Here we go, with a new packed newsletter for you. Let’s get into it.

We’ve also got more standout submissions on the community insights platform to share:

Emerging fund managers face countless challenges when setting up and structuring their first VC fund. The process is complex, daunting, and full of pitfalls, from navigating legal frameworks to engaging with the right service providers, the foundations you lay now will shape your growth trajectory.

That’s why we’re planning an exclusive 3-hour masterclass designed to equip emerging managers with the insights, strategies, and tools needed to tackle these challenges head-on.

EstVCA’s Kaari Kink and Karma Ventures’ Margus Uudam on Estonia’s rise as one of Europe’s most dynamic startup ecosystems

In today’s episode, Andreas talks with with Kaari Kink, Investment Manager at Superangel and Chair of EstVCA, and Margus Uudam, Partner at Karma Ventures and a long-time pioneer in venture capital, to uncover the secrets behind Estonia’s rise as one of Europe’s most dynamic startup ecosystems.

Estonia, known for producing global champions like Skype, Bolt, and Wise, has become a model for entrepreneurial success thanks to forward-thinking policies, minimal bureaucracy, and a bold mindset. Kaari and Margus share their experiences, reflect on Estonia’s journey, and highlight the policies and initiatives that other European ecosystems can learn from.

Together, we explore:

The key policies, like Estonia’s progressive stock option framework, that attract and retain tech talent.

The “Skype Effect” and how it transformed Estonia’s ecosystem.

Europe’s challenges in harmonizing policies to compete globally with the U.S. and China.

The role of cross-border collaboration and fund-of-funds in building a resilient VC landscape.

Watch it here or add it to your episodes on Apple or Spotify 🎧 chapters for easy navigation available on the Spotify/Apple episode.

Join Europe’s premier PE/VC conferences with Zero One Hundred Conferences!

From Vienna (Feb 18-20) to Amsterdam (Apr 2-4) and Budapest (May 14-16), the 2025 Zero One Hundred Conferences offer intimate, carefully curated networking with top decision-makers from firms like 500 Global, Balderton, EIF, Eurazeo, Id4 ventures, IOME Family Office, In-Q-Tel, KfW Capital, SOSV, Teachers' Venture Growth, UBS AM, and more!

✍️ Show notes

What role do VC Associations (VCAs) play in supporting ecosystems?

Margus: VC Associations are central to ecosystem development but focus differently across countries.

Some VCAs emphasize training (e.g., the British BVCA), while others focus on lobbying governments or fostering networking opportunities.

Estonia’s VCA is venture-capital-heavy, dominated by members from early-stage funds.

By contrast, Sweden’s VCA reflects a greater focus on private equity, showing how local markets shape priorities.

How does Invest Europe support the European VC ecosystem?

Margus: Invest Europe serves as a key platform for coordination and dialogue at a continental level.

It fosters discussions with the European Commission to influence regulation and support VC growth.

Larger European institutions, such as the European Investment Fund (EIF), are crucial partners that shape the industry’s investment priorities and funding strategies.

Why are independent initiatives like EUAC emerging outside traditional VC bodies?

Margus: Independent initiatives are often better suited to tackle pan-European challenges, like fragmentation, that VCAs struggle to address.

National VCAs typically focus on domestic ecosystems, while issues requiring cross-border solutions demand focused, independent action.

Initiatives like EUAC and Index Ventures’ warrant push are more agile and targeted, addressing critical gaps in Europe’s VC infrastructure.

Why is policy work crucial for VC leaders today?

Kaari: Policy directly shapes the success of startups and VCs, making it a critical focus for anyone committed to ecosystem growth.

Favorable policies support fundraising, talent acquisition, and operational success.

For VC leaders like Kaari, understanding policy early helps them influence change and support long-term development.

In Estonia, a deep sense of entrepreneurial pride drives leaders to engage with policy work, ensuring the ecosystem’s continued success.

What makes Estonia such a successful startup ecosystem?

Kaari: Estonia’s rise to global prominence combines digital infrastructure, bold policies, and a unique cultural mindset:

Digital-first infrastructure allows businesses to launch in 15 minutes.

The "Skype Effect" created a massive ripple impact, as early success reinvested talent and capital back into the ecosystem.

Estonians have an entrepreneurial mindset — building a startup is a point of national pride.

