Welcome to a new episode of the EUVC podcast, where we’ll cover recent news and movements in the European tech landscape with Dan Bowyer and Mads Jensen from SuperSeed.

Here are the core take-aways

Telegram Founder's Arrest Sparks Encryption Debate

Why it matters: The debate underscores the complex challenges that privacy-focused platforms face, raising questions about the feasibility of securing communications without enabling illicit activities. The discussion suggests that analyzing metadata could serve as a viable compromise. The arrest's speculated political motivations introduce additional complexity for companies in this sector, signaling potential impacts on future regulatory approaches and investment strategies in encrypted communication technologies. It seems we may need to wait a bit longer to see how these issues will unfold.

Agentic Workflows Poised to Revolutionize Enterprise AI by 2025

What it is: Agentic workflows involve AI agents collaborating within organizations to perform complex tasks and decision-making processes.

Why it matters: The prediction is that by 2025, large organizations will heavily utilize AI agents to communicate and perform various functions, potentially revolutionizing business operations. This evolution, akin to the shift from monolithic software to microservices, could drive unprecedented productivity gains. The trend is expected to open significant opportunities for startups focused on developing enterprise AI solutions, while also presenting risks to companies that do not keep pace with these technological advances.

VC Ecosystem Polarizes Between Mega Funds and Niche Players

Why it matters: The growing divide between mega funds and smaller players in the venture capital industry suggests different investment strategies and return expectations may be forming. This differentiation highlights that while larger funds often have inherent advantages, smaller funds can offer critical support during tough economic times. There is a consensus on the need for more substantial funds in Europe to create a "gravitational effect" that attracts and nurtures startups. Venture capitalists are encouraged to clearly define their value propositions and consider how the size of their funds aligns with their intended returns and the support they can provide to portfolio companies.

UK Labour's Cautious EU Approach May Hinder Economic Growth

Why it matters: The argument suggests that Labour's strong political position should be leveraged for bolder policies to stimulate growth and improve EU relations, rather than maintaining a cautious stance. This cautious approach is criticized, and a proposed youth mobility scheme is highlighted as a potential stepping stone towards more ambitious economic cooperation. These insights imply that venture capitalists should be alert to possible changes in UK-EU relations that could impact talent acquisition and market access for their portfolio companies.

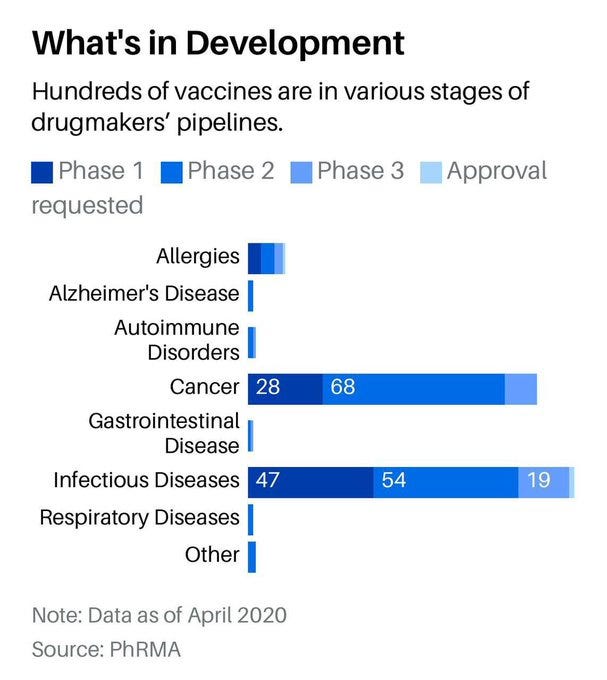

AI and mRNA Convergence Accelerates Cancer Treatment Development

What it is: The combination of mRNA technology and AI is rapidly advancing cancer treatment research and development.

Why it matters: AI technology could empower smaller entities to significantly influence cancer research, challenging the dominance of major pharmaceutical companies. Denmark's success in biotechnology exemplifies how smaller ecosystems can drive impactful innovations. This suggests that venture capitalists should be attentive to AI-driven health tech startups, especially those focused on drug discovery and personalized medicine, even in smaller markets. These startups are poised to transform the landscape of healthcare innovation.

