about doing some good ol’ market research:

Where do you want to expand to?

↳ Which funds are the leaders in that space?

↳ Which funds have the wanted behavior of sharing deals & knowledge?

↳ What is your path to them and what can you offer them as a Limited Partner?

Unfortunately, this is where the intransparency of venture really comes to the fore.

🤷♂️ Performance can be surprisingly hard to gauge (especially from afar)

😡 Promised behavior doesn’t always equal demonstrated behavior

💰 If you don’t show up with a big purse, many VCs have pretty packed calendars

🚫 In fact, most VCs don’t have vehicles for investors below their minimum ticket.

💖 That’s what we’re working hard to change.

↳ One fund at a time.

↳ One powerful Angel LP Syndicate at a time.

So if you’re looking to leverage LP syndicates to put your angel investing on steroids, don’t hesitate to reach out 💌

And if you know of a VC fund that you’d love to become part of, don’t hesitate to let us know. We’ll help diligence the opportunity and see if we can build a kickass LP syndicate 💸.

Pacenotes participates in Series C round of Anyfin

Led by their portfolio fund Northzone and with participation of Accel, EQT Ventures, FinTech Collective, Augmentum Fintech, Quadrille Capital and Citi Ventures, Pacenotes invests in the Series C round of Anyfin 💸.

Anyfin leads the way towards a more honest financial system by significantly reducing the interest burden through the refinancing of consumer loans at much better terms. Their refinancing product increases the financial well being of many which is especially important now that the cost of living is under lots of pressure throughout Europe.

Jeppe Zink, Partner at Northzone and Board member at Anyfin, comments:

“Overpayment for consumer financial services, fuelled by the opaqueness of the existing financial service industry, is perhaps the most valuable pain point which fintech can solve. Anyfin is addressing this head-on with its re-finance proposition. Customers love their service, making it a leader in the financial wellness category.”

Ending a dream 😢 Learning how to do it differently

Cristobal from the Startup Wise Guys team wrote an important and honest post about shutting down a company and the lessons learned. A worthy read for anyone these days.

For a founder, taking the decision to close your company is probably the most difficult professional life decision.

When that company reached 300k MRR, 100+ employees and raised pre-seed & seed rounds from top VCs, you can imagine the pain level.

Laimonas Noreika • ZITICITY 📦🚴🏼♂️💨 Vytautas Noreika and Karolis Januškas took such decision 6 months ago.

This week we got together VCs and the team to share the lessons learnt. Pure gold 🥇for every startup founder reading this.

Scaling

o Getting revenue at any cost and going after customers' demands might not be worth it, while it is not replicable with other customers and hurts unit economics.o Working with large enterprise customers with their specific demands and negative unit economics very early could kill your business.

§ If you already agreed to such customer — have a process to stop working with them if they are not giving the promised volumes / demand.

o Focus on a vertical and be excellent in one vertical with health economics before scaling.

o Make sure you have product-market fit and unit economics in place before you start scaling. First nail the city/region/country level before you start expanding

Metrics

o Explore deeper the growing metrics. Revenue fast growth is only good if margins grow as well

o Devil is in the details - you need to have very precise cost accounting to understand if and where you are operation profitably or not and where you lose money. Especially if you have heavy operational business, you might not even see that you have negative unit economics if you are not calculating it correctly

o Make sure you have an expert on the business / vertical on the board so it can challenge the investors and founders on tracking the business right and make sure you have a proper metrics session with the board

Organisation

o Sales team needs to be a profit-centre not cost-centre, you cannot scale sales team if you have not reached sales person profitability in the 1-2 person level.

o Right processes with the wrong people wont work

Board

o Have at least a 6 months view on where we want to go as a business so we discuss how are getting there vs just looking at how we did vs budget last 6 months

o For M&A too work you need to have the board helping and focusing, it can be done by the management alone while still pushing the founders to grow

Funding

o Failed next round should alert to going deeper into due diligence to find out what's wrong

o Make sure the angels that join funding rounds are willing to lose the money and stay for the long run. Have the discussion upfront

Smiling at the end of this journey & having all your investors (which we. All lost quite a bit of money) at the table is only possible when you did everything you could.

