EUVC Newsletter | 6.02.23

How are you balancing profitability and growth? How to think about angel portfolio strategy? Who made it into "Emerging 50?" & why we're backing SMOK. Read on for this & 5 hot new report releases 📚

Welcome to the newsletter that rounds up the week in European Venture from a GP/LP perspective.

Firstly, a heartfelt welcome to the 255 newly subscribed venturers who have joined us since our last post! If you haven’t yet subscribed, join the 7,661 angels, VCs and LPs 🤗

Love European Venture? Help us connect the ecosystem 👇

Do ping us if you have news, opinions or memes you want us to share. We’re here to connect & amplify the European Venture community 📣

Table of Contents

Why invested into SMOK Ventures

This week’s events

This week’s podcasts

GIFs & MEMEs

LP Musings w Chris Wade: Profitability - the hot new word

Angel LP Syndicate insights: Portfolio strategy

Stories of the week

The EU VC Lowdown with Cathy White

The VC Impact Playbook unveiled

Founders (still) require better sign-posting to external funding

European Universities leading in creating open-source startups

TechCrunch: We’re off to a “less than stellar start to the year”

Romanian Venture Report 2022

Emerging 50 🚀

Where is the money in 2023? Corporate venturing on the rise.

This week’s funds

This week’s hires

The EUVC Syndicate is investing in SMOK Ventures 🐲

At EUVC, it’s our mission to connect European venture. Unfortunately, gifs & gaffes don’t change the world. Hopefully, our LP syndicates will. Read on to learn more & join us in our mission 💖

📝 The executive summary (read the full memo)

SMOK is an operator-led US fund investing in top serial founders of the CEE region

SMOK has delivered on its promise of connecting ecosystems with 80% of the money raised by portfolio startups coming other global investors

SMOK has risen to become the first-choice fund among serial entrepreneurs in CEE in less than two years of operation

Named one of the most active CEE seed funds in 2020, and the second most active in Poland (Vestbee reports)

GP team consists of Borys Musielak, Diana Koziarska & Paul Bragiel

💸 The financial argument behind our investment

With Fund I, SMOK demonstrated they can consistently attract the best CEE entrepreneurs and attract global investors to follow on these deals.

SMOK delivers a differentiated value-add of being a “for founders by founders”-fund that is highly connected to both the local startup scene and global venture scene via the Bragiel brothers.

The firm-building strategy will further strengthen SMOK’s dominance as one of the go-to funds in software & GameDev in CEE.

Fund II is an extension of the strategy employed in fund I which is on track to become one of Europe’s highest-performing funds.

♟️ The strategic argument behind our investment

It’s an explicit goal of SMOK to give LPs initial CEE-traction, making it a high priority for the team to work actively with the EUVC syndicate.

Borys is one of the leading voices in Eastern European Tech making him a strong partner and entry point to the ecosystem. If you don’t already follow him on linkedin, we advise you to do so and check out his musings here.

Borys and Diana have demonstrated extremely high levels of collaboration towards us as well as their surrounding ecosystem ensuring us that they’ll be a great partner for knowledge sharing & co-investing.

❤️🔥 The type of investors we’re building the syndicate for

Tech entrepreneurs & operators from across the CEE

Community leaders and angel investors from CEE

Industry experts from various industries and geographies

Programmers from around the world

While the above are broad categories, they narrow a lot with the core criteria that we’re building the syndicate for investors that want to be engaged and useful.

And as Borys put it beautifully in our memo episode with him and Diana:

I don't want boring LPs. I don't want LPs that do it just for the returns. I want LPs that are entrepreneurs, friends, people who are like us, who care about the community in Central Eastern Europe and want to be part of something big. Of the big force that we’re building.

So if you’re not boring 👇

This week’s events 🥳

Affinity Campfire Conference Berlin

Date February 28, 2023 | Venue Factory Berlin Görlitzer Park

Lohmühlenstrasse 65, 12435 Berlin

Have you wondered how some dealmakers remain successful in the face of a shifting market? Register today and see what Affinity's Relationship Intelligence event, Campfire Berlin, has in store for you on February 28!

