Today, we have Nicholas Nelson, who recently joined MD One Ventures as Partner.

Nicholas is an important and active player in building Europe’s first defence and national security venture capital fund, supporting the growing portfolio of over a dozen defence and dual-use tech companies.

Nicholas is an internationally recognised defence investor and thought leader, with over 17 years of experience across the national security and defence tech sectors. His National Security career has spanned roles in the US Government, management consulting, and leading defence and dual-use tech companies.

Nicholas was an early investor in defence tech as we know it today, having made his first investment in 2020, and has been advising within the dual-use sector since 2015. He has become a leading advocate for the nascent European national security technology ecosystem- contributing to multiple publications and communities, including the US Army War College, the NATO Review, National Defence Magazine, Munich Security Conference, Defence Disrupted, College of Europe, University of Cambridge, and Kings College London.

We invite you to listen to this discussion below for a refreshingly honest talk on the defence tech sector, where we stand vis a vis the US and China, as well as actionable advice on how the ecosystem can change for the better.

You may not care about geopolitics, but geopolitics cares about you.

Scroll on ⏬ For the chapters & core learnings 🧠

Chapters:

00:02:24 - From Aerospace Defense to Government Services

00:04:24 - Transitioning from Government to Tech Startups

00:06:24 - The Role of Tech in a Changing Geopolitical Landscape

00:08:36 - Investing in European Defense Tech for Returns and Impact

00:10:36 - The Declining Tech Valuation Delta between Europe and the US

00:12:38 - Increase in European Defense Spending and Private Capital Engagement

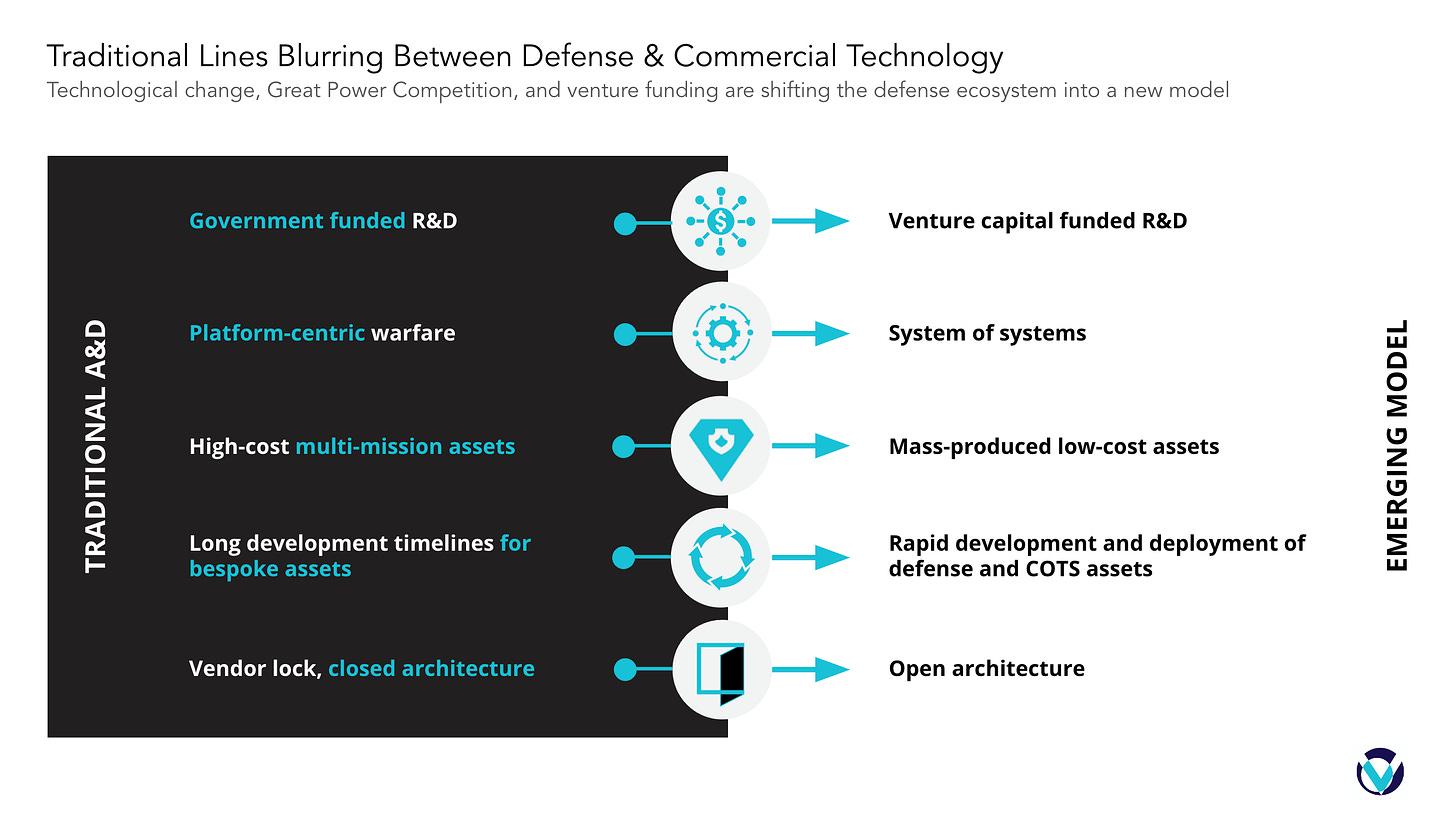

00:14:51 - The Blurring Lines Between Defense Technology and Commercial Use

00:16:51 - The False Sense of Long-term Security

00:18:55 - Trends in Military Spending

00:21:04 - Exclusion Lists for Aerospace Defense Companies

00:23:05 - Europe at risk of being left behind in defense innovation

00:24:59 - The Role of European Primes in the Defense Economy

00:27:02 - Investing in European Defense Tech

00:33:14 - Successful Defense-First Tech Companies

00:35:30 - The Role of Defense Experience in Investing

00:37:34 - The Value of Military and National Service in Tech

00:39:41 - Defense Tech in Eastern Europe

00:41:40 - European Unity and New Beginnings

Nicholas’s story into venture.

Venture capital wasn’t really on my radar for the first half of my career.