We would have loved for a different Finale but it has been an amazing 5 years journey, thanks guys.

“The EUVC team has figured out how venture works and what lacks in our market. With EUVC you can invest in a diversified portfolio across the best funds in Europe while becoming part of a value-add community that gives you the chance to get real close to the assets and learn from what would otherwise be a purely passive investment. I really like this strategy, and I think it’s the ideal way to get exposure to venture asset class.”

This week’s stories 🗞️

Will LPs turn on the thumbscrews? 🤔

TechCrunch put out a great article asking the question if LPs will turn on the thumbscrews, now that the market has changed. As they note, the last years’ bull run definitely led some VCs to pressure LPs to accept some creativity on terms. So now, with the tables turned, will LPs do the same? 🤔 TechCrunch asked US LPs, so I asked European LPs. Read on to find out.

Weird terms.

TechCrunch: According to one limited partner, in recent years, so-called “time and attention” standards — language in limited partner agreements meant to ensure that “key” persons will devote substantially all their business time to the fund they are raising — began to appear less and less frequently before vanishing almost completely. Part of the problem is that a growing number of general partners weren’t focusing all their attention on their funds; they had, and continue to have, other day jobs. “Basically,” says this LP, “GPs were saying, ‘Give us money and ask no questions.'

Let’s hear what the European LPs say:

James Heath, Dara5: Some of the best in the game have provided excellent returns to LPs with the tried and tested 2/20 model. Any fund trying to deviate from this, whether it’s increasing the management fee during the investment period, or a ratcheting performance fee, is an immediate orange flag for LPs. Backs are up against the wall and there will be a significant increases in the scrutiny of other pillars. There is enough in 2/20 for everyone to be a winner - why try to get creative with a winning model?

What is more, some GPs recycle management fees to being part of the GP commit, which I am, overall, open to. Generally, the bigger the GP commit, the more skin in the game and therefore the more comfort in the investment opportunity. We have seen cases of management fees being part waived to be part of the GP commitment - skin in the game is still there and this will help diversify the access of becoming a GP

Chris Wade, Isomer Capital: (Remember) at Isomer we invest in early stage some incubated some emerging and some just very investabable. We typically spent +6 months getting know a GP team and we have a good sense on what motivates the team. In most cases the mangers are building their net worth by building a successful fund and I would say they are very focused on the day and night job.. PS If your relying on “time and attention langague then you backed the wrong team .. IMHO.

Stephan Heller, AQVC: Definitely agree here. Especially with the emergence of the ceo/founder + vc funds. Focusing on lead/co-lead managers, we think that this is not scalable or sustainable for the long term. We expect all the partners to be fully committed to the success of the firm.

Disappearing advisory boards.

TechCrunch: A limited partner says these have largely fallen by the wayside in recent years, particularly when it comes to smaller funds, and that it’s a disturbing development. Such board members “still serve a role in conflicts of interests,” observes the LP, “including [enforcing] provisions that have to do with governance,” and that might have better addressed “people who were taking aggressive positions that were sloppy from an LP perspective.

The European LP perspective:

Chris Wade, Isomer Capital: We sit on the LPAC of 90% of all fund commitments. Rarely are the conversations about conflicts and governance and in most cases these topics are handled realtime via email. LPAC’s in, our view, are an opportunity to debate fund strategy and evolution, provide market input and, in general, be a sounding board for the GP. That said we constantly remind ourselves what the L stands for in the discussions and debates.

Stephan Heller, AQVC: We haven't seen the behavior described by TC yet, but such a development is a deal breaker for us. Not only that, but we also expect that there be at least one or two institutional investors on the LPAC.

Hyperfast fundraising.