This week’s podcasts🎧

The Super Angel, #04 Julia Morrongiello, ZeroHash

Today, we're happy to welcome you to Julia Morrongiello, an ex VC, turned operator, turned angel investor. She is the Head of Growth Europe for Zero Hash, a crypto-as-a-service provider whose clients include the likes of Stripe, Moonpay, Curve and Interactive Brokers. Julia spent most of her career working as a VC investor at Point Nine and GFC and now continues to invest in fintech and crypto as an angel and scout for Accel. Since starting her career as an angel investor a little over a year ago, she's invested in 10 companies and 1 VC fund.

In this episode you’ll learn:

Julia’s journey from VC to Operator to Angel & the value it brings to her both professionally and personally

How investing in women can be a better investment on both the hard and soft metrics

Why angel investing is the most giving hobby in the world!

Reflections on power law investing, upside maximization and why you can only get as much as you give

The importance of paying attention to unconscious biases and how to create processes that protect you

The European VC, #149 Borys and Diana, SMOK

Today we are happy to welcome you to our favorite type of episode: our memo episode! That means we’ll be diving deep on a fund that the EUVC LP Syndicate is investing into together with the GP team. So, please welcome Borys and Diana, Founding Partners of SMOK Ventures, an operator-led VC fund focusing on top serial founders from the CEE region.

At EUVC, we’re hyped about this investment because SMOK Ventures have risen to become the first-choice fund among many serial entrepreneurs in less than two years of operation by delivering on their promise of connecting the CEE and Global venture ecosystems with more than 80% of the money raised by portfolio startups coming from outside the region.

What is more, Borys and Diana are amazing human beings who our syndicate investors can count on to not only deliver returns, but also insights, learnings and access to the region.

We hope you’ll enjoy meeting Borys and Diana in this episode and invite you to reach out if you wanna learn more about how to join the EUVC LP syndicate.

The European VC, #148 Premysl Rubes, Presto Ventures

Today we are happy to welcome Premysl Rubes, Founder and Managing Partner of Presto Ventures, a Prague-based VC firm investing in early-stage (pre Series A) startups built by exceptional founders from Central and Eastern Europe.

In this episode you’ll learn:

Premysl’s journey from entrepreneurship, to angel investing to VC

Learnings going from a single GP & LP firm to multiple-partner team with a large LP-base

The importance of alignment of interests in a single LP set up

Why Presto Ventures double down on a high velocity investment strategy with multiple deals done per month and investment cycles of 2 years

GIFs & Memes 🙊

Down-turn survivor vs First rodeo VC

Originally shared by Ariel Cohen 💖

VC at End of Year Tech Conference

Originally shared by Pramod Gosavi💖

Over-engineered - what are you talking about?

Originally shared by David Citron💖

VC Value add

Originally shared by David Citron 💖

LP musings w. Chris Wade 🧠

By Chris Wade, founding partner of Isomer Capital (and European Venture’s #1 LP OG).

Get to know Chris in our two-part episode on his journey and thinking 🎧.

A new word in the VC & tech CEO vocabulary: Profitability

I have been having many conversations with one of CEOs in Growth fund portfolio and there’s a new word that is becoming more and more urgent in these dialogues: “profitability”.

The erstwhile years of VC capital abundance and euphoric sentiment to bet on the future the modus operandi was

🚀 GROWTH

🚀 GROWTH

🚀 GROWTH

And if an entrepreneur questioned the negative burn/revenue ratio the investor chorus shouted:

Clearly, in the race to market share leadership, this all makes sense.There are many examples where a company’s cash reserves have enabled them to win the race (and often not the best company in that space).

Enter 2022 and now 2023. Smart entrepreneurs have got the message the “VC ATM“ is switched off and they have to focus on building a sustainable cash-neutral/generative business.

This means dialing back growth and very painfully disassembling some of the teams that they have painstakingly built in previous years.

These team reductions are personal and mentally very tough. In discussing with “our” CEO on how to deal with this best, 2 themes have arisen:

To those leaving: “You were the best when we hired you and you are still the best. In fact, you’re even better. And you should leave with your head held high as many companies will be keen to hire you“. While this is likely cold comfort for the departing employee who took a bet on the company, it is, nonetheless, the right sentiment.