I’d say, I sent about half of my formative years living in Europe, when I went to university, and I was going in a completely different direction.

I decided to focus on international relations because it seemed like a natural fit for both my personal background and what I was really interested in.

After graduating, I didn’t know precisely what function I wanted to have. But, I did know I wanted to work in aerospace defence and government services. I left there was an interesting connection between where I professionally wanted to go and my own personal experiences.

To gain wider exposure, I worked in management consulting for a few years in London, and North America. Thanks to one of my clients I had the unique opportunity at some point to move over to government within the U.S. Department of Defence and work on a number of critical issues, including emerging tech.

What I was really seeing at that time, it was that we have a unique inflection point for government and the military, with capabilities that traditionally where the purview of major governments: drones, satellite, imagery. They were being democratized.

Two of the major success stories in the industry, Palantir Technologies, and maybe SpaceX, they literally had to fight tooth and nail for every single thing, and gain our approval for every purchase. They did that through a lot of bottom-up user stories, working with end-users rather than trying to go to the very senior levels.

That resonated with me. Being one of the early users of Palantir and seeing how they enabled myself and my colleagues to do our job better, it was what really got me into the next step. So, I decided to get an MBA, where I focused on engaging, advising early-stage startups in tech, which brought me to my first real role — working and advising an early-stage national security startup.

This set the stage for my next move into the defence tech ecosystem. In the following years I worked with a series of startups, companies, and accelerators across the industry. Eventually, everything brought me around my very first ange, investment…and the rest is history.

After the last few years being back in Europe, and leading European initiatives in the UK, where I’m currently based, I joined MD1 Ventures as a Partner.

Fundamental misconceptions about defence tech.

Defense technology is not just bullets and bombs, but instead, focused on key enablers. There are no startups building chemical weapons for instance, that is not what defense tech is. If you look at the seven technology areas prioritized by NATO, for example, each one has a civilian use case.