Tech Crunch: Many LPs were receiving routine distributions in recent years, but they were being asked to commit to new funds by their portfolio managers nearly as fast. Indeed, as VCs compressed these fundraising cycles — instead of every four years, they were returning to LPs every 18 months and sometimes faster for new fund commitments — it created a lack of time diversity for their investors. “You’re investing these little slices into momentum markets and it just stinks,” says one manager, “because there’s no price environment diversification. Some VCs invested their whole fund in the second half of 2020 and the first half of 2021 and it’s like, ‘Geez, I wonder how that will turn out?'

Let’s hear the what the EU LP take on this is.

Chris Wade, Isomer Capital: Well if you assume normal fund durations I think we can bet how that will fund will work out!! I think the comment in TC is a fair comment and we at Isomer sincerely hope that we have returned to 3-4 year fund cycles. I’d also add to the comments above that a longer investment period enables greater reflection on investment decisions and act as an antidote to the now infamous FOMO.

Stephan Heller, AQVC: Naturally given the slowdown we're going to see fundraising cycles going back to 3 years, maybe a bit shorter but the 12-18 month deployment periods are over.

Bad attitudes.

Tech Crunch: According to several LPs, a lot of arrogance crept into the equation. (“Certain [general partners] would be like: take it or leave it.”) The LPs argue that there’s much to be said for a measured pace for doing things, and that as pacing went out the window, so did mutual respect in some cases.

Only one in our EULP panel had anything to say to this and it was surprisingly concise 👇

Chris Wade, Isomer Capital: Venture capital is a humble business, period.

Opportunity funds

Tech Crunch: Boy do LPs hate opportunity funds! First, they consider such vehicles — meant to back a fund manager’s “breakout” portfolio companies — as a sneaky way for a VC to navigate around his or her fund’s supposed size discipline. A bigger issue is the “inherent conflict” with opportunity funds, as one LP describes it. Consider that as an LP, her institution can have a stake in a firm’s main fund and a different kind of security in the same company in the opportunity fund that may be in direct opposition with that first stake. (Say her outfit is offered preferred shares in the opportunity fund while its shares in the early-stage fund get converted into common shares or otherwise “pushed down the preference stack.”)

Now, this had the European LPs talk for some time:

James Heath, Dara5: Opps funds are a real bug for LPs. We run an active co-investment strategy and it has been very successful with the GPs we have backed to date. Putting an opportunity fund in place inevitably has conflicting interests with co-investments offered to LPs. Some of the economics attached to opportunity funds always seem to raise eyebrows. If a fund has an opportunity strategy, it’s unlikely we’ll be interested in exploring it further. Being asked to support the venture firm’s other vehicles always scares me. We back sector focused VCs, where we are investing in the fund’s brand and the partners’ expertise. When a fund starts deviating from its core thesis, where all of its track record has been built, where is the brand and expertise going to come from to successfully deliver returns? There’s always anomalies but it’s a red flag overall.

Chris Wade, Isomer Capital: I have a lot of sympathy for the comments made in the TC article. We are unlikely to consider such a fund, tbh. To balance the discussion though, there is merit in the early stage VC using an opportunity to remain close to a star company and/or stay on the board and that can also benefit the early-stage fund and LP.

Stephan Heller, AQVC: Opportunity funds, when done right, can actually make sense to some LPs. We think that opportunity funds, especially for solo GPs/smaller funds, should be with the sole purpose of capitalizing on pro-rata rights of the best existing portfolio companies, saving the hassle of raising SPVs, and should have a clearly defined policy (e.g. externally led series b+ rounds by top tier VC, etc.). Any additional mandates such as participating in growth rounds of companies outside the portfolio could defocus managers of their core product and require additional/different underwriting skills. Thus, we think that an opportunity fund should have significantly lower economics and shouldn't be larger than the main fund.