To those staying: “By focusing on profitability we can be in control of our company. No dependency on new investors or the consequences of a down-round. And once we’re profitable, we can control our decisions on growth”

All of the above is very familiar to those that have built companies. However in a recent conversation with one of Berlin’s star growth companies, I heard something new:

“You know, Chris I am so passionate about getting to profitability and we are close, but what I am hugely excited about is that everybody in our company gets it! There’s a complete undestanding of the fact that we can ALL play a role in achieving the Nirvana and cash-neutral position.”

For five years, not a single investor asked me when or how we would be profitable. I think that’s concerning, right?

It’s characteristic of the craziness that happened in the last few years in VC.

Now it’s turned completely and everybody only asks about when will you be profitable.

From my point of view, it was irrational to only look at growth [in 2021], but it’s also very irrational to only look at profitability now. ”

The company took the decision to prioritise profitability days after leadership meetings. The CEO continued:

“[We] quickly took the decision because we have a very good understanding of our business and we thought that we would know what would happen if we actually reduce marketing spend. Interestingly, we hit exactly what we projected [we would] if we changed marketing spend, which is great. But it’s also the fruits of the work over the last few years to build a very good understanding of the dynamic.”

How are you advising portfolio CEOs to balance profitability and growth these days? Have you swung too far to the other end of the ‘21-heydays?

Angel LP Syndicate Insights: Portfolio strategy

Insights & updates from building Europe’s leading Angel LP syndicate community 🚀 Apply to join the fam 🤗.

As an Angel, I believe it’s all about volume. The reality is: Venture investing operates on a power law. One investment will really help you return your entire fund and you have to adopt a similar approach as an angel.

That’s the voice of Julia Morrongielo, former VC with the famed VC funds Point Nine & GFC and now one of Europe’s absolute super angels any founder fintech founder would be lucky to have on their side.

We dived deep on Julia’s path from VC to operator angel and the principles that Julia have been able to apply as well as those she’s had to let go of now that she’s no longer part of a big shop.

Let’s get into it.

One of the most apparent differences between being part of a VC and being an angel investing solo is the need to optimize for massive outcomes.

As a VC, a 100M€ exit will often be inconsequential. Not so as an angel.

Let’s hear it from Julia:

As an angel, you don't necessarily need to be optimizing on these massive unicorn fund returners. Actually, if you invest a small amount in a business as an angel today and the company sells for 100 million and you still have a small stake in it, that can be a very, very good return for you.

Whilst as a VC, a 100 million exit is kind of inconsequential in most cases. It's a very different return dynamic. So as an angel, you can afford to, essentially, take bets that don't necessarily have that huge upside, but are just really good businesses, even though they won't give you a 3 or 5x return.

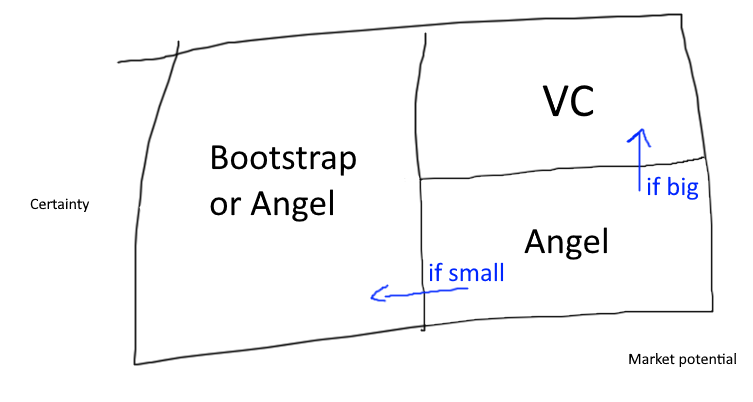

I think this is hugely important and something that should be kept central, ‘cos good founders will go for angel money when they’re unsure about the market potential of their idea 👇

This dynamic means that the capability to define what a VC case looks like as it develops is integral to an angel. So what does this look like?