If you are a deep tech investor, if you invest in quantum, biotech, manufacturing, or communications, you are already investing in tech that could be leveraged by defense.

These are known as dual-use technologies.

Over the last year, despite the invasion of Ukraine, the top defense and dual-use tech segments were not involved in munitions, but instead included energy, command and control, and biotech.

In Europe these include Munich headquartered Helsing, which became the first European Union based defense tech unicorn in 2022, and London headquartered Labrys Technologies, which raised the largest defense tech seed round in UK history in 2023.

The former is focused on artificial intelligence and electronic warfare and the latter is revolutionizing command and control at reach.

The role of tech in our future.

Essentially, there's also been a common misconception, particularly before the second invasion of Ukraine in 2022, that geopolitical events might not significantly impact the tech and venture capital sectors.

«"You may not care about geopolitics, but geopolitics cares about you."»

The Economist mentioned this at some point, and I think this sets the stage for my discussion, especially considering the focus on Ukraine, which likely leads many to assume defence tech discussions will predominantly center around the situation there.

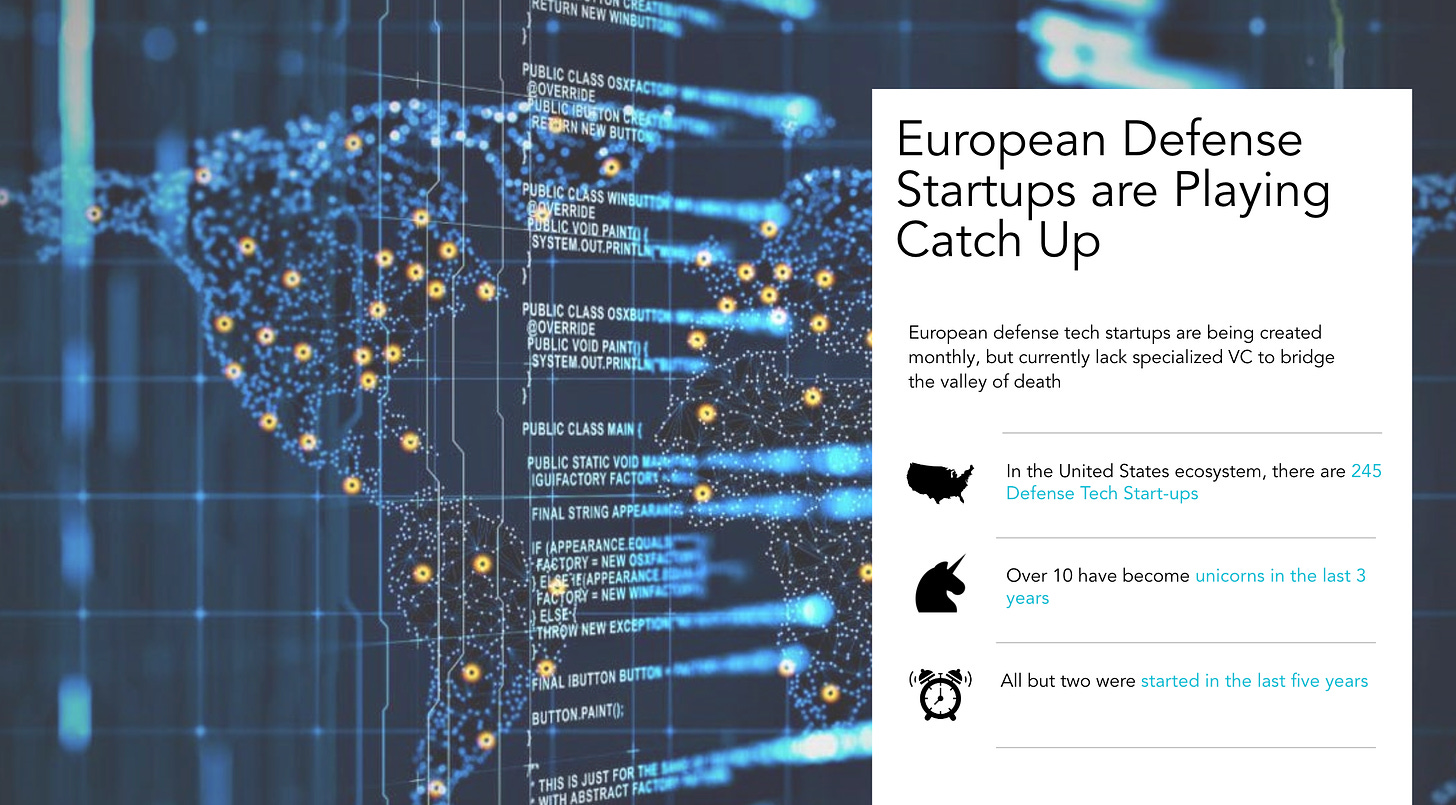

Indeed, Ukraine has sparked a renewed interest in defence tech across Europe. However, it's crucial to note that European defence tech investment was already on the rise before Russia's second invasion of Ukraine in February 2022. Despite this, venture capital funds and tech companies, particularly in Europe, have mostly been on the sidelines of this growing trend, which dates back to the first invasion of Ukraine in 2014. This oversight has created a significant gap, missing out on strategic advantages and potentially lucrative returns for investors interested in defence and dual-use companies.

Venture capital's role, even in mission-driven contexts, is to generate both returns and impact. Evidence suggests the tech valuation gap between Europe and the U.S. is narrowing across various sectors.

However, defence and dual-use tech often get overlooked or lumped together with other sectors. Recognizing the shifting landscape early on, I analyzed U.S. and European defence and dual-use tech companies across several countries, using criteria like annual recurring revenue, growth rate, employee count, profit margin, and market fit.

The findings revealed a valuation gap, with European companies valued at 42% less on average compared to their U.S. counterparts, even after adjusting for outliers. This clearly indicates a substantial opportunity in the sector.

Before diving deeper into the investment potential, let's examine why the defence sector is so vital. European defence spending was already on an upward trend before the latest Russian aggression.

Contrary to popular belief, the spending gap between Europe and the U.S. has been narrowing, particularly among EU countries that are also NATO members, who have significantly increased their defence budgets. This rise in defence spending reflects a strategic shift and a desire for Europe to assert itself as a capable independent actor on the global stage.