3 reasons why CEE is in it’s prime 📈

After successful examples like UiPath, Payhawk, and a few other startups that are currently taking off, more investors turned their eyes to Central and Eastern Europe. I must admit there are many reasons, and I’m discovering new ones as I discuss them with regional investors 👀.

This week I particularly resonated with a piece in AIN.Capital by Vital Laptenok, GP at Flyer One Ventures, who supported CEE startups before it was mainstream 👇

Reason #1: CEE grows unprecedentedly fast

Since 2017, the CEE region has grown by 7.6 times. The combined enterprise value of the CEE startups has quadrupled and now stands at €190 billion. Croatia, Lithuania, and Ukraine have grown the most.

Croatia — 16.6x, to €10 billion.

Lithuania — 15.7x, to €4.7 billion.

Ukraine — 9.3x, to €23.3 billion.

Unicorns boom

Over the last five years, companies valued at $1 billion or more have appeared in Europe more often than in the US. According to Venture Capital Journal, America has created net new unicorns at a rate of 50% year-over-year, while in Europe, it’s been 100% each year.

CEE is not an exception. Since December 2020, the number of unicorns has doubled there.

Impressive talents

Among the countries that produce the best developers in the world, there are four CEE states Moldova (1st place), Romania (3rd), Ukraine (4th), and Poland (7th).

Ukraine has more than 130,000 engineers — more than any other European country, including Germany and France. And every year, about 16,000 new developers graduate there, the highest number in CEE.

This week’s funds 💵

Section powered by the InnovatorsRoom.

🇦🇪 Venom Ventures & ICEBERG Capital - $1b, web3 - Abu Dhabi

🇫🇷 Resonance by Otium Capital - €150m, fund 1, 🌍 Europe, family office - Paris

🇮🇸 Crowberry Capital - kr.675m, fund 2, 🌍 Nordics, growth, sustainable - Reykjavik

🇩🇪 Yttrium rebranded from Digital+ Partners - Frankfurt

This week’s hires 👩💼

Section powered by the InnovatorsRoom.

EUVC (yup, yours truly) is hiring a junior marketing assistant. Hit up Andreas to apply

We’re also hiring a junior to midlevel IR 👇 Hit up David to apply.

First Momentum Ventures is hiring a remote VC Associate

JOIN CAPITAL is hiring a VC Analyst Internship in Berlin

Frst is hiring a VC Analyst in Paris

🇺🇸 Index Ventures - VC Associate - New York City, innvtrs.com/3QECYNZ

💻 Planet A Ventures - Visiting Analyst Climate Tech - Online, innvtrs.com/3Quatmc

🇩🇪 yfood Labs - Chief of Staff - Munich, innvtrs.com/3CKVzm2

🇩🇰 Look Up Ventures - Investment Professional - Copenhagen, innvtrs.com/3X5uuSH

🇬🇧 Octopus Ventures - Investment Manager SaaS - London,innvtrs.com/3w6OxV1

🇩🇪 Plug and Play Tech Center - Ventures Associate - Munich, innvtrs.com/3W2iU9r

🇩🇪💻 Tourlane - COO / VP Operations - Berlin, Online, innvtrs.com/3IFbVAa

💻 kooky. - Chief Operating Officer - Online, innvtrs.com/3CTTXqd

🇸🇪 CVX Ventures - Venture Associate - Stockholm, innvtrs.com/3GWl0TT

🇩🇪 OUR GREENERY - Founder Associate - Berlin, innvtrs.com/3IFoNX8

💻 StartFast Ventures - VC Associate - Online, innvtrs.com/3w08v3x

🇫🇷 McKinsey - Junior Associate PE & Principal Investor - Paris, innvtrs.com/3XiPqFf

🇬🇧💻 500 Global - Director of Fundraising EMEA - London, Online, innvtrs.com/3knZQVU

🇫🇷 OSS Ventures - Chief Executive Officer - Paris, innvtrs.com/3Wf9d7S

Thx for reading and being awesome 💗 we love you for it.