Let’s hear what Julia looks at when she first meets founders:

I mainly think about two things, when I'm doing Angel investments: the first is Founders above all. We’re investing at such an early stage that the reality is that there's no point overanalyzing, because it's very likely that the business will change. So, as long as there's a founder that you really believe in and a market that you think there's scope to build a significant business in, I have my main indicators covered.

Here, you can see that Julia optimizes for finding the venture cases. For that reason, she’s also applying the same portfolio model as a VC, which brings us back to our opening quote:

As an angel, I believe that it's all about volume. The reality is; in investments in Venture Capital, it really operates on a power law. One investment will really help you return your entire fund as a VC and you have to adopt a similar approach as an angel. Except in a fund there's, you know, many different partners investing whilst as an angel, it's just you. And in order to optimize for getting a good return, you actually have to deploy capital into many, many different businesses with a hope that one of them succeeds.

And in line with that, you need to be prepared to lose money and that most of your investments won't succeed. Ultimately success hangs on one or two outliers that will really make all of the work worth it.

While this is not the case for all angels and certainly doesn’t have to be, it is the only model where you can justifiably hope to back a unicorn with. Why so?

Well, unicorns are rare animals and you really need to kiss every frog to maximize your chances of finding the one that will turn out to be a unicorn.

There’s a million resources out there on portfolio models of successful angels and we will not tire you with restating them here, but for sure, we’ll dive deeper into this at a later point!

Earlier in this edition, I shared the TL:DR on our syndicate into SMOK ventures. We’re building these syndicates to allow angels to get closer to the best VC (and vice versa!). Both to get the type of diversification that increases the likelihood of venture returns, but also - and more importantly - to give access to direct exposure to new learnings and networks. In our first episode of The Super Angel pod, we talked with Roxanne Varza from Station F about this:

First and foremost, I do them to learn. And second, I'm obviously hoping not to lose my money entirely. But I do have to be comfortable with the idea that I could.

What I'm doing [with these investments] is that I learn from those investors who are really deploying at a very different level and scale.

Asked what type of funds she looks for, Roxanne points out that what really matters is that the fund manager will take the time to:

Share their deal flow.

Share their analysis on why they turn one down but invest in another.

Report at a deeper level than just the core metrics.

It’s really been an eye-opener for me. For example, the Web3 fund that I invested in operates in an area that I don’t know really well. So it's been incredible to watch how she's been evaluating the deals she gets. It’s just been amazing.

Roxanne Varza, Director of Station F

And how about networks - why are they so important? Strong VC relationships can be important at multiple times:

VCs can help you determine if the startup is a venture case. Just forward the high-level statement of the deal and check if it’s something they’d see as a venture case provided the team executes well. If you share something that’s in scope for the VC, they will be interested and remember you for it.

VCs can bring you into their deals. If you bring a differentiated value-add and understanding of a sector, many VCs will want to have you part of their investment round and diligence process.

VCs can take your portfolio startups to the next level in the next round. As said earlier, as an angel you’ll often come in before VCs in cases where it’s uncertain if the startup will be a venture case.

Let’s hear how Joe Cross, ex-operator angel with 25 investments and active an LP in VC funds thinks about working with VCs:

I do work with VCs and to be honest, that is without any question, the way I've accessed the industry. Through getting to know the VC and partners in VCs and Antony, for example, my favorite of all. For sure. And I think there's absolutely no way I could have made all of the Investments I've made if it wasn't through going out and getting to know VCs.

What I was really pleasantly surprised by was, as an ex-operator, it was like; open arms as I wanted to go and meet people. And I can see why now because real two-way benefit. I can help VCs find companies, but also vice versa, I can help due diligence for a VC. We do the deal together and then I'm helpful, as an angel. So there's a load of stuff that I think is very beneficial.

And now, let’s end this on Joe’s amazing CTA for anyone listening in:

So for anyone looking at like going into Angel Investing, if you're an ex-operator, just go for it. I was so pleasantly surprised by how open arms the VC world was.

We couldn’t have said it better ourselves. Do join us 💘

This week’s stories 🗞️

The EU VC Lowdown with Cathy White

Cathy is the founder of CEW Communication and host of the EUVC Lowdown podcast where she wraps up the week in European VC with a panel of Europe’s best.

Read on for this week’s headlines or listen to the full episode below 🎧.