The Rise of European Defence Tech

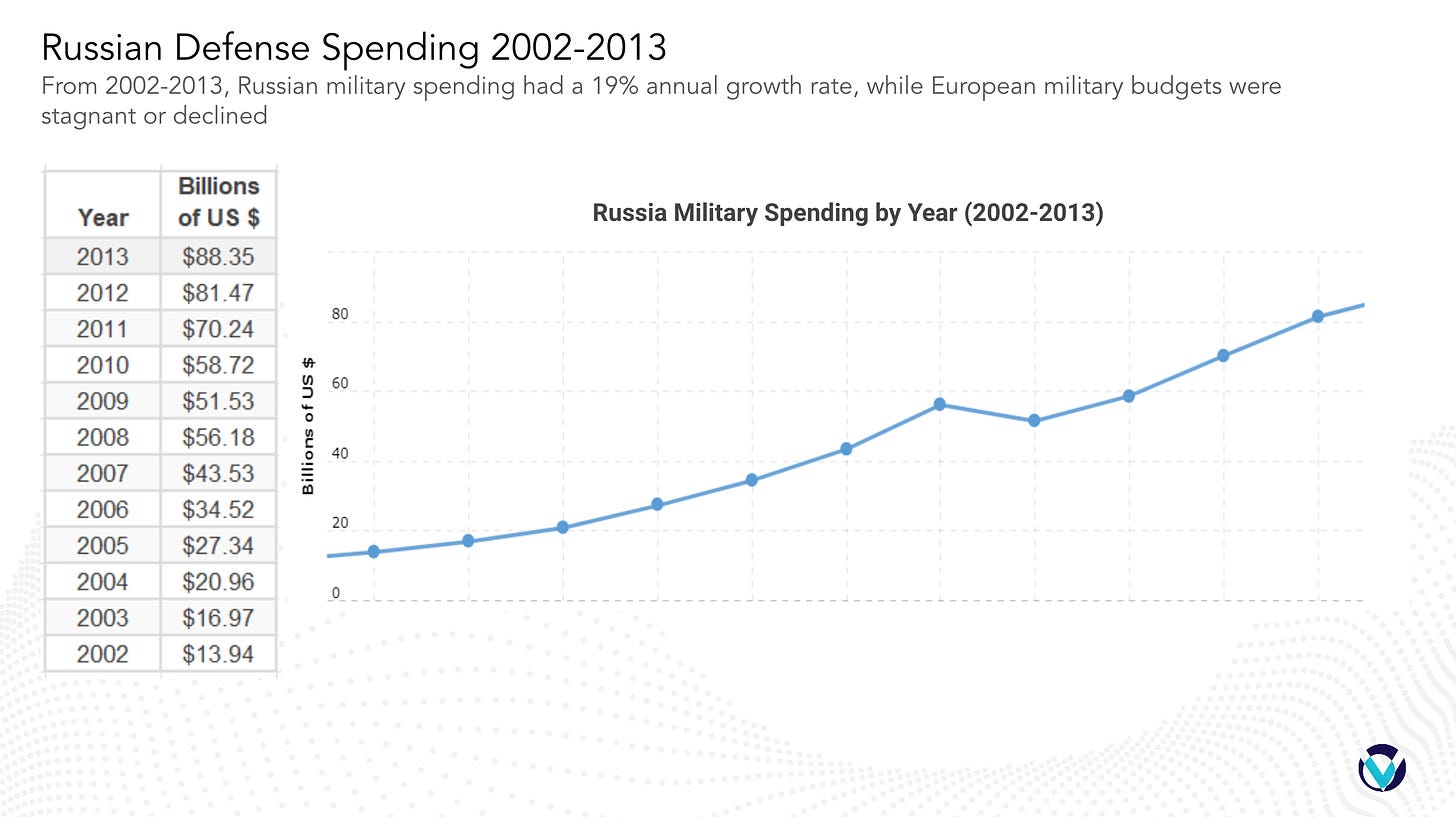

While Europe was celebrating its Nobel Prize and its ability to promote peace, Vladimir Putin was starting his third presidential term, and Russia’s military spending was the highest it has been since the Russian Federation’s reemergence as an independent nation after the fall of USSR.

Similarly, China increased its military expenditure by over 11% in 2012, which followed a nearly two decade long trend of double digit increases of defence spending, and was then mirrored by subsequent increases in the years that followed 2012.

Conversely, in 2012, NATO was still embroiled in Afghanistan, where I was actually deployed as a civilian that year, supporting ISAF.

Just two years later, European minds and budgets finally started to come around to the idea that Great Power War may not be an anachronism forever and that however many Western institutions push for cooperation and peace there are those that exist outside these alliances, unions, and partnerships that do not.

This was driven in part by the first Russian invasion of Ukraine.

Driven in part by the first Russian invasion of Ukraine, European military expenditure in the years leading up to 2022 began rising.

This is also now buoyed by a growing mainstream awareness of the need for defense technology after 2022 is not an outlier, but a recognition of the enduring need for Europeans to stay at the cutting edge of defense.

EU private and public capital markets have impeded tech development.

European governments, activists, and the EU have long pushed for aerospace and defense companies to be included on investment exclusion lists for an array of rationales from firearms production, the manufacturing of certain explosives, low fuel economy (yes really), or involvement in the nuclear supply chain.

This pressure meant sovereign wealth funds and investment firms excluded A&D companies, ranging from small- and medium enterprises (SMEs) to prime contractors such as Airbus, BAE Systems, and Rheinmetall, from their portfolios. In public markets, this increases volatility, results in lower valuations, and raises the cost of capital for these companies. This is changing, however, for an example Sweden’s own SEB Group dropped their restrictions in the last year for instance.

So, now that I’ve covered why VC is lagging in European defense and dual use investment, let’s look at the opportunities for investors moving forward.