Government policies focus on removing friction, creating an environment where innovation and growth can thrive.

What key Estonian policies should other countries adopt?

Kaari: Estonia’s stock option framework is a standout policy that supports startups and talent retention:

Options issued to employees are tax-free at the time of issuance.

Options held for three years or more are taxed only upon exercise, ensuring they remain a compelling incentive.

This system aligns rewards with company success and has been widely praised for attracting and retaining top-tier tech talent.

Can Estonia’s policies be scaled across Europe?

Margus: Scaling Estonia’s success across Europe faces major hurdles due to national tax policies:

Taxation is central to state budgets, and harmonization across countries remains politically difficult.

A unified startup legal structure across Europe could provide a foundation for gradual alignment, but it remains a long-term challenge.

How can Europe retain its growth companies and prevent U.S. relocations?

Margus: Companies often relocate to the U.S. for access to customers and growth capital. Europe needs better environments to compete:

Enterprise B2B startups often move to the U.S. for proximity to customers, making it essential for Europe to simplify operations.

Kaari: B2C businesses like Bolt show that success in Europe is possible, particularly in marketplaces and consumer sectors.

To keep companies local, Europe must improve business environments, reduce bureaucracy, and grow funding support for scaling firms.

What happened to Estonia’s push to become a fund domicile hub?

Kaari: In 2017, Estonia introduced the Investment Fund Act, creating a low-cost, efficient solution for emerging managers:

Smaller funds benefited from cost-effectiveness and streamlined regulations.

Margus: Larger funds still prefer Luxembourg due to its stable legal framework and international investor trust.

Building a global reputation as a fund hub takes decades of proven legal consistency, which remains a challenge for smaller countries like Estonia.

What are Europe’s biggest challenges for the future?

Margus: Europe must address systemic challenges to stabilize and grow its VC ecosystem:

Cross-border collaboration: Initiatives like the Baltic Innovation Fund show how smaller countries can pool resources to amplify impact.

Stable funding mechanisms: More fund-of-funds are needed to support ecosystems consistently through good and bad cycles.

Kaari: Talent remains critical. Estonia has increased its tech workforce 10x in the last decade by prioritizing startup visas, coding schools, and STEM education.

Policies must focus on attracting, training, and retaining diverse tech talent, which will be the foundation for Europe’s long-term competitiveness.

PORTFOLIO CONSTRUCTION (and a final word on REGULATION). Part 7. The EU & US Divergence

by Owen Reynolds from Teklas Ventures, the VC arm of a family office associated with Teklas. | Originally published on EUVC.

This piece is a guest piece written by our good friend Owen Reynolds from Teklas Ventures, the VC arm of a family office associated with Teklas.

Owen is an armchair economist and leads Teklas Ventures, the venture arm of an automotive family office, covering both venture fund investment and direct industrial tech investment strategies. He is a former US Peace Corps Volunteer, founder of a sustainable construction company, and economist at the US FERC. After his MBA, he started in impact investing at an Omidyar fund in the US, then spent two fund cycles with Expon Capital in Luxembourg.

I’ll get this out of the way. My American positivity makes me cringe at deconstructive “Euro-bashing”, so I’ve avoided it in this series. The entire motivation behind these posts was to detail some of the structural economic reasons behind the US innovation economy decoupling so distinctly from Europe’s—not the usual bemoaning.

However, it would be a particularly “rose-tinted glasses” perspective to write a seven-post series without pointing out this unfortunately structural issue. Yes, European regulations slow innovation, kill companies, and kill the motivation to innovate.

Germany is perhaps the worst offender. Reading out every page of your shareholders agreement at the notary before signing, bank’s inability to fathom cash-losing entities, rules on recognized revenue, requiring everything to be hard (paper) copies, and an inability to fire underperforming staff without bribing them to stay quite are just the top of my list. Recent reforms on employee stock options spares me some ink on that, thank heavens.

It is a broader problem of fostering a bureaucracy to embed itself in ways that were efficient at the time of that bureaucracy’s creation—not today. Many of these outdated regulations leave European startups default dead.

I’ll admit there are significant positive benefits to some regulations on the quality of life. And I used to be a regulator in the US, so I’m not saying they shouldn’t exist. However, that same security blanket that coddles the weak dampens the flames of the exceptional. It kills motivation to start something new—or risk it all in trying.