If you have news you’d love to highlight on The Lowdown, you can find Cathy White, on LinkedIn or Twitter at cathywhite10.

The VC Impact Playbook unveiled

A new collective of 120 venture firms has launched the UK’s ImpactVC programme and unveiled the VC Impact Playbook, a guide for European investors unfamiliar with impact-led returns.

The group aims to share industry knowledge on leveraging ROI and ESG value from impact-led investments. Firms involved in the collective include Ananda Impact Ventures, Balderton, ParTech and Stride.

Founders (still) require better signposting to external funding

A new report from VCTA shows that founders require better signposting to external funding. 4 in 10 said they needed better information on accessing external funding, and more than 9 in 10 anticipated their next capital raise within two years.

European Universities leading in creating open-source startups

Runa Capital revealed the ROSS Index this week, showing that European universities are leading the world when it comes to turning creating founders of fast-growing open-source startups, with France’s Epitech IT school leading the way. The full report select the top-20 open-source startups by their growth at Github quarterly.

TechCrunch: We’re off to a “less than stellar start to the year”

With one-twelfth of the year complete - when the f**** did that happen!? - Tech EU has crunched the data on the deals, exits, and, to quote, a “less than stellar start to the year”.

While the number of deals announced this January is fairly in line with last year, there was a 60% drop in the amount invested - and interestingly, debt funding makes up almost a third of capital announced this past month. UK startups raised the most capital, followed by France and Germany. And FinTech proved to be the top vertical.

But over at Sifted, it reported that January was a record month for European M&A deals - with a total of 378 deals reported. So, guess we’ve still got some juice in the European ecosystem 🚀.

Romanian Venture Report 2022

The amazing How To Web team have just published the Romanian Venture Report 2022 👀. As ever, a great read that underlines why How To Web is the place to go to experience the buzzing CEE scene.

Key findings include:

Romanian founders remain on a steady track and seem ready to weather the storms ahead

€102M volume in 2022 and an 11% increase compared to 2021

12x growth over the last 6 years (2017-2022)

Unfreezing Series A — the volume almost tripled compared to 2021

Seed volume grew by 29% compared to the previous year

Pre-seed volume went down by 13% compared to 2021

Emerging 50 🚀

Signature Block, a newsletter you for sure should consider following if you aren’t already, have published their inaugagural “Emerging 50” fund managers. Or as they say “the venture industry's newest fund managers as nominated by their LPs and founders they've backed.”

Personally, I sometimes feel we should do something like this for Europe. At other times, I feel like it’s just a hornet’s nest of some mentionend and many forgotten. But lo and behold, I’m sure I’ll find myself too tempted and end up doing yet another “So ein Ding must ich auch haben”.

So for now, I’ll leave it to call out a couple of spectacular mentions from the list:

Where is the money in 2023? Corporate venturing on the rise.

Wojciech Drewczyński from Black Pearls VC published an interesting read for anyone caring about corporate venturing. Explore it below and give a hand to the ⭐-team we should all thank for the effort: Dr. Dominik Dellermann, Magdalena Jarosz, and Peter Meyerhofer, Gabrielė Poteliūnaitė, Michele Luperini, Hootan M., Space3ac, vencortex, APX, Plug and Play Tech Center, Hyperseed.

We asked 71 corporates about their approach to working with startups and LP investments in venture capital GPs in the upcoming months. If you wonder about the current state of corporate venturing in European corporations, the answer you'll find in our latest research. Together with my team and partners, we identified their motives and provided an outlook on the strategic collaboration agenda with tech adventures.

You'll find much knowledge of Corporations working with startups and Corporate LPs backing venture capital GPs and current trends in this field. What I can say is that Corporate LPs are on the rise!

Key data from the report:

43.7% of respondents are more optimistic about working with startups in 2023 than in 2022

Corporations are most likely to look for opportunities to work with startups in AI and machine learning, Big Data, IoT, blockchain, fintech, e-commerce, and security

60% of corporations plan to increase their involvement in the startup ecosystem in 2023

The priority for corporates when collaborating with startups is efficiency solutions

Rise of Corporate LP investment.

23.9% of corporates have experience in investments in other Venture Capital funds as Limited Partners,

22.5% consider gaining such experience

What else can you find in the report?

Popular forms of venturing

Trending strategic fields

The Corporate-Startup Relationship: Challenges and Opportunities

Insights from GPs working with Corporate LPs

Overall market situation and strategic importance of corporate LP investments in venture capital funds

How are the Best GPs attracting Corporate Limited Partners?

Global view on Corporate Venturing Transactions of around 28 000 tech M&A transactions

This week’s funds 💵

Section powered by the InnovatorsRoom & Cathy White.

1 bn € for German deeptech

Germany has unveiled a new €1bn fund for deep tech and climate tech for growth-stage companies. This is just weeks after France announced plans to invest €500m into deep tech alongside other initiatives. The German ‘DeepTech & Climate Fonds’ or DTCF, is part of the federal government’s €10bn future fund launched in 2020 and European Recovery Programme.

A new deeptech VC emerges in the UK

In London and continuing in deep tech, Silicon Roundabout Ventures officially launched 👏

According to his interview with Sifted, the fund, which is targeting £10M, is looking to address the lack of specialist deeptech VCs with a technical background in Europe — 96% of investors in the UK have never worked in a technical role — which Perticarari says means potentially results in groundbreaking tech being missed. In recent years other funds - such as Lunar Ventures - have also launched with the same mission.

Founding GP Francesco Perticarari also joined us for last week’s Lowdown episode, so do go and give that a listen 🎧.

The quickie

🇬🇧 Highland Europe - €1b, fund 5, 🌍 Europe, growth - London

🇩🇪 FLEX Capital - €300m, fund 2, final close - Berlin

🇩🇪 PropTech1 - €30m; €100m target, fund 2, real estate - Berlin

🇮🇱 Reichman University (IDC Herzliya) VC Fund - $30m, first close, pre-seed - Herzliya

This week’s hires 👩💼

Section powered by the InnovatorsRoom.

EUVC (yup, yours truly) is hiring a junior marketing assistant. Hit up Andreas to apply

We’re also hiring a junior to midlevel IR 👇 Hit up David to apply.

🇬🇧💻 Lvp - VC Analyst / Associate - London, Online innvtrs.com/3XHmyGY

🇬🇧 Ørsted - Ventures & Open Innovation Specialist - Edinburgh, London innvtrs.com/3WwWHkl

🇸🇪💻 Norrsken VC - Investment Manager - Stockholm, Online innvtrs.com/3R3MBGx

🇩🇪 Antler - Investment Team - Berlin innvtrs.com/3XDiojk

🇨🇭 The Global Fund - Operations Officer - Geneva innvtrs.com/3XwiLMC

💻 Hero - Chief of Staff - Online innvtrs.com/3GVxoma

💻 Trinsic - Chief of Staff / Head of Operations - Online innvtrs.com/3D0RCtu

💻 500 Global - Senior Portfolio Insights Strategist - Online innvtrs.com/3kFMTat

🇩🇪 HomeToGo - Founder Associate - Berlin innvtrs.com/3JcY9oY

🇩🇪 Lufthansa Innovation Hub - CEO / Cofounder - Berlin innvtrs.com/3H4s2Vs

🇩🇪 Techstars Berlin - Investment Associate - Berlin innvtrs.com/3j3NqT6

💻 First Momentum Ventures - VC Internship - Online innvtrs.com/3ZRQthL

🇩🇪 Bridgemaker Portfolio - Chief Executive Officer - Munich innvtrs.com/3w6IDDh

🇺🇸💻 AI Fund - Senior Associate - Palo Alto, Online innvtrs.com/3DcGVnA

💻 Enpal - Founder Associate - Online innvtrs.com/3iTmdCA

💻 Binance - M&A Associate - Online innvtrs.com/3Wtq46N

🇵🇹 McKinsey & Company - Associate - Lisbon innvtrs.com/3Hf1aDK

🇸🇪 Spotify - Project Manager Business Development - Stockholm innvtrs.com/3IWvSma

💻 Mercury - Venture & Ecosystem Internship - Online innvtrs.com/3J5oLYZ

Thx for reading and being awesome 💗 we love you for it.