Private capital - the main driver of the defence economy.

Rapid development and deployment of defense capabilities requires an understanding of how defense investment has fundamentally changed in the last decade.

Technological and investment trends have accelerated, shifting the balance of power in foundational research and development (R&D) and innovation away from governments and militaries to emerging tech companies and venture capital.

The U.S. and China have been adapting to this new reality, with both embracing fast-growing, venture-backed startups focused on dual-use and defense tech, creating an array of new defense unicorns. This has not yet been matched in Europe. Without the private capital ecosystem to support these companies, the continent is at risk of being left behind.

Many investors and government officials — at least those outside of their respective ministries or departments of defense — are unfamiliar with modern defense markets and associated defense and dual-use technologies.) Like I already mentioned, defense requirements have expanded, going beyond kinetic equipment that most people immediately think of — firearms, bombs, and fighter jets. Increasingly, defense relies on key enablers such as space capabilities, unmanned systems, and artificial intelligence and analytics. While the U.S. and China have recognized this shift and greatly increased government and private sector investment in these areas, this has not yet been matched in Europe.

Let’s take a generalist look at this.

Now most of you will be familiar with Founders Fund, one of the leading U.S. venture capital funds. Founders Fund is well known for being an early investor in Facebook, AirBnB, and Stripe, but what you may not know is that they are the second most prolific investor in dual-use and defense technologies, having led rounds for Palantir, SpaceX, and Anduril, and most recently in Wraithwatch and Galvanick.

Startups are driving defense innovation.

In looking at the defense sector landscape, it is important to understand the existing and legacy European aerospace and defense companies, also called Primes, and why they are not driving the new defense economy.

Primes are large companies with multi-billion euros in annual revenue, which due to scale and previous contracts, are viewed by governments and militaries as “capable” of leading major, multi-year development efforts, traditionally focused on building bespoke, multi-mission hardware-based assets. In Europe, these Primes have a further distinguishing characteristic, being what I call “national champions”, with most having their respective governments as major shareholders if not outright owners.

Unsurprisingly these companies are mostly structured within their home country and their largest customer is their respective governments. As to be expected, these companies are deferred to for most if not all major government contracts and continue to mirror their governments in their operations and makeup. European Primes significantly underperform, with revenue per full-time employee, only 1/8th of the U.S. counterparts.

At the same time, they have demonstrated an inability to drive forward major new development programs with multi-billion-euro programs such as the Future Combat Air System, lagging behind schedule and riven with strife between the leading Primes.

Slowly but surely, European governments are recognizing that they need a different approach, and are dedicating budget towards startups and fund investments, including the European Investment Fund’s recently launched €175m defense equity facility, alongside the €1B NATO Innovation Fund. But they need educated, dedicated private capital to grow this market, particularly at an early stage.

Now thankfully, some European VCs, have started talking more about defense, and even a few have started investing in the sector, but these have largely been few and far between.

Investing in defence creates opportunities.

For value investors and generalists, there is a clear valuation delta to be taken advantage of. Similarly, for ESG and other impact focused investors, without the ability to protect one’s own citizens from misinformation or even from, yes, actual invasion, the rest of ESG doesn’t actually have any impact.

The cultural stigma and institutional barriers against defense and dual use technology investments are rapidly collapsing and the sector is proving to be a vital and robust opportunity for the investment community.

Overall, Europe has the talent, the desire, and the infrastructure to become a defense and dual-use tech leader, now it just needs its private capital to get off the sidelines.

Upcoming events

📺 Virtual events we’re hosting

Acing LP Relationships | Feb 12, 2024, 12:00 PM - 1:00 PM

Is Crypto back? | Feb 15, 2024, 12:00 PM - 1:00 PM

🤝 In-person events we’re attending

Hit us up if you’re going, we’d love to connect!

GoWest | 📆 6 - 8 February | 🌍 Gothenburg, Sweden

Odense Investor Summit | 📆 13 - 15 March | 🌍 Odense, Denmark

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

On The Rise of Defence Tech with Nicholas Nelson, GP of MD One Ventures