The innovation economy relies on the exceptions, the exceptional, and their inherent motivation to change some corner of the world.

Portfolio Construction

This series of posts, regulation included, boils down to one thing—portfolio construction.

Without significant capital at the risk end of the risk-return spectrum from big capital allocators, there is no innovation finance. Without risk, there is no R&D in large corporates, there is no venture capital, there is nothing ventured and nothing new.

According to Atomico’s State of European Tech 24, Europe’s pension funds committed €637m into global VC in 2023—some of which certainly went to US funds. This global exposure represents only 4,1% of the €15,4b raised by venture funds in Europe in total, and is diluted by the pension funds’ US exposure.

But it’s not that Europe doesn’t have serious fire power. To put this into scale, VC commitments by Europe’s pension funds is a measly 0,007% of AUM, on average. There is some regional variation, shown below, with DACH once again disappointing, in comparison to the 0,02% allocation by CEE neighbors to the East.

And this is already against the backdrop of pension funds doubling their commitments to VC in Europe, though down from the peak in 2019. According to Atomico’s State of European Tech 24, global pension fund commitments to European VCs doubled between 2015 and 2023, as shown below.

How does this compare to US pension funds?

In a paper exactly 20 years ago, Gilles Chemla wrote “Pension funds have long been a major source of capital to private equity funds. At the end of 2001, over 50% of capital investment to venture capital funds in the U.S. came from pension funds…”

So, 20 years ago, American VC funds were getting half of their capital from pension funds, while today European VC funds are getting only 4%.

This has diversified over the years in the US, as endowments and family offices have become bigger parts of the ecosystem. However, Europe’s lack of endowments and the relatively risk-averse attitude of many family offices leaves that side of the equation lacking as well on this side of the pond.

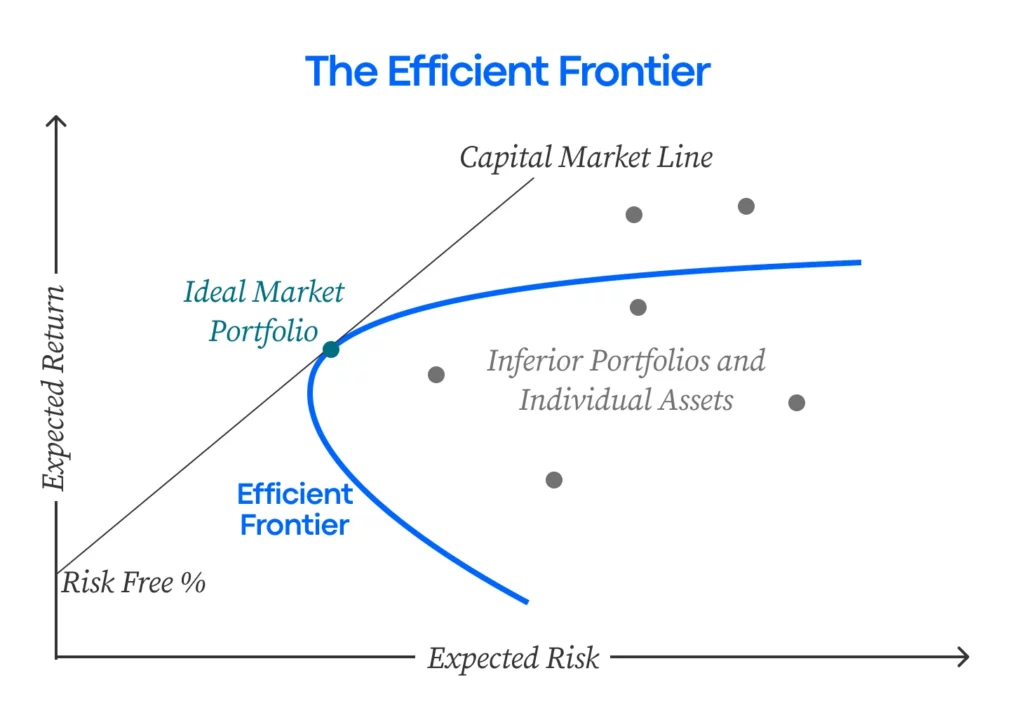

On both sides of the pond, investors are taught the risk-return spectrum, shown below. This academic allocation strategy was first developed by Harry Markowitz in 1952, to support logical, diversified investments for these types of long-term funds. Imagine that private real estate, private equity, venture capital, and crypto are all asset classes further up and to the right from emerging markets equities show below.

As a result of Markowitz’ research, investors are taught to (1) understand our portfolio’s risk tolerance, (2) pick the highest returning point (tangent) along that risk curve, and then (3) invest along that entire curve programmatically until the exposure size no longer justifies the economics to hire the required expertise, assuming a long horizon. (Thanks Linqto for the graphics!)

This would imply that investors should diversify across the asset class spectrum, adjusting to their risk tolerance.

It’s no surprise, the academic research in Europe points towards the same thing and increased exposure into VC (often lumped together with its bigger sister, PE). Investment & Pension Europe recommends the asset class as a great opportunity.

And Europe’s largest pension fund, Norges Bank, had a team of academics pour through historic returns, the global landscape, and economic research that puts this blog series to shame. Their recommendation clearly favored increased exposure into PE & VC:

We documented that PE fund performance historically has exceeded public equity index returns (without further correcting for differences in risk) for both buyout and venture, and in both the U.S. and Europe. For U.S. data, the average buyout fund delivered 20% higher distributions over the life of the fund, compared to a strategy that invested similar amounts in the S&P500 index with the same timing. The average VC fund delivered 35% higher distributions than the corresponding S&P500 strategy over the life of the fund.

Despite all the evidence needed, time and time again I hear pension funds, family offices, and other allocators saying they “don’t do PE”, “don’t allocate to venture”, “or don’t take on that kind of risk”.

The results are an artificially truncated portfolio, which will inherently underperform. If you assume a long-term time horizon, then it follows you can weather the storms of market volatility. But if investment managers choose not to follow the academic evidence, they are preserving wealth at a nominal value but losing it in relative terms. The only wealth preservation strategy over time is wealth creation, which requires risk.

WHY?

So why don’t European investors invest as much as American investors into venture capital and private equity? These are theoretically rational, professional investors. And pension funds are particularly under exposed to high growth, high risk assets.

There are several logical reasons for European fund managers to decrease exposure into venture relative to American peers. In Culture, we walked through history and the impact education has on the innovative economy and risk tolerance. Dollar Reserve Discrepancy details a critical advantage to investing in uber-productive industries like tech and biotech enjoyed by the US.

The Monetary Premium & Investments goes on to show secured capital flows from savers to markets that boost valuations in the US. The Land of Liquidity expands on that to connect higher valuations to increased liquidity in the US. And Structured Failure puts risk culture in context.

The best talent is better compensated in the US thanks to hiring up and the structure to fail and try again. Similarly, capital is structured to buoy market valuations, offering greater liquidity and higher chances of stock-based compensation. This all puts the US at a competitive advantage for funding innovation.

But that only explains part of the story.

One additional variable is a link between compensation and allocation, driving a major problem in allocating to high-risk, high-return sectors. Fear appears to be driving intellectual dishonesty at the allocator level (pension funds, endowments, family offices).

Thanks to the “hiring up” mentality, American allocators are frequently offered significant upside. They receive bonuses, salary boosts, and carry-on-interest (a type of upside participation bonus that is tax-advantaged) for making high conviction investments into the right companies and the right investment teams.

It may cost you your job if you’re wrong. But it’s worth “going out on a limb” when you have that conviction, as long as the upside is there.

Many of Europe’s pension funds are very much treated like public servants. They may have bonuses at the top, but many of the junior staff spend years training in indifference—instead of training in conviction. Generation after generation of CIOs (Chief Investment Officers) are trained to play it safe and keep their job, decreasing risk and the incentive for increasing exposure in the face of decades of research.

That is reflected in salaries of CIOs between the US and Europe. According to Business Insider, 40% of family offices are paying their CIOs $1m or more, compared to only 6$ in Europe. The results “based on surveys of 635 family office leaders, didn't find any CIOs in the UK, Middle East, and Australia making as much as chief investors in the US”. Similar anecdotes are peppers across the investment team compensation press.

Takeaway

There are a lot of ways that Europe and the US are different. But in recent years the markets have diverged in a way that seems obvious in hindsight, but didn’t seem obvious only a few years back.

This post series goes through some of the structural components that have caused the divergence. Some are fixable—while others we’ll just have to live with. I’ll leave the fixing for smarter minds and bigger teams. Meanwhile, I’ll continue to put capital where it counts and invest into venture capital.

Venture Capital Compensation in Europe 🇪🇺 - Part 2

by EUVC & Luis Llorens Gonzalez, Principal at Plug and Play Tech Center | Originally published on Learning VC💡

We’re thrilled to share part 2 of the Learning VC & EU.VC Compensation Survey Results. I believe this is the edition most of you have been waiting for - comprehensive compensation benchmarks for European Venture Capital roles, broken down by country.

We received over 400 survey responses to address a key question: What does the compensation package for European VCs look like?

This post focuses exclusively on VC compensation data, gathered from 24 European countries and 48 different cities. In a future report, we’ll explore findings from the 50+ CVC (Corporate Venture Capital) responses.

2024 Annual Review Guide For Investors

Guest post by Julius Bachmann, Founder of Bachmann Catalyst. | Originally published on The Effective Entrepreneur.

Our friend and EU.VC podcast guest, Julius Bachmann, is an experienced venture capitalist who has transitioned into executive coaching. Recognizing the value of year-end reflection, he has created a thoughtful annual reflection guide tailored specifically for VC investors.

If you're looking to end the year on a more mindful note but find generic reflection questions uninspiring, this guide offers a valuable resource. It provides a structured framework to help VC professionals take stock of the past year, extract meaningful insights, and plan for the year ahead - all designed to help investors gain clarity, identify areas for improvement, and enter the new year with renewed focus and purpose.

Some things are made for platforms - music, cabs & pizzas. But fund solutions aren’t one of them. Their individual client focus and regulation-first approach is your guarantee for flexible solutions accommodative to a broad range of deal and client specifics. The kicker? Prices that match any of the shelf-products in the market.

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

✍🏻 EUVC Masterclass | Marketing & VC Fund Narrative

Your brand is everything. It’s what sets you apart, helps you win the best deals, attract LPs, and ultimately drive your growth. For emerging fund managers, building a credible brand and establishing the right marketing foundations early on are game-changers. Yet, many don’t know where to begin.

Your fund’s narrative is what makes the difference between an LP glancing at your deck or deciding they’re ready to write a check. It’s your brand that makes LPs feel confident they’re partnering with someone who knows how to make magic happen.

We’re planning a masterclass on building strong marketing foundations with a top industry leader. If enough people show interest, we’ll make it happen.

EUVC Masterclass: Benchmarketing for GPs & LPs

In venture, knowledge is power—and benchmarking is the key to unlocking it. Understanding where you stand against your peers is what makes you set realistic expectations, and drive portfolio performance.

For GPs, benchmarking can reveal the strengths and weaknesses of your portfolio, while for LPs, it provides a clearer picture of where your commitments stand in the broader market. Yet, many don't know how to effectively utilize benchmarking tools or interpret the data.

We’re planning a masterclass on mastering the art of benchmarking, led by a top expert in the industry. If enough people express interest, we’ll make it happen!

💬 EUVC Community | LP AMA with AQVC’s Marius Weber

Join us for an exclusive AMA session with Marius Weber, Founding Partner at AQVC.

After a history as a co-founder of startups and a manager of several VC funds over the last 15 years, in 2021 Marius Weber partnered with his long time friends Marcus and Oliver and co-founded AQVC, a tech enabled asset manager for Venture Capital which is divided in two departments.

This AMA is part of our ongoing series of small-group sessions designed to foster deep, meaningful discussions within the VC community. Participation is free for members of our community, but spots are limited. Reserve your spot now to ensure you don’t miss this opportunity.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

GoWest | 📆 28 - 30 January 2025 | 🇸🇪 Gothenburg, Sweden

Investors Summit Bilbao 2025 | 📆 11 - 12 February 2025 | 🇪🇸 Bilbao, Spain

0100 DACH 2025 | 📆 18 - 20 Feb 2025 | 🇦🇹 Vienna, Austria

0100 Europe 2025 | 📆 02 - 04 April 2025 | 🇳🇱 Amsterdam, The Netherlands

0100 Emerging Europe 2025 | 📆 14-16 May 2025 | 🇭🇺 Budapest, Hungary

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🇩🇪 Berlin, Germany