AI Regulation and Its Impact on Europe

Why it matters: This decision is attributed to the regulatory environment in the European Union, which has implemented stricter controls on artificial intelligence technologies. The move reflects a growing divide between the technological offerings available in the US and those in Europe, potentially impacting the competitive landscape and consumer access to advanced AI features.

Tactyc is the leading forecasting and scenario-planning software for venture capital funds, combining portfolio construction, portfolio management, forecasting, and reporting into a unified platform.

Germany's Economic Challenges Impact European Tech Ecosystem

Why it matters: The criticism towards Germany's decision to decommission nuclear plants highlights a perceived contradiction in the country's energy strategy, seen as undermining its renewable energy progress. On the other hand, Germany's swift adaptation of regulations for renewable energy projects is viewed as a sign of potential for positive change. The consensus is that Germany's economic health is vital for the European tech ecosystem, indicating that venture capitalists should keep a close eye on German policy decisions when assessing investment opportunities in Europe.

Where is Ai today, and what is its core business value?

SSpeaking at Sequoia Capital's AI Ascent event, Andrew Ng highlighted the potential of agentic workflows, where AI agents collaborate to complete tasks, suggesting that these could have a more substantial impact than even the next generation of foundational models. This view emphasizes the critical need for developing systems that enable effective collaboration among multiple AI agents, which could revolutionize how AI is applied across various domains and industries.

UK Labour's Cautious EU Approach May Hinder Economic Growth

Why it matters: The strong political position of Labour is seen as a chance to implement bold policies that could enhance growth and mend EU relations, despite current strategies being deemed too cautious. This situation is suggested as an opportunity to introduce more ambitious initiatives, such as a youth mobility scheme, which could pave the way for enhanced economic collaboration. Venture capitalists are advised to stay alert to potential changes in UK-EU relations, as these could significantly impact talent acquisition and market access for portfolio companies.

Stay tuned for next week's episode, where we'll continue to bring you insights from the forefront of the startup and VC world.

🧠 Upcoming advanced EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

VC Portfolio Management: Capital Deployment and Reserve Planning

📅 Tue, September 24 | 4:00 PM - 6:00 PM CET | Lecturer: Anubhav Srivastava, Tactyc

Venture Debt: Structuring & Deal Terms

📅 Tue, October 8 | 11:00 AM - 1:00 PM CET | Lecturer: Hemal Fraser‑Rawal, General Partner at White Star Capital

Benchmarking Session for GPs & LPs

📅 TBD - preregistration open now | Lecturer: To be announced 🤫

Got ideas or requests for future topics to cover? Let us know here.

📺 Virtual events coming up

Mastering the sell-side of secondaries | VC Masterclass | 📆 Tue, Sep 3, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This session will delve into the fundamentals of the secondaries market, distinguishing between direct and fund secondaries, and identifying key stakeholders such as employees, founders, LPs, GPs, and intermediaries. Alberto will share his sophisticated buyer process, including his quantitative scorecard approach and detailed due diligence. Learn how to prepare assets for sale, understand valuation techniques, navigate legal and regulatory considerations, and stay ahead of market trends.

Investing and scaling in Portugal and beyond | 📆 Wed, Sep 4, 2024, 3:00 PM - 4:00 PM (CET) | Register here

Delve into key topics such as navigating the Portuguese investment landscape, empowering women-led startups, and scaling businesses beyond borders with global best practices. Learn about pioneering innovation in tech companies and be inspired by real-life success stories of Portuguese scale-ups. Engage directly with industry leaders, gain cutting-edge strategies, and understand how global trends intersect with local opportunities.

GP Roundtable: Leveraging AI in Portfolio Monitoring & Management | 📆 Mon, Sep 9, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This roundtable is a must for GPs looking to get an edge using AI. By tapping into AI-driven analytics and predictive modeling, VCs can unlock hidden trends and streamline their operations. Plus, tackling early risk assessment can save portfolios from tanking 💥. It's about staying ahead in a cutthroat world.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

Nordic LP Forum & TechBBQ | 📆 11 - 12 September | 🌍 Copenhagen, Denmark

How to Web | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 October | 🌍 Dubai, UAE

Invest in Bravery | 📆 21th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany